A fixed index annuity is a much simpler financial tool than a variable annuity. The insurance company guarantees a level of return so you always know exactly how much you’ll be receiving at the payout phase. The insurance companies place the investments in low-risk portfolios. Such as corporate bonds or government securities, that are very unlikely to lose value.

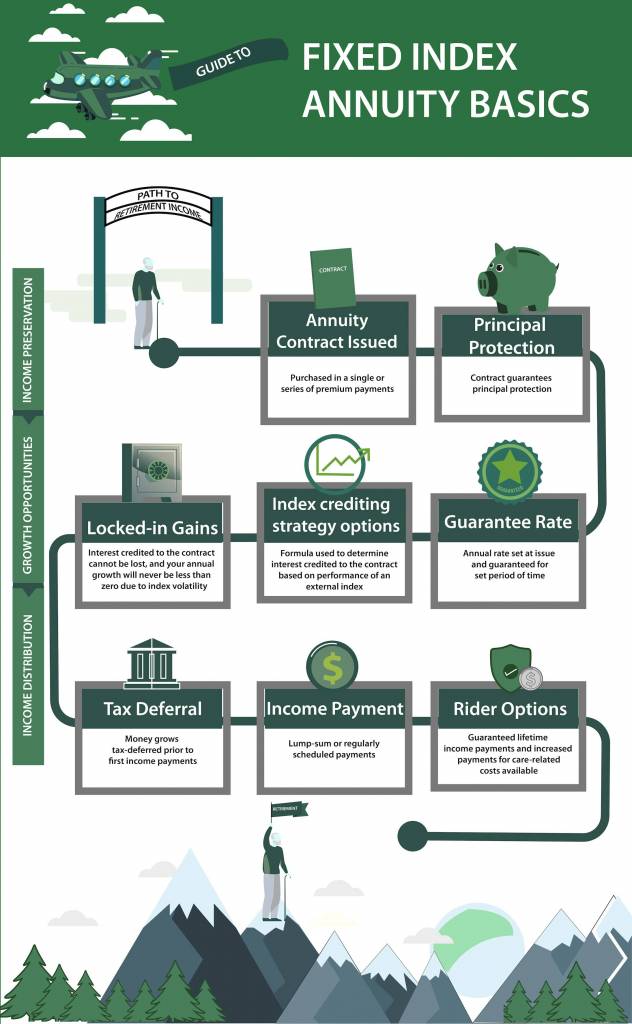

Like other forms of annuity, a fixed index annuity is tax-qualified. The inland revenue doesn’t impose taxes until the withdrawals begin. For top-level taxpayers, in particular, that can make for significant savings. A fixed index annuity becomes not just a reliable way of earning a future income. It’s also a way to earn that extra money while lowering your tax payments.

It’s long been said that you can’t have your cake and eat it too. And, you might assume that this proverb is applicable to annuities as well. After all, aren’t you limited to only a fixed or variable annuity?

Not exactly. Another type of annuity that you can purchase is one known as a fixed index annuity. It actually combines the features of both a fixed and variable annuity so that you’ll receive a guaranteed rate from the insurance rate while also having a chance to also chose the index they want their assets to follow. In turn, this can earn interest based on the market without the risk of market loss.

While that may sound too good to be true, it is. But, before committing to a fixed index annuity, here’s everything you should know about them to make sure that they fit into your retirement plan.

What is a Fixed Index Annuity?

A fixed index annuity, as with most other annuities, is a financial product offered by an insurance company that will guarantee a level of lifetime income. What makes it unique is that in addition to being a tax-favored accumulation product, it shares common features with fixed deferred interest rate annuities.

