With the ability to work anywhere in the world and with the demand from consumers and businesses to receive and share products and services on a global basis, there has been a greater need for international payments companies.

These companies are providing exceptional online, offline, and mobile payment processing options, software, and equipment for international payment processing for just about anywhere in the world. This includes working in multiple languages and currencies, helping everyone from the startup and freelancer to the small and mid-sized business owner to the global conglomerate offer the widest and most secure payment options to their customers.

Here are the top international credit card payment companies in the world:

Table of Contents

Toggle1. Due

Due is a payments company that offers invoicing, payment acceptance through eCheck, PayPal, Stripe, digital wallet, and domestic and international payment processing.

2. Checkout

2Checkout is a leading international payment platform that allows companies to accept online and mobile payments from buyers worldwide with localized payment options. Capabilities include a pre-integrated payments gateway, merchant account, PCI compliance, international fraud prevention, and integration with more than 100 shopping carts.

Comparing the two: Both Due and 2Checkout offer payment processing solutions for companies of all sizes. In addition they both offer a hosted checkout and a payment processing API. 2Checkout operates across borders while Due only operates in the United States for now. For transactions in the United States, 2Checkout charges 2.9% +$0.30 per successful transaction. Due charges 2.8% flat for credit cards. In addition, Due offers invoicing, time tracking, project management, and much more completely free of charge.

3. ACH Payments

ACH Payments offers web-based ACH and credit card processing for companies, including virtual terminals and API integration.

Comparing the two: Both Due and ACH Payments offer payment processing solutions for companies of all sizes. In addition they both offer a hosted checkout and a payment processing API. ACH Payments offers POS hardware for computers, while Due does not yet have that functionality. Depending on your payment processing solutions, processing fees for ACH payments can get a bit expensive. Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

4. Adyen

Adyen allows anyone to accept payments online, in-app, and in store within a single solution almost anywhere in the world.

Comparing the two: Adyen is an in-house end to end payments platform that allows you to connect directly to over 250 different payment methods. Both Adyen and Due allow you to process payments online using various methods. Adyen provides point of sale and in-app payments which Due does not yet have. Adyen charges processing fees based on the number of transactions + commissions charged by the payment method. Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, digital wallet, and much more completely free of charge.

5. AlgoCharge

AlgoCharge is a comprehensive algorithm-based payment service provider that supplies new and established online companies with the latest payment solutions.

Comparing the two: Both Due and AlgoCharge offer merchant services like credit card processing, debit card processing, ACH transfers, and more. AlgoCharge offers a payment gateway that allows you to process payments through various partners. Due offers a direct payment processing solution. Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, digital wallet, and much more completely free of charge.

6. Aliant Payments

Alliant Payments is a credit card processing and independent merchant services provider, working in conjunction with the world’s leader in credit card and payment processing.

Comparing the two: Both Due and Aliant Payments offer payment processing solutions for companies of all sizes. In addition they both offer a payment processing API for e-commerce businesses. Depending on your payment processing solutions, processing fees for Aliant Payments can get a bit expensive. Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8%, no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, digital wallet and much more completely free of charge.

7. Allied Wallet

Allied Wallet offers customized payment solutions to businesses of any size for 164 currencies, 196 countries, and nearly every international payment method on a global basis.

Comparing the two: Both Due and Allied Wallet offer merchant services like credit card processing, debit card processing, ACH transfers, digital wallet, and more. Allied Wallet offers a payment gateway that allows you to process payments through various partners. Due offers a direct payment processing solution. Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% with no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

8. Amazon Payments

Amazon Payments offers a way to grow a business and engage with Amazon’s customers across desktop, tablet, and mobile platforms. A consumer can use their stored account and payment information on Amazon to pay directly on a merchants website.

Comparing the two: Both Due and Amazon Payments offer payment processing solutions for companies of all sizes. Amazon Payments offers much more extensions and plug-ins for your e-commerce platform than Due at the moment. However, Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

9. American Express Serve

American Express Serve is a prepaid debit card that provides for 1% cash back in stores and online. It offers free ATM withdrawals, fraud protection, and mobile access.

