At some point, you will have to ask an important question, “I much do I need to retire?”

There are actually several rules of thumb when it comes to saving for retirement. The most common, though, is somewhere near $1 million. Other experts suggest that you’ll 80% to 90% of your pre-retirement income or 12 times your salary before retiring.

What’s the best option for you? How will you know when you’re on the right path?

To answer those questions, you have to consider many factors, such as your age and life expectancy. Additionally, you also need to consider your income sources and goals in retirement. Suffice to say; this can be daunting when saving for retirement.

The good news? There may be an easier way to figure out how much you really need to save for retirement by calculating your net worth. By doing so, you’ll be able to assess your present financial situation, set realistic retirement goals, and budget your retirement accordingly.

Table of Contents

ToggleWhat is Net Worth, and Why is It Important?

“When you start thinking about the net worth, you might envision some internet billionaire or media tycoon — a bigwig with big bucks,” writes Megan DeMatto for CNBC. “But anyone can calculate their net worth, and it’s a good number for everyone to know.”

To put it more simply, net worth is a measure of wealth. So first, you would add up your assets, live savings, investments, and property to figure this. Next, you would subtract the liabilities you owe, like student loans, credit card debt, or your mortgage.

“Net worth is different than income since we don’t necessarily keep every dollar we make,” explains DeMatto. “Instead, we buy, borrow and make investments with money, and the total value of our properties and cash goes up and down with time.”

Therefore, calculating your net worth is a good measure of your overall financial well-being. “Think of it like a snapshot that shows you where you are on your financial journey,” she adds.

As of September 2020 (based on data collected in 2019), the median net worth of U.S. households was $121,700. However, it’s more than double for people aged 65 to 74.

The Federal Reserve shows that Americans in their late 60s and early 70s have a median net worth of $266,400. For this age bracket, the average (or mean) net worth is $1,217,700. But, since averages tend to be higher due to highly affluent households, the median is much more representative.

While $266,400 may seem like a lot of money at first, it may not be enough to cover your living expenses as you age. That’s why understanding net worth and how it relates to living on a fixed income is crucial when planning for your retirement.

Why is net worth important?

“Keeping track of your net worth over time is a good indicator of your financial status,” explains DeMatto. “People work hard to bring home their salaries, but what happens after your paycheck hits your bank account is not always predictable.”

When you review your net worth, you can see where your money has gone in the past versus where you want to put it going forward.

You can use your net worth to see how far you’ve come when deciding whether to purchase a car or a home, take out debt to go back to school, or set a savings goal. However, it won’t help you with, say, sticking to a daily budget,” she notes.

How to Calculate Your (Tangible) Net Worth

It’s important to note that an individual’s net worth will differ slightly from that of a company’s net worth. In either case, though. all assets minus all liabilities equals net worth. But, for purposes of calculating net worth for individuals, assets are valued at their current market value rather than their original purchase price. On the flip side, when calculating company net worth, assets are valued based on their original purchase prices rather than their market value today.

In the event of a death, an individual’s net worth equals their estate value. After probate is completed and the deceased’s liabilities have been settled, any remaining assets are distributed to heirs. After receiving an inheritance, that amount becomes a part of the inheritor’s wealth.

An asset’s value is sometimes referred to as the open market value or the carrying value in business. In other words, this would how much these assets would fetch when being sold, like at an auction. The terms mark-to-market, fair value, and fair market value can all be used interchangeably with carrying value, regardless of context.

If a company or individual has more liabilities than assets, they have a negative net worth. There are two ways that this can happen. First, the liabilities grow over time as more debt is taken on. Or, second, the assets become less in value.

How to calculate your net worth.

To figure out your net worth, you need to take an inventory of your assets and liabilities. FYI, assets can be items you’re still paying off, i.e., your car or home.

Generally speaking, however, assets include anything that you could sell for cash, like;

- Cash

- Checking accounts

- Savings accounts

- Retirement vehicles, such as 401(k)s, IRAs, pensions, and annuities

- Investments, like stocks, bonds, and mutual funds

- Real estate

- Vehicles

What about liabilities? If you owe a person or entity any money, that’s called a liability. Common examples include;

- Credit card balances

- Student loans

- Mortgages

- Auto loans

- Medical bills

As a very basic example, if you were to take out a mortgage on a house worth $250k, but the balance on the loan is $150,000, your net worth would be $100,000.

The formula is basically:

ASSETS – LIABILITIES = NET WORTH

Or, if you prefer, you can plug all this information into a net worth calculator. Again, these are easy to find online. But, some examples would be those from Bankrate, Personal Capital, or the AARP.

As a side note, your net worth does not include your income. When people spend most of their money, they have a low net worth, even if they earn a hefty paycheck. However, even individuals with modest incomes can accumulate wealth and a high net worth if they own appreciating assets and are responsible savers.

How to calculate your tangible net worth.

“Your tangible net worth is similar to your net worth in that it totes up your assets and liabilities,” notes Jean Folger over at Investopedia. “But it goes one step farther. It subtracts the value of any intangible assets, including goodwill, copyrights, patents, and other intellectual property.”

