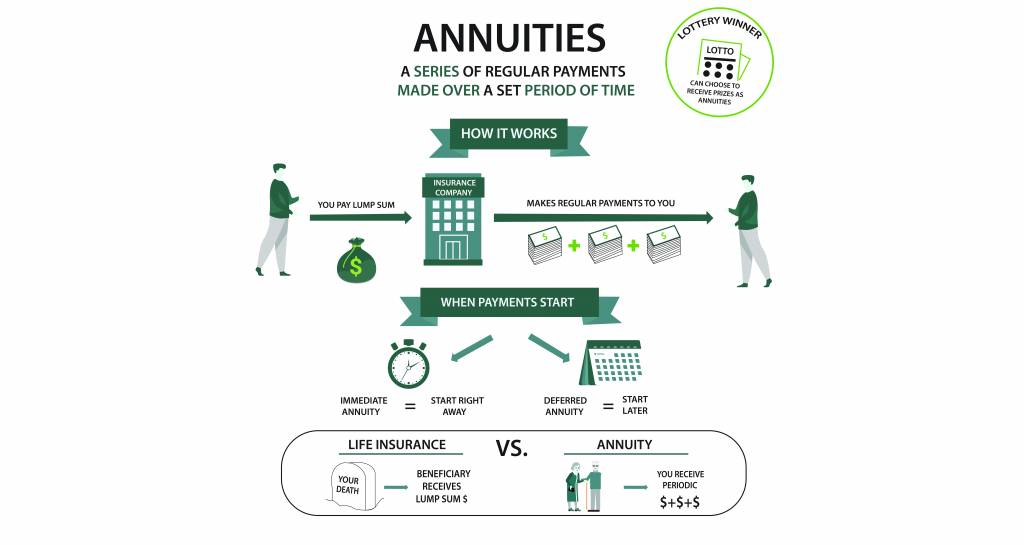

The basics of annuity, in the scheme of things, is pretty straightforward. It’s simply a contract between you and an insurance company. You make payments, aka contributions to your account over time. When you retire, these contributions are converted into periodic payments that can run for the rest of your life.

Annuities are the holy grail of retirement planning. At Due, your annuity is a guaranteed, lifetime source of income.

But, if annuities are all that, then why aren’t more people taking advantage of them? Well, not everyone actually wants an annuity. If you’re already financially set, you probably aren’t sweating too much over money. What’s more, this guarantee also involves some risk and an annuity can be overwhelmingly complex — what with all of the options, riders, contingencies.

How Does An Annuity Work?

Annuities are often misunderstood. So, to clear the air, let’s explore how an annuity works so that you can decide if it’s worth pursuing or not.

Annuity payment size depends on the following:

- The type of annuity.

- How much you pay for annuity premiums.

- When you want annuity payments to start and end.

- The interest rate that your annuity earns.

If you want a more accurate figure, there are a number of free online annuity calculators that you can use to calculate your payout.