Comparing the two: American Express focuses more on credit card solutions for individuals and larger enterprises. Due offers a hosted checkout and payment processing API for e-commerce businesses. Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

10. Android Pay

Android Pay is a way to make payments from an Android smartphone for in-store and in-app purchases. Phones can be unlocked and placed near a contactless terminal to pay in a store or used at checkout within an app. It can also be used to track purchases and store payment information in a secure, convenient way.

Comparing the two: Android Pay is mainly targeted to everyday Android users. Like Due, Android Pay allows you to link your credit or debit card and make purchases from your device. Due provides payment services to both everyday consumers as well as businesses. With Due, you can use our payment processing API and access our hosted checkout for your e-commerce businesses. Soon, Due will offer payment processing options for POS purchases. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

11. ApplePay

Apple Pay is a safe and convenient way to pay for merchandise by using an Apple device like an Apple Watch or iPhone.

Comparing the two: Apple Pay is mainly targeted to everyday Android users. Like Due, Android Pay allows you to link your credit or debit card and make purchases from your device. Due provides payment services to both everyday consumers as well as businesses. With Due, you can use our payment processing API and access our hosted checkout for your e-commerce businesses. Soon, Due will offer payment processing options for POS purchases. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

12. Authorize.net

Authorize.net offers online and mobile merchant solutions as well as telephone and mail order merchant solutions.

Comparing the two: Both Authorize.net and Due offer similar payment capabilities. Both platforms offer credit card processing, e-checks, online payments, and recurring billing. Authorize.net offers in-store payments while Due does not yet have POS capabilities. The main difference is pricing. Authorize.net charges $49 for setup, $25/month for the payment gateway, and $2.9% + $0.30 per transaction. Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

13. Bank Associates Merchant Services

Bank Associates Merchant Services is a full-service global payment acceptance solutions provider that offers world-class electronic transaction processing services.

Comparing the two: Both Due and Bank Associates Merchant Services offer a large suite of merchant solutions such as payment processing, online payments, recurring payments, and reporting. Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

14. Bell ID

Bell ID is a recognized leader in mobile payments. The technologies created by Bell ID include a full suite of mobile payment solutions that support cloud-based services using host card emulation (HCE), EMVCo tokenization (TSP), trusted services management (TSM) for SIM-based projects and embedded secure element solutions.

Comparing the two: Bell ID focuses mostly on mobile payments, allowing users to pay for products with their mobile devices (HCE), and tokenization. Due offers payment processing options for businesses of all sizes. Due offers a hosted checkout for e-commerce businesses with credit card processing rates starting at 2.8% flat or lower. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

15. Bitcoin

Bitcoin is an alternative way to make payments and conduct transactions.

Comparing the two: Bitcoin is a crypto-currency that has truly revolutionized the online payments industry. Bitcoin is a very secure way to make and receive payments online. If you want to make and receive purchases via Bitcoin you must choose a Bitcoin Wallet to store your bitcoin, and access a Bitcoin exchange to buy and sell your Bitcoin. Due actually allows it’s users to make and receive payments using Bitcoin. Due offers a much wider variety of features, such as payment processing, invoicing, digital wallet, time tracking, project management, and much more.

16. Bitpay

Bitpay enables bitcoin payments to be deposited into a bank account and be used to pay for products and services.

Comparing the two: Bitpay essentially lets users buy and sell products using bitcoin and offers FIAT settlement into nearly all the most popular currencies. Due actually allows it’s users to make and receive payments using Bitcoin. Due offers a much wider variety of features, such as payment processing, a hosted checkout for online businesses, invoicing, digital wallet, time tracking, project management, and much more.

17. Blue Dog Business Services

Blue Dog Business Services provides small businesses with credit and debit card processing in over 200 countries, EMV and mobile wallet processing, Apple Pay processing, e-commerce processing, mobile solutions, gift card solutions, and ACH and check conversion. They also provide a range of marketing and analytics services.