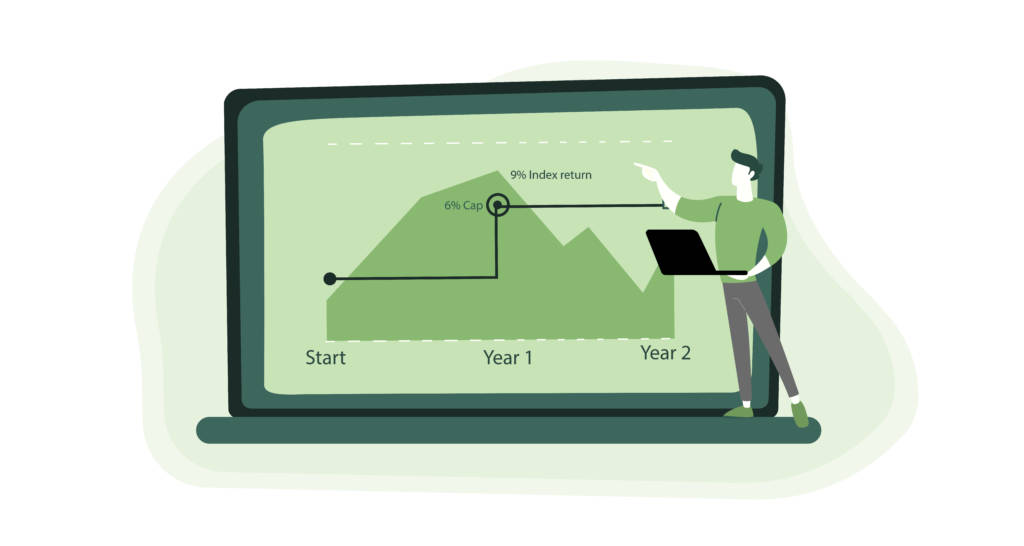

However, there’s also an index annuity component. As such, annual growth is benchmarked to a stock market index, such as Nasdaq, NYSE, or S&P500, instead of an interest rate. Since the growth of index annuity is subject to rate floors and caps, it will never exceed or drop below the specified return levels. This is the case even if the underlying stock indices fluctuate.

In short, with a fixed index annuity, the insurance company assumes all of the risks that are associated with the stock market. Even if there is a sharp decline, you won’t lose any of your principal. And, there’s also an opportunity for your potential gains to be capped at a rate between 3% and 9%.

As if that weren’t enough, it’s not unusual for fixed index annuities to also offer premium bonuses. But, this is usually at the expense of lower potential gains.

How Do Fixed Index Annuities Work?

A fixed indexed annuity is a long-term savings insurance contract. It offers two different ways of earning interest. These are also called crediting strategies.

The “fixed” part of the strategy is the one with the lowest risk and most upside. For this strategy, the insurance company provides annuitants a fixed interest rate for a specific number of years. If you’ve ever purchased a certificate of deposit (CD), you should spot the similarities.

Generally, the initial rate is only for one year. After that period, the rate resets. However, it will never go below the minimum rate that the insurance company has guaranteed.

The other crediting strategy is the “index” part of the annuity. This offers more of an upside as the money in this part of your annuity account will earn interest based on the performance of an index, like the S&P 500, the Nasdaq, the Russell 2000, or the Hang Seng. However, these rates often have restrictions attached to them. As such, you need to be aware of these to make sure that it’s worth investing in this type of annuity.

One example of this would be the fact that your money doesn’t technically go into the index fund. What’s more, insurance companies usually offer a 0% floor.

What exactly does that mean? Well, your money will either not grow at all and stay exactly the same.

And, thanks to the involvement of rates and rate caps, your returns may not be as robust as you would like. Usually, they work as follows;

- Rate cap: Let’s say that you have a 6% rate cap in your contract. That will be the maximum return you’ll receive. Even if the index garners 9% in returns, you’ll be stuck with that 6% rate cap.

- Participation rate: If the contract includes a participation rate, you’ll get a certain percentage of the growth of your index experiences. That means if your contract contains a 50% participation rate and your index grow steadily by 8%, expect 4% in returns.

After you’ve set up and opened your account, you do have the ability to decide on how much you want to allocate to each strategy. Since there are usually several index strategy options, you have the flexibility to allocate your money to more than one. For anything that you haven’t contributed to an index will grow through your contract’s current fixed rate.

And, remember, annuities, regardless of the type, are retirement savings products. As such, there are stringent withdrawal rules that you should know. Mainly, you’ll face hefty withdrawal charges if you take money out of the account before the contract’s terms stipulate. Furthermore, you’ll be charged a 10% early withdrawal penalty by the IRS if you withdraw funds from your account before the age of 59 ½.