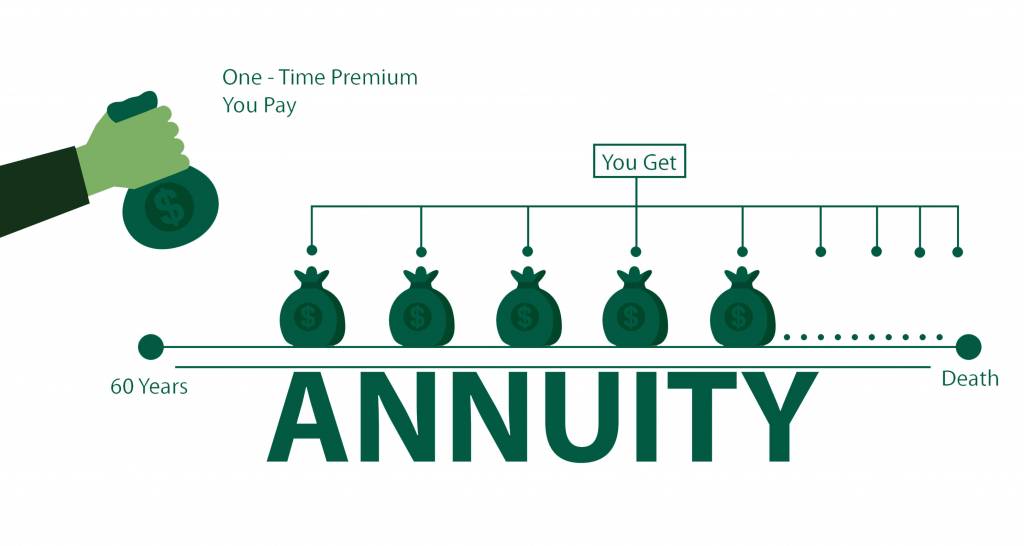

With annuities, you have two options in regard to the length of your payment period. You can receive payments for the rest of your life or for a specific number of years. If you opted for lifetime payments, that will help ensure that you won’t outlive your assets. On the flip side, your payments won’t be as high.

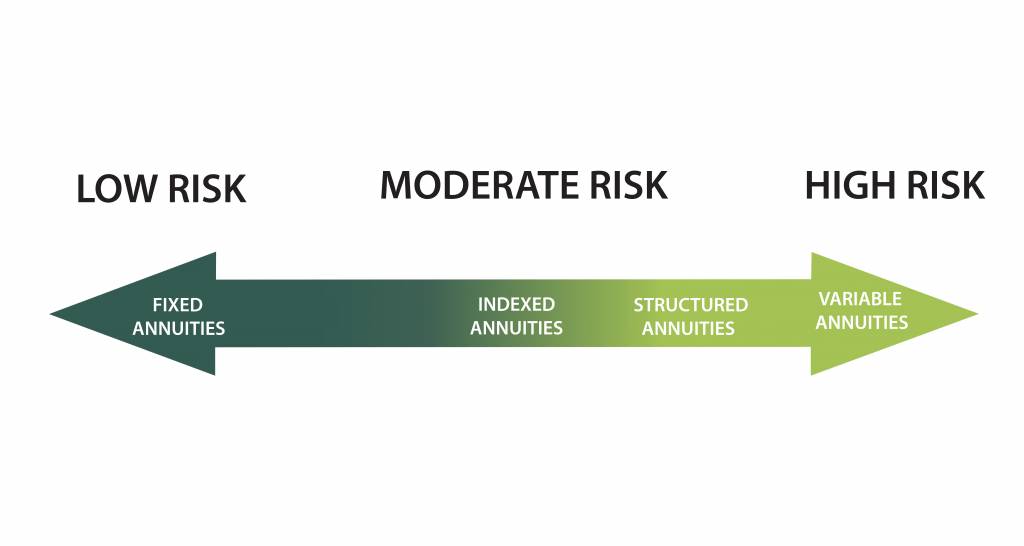

Furthermore, the amount you’ll receive depends if you went with a guaranteed payout (fixed annuity) or a payout stream. The latter is determined by your annuity’s underlying investments (variable annuity) performance.

The Basic Annuity Types

Since we’ve briefly discussed the difference between immediate annuities and deferred annuities in a previous chapter, there’s no need to go too in-depth here. But, as a refresher, when you go to purchase an annuity you have two types to choose from; immediate and deferred.

Immediate annuity.

If you’re closer to retiring, or need money sooner than later, then you’ll want to select an immediate annuity. With this type of annuity, the payout can begin in as little as a year after you’ve purchased the premium. You also have the flexibility to receive a lump sum or a series of payments that will be deposited into your bank account monthly, quarterly, or annually.

An immediate annuity also lets you choose how long you’ll want to receive payments. You can either receive payments for a fixed number of years — or you can choose to have a lifetime income.

There’s a slight variation of an immediate annuity called an income annuity. With this type, you swap out a lump sum amount for a guaranteed cash flow that you’ll receive monthly or annually. The immediate annuity is meant for retirees who are sweating about outliving their retirement savings. Also, it focuses on creating an additional income stream as opposed to accumulation.