Comparing the two: Both Due and Blue Dog Business Services offer very similar payment features. Both platforms offer credit card processing, an commerce payment checkout, and ACH payments. Blue Dog Business Services offers point of sale processing which Due does not yet offer. As far as pricing goes, Blue Dog Business Services claims to have competitive rates, you will need to submit a quote to inquire about these rates. Due guarantees the lowest rates in the industry starting at 2.8% flat or lower, no per transaction or monthly fees. In addition, Due offers features such as, time tracking, digital wallet, project management, and much more completely free of charge.

18. Boku

Boku is operational in over 60 markets and can process payment requests from over 4 billion phones, making it the largest independent carrier billing company in the world.

Comparing the two: Boku focuses on mobile payment processes for businesses of all sizes. Both Due and Boku offer a hosted checkout for web based merchants. Boku only provides mobile payment options while Due provides both. In addition, Due offers features such as, time tracking, digital wallet, project management, and much more completely free of charge.

19. Braintree

Braintree is a payments company that offers global commerce tools in order to accept payment across any device and through almost every payment methods. It works with 130 currencies across 40 countries.

Comparing the two: Both Braintree and Due allow businesses of all sizes to utilize their payment processing capabilities. Both platforms offer a hosted checkout experience for online businesses, Braintree allows you to choose a standard checkout flow or customize your own. At the moment, Due only offers a standard checkout flow. Both services charge a flat fee with no monthly or hidden costs. Both platforms also allow you to integrate with PayPal and Bitcoin. Braintree charges 2.9% + $0.30 per transaction while Due charges 2.8% flat or lower depending on volume. In addition, Due offers features such as, time tracking, digital wallet, project management, and much more completely free of charge.

20. Card Payments International

Card Payments International offers domestic and international credit and debit card processing as well as online solutions, credit card terminals, POS software, loyalty and gift cards, mobile payment solutions and check processing.

Comparing the two: Both Due and Card Payments International offer payments processing, online payments, eCheck processing, and ACH transfers. Card Payments International offers POS software and loyalty/gift cards which Due does not yet offer. To get an idea of pricing you need to submit a quote online. Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

21. Cayan Merchant Services

Cayan is the leading provider of payment technologies that give businesses a competitive advantage, including simple and reliable payment processing as well as fully integrated, multi-channel Customer Engagement Platform solution.

Comparing the two: Both Cayan and Due offer credit card processing solutions for businesses of all sizes. Cayan offers both e-commerce and point of sale solutions while Due only offers an e-commerce solution for now. Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

22. CCBill

CCBill is an international payments company for consumers, businesses, and developers. Services include credit card payment processing and global billing services.

Comparing the two: Both Due and CCBill offer merchant services like credit card processing, debit card processing, recurring billing, and more. CCBill offers a payment gateway that allows you to process payments through various partners. Due offers a direct payment processing solution. Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% with no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

23. Chase Paymentech

Chase Paymentech offers a complete payment and credit card processing service for businesses that includes credit card processing, NFC payments, Apple Pay, recurring payments, international payments, electronic checks, PayPay, online and mobile payments, POS systems, and credit card machines.

Comparing the two: Chase Paymentech and Due both offer credit card processing services, e-checks, paypal integration, online and mobile payments, as well as recurring payments. Chase Paymentech offers international payments and POS systems which are on Due’s roadmap but not yet available. However, Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, digital wallet, and much more completely free of charge.

24. Circle Plus Payments

Circle Plus Payments allows people to accept credit card payments and Bitcoin transactions on their Android and iOS smartphones anywhere in the world.

Comparing the two: Circle Plus Payments solely allows users to accept credit and debit card and bitcoin transactions through their smartphones in over 23 different countries. Circle Plus Payments is integrated with Stripe Connect and charges 2.9% + $0.30 per successful transaction, they do not sell merchant accounts or perform any actual transactions for you. Due offers a hosted checkout that will perform transactions for your online business, and eventually for POS systems. Due charges a flat 2.8% fee or lower depending on volume. In addition, Due offers features such as payment processing, time tracking, digital wallet, project management, invoicing, and much more.