How to Invest in a Fixed Index Annuity

Want to set up a fixed index annuity of your own? Well, the first step is first purchasing a contract. You actually have several different options to go about this. You can either make a lump sum deposit, make a series of payments over a period of time, or even transfer over funds from another retirement plan. The next step is letting the company whom you purchased the annuity from how you want your money to be invested.

While this may be overwhelming if you’re an annuity newbie, you can either go all-in by putting your money into one index or be a little more cautious by spreading it across several different indexes. The return you’ll receive is then based on how the market indexes you’ve picked perform.

How is the Potential Fixed Index Annuity Investment Return Calculated?

Arguably, the most misunderstood aspect of a fixed index annuity “is the calculation of the investment return credited to your account,” notes the folks over at Fidelity. “To determine how the insurance company calculates the return, it is important to understand how the index is tracked, as well as how much of the index return is credited to you.”

To get started, you first need to understand what index tracking is. Why? Because the money that will be deposited into your account relies on how much the index changes. “For example, they may use different time periods, such as a month, a year, or even longer periods of time. It is important to understand how the index is tracked, as it will have a direct impact on the return credited to you,” adds the Fidelity team.

What’s more, the following factors will influence the amount an insurance company will credit you.

- Return cap. As a reminder, this is an “upper limit put on the return over a certain time period.” As an example, “if the index returned 10% but the annuity had a cap of 3%, your account receives a maximum return of 3%.” It’s not uncommon for fixed index annuities to have a cap on the return.

- Participation rate. Again, will be the percentage of the index’s return that the insurance company credits to the annuity. So, “if the market went up 8% and the annuity’s participation rate was 80%, a 6.4% return (80% of the gain) would be credited.” If you fixed index annuity has a cap, then there’s also a participation rate attached. As an example, this “would limit the credited return to 3% instead of 6.4%.”

- Spread/margin/asset fee. Your annuity company may also deduct a spread/margin/asset fee from your return each year. For instance, “if an index gained 12% and the spread fee was 4%, then the gain credited to the annuity would be 8%.”

- Bonus. This would be “a percentage of the first-year premiums received that is added to the contract value.” Usually, “the bonus amount plus any earnings on the bonus are subject to a vesting schedule that may be longer than the surrender charge period schedule. That means that depending on the vesting schedule, “the bonus may be entirely forfeited upon surrender in the first few contract years.”

- Riders. All annuity types allow you to add extra features to your contract. These can include “minimum lifetime guaranteed income, that can be added to the annuity for additional costs, further reducing the return credited to the account.”

“One challenge here is that insurance companies typically have the flexibility to lower the participation rate, increase the spread, or lower the cap, which lowers your potential returns,” says Tom Ewanich, a vice president and actuary at Fidelity Investments Life Insurance Company. “If this happens during the surrender charge period after you’ve invested in the annuity, you have very little recourse.”

Additionally, an index return excludes dividends when an insurance company calculates a return. As a result, your return will not include dividend income. That’s important to note as “history indicates that dividends have been a strong component of equity returns over the course of time.”

“For example, over the past 20 years, ending October 2020, the S&P 500 index has gained 4.26% annually without dividends and 6.30% with dividends. Insurance companies are leaving 47% of the return on the table, and that’s before considering any caps, participation rates, and spreads.”

Fixed Index Annuity Withdrawals

Are you ready to take money out of your account? If that’s an emphatic yes, you have the option to convert the balance of your fixed index annuity into a steady stream of future income. Typically, the payments you’ll receive will last for a specific period of time, let’s say 20 years, or for the remainder of your life.

How much will you receive? That depends on factors like your account balance, investment return, and how long you want to receive payments. FYI, a longer period equals smaller monthly payments.

Alternatively, you could also take out all of your money at once via a lump sum withdrawal. Having a large sum of cash might sound appealing. But, this prevents you from having a guaranteed lifetime income. And, if you make this withdrawal during the surrender period, which is between five to seven years after you bought the contract, you might have to account for a surrender fee or the 0% penalty by the IRS for early withdrawal if you’re under 59 ½.