A company, for example, calculates tangible net worth to determine its liquidation value if it were to cease operations or to be sold, Folger adds. Likewise, individuals who apply for personal and small business loans, and the lender asks for a “real” net worth figure, can also use this information.

“Your lender may be interested in your tangible net worth because it provides a more accurate view of your finances—and how much the lender could recoup if it had to liquidate your assets if you defaulted on their loan,” she states.

While not applicable for everyone, it’s essential to use the following formula if you just so happen to own intangible assets like copyrights, goodwill, patents, trademarks, or any other property.

Calculating your tangible net worth is as follows:

Total Assets – Total Liabilities – Intangible Assets = Tangible Net Worth

“Calculating your net worth is a multi-step process,” says Folger. “Before you start, decide if you want to calculate net worth individually (you) or jointly (you and your spouse or partner).” Additionally, gather all your financial statements (such as bank and credit card statements) in one place.

“The first time you calculate your net worth will probably take the longest,” she warns. “Once you figure out the methodology and how to value your assets, however, the process will likely take less time.”

You first need to add up your assets, like CDs and checking and savings accounts, to get started. Next, move on to your investments, such as stocks, bonds, and retirement plans. And, then you’ll want to take stock of your personal property, including real estate, collectibles, and vehicles.

Once you’ve added up your assets, you’ll need to deduct your liabilities. Folger recommends starting off with a secured debut, Examples of these would be a mortgage or car loan. After that, focus on unsecured debt like personal loans or credit card balances.

After adding up your liabilities, you’ll want to take inventory of your intangible assets. And, using the formula above, you’ll come up with your tangible net worth.

Determining How Much You Need to Retire

You should choose a net worth goal that accommodates your lifestyle and limits in retirement. The thing is, there is no one-size-fits-all approach. As such, figuring out how much you’ll need in your post-work life will vary.

However, a solid starting point would be to focus on your retirement spending and not your income.

Most likely, you will not spend the same amount in retirement as you do now. For example, you may no longer have a mortgage payment when you retire. In addition, if you have grown-up children and they’re living on their own, they may no longer depend on you financially — you may even be able to downsize your home. And, you’ll also eliminate work-related costs such as commuting, childcare, and business attire expenses.

However, you’ll be faced with other expenses that you may not have to deal with right now. Most glaring will be how much you’ll have to pay out-of-pocket costs for medical and prescription costs. Prescription drugs cost Americans, on average, $1,200 per year, according to the Organisation for Economic Cooperation and Development. What’s more, medical costs are expected to increase at an average annual rate of 5.4% and reach $6.2 trillion by 2028.

Additionally, you may wish to outsource home-related tasks that you currently do yourself. This could include mowing your lawn, shoveling snow, clearing your gutters, cleaning your home, or laundry. Alternatively, you may decide to travel more or engage in new hobbies.

Multiply your current annual spending by 25.

Income isn’t the best metric to use when calculating how much you need for your golden years. And, the same is true with expenses. However, expenses can at least provide a baseline on what you should target. Again, some of your current expenses will shrink, but others will rise. But, for most of us, it’s safe to assume that what you’ll spend in retirement is close to what you’re spending today.

For a rough estimate of the amount of money you’ll need when you retire, multiply your current annual spending by 25. In retirement, you’ll need that amount of savings to be able to withdraw 4% of it every year and live comfortably. While the 4% rule has its shortcomings, it’s a good starting point to determine a safe annual withdrawal amount.

If you currently spend $40,000 a year, you’ll need an investment portfolio of 25 times $40,000 a year, or $1 million at the start of retirement. In your first year of retirement, you can withdraw 4% of that amount, and that 4% will be adjusted for inflation every year after that. Sticking with this strategy, the chances of you not outliving your money are relatively good.

Spend Without Worry in Retirement

Even after doing all of the above, almost half of Americans fear that they’ll run out or outlive their money. While some proclaim that this fear is overblown, there is some validity here. After all, there’s inflation, rising medical costs, and the fact that people are living longer.

One way to put your mind at ease over this is to save 20% of your income for retirement. To save 20% of your earnings, you’ll probably need to work up to it over time. To reach this, though, you can take the following steps:

- Budgeting for retirement and prioritizing saving.

- Transfer money from raises or tax returns straight into your retirement account before spending it.

- Automatic contributions should be gradually increased.

So, let’s say that you’re currently contributing 10% of your income. Consider increasing this to 12%. You can test whether you can live on what is left over by doing this. If so, keep making contributions gradually. And, even better, you probably won’t even notice much of a disruption in your daily life.

In addition, you can also try the following strategies to spend without concern in retirement.

Adjust the 4% rule.

In their early years of retirement, many retirees spend more money traveling and engaging in other activities than in their seventies and eighties when they are more able to cut back. Create a retirement income and expense timeline for a withdrawal plan that aligns more closely with your retirement lifestyle. Using this exercise, you’ll be able to develop a strategy to eliminate the gap between your savings and your income each year.

Delay your social security benefits.

