A deferred payment annuity lets someone put money aside each month for the future. However, an alternative approach is to give the insurance company a lump sum and begin receiving payments immediately. An immediate payment annuity pays an insurance company to manage funds and deliver a regular income for a certain period of time.

Like other kinds of annuity, people usually buy immediate payment annuities to create an additional, reliable revenue stream to supplement pension payments. And it’s always possible for the owner of the contract to pay themselves that income. So the purchase of an immediate payment annuity represents a gamble. If the owner dies before they’ve received an amount equal to the purchase price of the annuity, they’ll have lost out on the payments. If they purchase a lifetime annuity, though, and live to a ripe old age, they’ll come out on top.

The Benefits of an Immediate Payment Annuity

Even though we all know that we should save our money for the future, the brain has a tendency to prioritize instant gratification. Research has found that the brain actually battles itself over short-term rewards and long-term rewards.

The emotional part of your brain craves instant gratification, while the logical part of the brain is your voice of reason.

“Our emotional brain has a hard time imagining the future, even though our logical brain clearly sees the future consequences of our current actions,” explains David Laibson, professor of economics at Harvard University. “Our emotional brain wants to max out the credit card, order dessert, and smoke a cigarette. Our logical brain knows we should save for retirement, go for a jog and quit smoking. To understand why we feel internally conflicted, it will help to know how myopic and forward-looking brain systems value rewards and how these systems talk to one another.”

Taking this into consideration, considering an annuity may definitely cause a struggle between your two brains. But, what if there was an annuity that was a happy medium? Well, an immediate annuity might be that compromise your brain is craving.

What is an Immediate Annuity?

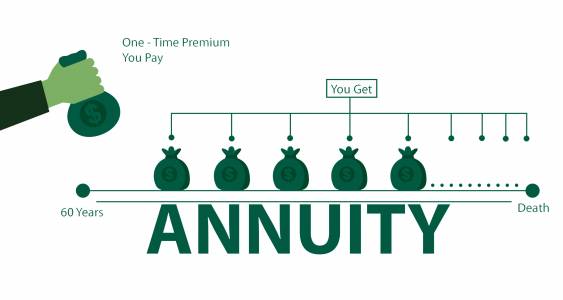

An immediate annuity, sometimes referred to as a Single Premium Immediate Annuity (SPIA), is like most other annuities. It’s nothing more than a contract between you and an insurance company that promises a guaranteed income.

Unlike a deferred annuity, however, an immediate annuity bypasses the accumulation phase. That means you can expect to receive payments almost immediately, as opposed to, let’s say, 20-years from now. In most cases, payments are issued within a year after you’ve purchased the premium with a lump-sum payment.

An Immediate Annuity is the oldest type of Annuity

It’s believed that this type of annuity is the oldest. In fact, it can be traced back to the ancient Roman Empire. At that time, the word annuity was derived from the Latin term annua, which translates roughly to annual payments. To compensate Roman soldiers for their service, they received lifetime annuity payments.

Many experts consider an immediate annuity to be the simplest and most consumer-friendly type. Despite this, But it represents merely 10 percent of all the annuities sold each year.

For those who are approaching retirement age, an immediate annuity may be a more attractive option. It’s more appealing mainly because the person can make substantial contributions without the limitations of 401(k) plans and IRAs.

SPIA

Also, SPIAs can help seniors supplement their income from Social Security income and pension plans to ensure that they have enough to cover their retirement living expenses. It’s also not uncommon for employees who are retiring to roll their 401(k) plans into an SPIA so that they’ll have a more significant retirement income.

How Does an Immediate Annuity Work?

If you want to buy an immediate annuity, the process is pretty straightforward. Take a lump sum of money and hand it over to an insurance company. In return, the insurance company promises to pay you, the annuitant, a regular income. The amount you’ll receive is spelled out in the contract and is often based on factors like age, prevailing interest rate, and how long you’ll receive the payments.

This type of annuity earned its name because payments can begin in as little as one month after it’s been purchased.

A stand-out feature with immediate annuities is how customizable they are.