25. Clover

Clover offers a wide range of POS solutions, payment platforms, and marketing tools like online store development and gift cards.

Comparing the two: Both Clover and Due offer online credit card processing capabilities. Clover offers various POS systems while Due does not yet have this functionality. Clover allows businesses to make their own “online stores” through various templates. Due allows you to integrate a hosted checkout to your already existing e-commerce platform to start accepting payments. In addition, Due offers features such as time tracking, digital wallet, project management, invoicing, and much more.

26. Credorax

Credorax is an international payments company that provides solutions for all types of businesses around the world.

Comparing the two: Both Due and Credorax offer global and domestic payment processing for businesses of all types. Both solutions are completely PCI compliant and offer multi-currency processing. To get an idea on pricing, you’ll need to submit a quote with Credorax. Due offers the lowest credit card processing rates in the industry at 2.8% flat. Depending on volume, Due offers rates below 2.8% with no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, and much more completely free of charge.

27. CyberSource

CyberSource provides all types of payment and merchant solutions, including recurring billing, direct debit payments, digital wallet and digital payment services, cross-channel payments, the ability to connect with 100 processors around the world and accept cards from over 190 countries, and payer authentication.

Comparing the two: Both CyberSource and Due allow you to access features such as payment processing, digital wallets, and recurring billing. CyberSource does so through a giant network of processing partners and Gateways. With Due, you can process payments directly and utilize the digital wallet on the platform. Due’s processing fees start at 2.8% or lower depending on volume. Due’s other features such as invoicing, time tracking, reporting, project management, and the digital wallet are all available completely free of charge.

28. Digital River World Payments

Digital River offers commerce and merchant services for over 200 payment types and 175 currencies. Services include recurring payments, payments page hosting, multi-channel payments, and global payment processing.

Comparing the two: Both Digital River and Due offer payment processing, recurring payments, a hosted payments page for e-commerce, and much more. Digital River offers industry specific solutions, while Due has a general solution. Due’s processing fees start at 2.8% or lower depending on volume. Due’s other features such as invoicing, time tracking, reporting, project management, and the digital wallet are all available completely free of charge.

29. eCorePay

eCorePay provides payment options for all industries, including offshore, onshore, and international merchant accounts as well as recurring payments, payment gateway, ACH/e-check processing and MOTO services.

Comparing the two: Both eCorePay and Due offer credit card processing, recurring payments, ACH/eCheck processing, and much more. eCorePay offers processing through a payment gateway with rates starting at 3.2%. Due offers a direct processing solution with rates starting at 2.8% or lower depending on volume with no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, digital wallet, and much more completely free of charge.

30. eMerchant Pay

eMerchant Pay is a UK-based payment service provider that provides international online, mobile, and POS payment processing services to merchants on an international basis.

Comparing the two: eMerchant Pay and Due both offer online payment processing for businesses of all sizes all over the world. eMerchant Pay offers industry specific solutions as well as POS systems. Due only offer an online solution at the moment and has one general solution for all industries. To get an idea on pricing you must submit a free quote with eMerchant Pay. Due offers a direct processing solution with rates starting at 2.8% or lower depending on volume with no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, digital wallet, and much more completely free of charge.

31. EPX

EPX is an international payments company that offers credit card, debit card, and eCheck (ACH) processing, e-commerce payment processing, virtual terminal, mobile payments and comprehensive reporting to help merchants and retailers all over the world.

Comparing the two: Both Due and EPX offer credit card, debit card, and ACH processing services to businesses of all sizes. EPX offers POS systems while Due only offers e-commerce solutions at the moment. EPX allow users to create a pay-page for their online business while Due allows users to integrate a hosted checkout to their already existing platform. Due offers additional features such as payment processing, time tracking, digital wallet, project management, invoicing, and much more.

eSafe Payments is a secure merchant services company for U.S. and international payment processing. They offer credit card processing, e-wallet, ACH and check processing, multi-currency processing and chargeback management for all industries.

