So annuities come in a range of different flavors. You can choose annuities that pay out immediately or in the future; in a lump sum or in installments; in limited installments or in lifetime installments; that move with the markets or that deliver a promised return. You can even buy an annuity that tracks a particular index and combine it with other annuities to create the mixture of risk and guarantee that suits you. Which of those sorts of annuities—or mixture of annuities—you should buy will be an important question. But there’s no definitive answer to that question. You’ll have to decide for yourself how you want to secure your future income.

No less important than any of those questions though is how much you should be putting aside and how much your annuity is worth. You’ll need to know how to calculate the present value of your annuity and the future value of your annuity. Neither of those calculations is straightforward.

The Future Value of an Annuity

You can think of the future value of an annuity plan as your destination. Each month, you’re going to be putting money aside in the hope that over the following years, that money will build up, with interest, into a sum that will give you a guaranteed income.

So Future Value is the amount that your series of payments will be worth at the end of the accumulation phase, and it’s something that you’ll want to know. There is a calculation you can make that multiplies the amount you pay by the insurance rate and the number of payments you’ll be making.

How To Measure Your Annuity

If you’re buying a fixed rate annuity, that calculation is:

Future Value = P * ([1 + I]^N – 1 )/I

P is the amount of each payment.

I is the interest rate the insurance company is paying you.

And N is the number of payments you’re going to make before you start extracting the money.

That looks complex to measure your annuity but it’s not quite as complicated as it looks.

Let’s say that you’re putting $6,000 a year into an annuity that pays an annual interest rate of 5 percent, and you’re going to be making those payments for the next ten years.

The calculation would be:

Future Value = 6000 * ([1 + 0.05]^10 – 1 )/0.05.

You can try to crunch that formula yourself but you can also throw it into Google and let the Web do the work for you. Either way, you’ll find that at the end of ten years, the future value of that fixed rate annuity will be $74,467.

But of course, the calculation isn’t quite that simple because you don’t usually make annuity payments annually. You’re more likely to make them monthly. That means you have to divide the annual interest rate by the twelve payments you’ll make each year. You’ll also need to know the total number of payments you’re going to make which just means multiplying the number of years by the number of annual payments.

So the future value calculation for a payment of $500 every month for ten years would be:

Measure Your Annuity: Future Value = 500 * ([1 + 0.004]^120 – 1 )/0.004

The 0.004 is the interest you’re making each month, and the 120 is the number of $500 payments you’re going to be making over the next ten years. Because you’re making payments earlier, they’ll have more time to earn interest and you’ll get a slightly higher return: about $76,816.

Calculating the Future Value of a Variable Rate Annuity

Calculating the Future Value of an annuity then isn’t as difficult as it looks. You just need to know how much you can afford to pay, how long you’re going to be paying it, and how much interest the insurance company will give you.

If you’re buying a fixed rate annuity, you’ll have all of that information. If you’re buying a variable rate annuity, though, you won’t know how much interest the insurance company will give you. It’s variable. That means you won’t be able to come up with a completely accurate future value for your annuity, but you will be able to come up with a range. You’ll be able to look at the previous performance of that annuity over the last decade or so and calculate three interest rates: an average of all the annual interest rates; an average of three highest annual rates; and an average of the three lowest interest rates.

There are few guarantees with a variable rate annuity, but you can expect that the interest you will earn will be close to the overall average. But the other two rates will show you the most and the least you can realistically expect to collect during the accumulation phase. That’s important because while it’s unlikely that your annuity will earn no more than the lowest returns seen over the last decade, you should have a plan in mind if the market does tank and takes your annuity with it. You’ll want to have a picture of the worst-case scenario, as well as the most likely and the best-case scenarios.

Variable annuities do introduce an element of risk but it’s important to know the degree of those risks and the effects that they can have on your future income.

What Knowing the Future Value of Your Annuity Tells You

So calculating the future value of your annuity will take a bit of effort, especially if you’re considering buying a variable rate annuity. But it is worth making the effort because even those sample calculations reveal a couple of things.

First, they give you an idea of how much money you’ll have available when you’re ready to leave the office and collect your payments. You’ll be able to see whether that will be enough to live on for your remaining years.

And second, it will show you how much you’ll need to save each month to earn that income. You’ll then be able to play with the numbers, raising and lowering them to give yourself more money in the future or more money now.

What you’re likely to find though, is that the numbers are surprising. Putting aside $500 every month for ten years sounds like a big deal—and don’t forget that that money comes in addition to your 401(k) payments and any other savings plans you might have. The roughly $75,000 it generates over ten years looks like a nice sum. But if you take out $1,000 a month, even with a continued 5 percent interest rate, you’ll still burn through your savings in about 7.5 years. If you plan to retire at 65 and live beyond the age of 62.5, you’re going to run out of money.

There are, fortunately, a couple of solutions. You can put aside more money each month. And you can put aside money for more months. If you’re going to buy an annuity, the sooner you start, the better.

But when you’re calculating the future value of your annuity, there is another consideration you need to bear in mind.