Remember, fixed index annuities are meant to be long-term contracts. That’s why the annuity company is threatening you with these fees, which are usually around 7% of your withdrawal. However, these fees should decrease each year you hold an annuity.

The Pros of Fixed Index Annuities

Are you considering a fixed index annuity? If you’re still not 100% onboard here are five reasons why you should consider buying one.

- Protection from loss. Perhaps the most attractive feature of a fixed index annuity is that you won’t lose sleep over losses in case there’s a market downturn. To put that another way, your annuity won’t lose value.

- Guaranteed retirement income. If you’re concerned about running out of money or outliving your savings, an annuity can solve this problem if you opt to receive recurring lifetime payments.

- Inflation protection. A fixed index annuity will have a higher return than a fixed annuity or a certificate of deposit (CD). Moreover, this interest is locked in and can help your savings outpace inflation.

- Tax-deferred growth. You won’t be taxed on your fixed index annuity until you begin making withdrawals. As such, this can help your annuity grow at a faster rate.

- Flexibility. Besides deciding on how to invest your money and how you’ll receive payments, you can add-on riders, such as death benefit options for your beneficiaries.

The Cons of Fixed Index Annuities

As the power balled from Poison goes, “every rose has its thrown.” In this case, with every advantage that a fixed index annuity offers, there are disadvantages to weigh.

- Mediocre growth potential. Thanks to rate caps or participation rates, you might miss out on exceptionally well-performing indexes.

- High fees. Except paying a sizable amount of your annual gains to your annuity company because of pricey annuity fees and the earnings cap.

- Surrender charges. You’ll also owe the annuity company a significant fee if you cancel your contract prior to the surrender period.

- Uncertainty. While not as prevalent as the unpredictability of a variable annuity, there is some uncertainty on how much your payouts will be because you can’t predict what the market will do.

A Low-Cost, Reliable Annuity

First, they’re a relatively cheap form of an annuity. Because they’re much more simple than the complex portfolios that variable annuities need, the fees are often lower—although they’re still likely to be higher than the fees charged for other kinds of investments.

But the big advantage is their reliability. When you buy a fixed annuity, you ensure that you’ll receive a particular income to supplement your retirement. As long as you make the payments, you can count on those extra revenues.

As always, it’s worth remembering that money paid into an annuity is not liquid. Even fixed-rate annuities carry surrender charges for early withdrawals, and the tax authority will have its own demands. Like other annuities, a fixed index annuity is only for people who really won’t need the money until they reach the withdrawal phase.

Annuities Are Unsecured

And while the government guarantees money placed in bank accounts, there’s no insurance for money placed in an insurance company’s annuity policy. People who buy fixed rate annuities are usually looking for stability and reliability. They want to lower risks and know that money they don’t need now will be available when they need it in the future.

So if you are thinking of purchasing a fixed rate annuity, do make sure that the insurance company you use is financially secure. You’ll probably be better off paying a slightly higher fee. This helps you feel confident that the company will still be around in fifteen or twenty years. This over saving half a percent and worrying about being left with nothing.

So a fixed rate annuity is a useful, if slightly expensive, way to buy a guaranteed income in the future. It’s relatively simple to understand and follow.

If you’re looking for something slightly more complex, more risky but still relatively simple to follow, you could try an indexed annuity.

Fixed Index Annuities vs. Other Types of Annuities

If there is one takeaway from this guide, it’s knowing which type of annuity contract is right for you. And, the only way to determine that is by seeing how a fixed index annuity stacks up against a variable or fixed annuity.

- Variable annuity vs. fixed index annuity. Both of these types of annuities put your money into stock market funds. However, a variable annuity will give you the best potential return. The tradeoff is the risk involved. A fixed index annuity is less risky since you’ll get some market exposure without suffering from large losses since you’ll get a predetermined interest rate.

- Fixed annuity vs. fixed index annuity. With both types, you’ll be the recipient of a predetermined interest rate. However, with a fixed index annuity, you’re also playing the market. In turn, you’ll get potentially stronger earnings caps and participation rates. On the flip side, it’s not as predictable as a fixed annuity.

