The question of whether to buy a deferred annuity or an immediate payment annuity is likely to be straightforward. If you’re some years from retirement, have maxed out your 401(k) and your IRA, and are looking for another way to save for the future, a deferred annuity is a good solution.

If you’re about to retire and want to add another income stream to your retirement fund, then an immediate payment annuity will do the job.

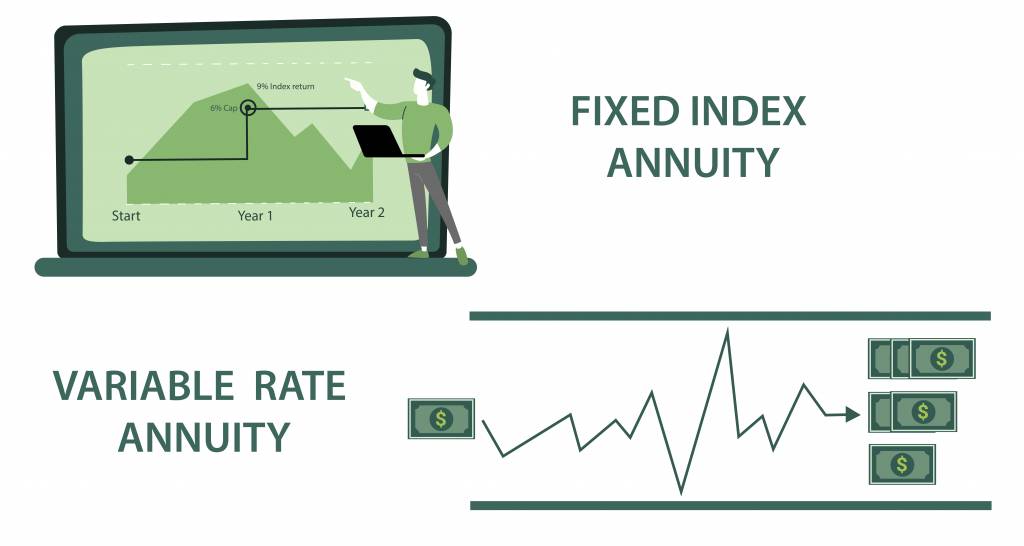

Whether to choose a fixed index annuity or a variable rate annuity will be a harder decision.

Fixed index annuities provide a stable income. That income might not rise in line with inflation, effectively falling each year. But they do provide a certain amount of security. They allow retirees to know exactly how much they’ll receive each month regardless of the performance of the rest of the economy.

A fixed index annuity can be the closest many people will get today to a defined benefit pension.

A variable rate annuity changes with the performance of the market. It’s less reliable and more volatile but it can produce higher returns at times of economic growth. It can also be expensive. Insurance companies often add extra fees to variable annuities to cover the costs of administration and a guaranteed death benefit. You can expect to pay as much as 2 percent each year of the value of the contract. That’s an amount that can take a large dent out of the growth of the fund. As you compare the expected returns of a fixed rate annuity and a variable rate annuity, be sure to account for the effect of each fund’s fees.

Whether you choose a fixed rate annuity or a variable rate annuity though, will ultimately depend on your appetite for risk and the arrangement of your other retirement funds.

- The Four Stages of Retirement

- When Can You Retire?

- How Much Will You Need to Save Before You Can Retire?

- How to Create a Retirement Savings Habit

- The Benefits and Costs of a Pension

- Retiring with a 401(k)

- The Benefits of a 401(k) Plan

- The Costs of a 401(k) Plan

- Vesting a 401(k) Plan

- 4 Types of 401(k)

- Rolling Over Your 401k

- Leave Your Old 401(k) with Your Old Employer

- How to Rollover Your 401(k)

- Individual Retirement Accounts—IRAs

- How an IRA Works

- Working Your IRA With Your 401(k)

- 3 Types of IRAs

- SEP IRA Limits

- Annuities

- The Benefits of an Annuity

- Deferred Annuities

- Immediate Payment Annuities

- Fixed Index Annuities and Variable Rate Annuities

- Qualified and Non-Qualified Annuities

- Changing Your Annuity—The Section 1035 Exchange

- The Limits of a 1035 Exchange

- How to Plan for Your Retirement

- How to Start Planning Your Retirement