The Effect of Tax on the Future Value of Your Annuity

Annuity payments are made on a tax-deferred basis. You don’t pay income tax on the growth of those funds until they come back to you in the payment phase. At that time, your income—and your tax rate—is likely to be lower. And unlike pensions, there’s no limit on the amount you can put in an annuity.

That means that there’s another number you need to toss into your assessment of the value of your annuity: the amount of taxes you’ll be able to save.

You’ll need to know your current tax rate, and you should have an idea of the tax rate you can expect to pay when you’re living on your retirement income. The difference between those two rates will tell you how much extra money you’ll be able to save by putting your money in an annuity instead of buying a CD or throwing it into the stock market.

Of course, it’s still not quite as simple as that. Annuities aren’t the only form of tax-deferred savings plan. But the effect that tax deferment can have on your annuity savings isn’t something you should ignore.

The Tax Benefits of an Annuity

If you’re paying a 37 percent federal tax rate and you put $500 into an annuity paying 5 percent for 20 years, those investments will have earned $85,517 in interest by the end of the accumulation phase. Taxed at your regular tax rate, that growth would have given you a tax bill of $31,641.

If you’re only paying a 12 percent tax rate during the payout phase, you’ll only be liable for $10,262 when the money comes back to you. You’ll have kept an extra $21,379 for yourself by putting it into an annuity and taking it back in the future.

That’s a big difference, and although that’s a simple example that doesn’t take into account other tax liabilities, it does show that you will need to consider the effect that taxes have on the future value of your annuity.

It also makes your calculations a lot more complex. Even if you’re filing your taxes yourself, it is worth talking to an accountant or a financial advisor to understand exactly how much an annuity will be worth to you—and how much you might save if you put that money aside now for the future.

The Present Value of an Annuity

The challenge of calculating the future value of an annuity is that you can never tell what’s going to happen in the future—especially if you’re buying a variable rate annuity. But if you know the interest rate that you’ll earn from your annuity, you can make a different kind of calculation. You can calculate the present value of your annuity.

That’s useful because there’s a difference between receiving a lump sum now and receiving a series of payments over a long period of time.

Imagine that you’ve won $10 million in a lottery. When you ask for your money the lottery company tells you that it’s paid in installments of half a million dollars a year over the next twenty years. They can give you a lump sum but if they do, they’ll have to take off the value of the 5 percent interest the money would have earned over that time. So if you take all the money now, you’ll be receiving a smaller amount than the total value of that $10 million annuity.

How much smaller?

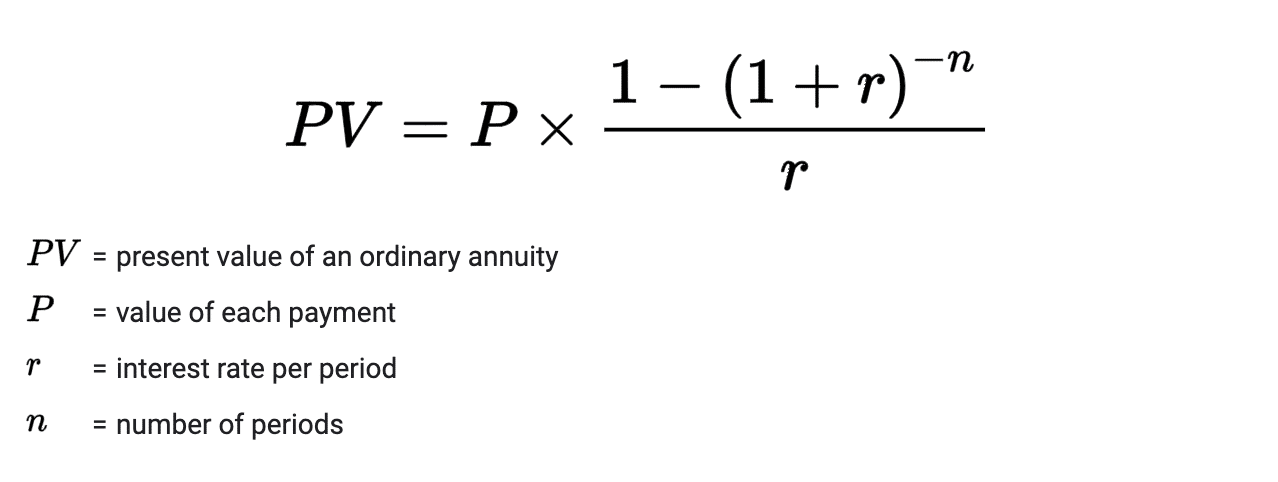

To calculate the present value of an annuity, you need to add up all the present values of each annuity. To discover the present value of each payment, you have divide each payment by the interest factor.

The math looks like this:

Present Value = Annuity payment * (1 – (1 + interest rate)-number of payments)/ interest rate

So if the lottery company tells you that its $500,000 per year payment is based on a 5 percent interest rate, then the calculation would be:

Present Value = 500,000 * (1 – (1 + 0.05)20)/0.05.

which comes to $6,231,106.