Deferred annuity.

Your other option is a deferred annuity. This type of annuity is better suited for those who don’t see retirement on the horizon anytime soon. But, they want to still have the peace of mind that they’ll have a guaranteed income when they do arrive on the shores of retirement.

Unlike an immediate annuity, you can’t access this income stream until after the accumulation period has ended. The accumulation period could be several years down the road. Because of the long savings years required to get to retirement — this type of annuity is similar to how a CD performs. However, you can withdraw a small percentage each year if you must. If you take this savings out early — just expect surrender charges, (like any other retirement savings plan) as well as a 10% IRS penalty if you withdraw funds before age 59 ½.

The distinction between an immediate and deferred annuity is simply when you want to start receiving payments.

Annuity options.

For a lot of us, picking between an immediate and deferred annuity isn’t really all that taxing. But, just imagine the first time you stepped into a Chipotle for a tasty burrito.

Sure, you know that you want a burrito. But, you probably were overwhelmed by all of the options that you had to choose from. The same is true with an annuity. There are a lot of preferences that will determine when you want to receive payments and for how long you want the payments to last.

- Single premium. Also known as an SPIA, this is the oldest annuity option dating back to Ancient Rome. As an immediate annuity, this type skips the accumulation phase. As a result, it begins paying out an income either immediately or within a year after you’ve purchased it with a single, lump-sum payment.

- Flexible premium. Here is a tax-deferred, variable annuity contract meant to build your long-term savings. The flexible annuity earned its name because you can fund the annuity with multiple premium payments.

- Fixed. A fixed annuity is arguably one of the simplest and predictable options you have. The money that you contribute will earn a fixed interest rate. For example, with a Due Fixed Annuity, you get 3% on your money each month. When it’s time to start receiving your money, a fixed payment is guaranteed for life.

- Variable. With a variable annuity, your money is divided into sub-accounts. These are stocks, bonds, and other investments of your choosing. While you can expect a minimum income, how much you’ll get depends on the performance of the market. As such, there’s more risk, along with higher fees than you might find with mutual funds.

- Equity-taxed. An equity-taxed annuity is actually a variation of a fixed annuity. The interest is based on an outside index, such as a stock market index. Also, like a variable annuity, an equity-taxed option pays a minimum rate that can fluctuate with the market.

- Life income. As long as you’re alive and well, and there’s money in your annuity, the payments will keep rolling in. If you have a spouse or children, you may want to add an installment refund rider. If you name them as beneficiaries, they’ll receive your payments when you pass away. If you don’t attach this rider — the insurance company will keep your money.

- Joint and life income. With this option, you’ll receive a lifetime income for both you and your significant other. If one of you passes away prematurely, the survivor will continue to receive payments.

Annuities explained in a little more detail.

Are you still lost? Chris Hogan, a financial expert, and bestselling author, compare this to ordering a burrito at Chipotle. “You can create an annuity based on your preferences and your own personal situation, minus the chips and guac,” he explains. “Here are the different ways you can put an annuity together.”

- Single vs. Multiple Premiums: How do you want to pay for the annuity? “If you have a large pile of money—maybe through years of saving or an inheritance—you can pay for an annuity in one big payment,” writes Hogan. “Or you can pay for the annuity with a series of payments over many years.”

- Immediate vs. Deferred: When do you want to receive payments? An immediate annuity is self-explanatory, it’s a payment that you’ll take right now. Or, you can wait and take payments out at a later time. “Keep in mind that if you take out any money from your deferred annuity before age 59 ½, you’ll get hit with a 10% early withdrawal fee on top of the income taxes you’ll owe!” warns Hogan.

- Lifetime vs. Fixed Period: How long will your annuity payments last for? “In addition to choosing when you’ll start receiving annuity payments, you’ll also need to decide how long those payments will last,” Hogan states. “One of your options is a lifetime annuity that will pay you a certain amount for the rest of your life.” The other choice? A “fixed period annuity that will send you payments for a set amount of time—anywhere from 5 to 25 years.”

