Here are a few clear methods for investing $ 50,000, each with various approaches suited to different risk profiles and investment objectives. Readers are provided with detailed rankings and insights to help select the option that best fits personal needs. The background reflects recent trends in investing, noting that traditional stocks and newer platforms both offer advantages. The evaluation relies on specific criteria that examine return potential, fee structures, liquidity, risk, and user satisfaction. The criteria used include:

- Risk Profile

- Expected Returns

- Access to Funds

- Fee Structure

- Liquidity

Table of Contents

ToggleTop 14 Ways To Invest 50,000

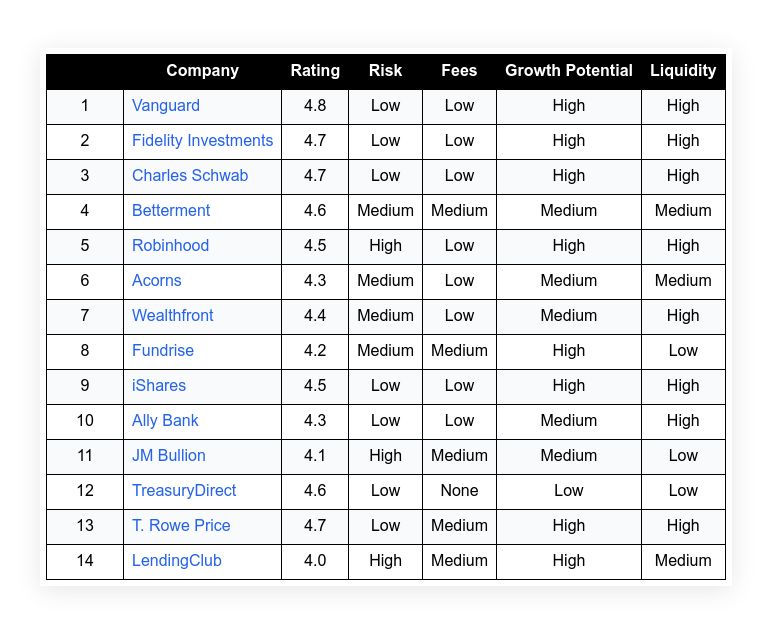

| Company | Rating | Risk | Fees | Growth Potential | Liquidity | |

|---|---|---|---|---|---|---|

| 1 | Vanguard | 4.8 | Low | Low | High | High |

| 2 | Fidelity Investments | 4.7 | Low | Low | High | High |

| 3 | Charles Schwab | 4.7 | Low | Low | High | High |

| 4 | Betterment | 4.6 | Medium | Medium | Medium | Medium |

| 5 | Robinhood | 4.5 | High | Low | High | High |

| 6 | Acorns | 4.3 | Medium | Low | Medium | Medium |

| 7 | Wealthfront | 4.4 | Medium | Low | Medium | High |

| 8 | Fundrise | 4.2 | Medium | Medium | High | Low |

| 9 | iShares | 4.5 | Low | Low | High | High |

| 10 | Ally Bank | 4.3 | Low | Low | Medium | High |

| 11 | JM Bullion | 4.1 | High | Medium | Medium | Low |

| 12 | TreasuryDirect | 4.6 | Low | None | Low | Low |

| 13 | T. Rowe Price | 4.7 | Low | Medium | High | High |

| 14 | LendingClub | 4.0 | High | Medium | High | Medium |

Vanguard

Vanguard is known for its low-cost index funds and a wide range of investment options. The platform has a long history of serving investors with a clear focus on long-term growth. Vanguard offers easy account management and a stable reputation among its users. It suits both new investors and experienced individuals who prefer a controlled risk environment. The user interface is straightforward, and the fee structure appeals to cost-sensitive investors. Recent reviews indicate that the company consistently delivers strong performance, with a focus on asset diversification and long-term wealth growth.