You opt to receive payments monthly, quarterly, semiannually, or annually. You can also choose your income stream. For example, you can receive guaranteed payments over one life or two lives. You can then name a beneficiary so that your heirs will continue to receive these payments. Or, you can set it up where you’ll receive payments over a specific period of time, such as 5 or 10 years. This is referred to as “period certain.”

Regardless of the timeframe you select, the payments you’ll receive are with your premium plus a portion of interest earnings. And, the interest rate that you’ll get can be either fixed, adjusted annually for inflation, or varied with earnings.

And immediate annuity interest rates tend to be more favorable than a certificate of deposit (CD) and U.S. Department of the Treasury rates.

Types of Immediate Annuities

When you go with an immediate annuity — you will have to pick between three primary types; fixed payout, inflation-indexed, and variable. Understanding the difference between each will assist you in determining which one is best for you and your retirement plan.

-

Fixed Immediate Annuity.

If you want an easy-to-understand and predictable annuity, then this is your best bet. Simply place funds into an account, and the insurance company will determine how much you’ll receive. No matter what happens, the payment will stay the same throughout the term of your annuity contract.

-

Inflation-Indexed Annuity.

Also known as an inflation-protected annuity, this type is similar to a fixed annuity. You’ll receive a guaranteed stream of income from the insurance company you’re working with for the rest of your life. The difference? Payments will increase or decrease annually to keep pace with the rate of inflation. The main criticism is that inflation-adjusted annuities begin with smaller payments than a fixed payment plan. As such, it could take years for you to catch up.

-

Variable Annuities

The amount of income you’ll receive with a variable payout annuity is based on how your investment portfolio is performing. Usually, these are stocks, bonds, and mutual funds that you’ve selected. As a consequence, your payments will fluctuate. Moreover, this type lacks reliability because the payments vary, which kind of defeats the purpose of having an annuity in the first place.

What is the best type of immediate type for you? Well, there is not a one-size-fits-all answer to that question. But, as a general rule of thumb, immediate annuities should be considered for those who have enough money to stash away for the next year or so. As for the right type, that depends on your retirement goals and financial circumstances.

If you’re looking to simply add to your retirement income plan, the fixed payout option makes the most sense, as it will generate a guaranteed income that you can’t outlive. What if you’re concerned about rising inflation later in life? The inflation-adjusted product is worth exploring. And, if you’re willing to take the risk, a variable annuity could provide the most growth.

Immediate Annuity Terms

When you go to purchase an immediate annuity, you’ll have to choose the annuity term. Again, this dictates how long your guaranteed income stream will last. That’s just another way of saying you can either receive payments for life for a specific number of years.

But, there are also joint-life options. These are meant for married couples to ensure that payments will continue as long as one of the annuity owners is alive. You may also want to select a return of principal option so that your heirs will receive whatever the remaining balance is.

And, you may want to put off purchasing an immediate annuity. The reason is simple. Since you don’t have as long to live, payouts will be higher. That sounds grim. But that’s the insurance game for you.

Immediate Annuity Rates

Don’t be fooled by the fact that you’ll see an immediate payout rate somewhere online. This is not the same as the rate of return or yield. With that in mind, don’t rely on an immediate annuity payout rate or a calculated rate of return when comparing it to other investments. Again, the purpose of being an annuity is for the guarantees and not for the returns.

While you may be able to create more total wealth with an immediate annuity, it also provides security and peace of mind. And, that’s a value that you can’t put a dollar sign-on.

Funding an Immediate Annuity

You’ll fund your immediate annuity either with qualified or non-qualified funds. You’ll need to know the difference between the two, as this will determine how your payments will be taxed.

Qualified Immediate Annuities

“When applied to immediate annuities, the term qualified refers to the tax status of the source of funds used for purchasing the annuity,” explains Hersh Stern for Immediate Annuities. “These are premium dollars which until now have ‘qualified’ for IRS exemption from income taxes. The whole payment received each month from a qualified annuity is taxable as income (since income taxes have not yet been paid on these funds).”