Here are a few other annuity experts you should learn from.

How Does an Annuity Payout?

After you’ve put together your burrito, you probably have two ways of devouring it. The first way to eat your burrito is to simply pick the whole thing up and see how much you can bite into it. The other option is going at it with a fork and knife to make eating the burrito more manageable.

While a burrito and an annuity are not exactly the same thing — when it comes to how you’ll consume your annuity, there are two ways to go about it; withdrawal and annualization.

Withdrawals.

If your contract permits withdrawals, there are three categories for getting your money out. These withdrawal options are full withdrawal, systematic partial, and non-systematic withdrawals.

“Full withdrawal is just what it sounds like: whatever the value of your annuity is at the time of withdrawal, you get all your money in a single payment,” explains the MassMutual Staff. “Keep in mind that when you withdraw that sum you’ll be responsible for paying any taxes due.”

“The systematic partial withdrawals option lets you tell the insurance company how much you want to receive and how often you want to receive it if withdrawals are allowed under the contract,” they add. “Being able to set a higher or more frequent payment may be appealing.”

However, “it’s worth noting that with this payout option, unlike certain annuity payment options, the insurance company won’t guarantee that you won’t outlive the annuity. While you may have greater access to your contract value you will have to manage longevity risk on your own.”

“Non-Systematic Partial withdrawals, if allowed by your contract,” allow you to take “out a portion of your annuity’s value to help meet short-term objectives. It’s potentially useful if you need it, but any partial withdrawal (systematic or non-systematic) may reduce your annuity’s benefits, such as your death benefit, which allows you to pass on the contract to your beneficiaries in the event of your death.”

If you’ve selected a deferred annuity, then the contract probably includes a “free withdrawal provision.” If so, you can “ receive a certain amount each year without incurring fees, though what that amount is will vary depending on contract specifics,” adds the MassMutual Staff.

Again, most annuities include a surrender charge on any withdrawals if you sell or take out money during the surrender charge period. And, if you make a withdrawal prior to age 59½, don’t be shocked if you get hit with a 10% federal income tax.

Annuitization.

Your other option? Annuitization.

As MassMutual explains, this “is the switch that flips an annuity into ‘payout mode,’ initiating income payments according to the contract.” And, because the world of annuities is a complex one, you have several annuity payment options here.

The first is a period of certain annuitization. Here you “choose a defined period of time over which to receive payouts.” What happens if you die within that time? If you have a listed beneficiary, then they “will receive the rest of the payments until the defined period is complete.”

Your second option would be life payments. These aren’t based on a fixed period of time. Rather, “on the annuitant’s calculated lifespan,” they explain. “The basic life option pays the contract-owner for the rest of their life, while joint life calculates a lower payout, which is based on you and your spouse being alive.” This gives “the option for payments to go to your spouse for the rest of his or her life should you predecease them.”

Typically, the single life annuity payment “provides the largest payment amount, but has the most risk since payments cease upon the annuitant’s death. No payments will be made to a beneficiary.”

There’s also a Life with Guaranteed Term option. In short, this blends certain aspects of “life” and “period certain.” For example, just like with the “life” option, you’ll receive a guaranteed income. But, as with “period” time, you can select a time period for guaranteed payments.

Why is this appealing? On one hand, you’ll “get the ‘life’ payments that are calculated based on your life expectancy.” On the other, “if you die sooner than expected, payments will continue to your beneficiary until the guarantee period is up.”

Regardless of “what type of annuitization option you choose, keep in mind that annuity payments may be subject to tax.” The nitty-gritty of how your annuity will be taxed vary as they are “based on what type of annuity you buy and what type of annuitization option you select, as well as whether you purchase the contract with pre-tax or after-tax money.”

To be frank, this is a lot of information we just threw your way. So, go ahead and take a timeout — maybe go outside for a walk to clear your head. When you return, contact your financial or tax professional to discuss the best annuity options for you.

