Also known as a fixed-index annuity, index annuities are essentially a hybrid of a fixed and variable annuity. The reason being is that index annuities combine the features of both of these types of annuities.

Differences Between Fixed and Indexed Annuities

The main differences between fixed and indexed annuities are as follows;

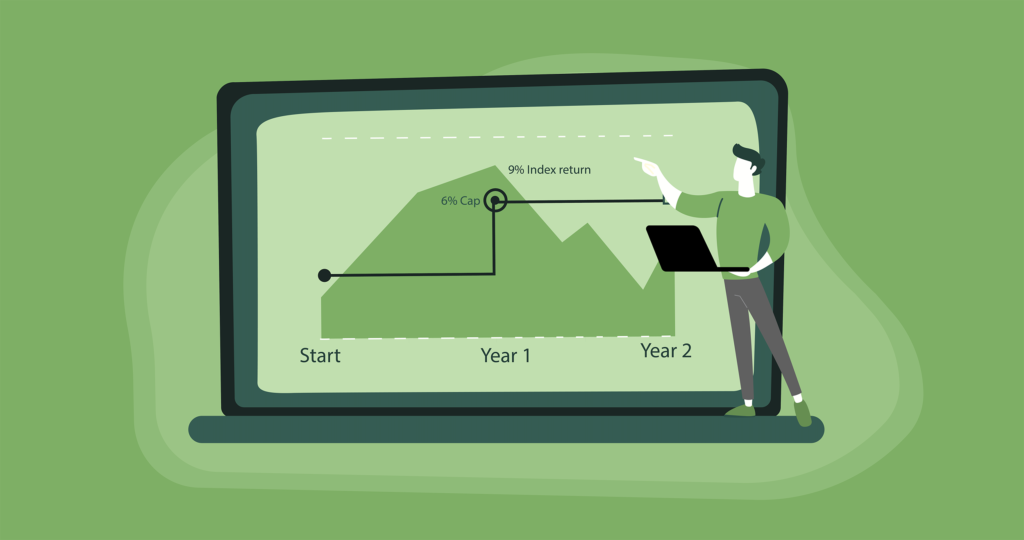

- With a fixed annuity, interest is based on the date of contact. With index annuities, interest is determined by the performance of an index, such as the S&P 500. Just note that indexed annuities will never drop below a certain level.

- Generally, fixed annuities have lower fees, while indexed annuities higher fees.

- Overall, fixed annuities are predictable and simple to understand. Indexed annuities can be complicated and slightly riskier.

Chapters - Fixed Annuity

- How Does a Fixed Annuity Work?

- Always refer to your contract

- The Benefits and Criticisms of Fixed Annuities

- Benefits of Fixed Annuities

- The drawbacks of fixed annuities

- Current Fixed Annuity Rates

- Are Fixed Annuities Guaranteed?

- The Differences Between Fixed and Indexed Annuities

- Fixed Annuity Calculator

- Buying a Fixed Annuity