Have you ever purchased a certificate of deposit (CD)? If so, then you may find that a fixed annuity is awfully similar.

Like a CD, you can use a fixed annuity to build wealth. They’re also considered low-risk investments meaning that your principal is secure. And, after each matures after a predetermined timeframe, you can collect your money at a guaranteed minimum rate.

But, that’s why the similarities end. CDs are usually reserved for short-term goals, like putting a down payment on a house. Fixed annuities are long-term investments that you’ll use during retirement.

With that out of the way, here’s how a fixed annuity works.

You purchase a fixed annuity through an insurance company. You have the option to either do this in one lump sum or through a series of payments. Said insurance company then guarantees that the money in your account will earn a certain rate of interest.

During the accumulation phase, your money will grow tax-deferred. When you, the annuitant, begin receiving a regular income from the annuity, the insurance company will calculate your rate through a variety of factors including;

- The premium amount

- Current interest rates

- Your age and life expectancy

- Your gender

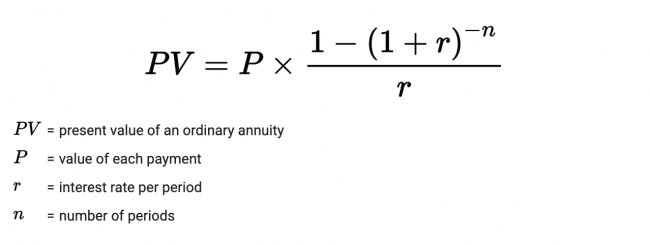

If you’re feeling amphibious, and don’t mind crunching some numbers, you can use the following formula to calculate your payments;

Annuity Value = Payment Amount x Present Value of an Annuity (PVOA) factor.

For example, if you have a $500,000 annuity with a 4% interest rate that you’ll annuitize for 25 years. If so, the PVOA factor would be 15.62208. So, 500,000 = Annual Payment x 15.62208. And, that would make the annual payment gives $32,005.98.

Keep in mind that how your money will grow and what you’ll receive is detailed in your contract. You could set it up so that you’ll be getting a set dollar amount, interest rate, or another formula to your liking.

- How Does a Fixed Annuity Work?

- Always refer to your contract

- The Benefits and Criticisms of Fixed Annuities

- Benefits of Fixed Annuities

- The drawbacks of fixed annuities

- Current Fixed Annuity Rates

- Are Fixed Annuities Guaranteed?

- The Differences Between Fixed and Indexed Annuities

- Fixed Annuity Calculator

- Buying a Fixed Annuity