Why do people buy annuities?

The answer is quite simple. People mainly buy annuities to help manage their income once they retire. In fact, annuities can be a handy retirement planning tool, since they can provide:

- Periodic payments for a specific amount of time. Again, this could be for the rest of your life or a specific timeframe. Or, it can last the life of your spouse or another person.

- Death benefits. What if you pass away before you start receiving payments? The person you name as your beneficiary will receive a specific payment.

- Tax-deferred growth. Here’s a nice little perk. You won’t have to pay any taxes on any income and investment gains from your annuity until it’s withdrawn.

Just keep in mind that while annuities are a solid retirement option, they aren’t the best option for certain individuals, like those with high expenses. Overall though most financial planners and insurance salesmen will advise seniors or other people in various stages toward retirement towards annuities.

Let’s dig a bit deeper into the benefits of your annuity.

How Do Annuities Compare to 401(k)s and IRAs?

Annuities, 401(k)s, and IRAs have the same goal. And, that’s to help your retirement dreams come true. With the exception of traditional IRA, annuities, 401(k)s, and Roth IRAs are also tax-deferred. And, with an IRA and annuity, you’ll get a guaranteed retirement income with the option to add beneficiaries.

But, that is pretty much where the similarities end.

- Availability. While you can open a self-employed 401(k) — 401(k) plans can only be obtained if your employer is offering one. Annuities are not a part of an employer-sponsored plan (yet). As such, they can be purchased by anyone.

- Contribution limits. There aren’t contribution limits for annuities. In 2021, you can contribute $19,5000 to a 401(k) and $6,000 for a traditional and Roth IRA if you’re under 50.

- Tax deferrals. With both an annuity, Roth IRA, and 401(k) you don’t have to pay your taxes until the money is withdrawn. The IRS permits you to take deductions on your taxes in the year that you made the contribution — you can’t do that with an annuity. And, you pay your taxes upfront with a traditional IRA.

- Taxes on withdrawals. Remember that 401(k) deduction. Well, that means this type of account has withdrawals taxed entirely. With annuity withdrawals, only the earnings portion will be taxed.

It’s suggested that you don’t contribute to an annuity until after you’ve maxed out your other retirement plans — mainly a 401(k). When you’ve maxed out your other plans (if you have them) you have some wiggle room to play with.

For instance, you can roll part of all of your 401(k) into an annuity to secure a steady and guaranteed income stream for your retirement.

How Much Money Do You Need to Start an Annuity?

Short answer? That depends.

While “that depends” is not always the answer you want to hear — it’s true. The reason being that each annuity has different fees and restrictions. So, a better suggestion would be to consider your return. When you consider your return — you can see if an annuity fits into your long-term retirement plan.

Of course, your long-term retirement plan will depend on a number of factors. These factors include the type of annuity, payout rate, and how long you will make contributions. So, for fixed, an immediate annuity with a 5% payout rate that you purchased for $1,000 means you’ll only get a 50-year payment or $4.71/month. $100,000, however, will net you $5,000/year or $208.33/month — and so on.

Buying (or Saving) an Annuity that’s Right for You

Are you ready to buy an annuity? Well, you should consider the following;

- Your current and future lifestyle

- Retirement needs

- How comfortable you are taking risks.

Not only will thinking about and making a plan help you determine if an annuity is the right fit, but you’ll also use this information to customize your annuity contract.

Furthermore, purchasing an annuity involves a lot of homework. If you believe the pros outweigh the cons, specifically premium protection, lifetime income, long-term care, and financial provisions — and you’ve maxed out your other retirement contributions — then let’s jump aboard the annuity bandwagon.

Purchasing an Annuity.

Sure. You can buy an annuity at any point in your life. But, a majority of annuity purchasers wait until that approaching retirement. Or, at the very least, in their mid-career and are starting to map out their retirement.