Risk Profile: Low

Expected Returns: Steady

User Satisfaction: High

Fees: Minimal

Liquidity: High

| Summary of Online Reviews |

|---|

| Users mention that “Vanguard delivers steady performance” and praise its low fees and range of choices. |

Fidelity Investments

Fidelity Investments offers a range of investment opportunities, including index funds and retirement options. The platform is appreciated for its educational resources and personalized advisory services. It is positioned to support both long-term planning and short-term strategies. The service provides competitive pricing with favorable user feedback regarding ease of use and helpful customer service. Fidelity consistently maintains high standards for managing diversified investment portfolios and demonstrates reliability through detailed guidance and flexible investment solutions.

Risk Profile: Low

Expected Returns: Consistent

User Satisfaction: High

Fees: Competitive

Liquidity: High

| Summary of Online Reviews |

|---|

| Several users state “Fidelity helps simplify investing” and enjoy the platform’s reliable support. |

Charles Schwab

Charles Schwab is favored for its extensive investment tools and broad range of investment products. The service stands out with its intuitive interface and low-cost commission structure. It caters to both frequent traders and long-term investors by offering a diversified range of options. The company prioritizes security and reliability, ensuring that clients have access to the latest market insights. Many investors commend its solid customer service and streamlined account processes, which contribute to a high level of confidence among its user base.

Risk Profile: Low

Expected Returns: Stable

User Satisfaction: High

Fees: Low

Liquidity: High

| Summary of Online Reviews |

|---|

| Feedback includes “Schwab offers straightforward investment tools” and praises its economical fees. |

Betterment

Betterment helps by providing automated portfolio management and personalized advice. The approach simplifies investment decisions and helps users build diversified portfolios with minimal effort. The platform is noted for its ease of setup and clear fee structure. Many investors find the digital tools accessible and are satisfied with the performance management strategies. Betterment suits individuals who want to manage their wealth with automated guidance and provides clear insights into their portfolio developments.

Risk Profile: Medium

Expected Returns: Moderate

User Satisfaction: Good

Fees: Moderate

Liquidity: Medium

| Summary of Online Reviews |

|---|

| Users report “Betterment makes investing simple” with praise for its user-friendly design. |

Robinhood

Robinhood offers commission-free trading and a modern, mobile-friendly platform. It attracts younger investors looking for fast and accessible market entry. The service provides a streamlined approach to trading stocks and cryptocurrencies. While the focus is on simplicity and cost-efficiency, it also includes basic research tools. Users appreciate the minimal fee structure and responsive design. This platform is better suited for those who are comfortable with higher risk levels and value a direct approach to managing trades and monitoring market changes.

Risk Profile: High

Expected Returns: Variable

User Satisfaction: Good

Fees: Negligible

Liquidity: High

| Summary of Online Reviews |

|---|

| Reviews state “Robinhood is fast and cost-effective” with users admiring its mobile design. |

Acorns

Acorns turns everyday spending into a simple investment routine. It automatically rounds up purchases and invests the change in diversified portfolios. The app appeals to those beginning their investment journey by lowering the barrier to entry. Many users appreciate the automated nature of the service and find the app easy to understand. Acorns offers an alternative way to accumulate wealth while keeping the process straightforward and automated over time. Its structure makes it a fit choice for investors looking to start with routine contributions without complex decisions.

Risk Profile: Medium

Expected Returns: Steady

User Satisfaction: Good

Fees: Low

Liquidity: Medium

| Summary of Online Reviews |

|---|

| Feedback includes “Acorns simplifies savings and investing” with recognition for its automated approach. |

Wealthfront

Wealthfront is a digital platform that utilizes technology to manage portfolios and assist in financial planning. The service is driven by algorithms that aim to maintain a balanced portfolio in accordance with risk tolerance. Investors are attracted by the clarity and ease-of-use that accompany its automated advice. The system regularly monitors accounts to keep allocations in line with the investor’s strategy. Many clients report that the computerized monitoring and rebalancing add to their confidence in steady growth.