“Qualified annuities may either come from corporate-sponsored retirement plans (such as Defined Benefit or Defined Contribution Plans), Lump Sum distributions from such retirement plans, or from such individual retirement arrangements as IRAs, SEPs, and Section 403(b) tax-sheltered annuities,” adds Stern. Or, they may come via Section 1035 annuity or life insurance exchanges.

Non-qualified Immediate Annuities

“Non-qualified immediate annuities are purchased with monies which have not enjoyed any tax-sheltered status and for which taxes have already been paid,” Stern states. “A part of each monthly payment is considered a return of previously taxed principal and therefore excluded from taxation. The amount excluded from taxes is calculated by an Exclusion Ratio, which appears on most annuity quotation sheets.”

“Non-qualified annuities may be purchased by employers for situations such as deferred compensation or supplemental income programs,” he says. “Or by individuals investing their after-tax savings accounts or money market accounts, CD’s, proceeds from the sale of a house, business, mutual funds, other investments, or from an inheritance or proceeds from a life insurance settlement.”

How to Customize an Immediate Annuity

“When you shop for an immediate annuity, you will find that one of the key factors in pricing is your age and life expectancy,” Stern states. “In a sense, purchasing an immediate annuity is like making a bet with an insurance company about how long you will live.” Because “the insurer will stop making payments when you die, it is betting that you won’t live beyond your life expectancy.” On the flip side, “if you live longer than predicted, your return may be far greater than estimated.”

“Immediate annuity coverage can be increased by including a second person (“Joint and Survivor” annuity). You can also add a guaranteed period of time (“Period Certain” annuity) or guarantee that payments “will continue at least until the original purchase amount has been paid out (“Refund” annuity),” Stern adds. “This added risk to the insurer is likely to reduce monthly payments by about 5% to 15%, depending on the age of the annuitants and the length of the guarantee period.”

Of course, not everyone needs special conditions to be attached to their immediate annuity. But, you might if you’re married and want a guaranteed income for both of you. Or that you want your payments to be designated to a beneficiary for either a specific period of time or until the remaining balance has been distributed.

The Advantages of an Immediate Annuity

We’ve covered a lot of mileage here. But, let’s get into why you should consider buying an immediate annuity.

- Guaranteed and immediate income Since you’re transferring all the risk to an insurance company when you buy an annuity, you can be certain that you will receive guaranteed payments. These will never drop below a certain threshold if you have a fixed annuity — no matter what. And, you can receive payments within the first year of your contract.

-

- Easy to use. Immediate annuities provide a systematic and reliable payment stream. And, after you’re all set up, there’s no other maintenance or work required.

- No Fees. Your eyes didn’t deceive you. There are no fees, such as account management or account maintenance charges, with immediate annuities.

- One-Time Withdrawal. Do you have an immediate need for cash? You might be in luck. Some insurance companies allow for a one-time cash advance. If you don’t need your money ASAP, the annuity will payout according to your agreed-upon disbursement schedule.

- Mortality Credits. “An annuity combines your deposit into a large pool with many other customers’ money,” explain David Rodeck and John Schmidt in Forbes. “When a client passes away earlier than expected, part of their deposit goes to the surviving annuity customers through a payment known as a mortality credit. If you live a very long life, these credits increase your overall payout. Mortality credits are another advantage annuities offer that investing on your own doesn’t.”

- Plan for Retirement. You can use an immediate annuity to fund your retirement. Sit down with a financial advisor or use an annuity calculator to figure out how much you’ll need to enjoy your golden years.

- COLA. You can purchase a cost of living adjustment (COLA) rider for your SPIA for an additional cost. Doing so will increase your annuity payments over time. But that’s dependent on the rate of inflation has increased.

The Disadvantages of an Immediate Annuity

For every head, there’s a tail. So, let’s also review the disadvantages associated with immediate annuities.

- Loss of control. Once you sign an immediate annuity, it’s set-in-stone. That means your money is locked away until it’s distributed and you can not cancel the contract. And, you might not be able to access your money for an emergency without getting penalized. For some, this commitment might be the most significant drawback.