That’s how much the lottery company would give you in a lump sum now, instead of stretching out the payments over the next twenty years with interest. It’s a big difference that shows just how much the future value of an annuity can differ from its present value.

Why the Present Value of an Annuity Matters

When you’re planning an annuity, this calculation matters for a couple of reasons. First, an annuity is dynamic. You’re constantly putting money into it, and then you’re constantly taking money out of it. You should know how much that money is worth at any moment.

Second, you should also know the additional value that the insurance company is bringing. By giving you $10 million over 20 years instead of $6,231,106 today, the lottery company is assuming that its investments can earn $3,768,893—about half of its current sum—in interest payments.

So one question you’ll need to consider is whether you can do better than the insurance company. You might put money into an annuity, for example, in order to benefit from the lower tax rate. But when you reach the payout, you’ll be able to decide whether to take the monthly payments at the insurance company’s interest rate or take a smaller lump sum and invest it in something that might perform better, such as real estate.

There’s no definitive answer here. If you’ve bought a fixed rate annuity, you’ll be able to calculate the exact present value and the exact future value. If you’ve bought a variable rate annuity, you’ll be able to calculate an average value, as well as a best- and worst-case value. You’ll then be able to compare those values with the amounts that you’d expect to earn from a different kind of investment.

As always, it’s worth checking with a tax advisor and a financial advisor to make sure that your tax liabilities and your investment sums are in order. But you should know the difference between the present value of your annuity, the future value of your annuity, and return you might get from some other way of making money.

What Is Ordinary Annuity and Annuity Due?

So you know how to calculate the future value of an annuity and the present value of an annuity—and the calculations aren’t as nightmarish as you might think. As long as you know the variables and can find your way around a scientific annuity calculator, you can crunch the numbers.

But it’s not quite as simple as that.

The calculation above is based on ordinary annuity.

The Definition of Ordinary Annuity Payments

An ordinary annuity is a series of payments made at the end of a set period, like a stock dividend. The company has made the money, the period has ended, now it shares the profits it has earned over the previous period with its shareholders. The same applies to a bond payment. The period of the loan has ended and now the payment is due.

Most annuities demand payments on an ordinary annuity basis. You start counting the value of your annuity from the start of the contract but you begin paying at the end of the first period. You’re always paying for the previous period.

The alternative way to pay for an annuity is annuity due.

The Definition of Annuity Due Payments

While ordinary annuity payments are made retroactively, annuity due payments are made in advance. They’re more like rent payments. Landlords usually demand rent at the start of a rental period. They don’t want to chase down funds after the tenant has been living in their property. Annuity due payments are also made at the start of the payment period instead of at the end.

The difference between ordinary annuity and annuity due matters because of the time value of money. Funds that you hold now are worth more than funds that you receive in a month’s time. Once you receive money, you can start investing it. If you receive $1,000 now and invest it immediately at 6% a year, in a month’s time, that thousand bucks will have grown to $1,005. The time value difference of those two payments is five bucks.

When you’re calculating the present value of your annuity, those differences are important. That’s why the formula for calculating the present value of an annuity due is slightly different from the formula used to calculate the present value of an ordinary annuity.

The math used to calculate the present value of an annuity due looks like this:

Measure Your Annuity: Present Value of annuity due= Annuity payment × (1−1/(1+interest rate)x number of payments))/interest rate x (1+interest rate.)

Let’s say you had been putting $500 into an annuity for ten years on an ordinary annuity basis. The annuity earned 5 percent a year. The present value of your annuity would be $152,648.94.

If you made those payments on an annuity due basis, after ten years the present value of your annuity would be $156,736.75.

The extra interest those earlier payments had earned would be worth more than $4,000 after ten years.

So it looks like you should be paying for your annuity on an annuity due basis. The insurance company puts the money to work as early as possible. But that’s only true if you wouldn’t have put that money to work yourself. Invest those funds until you need to make your payment and the difference will be smaller. If you can make a higher return than the insurance company then you should hold onto those funds for as long as possible.

In general, your annuity will be worth more if you’re paying on an annuity due basis. If you’re paying on an ordinary annuity basis—and you’ll probably be paying on an ordinary annuity basis—make sure that you’re earning interest on your funds until it’s time to make your payments.

- What Is an Annuity?

- The Difference Immediate Annuities and Deferred Annuities

- How does an annuity work?

- The Benefits of a Deferred Annuity

- The Benefits of an Immediate Payment Annuity

- What Is a Variable Annuity?

- What Is a Fixed Index Annuity?

- What Is an Indexed Annuity?

- A Brief History of Annuities

- Will Annuities Recover?

- Money for Today or the Rest of Your Life?

- Are There Any Other Types of Annuities?

- Become Familiar With Annuity Fees

- What Are Your Payout Options?

- Weighing the Pros and Cons of Annuities

- Is An Annuity Right For You?

- How To Measure Your Annuity

- Understanding Annuity Formulas

- Annuity Calculators

- Questions To Ask Before Buying An Annuity

- Annuity Glossary Index