Risk Profile: Medium

Expected Returns: Moderate

User Satisfaction: Good

Fees: Low

Liquidity: High

| Summary of Online Reviews |

|---|

| Clients mention “Wealthfront keeps portfolios balanced” and find comfort in its consistent monitoring. |

Fundrise

Fundrise offers real estate investment opportunities through an online interface. The service allows access to private real estate projects. Investors appreciate its low entry point and the chance to diversify away from traditional stocks. The platform provides detailed project information and updated performance metrics. Client reviews note that Fundrise makes real estate investing approachable while delivering transparent information regarding returns and project performance.

Risk Profile: Medium

Expected Returns: High

User Satisfaction: Good

Fees: Medium

Liquidity: Low

| Summary of Online Reviews |

|---|

| Reviews include “Investing in real estate is simplified with Fundrise” along with praise for its clear project details. |

iShares

iShares by BlackRock offers a range of exchange-traded funds designed to provide broad market exposure. Investors use it to build diversified portfolios with low expense ratios. The service is acclaimed for enabling access to various sectors and geographies via single instruments. The structured funds appeal to those who favor a balance between risk and return. User feedback reflects satisfaction with the variety and flexibility these funds provide.

Risk Profile: Low

Expected Returns: High

User Satisfaction: High

Fees: Low

Liquidity: High

| Summary of Online Reviews |

|---|

| Users note “iShares offers wide market coverage” and applaud its low cost structure. |

Ally Bank

Ally Bank presents investment opportunities with its certificate of deposit options. It is known for offering competitive rates and a secure savings alternative. The digital platform is clean and user-friendly. The bank has earned praise for its responsive customer care and straightforward processes. This option is ideal for conservative investors seeking a low-risk way to grow savings without market volatility.

Risk Profile: Low

Expected Returns: Moderate

User Satisfaction: Good

Fees: Minimal

Liquidity: High

| Summary of Online Reviews |

|---|

| Clients share that “Ally Bank offers secure CD options” and value its competitive rates. |