Delaying your Social Security benefits can be one of the most effective ways to protect your retirement savings from inflation. Why? Because Social Security automatically adjusts for inflation every year, unlike just about any other retirement portion. In 2022, the COLA for Social Security could increase by up to 6.3% because of recent increases in consumer prices.

Furthermore, you’ll receive an 8% credit each year you delay claiming benefits from full retirement age, or FRA until you turn 70.

Lower your taxes on your savings.

There’s an assumption that your taxes will be lower in retirement. However, you’re going to be still earning an income from Social Security benefits and retirements savings. And, that means you’re going to have to pay Uncle Sam some taxes.

Consider tax-exempt investments, such as municipal bonds, to pay fewer taxes in retirement. You can also gain income from tax-advantaged sources of income, such as capital gains and rental real estate. And, to avoid moving into a higher tax bracket, withdraw the majority of your money from a Roth plan.

Or, relocate to a state that doesn’t tax retirement plan income or no state income taxes. These include Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. In addition, Illinois, Mississippi, and Pennsylvania will not tax distributions from 401(k) plans, IRAs, or pensions. And Alabama and Hawaii won’t tax pensions but do tax distributions from 401(k) plans and IRAs.

Reduce the effect of RMDs.

When you turn 72, you must begin required minimum distributions from tax-deferred accounts, regardless of whether you need the money. RMDs are calculated by taking the total amount of money you have in all of your accounts at the end of the year, then dividing it by a life expectancy factor. You will be taxed on withdrawals at your ordinary income tax rate; you will also face a higher Social Security tax and a higher Medicare premium.

Note that Congress is considering legislation that would change the increase of this age from 72 to 73 on January 1, 2022. And it would steadily increase the RMD age to 75 by 2032.

Until then, you can take matters into your own hands by making withdrawals earlier, donating your RMD, or postponing retirement. You could also roll over some of your savings into a Roth IRA or a qualified longevity annuity contract.

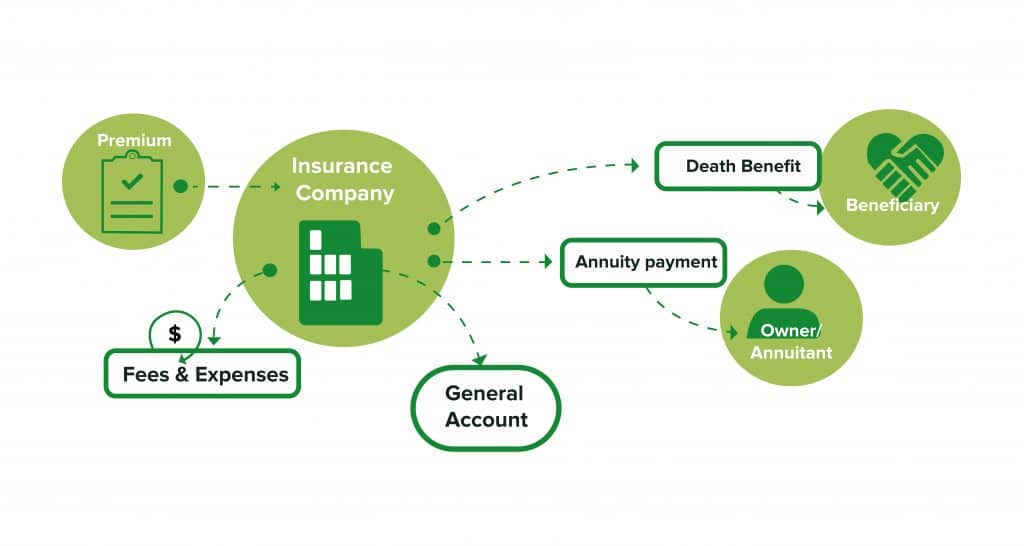

Buy an annuity.

Annuities provide a tax-deferred guaranteed lifetime income while also providing higher returns than traditional fixed-income investments. For instance, you would receive a guaranteed payout every year, whether the account balance falls to zero or not, if you purchase an annuity with a guaranteed lifetime withdrawal benefit rider.

While annuities aren’t flawless and can be complicated, here are some of the most common types.

- Single-premium immediate annuity — also called an immediate annuity. Typically, insurance companies ask for a lump sum in return for monthly payments for the remainder of your life or a specific period of time. Payment can begin immediately.

- Deferred-income annuity. You will receive guaranteed payments from an insurance company when you reach a certain age. You can buy this annuity with a lump sum or through installments.

- Multi-year guaranteed annuity. This investment provides a fixed rate of return for a specific time period (usually 3 to 7 years).

- Fixed annuity. With a fixed annuity, you’re guaranteed a specific level of return. For example, with a Due Fixed Annuity, you’ll earn 3% interest on every dollar in your account.

- Fixed-index annuity. You will receive returns based on a specific index, such as the S&P 500.

- Variable annuity. These deferred annuities invest in mutual fund-type accounts to create future income.

As you can see, there’s a lot to consider when planning your retirement. But, if you determine your net worth, how much you’ll anticipate spending, and find ways to prevent outliving your money, you can actually enjoy your retirement.