- Loss of purchasing power. Does your single premium immediate annuity contain an inflation adjustment feature? If not, then your payments may not be keeping up with inflationary trends.

- Single-premium immediate variable annuity risk. A bulk ofSPIAs purchased are fixed. But, if you happen to have a single premium immediate annuity that’s variable, you should at least be aware of the market risk involved.

- Smaller inheritance. “Moving your money into a SPIA could reduce the potential inheritance for your heirs, depending on how you set up the contract,” state Rodeck and Schmidt. “If you set up a SPIA for your life only, it will not pay anything more after you pass away. Alternatively, you may buy a contract guaranteeing a minimum number of monthly payments, or you can purchase a death benefit rider to make sure that some amount goes to your heirs. Either of these moves, however, will lower your monthly annuity income.”

How to Buy an Immediate Annuity

Anyone has an opportunity to purchase an immediate annuity. The catch is working with the right insurance company. When shopping for an immediate annuity, you’ll want to only work with insurers who have an A+ rating. And, you should compare payouts at ImmediateAnnuities.com or Schwab’s immediate-annuity marketplace.

When you find an insurer, you’ll purchase the annuity with a lump sum upfront. Your payments will then be calculated using a number of factors. These include the type of annuity you buy, the contract term, your age, and gender.

Also, the type of premium you use to find the annuity, which will either be non-qualified or qualified, will also impact how your payments will be taxed. And, be aware that some states levy a state premium tax on annuities. As a consequence, you’ll have to pay the premium tax at the time of purchase.

And, since immediate annuities are annuitized immediately, your premium becomes a regular stream of payments.

Joint and Survivor Annuities

There are ways to reduce the risk that an early death will make an immediate payment annuity a poor purchase. One option is to purchase a joint and survivor annuity. That adds a second person to the contract. If one owner dies, the co-owner of the contract will continue to receive payments. Other options include provisions to pay beneficiaries in the event of the death of the owner—at least for a certain period of time—or refunding at least some of the principal to beneficiaries if the owner dies.

All of those options can lower the risk level involved in purchasing an immediate payment annuity. They let you hedge your bets, although you can expect them to come with additional feed. But what’s always true is that once you’ve purchased an annuity, you won’t be able to cash it out. If you’re buying an immediate payment annuity, you’ll either get your money back in installments, or the funds will go to your heirs. Make sure that you have emergency money available that you can tap if you really need to.

Who Should and Shouldn’t Purchase an Immediate Annuity?

Annuities are not for everyone. With that in mind, before purchasing an immediate annuity on a whim, evaluate your current and future well-being. And speak with a financial advisor. FYI, State Insurance Departments require financial advisors to undergo annuity training.

After that, you should also ask the following questions to make this decision easier for you.

- Are you more comfortable with safety and guarantees or riskier options?

- Are less than 50% of your projected retirement expenses guaranteed sources of income? Examples would include Social Security and pensions?

- What is your age? “The sweet spot for the immediate annuity is early to mid-seventies,” says Rob Williams, managing director of financial planning at Charles Schwab.

- How healthy are you? Do you believe that you’ll live longer than the average life expectancy?

- Are you concerned about over-spending early or running out of money in retirement?

If you answered yes to any of the questions above, you might want to include an immediate annuity in your retirement income plan.

- What Is an Annuity?

- The Difference Immediate Annuities and Deferred Annuities

- How does an annuity work?

- The Benefits of a Deferred Annuity

- The Benefits of an Immediate Payment Annuity

- What Is a Variable Annuity?

- What Is a Fixed Index Annuity?

- What Is an Indexed Annuity?

- A Brief History of Annuities

- Will Annuities Recover?

- Money for Today or the Rest of Your Life?

- Are There Any Other Types of Annuities?

- Become Familiar With Annuity Fees

- What Are Your Payout Options?

- Weighing the Pros and Cons of Annuities

- Is An Annuity Right For You?

- How To Measure Your Annuity

- Understanding Annuity Formulas

- Annuity Calculators

- Questions To Ask Before Buying An Annuity

- Annuity Glossary Index