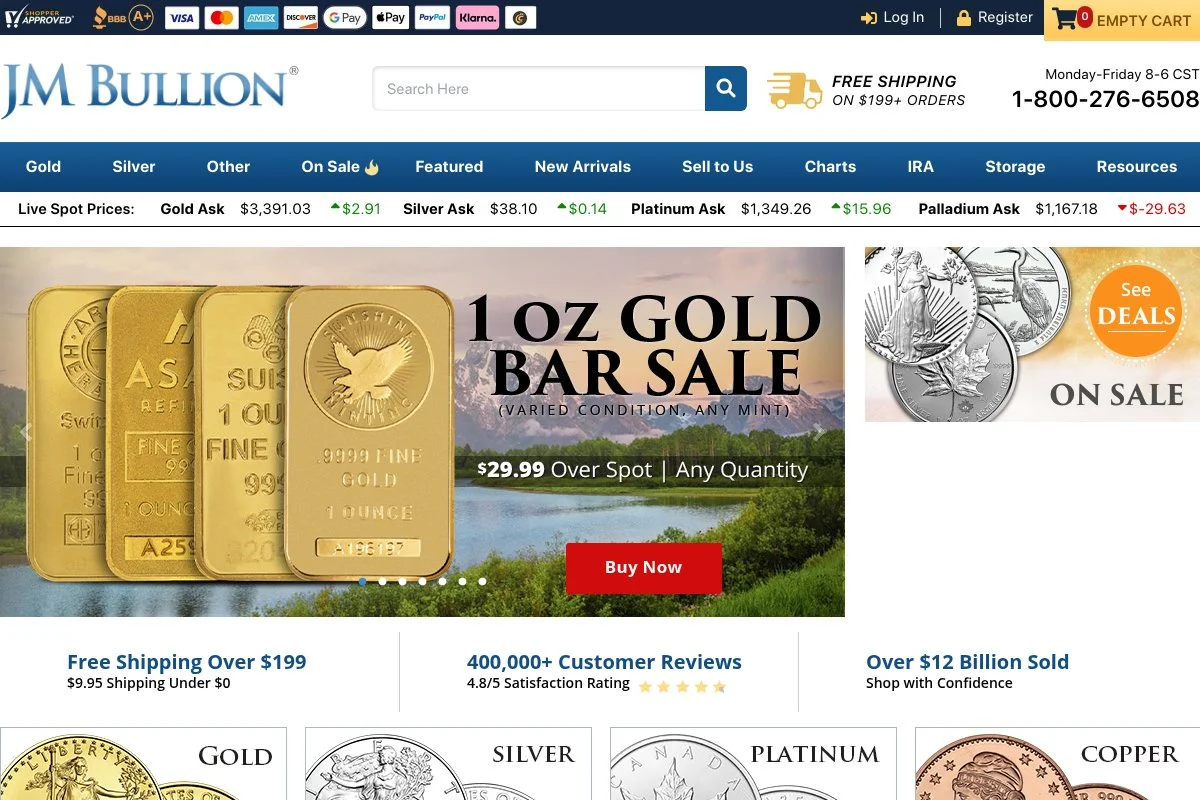

JM Bullion

JM Bullion offers an opportunity to invest in tangible assets, such as precious metals. Investors use this route to hedge against market fluctuations. The company offers an extensive catalog of gold, silver, and other metals. It caters to individuals who prefer physical assets over digital securities. The online store is straightforward, with clear pricing and detailed descriptions. Many users find comfort in owning physical assets, particularly during times of economic uncertainty.

Risk Profile: High

Expected Returns: Moderate

User Satisfaction: Fair

Fees: Medium

Liquidity: Low

| Summary of Online Reviews |

|---|

| Reviews mention “JM Bullion is trusted for metal investments” and highlight its clear product details. |

TreasuryDirect

TreasuryDirect allows investors to purchase government-issued bonds directly. It appeals to those seeking secure investments backed by the government. The website provides a straightforward process for buying and managing securities. Users appreciate the absence of management fees and the reliability that comes with government bonds. It is a favorable option for conservative investors who value safety over high return potential. The system is designed to provide all necessary details on bond maturity and interest schedules in a clear and easy-to-understand format.

Risk Profile: Low

Expected Returns: Low

User Satisfaction: High

Fees: None

Liquidity: Low

| Summary of Online Reviews |

|---|

| Investors share that “TreasuryDirect brings security above all” with mention of its no fee structure. |

T. Rowe Price

T. Rowe Price is recognized for its actively managed mutual funds. The firm has long been associated with detailed research and portfolio management. Investors who prefer professional guidance to shape their investments find T. Rowe Price appealing. The service highlights a balanced approach between risk and return, combined with diversified options. It caters to individuals looking for both stability and growth through managed investments. The platform is designed for those who value a measured path to wealth accumulation.

Risk Profile: Low

Expected Returns: High

User Satisfaction: High

Fees: Moderate

Liquidity: High

| Summary of Online Reviews |

|---|

| Investors note “T. Rowe Price delivers reliable fund performance” with appreciation for its professional management. |

LendingClub

LendingClub offers an avenue for peer-to-peer lending investments. This option suits investors looking to support personal or small business loans while earning interest. The platform hosts a diverse range of borrower profiles and provides detailed information to help assess risk. With a focus on transparency, it offers statistical reports and performance indicators. Many investors choose LendingClub to diversify their portfolios with loan assets while accepting higher risk in exchange for attractive returns. The service is built on clear guidelines and detailed loan information.

Risk Profile: High

Expected Returns: High

User Satisfaction: Fair

Fees: Moderate

Liquidity: Medium

| Summary of Online Reviews |

|---|

| Reviews include “LendingClub offers potential high returns” with investors pointing out its transparent approach. |

Final Thoughts

Investing 50,000 dollars offers many possibilities. The options range from traditional funds to modern, digital platforms. Each method carries its own risk and reward balance. The ranked list highlights choices that cater to conservative and aggressive approaches. Selecting the right option depends on personal financial goals and comfort with risk. The evaluation criteria provide insight into how each solution handles fees, liquidity, user satisfaction, and growth potential. Readers can choose based on whether they prioritize safety, simplicity, or potential high returns.