401(k) plans are usually delivered by employers. They’re managed by financial funds and they’re usually tax-deferred—your employer makes your contributions on your behalf with pre-tax dollars. You only pay the tax on that income after you retire and start receiving the funds.

They’re also limited. You can’t put as much as you want into your 401(k) on a tax-deferred basis.

IRAs are even more limited. While you can choose your own IRA, you can usually place no more than $500 a month into your account.

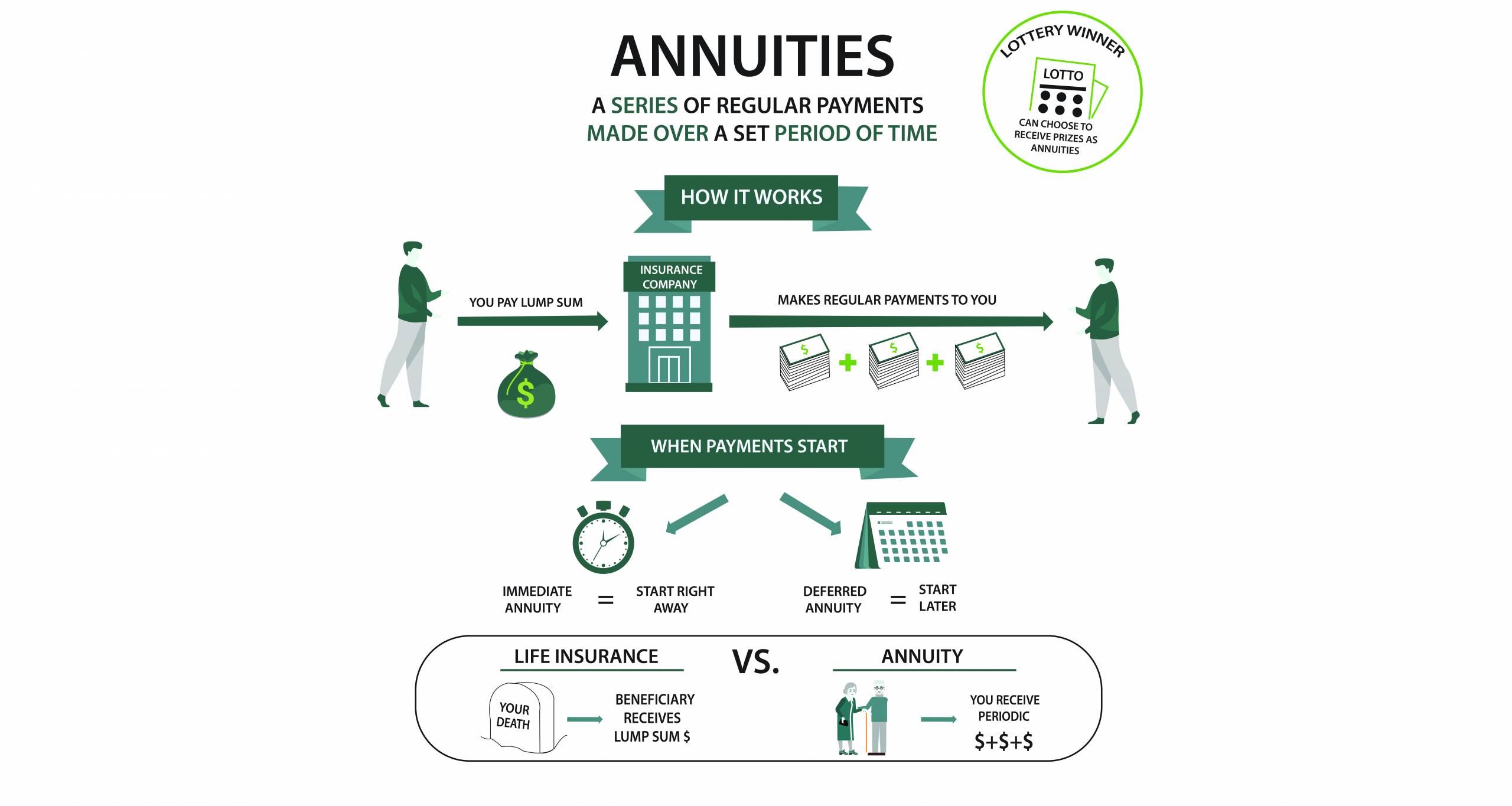

Retirement annuities are contracts with insurance companies. Like IRAs and 401(k) plans you can make contributions using pre-tax dollars and receive a monthly income in return.

The contents of the fund then grows on a tax-deferred basis, with no tax due until retirement. But there are no limits on the contributions you can make. You can put as much money into an annuity as you want.

That makes them valuable additions to your retirement planning toolkit.

If you’ve maxed out your 401(k) and your IRA, then buying an annuity can help you to continue shoveling money into the future and lowering your tax bill.

- The Four Stages of Retirement

- When Can You Retire?

- How Much Will You Need to Save Before You Can Retire?

- How to Create a Retirement Savings Habit

- The Benefits and Costs of a Pension

- Retiring with a 401(k)

- The Benefits of a 401(k) Plan

- The Costs of a 401(k) Plan

- Vesting a 401(k) Plan

- 4 Types of 401(k)

- Rolling Over Your 401k

- Leave Your Old 401(k) with Your Old Employer

- How to Rollover Your 401(k)

- Individual Retirement Accounts—IRAs

- How an IRA Works

- Working Your IRA With Your 401(k)

- 3 Types of IRAs

- SEP IRA Limits

- Annuities

- The Benefits of an Annuity

- Deferred Annuities

- Immediate Payment Annuities

- Fixed Index Annuities and Variable Rate Annuities

- Qualified and Non-Qualified Annuities

- Changing Your Annuity—The Section 1035 Exchange

- The Limits of a 1035 Exchange

- How to Plan for Your Retirement

- How to Start Planning Your Retirement