Overall, fixed indexed annuities are the best of both worlds. You’re able to tap into the advantages of both a fixed and variable annuity without the downside. What’s more, a fixed index annuity is extremely flexible and is worth pursuing if you want a less risky and semi-predictable medium or long-term investment.

Frequently Asked Questions About Fixed Index Annuities

Finally, if you’re still a little confused about this annuity product or not 100% sold on it, here are ten questions that should clear everything up for you.

- How much do I need to purchase a fixed indexed annuity?

You don’t need an arm and leg to purchase any type of annuity. Usually, there’s a $5,000 minimum to buy an annuity. However, this varies by the exact product and insurance company that you’re working with.

- How complicated is a fixed index annuity to understand?

While it is true that annuities, in general, can be complex, they’re probably not as complicated as you would assume. Remember, an annuity is nothing more than a contract between you and an insurance company. In exchange for a premium, you’ll receive either a lump sum or series of payments at a later date.

With a fixed index annuity, your money will grow at a guaranteed rate, while a portion of the annuity will be invested. The main advantage of this is that your principal is protected from market volatility.

- At what age can you purchase an annuity?

While some annuity products have age restrictions, most don’t. However, annuities are often purchased when one is closer to retirement age. And, the more important age to be aware of is 59 ½. If you withdraw money prior to that age, you’re responsible for an additional 10 percent tax on your funds.

- What’s the difference between a fixed annuity and a fixed index annuity?

With a traditional fixed annuity, the interest that is accumulated is based on a fixed interest rate. This is guaranteed by the insurance company for a set period of time. It’s a popular annuity type if you’re looking for steady and consistent growth without dealing with market risk.

A fixed index annuity also contains the same key feature as a traditional fixed annuity. But, there’s also potential for additional interest through the return of an index, such as the S&P 500.

- Are there tax benefits with a fixed index annuity?

As with other annuity types, fixed index annuities offer tax-deferred growth. As such, taxes are not due until you make a withdrawal.

- Do fixed index annuities invest in the stock market?

Make no mistake about it, fixed index annuities are insurance products first and foremost. That means that they’re not directly linked to the stock market. But, if you aren’t investing in the stock market then how is interest earned? It’s through an external equity or bond index. Because of this, the interest credited to your account will never be less than zero. And, you won’t lose the principal if there’s a market downturn.

- How can I access money within an annuity?

Well, that depends on the type of annuity you’ve bought. If you need to tap into your funds right away, you’ll want an immediate annuity. This way you’ll start receiving regular annuity payments within the first year of your contract.

If you can, or prefer, to wait, then you’ll want a deferred annuity. While you can withdraw your money whenever you want, the surrender charge is often higher.

- What is the difference between a fixed index annuity and a variable annuity?

Once again, a fixed index annuity is a type of fixed annuity that also earns interest based on changes in a market index. And, no matter how the market performs, the interest rate is guaranteed to never be less than zero.

Variable annuities earn investment returns based on the performance of “sub-accounts.” These investment portfolios are chosen by you and the return isn’t guaranteed. So, you’ll make money when your sub-accounts go up and lose money when they drop.

- How are annuities regulated?

All annuities are regulated at the state level. Specifically, annuities are overseen by each state’s insurance commissioners.

- Is a fixed index annuity right for me?

The only person that can answer that is you. You may want to consult with a financial advisor as well. But, it ultimately comes down to your goals, when you want your payments to begin, how comfortable you are with risk, market volatility, and tax requirements.

- What Is an Annuity?

- The Difference Immediate Annuities and Deferred Annuities

- How does an annuity work?

- The Benefits of a Deferred Annuity

- The Benefits of an Immediate Payment Annuity

- What Is a Variable Annuity?

- What Is a Fixed Index Annuity?

- What Is an Indexed Annuity?

- A Brief History of Annuities

- Will Annuities Recover?

- Money for Today or the Rest of Your Life?

- Are There Any Other Types of Annuities?

- Become Familiar With Annuity Fees

- What Are Your Payout Options?

- Weighing the Pros and Cons of Annuities

- Is An Annuity Right For You?

- How To Measure Your Annuity

- Understanding Annuity Formulas

- Annuity Calculators

- Questions To Ask Before Buying An Annuity

- Annuity Glossary Index