However — it doesn’t matter what some people are saying — we are finding that even Millennials are determined to start saving for retirement now. Their payments won’t be as high each month and they can arrive where they want to be. The earlier you begin saving – the better and easier it will be to save your retirement funds.

Since annuities are meant to secure your financial future and guarantee payments for life, you can’t just purchase these from anyone. They need to be a reputable provider who has strong financial strength.

It’s important to note that only insurance companies can issue an annuity — despite the fact that many types of financial companies do offer an annuity. There’s actually a valid reason for this. Annuities are insurance products. And, in most cases, it’s probably the same insurance company that you’ve purchased your automobile, home, or life insurance from. So, if you have found the right financial company — make sure they are an insurance company as well.

In fact, it’s been found that in America, 90 percent of all annuities sold annually come from the country’s major firms.

Where to Buy Annuities?

While it’s true that an annuity must be issued by an insurance company, the public can purchase an annuity contract through the issuing company’s own agents, aka middlemen. Examples of these agents include;

- Due

- Annuity distributors. These are often large brokerage firms, also known as wirehouses. Common examples would be Merrill Lynch or Morgan Stanley

- Independent broker-dealers, such as Raymond James.

- Large, national banks, such as Bank of America.

- Mutual fund companies, including T. Rowe Price or Vanguard. Because they offer lower fees, working with these types of agents can be competitive.

- Thousands of independent agents, brokers, and financial advisors located in all 50 states.

If you don’t purchase your annuity directly from an insurance provider and go through any of the above, then that’s who you’ll work with. Even though you’re receiving information, such as quarterly statements regarding your investments in your variable annuity, from the insurance company periodically — the agent is responsible for managing your contract.

Selecting an Annuity Company.

This can’t be stressed enough. Annuities are not guaranteed by the FDIC or SPIC, like your checking, savings, and money market accounts are. Rather, this is all on the insurance company that issued the annuity. To protect investment, also conduct thorough research when choosing a purchaser.

To simplify this process, here are the factors you should take into account;

- The company’s rating from an independent rating company like AM Best, Standard & Poor’s, Fitch, or, Moody’s.

- Contract details including death benefits, surrender fees, and administrative fees.

- The minimum guaranteed return you’ll be receiving.

- The provider’s financial health.

- Online reviews

If you’re uncomfortable with all this, you might want to call in the calvary. In this case, soliciting assistance from an expert known as an independent fiduciary. They can help clarify the process and recommend what type of annuity you should purchase. They may also suggest which insurance company to work with. Since they are independent of annuity sales, rest assured that they aren’t pulling the wool over your eyes.

Paying for Your Annuity.

So, you want to go ahead and buy an annuity. As long as you’ve maxed out your other retirement contributions and it fits into your retirement, this is a smart move. But, you have one more important decision to make. And, that’s how you want to pay for the annuity.

If you have a large sum of money, let’s say from an inheritance, lottery winnings, or through years of diligent saving — you can buy an annuity with just one payment, aka a single premium. You’ll still reap the benefits. But, you don’t have to worry about making recurring contributions.

If you don’t have a giant surplus of money, don’t fret. You can still get in on the annuity fun by making a series through multiple premiums over many years. How much you contribute each month is up to you. But, you should use an Annuity Calculator to make sure that you’re on target to reach your annuity goal.

- What Is an Annuity?

- The Difference Immediate Annuities and Deferred Annuities

- How does an annuity work?

- The Benefits of a Deferred Annuity

- The Benefits of an Immediate Payment Annuity

- What Is a Variable Annuity?

- What Is a Fixed Index Annuity?

- What Is an Indexed Annuity?

- A Brief History of Annuities

- Will Annuities Recover?

- Money for Today or the Rest of Your Life?

- Are There Any Other Types of Annuities?

- Become Familiar With Annuity Fees

- What Are Your Payout Options?

- Weighing the Pros and Cons of Annuities

- Is An Annuity Right For You?

- How To Measure Your Annuity

- Understanding Annuity Formulas

- Annuity Calculators

- Questions To Ask Before Buying An Annuity

- Annuity Glossary Index