Comparing the two: Both Due and eSafe Payments offer credit card processing, digital wallet, ACH/eCheck processing, multi currency processing, and much more. To get an idea on pricing you can apply for a merchant account for free online. Due offers a direct processing solution with rates starting at 2.8% or lower depending on volume with no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, reporting, and much more completely free of charge.

Consumers can use their debit cards to send money to people through their Facebook Messenger app and not have to worry about transferring the funds to receive or send because it comes directly from a bank account.

Comparing the two: Facebook Messenger allow users to link their cards to their Facebook account and send and receive payments. The transactions are always bank to bank. Due also allows users to send and receive payments via a linked debit and credit card or bank account. Due offers additional features such as payment processing, time tracking, digital wallet, project management, invoicing, and much more.

First Atlantic Commerce is a leading international online payments and fraud and data management solutions provider. Headquartered in Bermuda, the company provides multi-currency, payment processing and risk management solutions for Internet merchants and acquiring banks around the world.

Comparing the two: Both Due and First Atlantic Commerce offer online payment processing solutions for businesses all around the world. First Atlantic Commerce offers industry specific solutions such as payment gateway’s for banks. Due offers a direct processing solution with rates starting at 2.8% or lower depending on volume with no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, digital wallet, and much more completely free of charge.

First Data offers credit and debit card processing as well as other merchant services for small businesses and mid-sized companies so that they can do business in the U.S. and around the world.

Comparing the two: Both First Data and Due offer payment processing solutions for businesses. First Data covers a much larger range of industry specific solutions. These industries include: global and national financial institutions, community financial institutions, and government institutions. They offer both POS and online processing while Due only offers an e-commerce solution. However Due is a much better option for small businesses. Due offers features such as payment processing, time tracking, digital wallet, project management, invoicing, and much more completely free of charge. Processing fees start as low as 2.8% or lower depending on volume. While First Data covers a larger range of industries, Due is a much more simplified solution for your business.

FIS Global is a financial solutions company that offers a payments platform for digital payments, enterprise payments, corporate payments, and credit and debit card processing. Other merchant solutions include payment gateways, apps, and equipment.

Comparing the two: Both FIS Global and Due offer payment processing solutions to businesses of all kinds. FIS Global also offers banking, wealth, and management consulting services to better exceed customer expectations. FIS Global focuses more on larger enterprises covering a huge range of industry specific solutions. On the payments side, they cover a similar range of solutions as Due. Due offers additional features such as payment processing, time tracking, digital wallet, project management, invoicing, and much more.

Founded in 2007, Fortumo is a leading global provider of direct carrier billing. Fortumo payments cover 94 markets and connect merchants to subscribers of more than 350 mobile operator networks.

Comparing the two: Both Fortumo and Due offer payment processing options for a multitude of businesses. Both offer an optimized checkout experience, detailed reporting and analytics, as well as a recurring payments engine. Due offers additional features such as time tracking, digital wallet, project management, invoicing, and much more.

Gate2Shop is a UK payments company that works with thousands of digital goods and service merchants. They provide over 80 international payment methods for worldwide payments.

Comparing the two: Gate2Shop and Due both offer payment processing for businesses of all sizes all around the world. Gate2Shop charges 2.9% +0.30 EU per transaction. Due offers a direct processing solution with rates starting at 2.8% or lower depending on volume with no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, digital wallet, and much more completely free of charge.

Global Payments is a leading worldwide provider of payment technology services that delivers innovative solutions on a global basis.

Comparing the two: Both Global Payments and Due offer online payment processing and other merchant tools for businesses worldwide. Global Payments offers POS systems and industry specific solutions while Due does not yet have this functionality. Call or submit a form online to get an idea on pricing with Global Payments. Due offers a direct processing solution with rates starting at 2.8% or lower depending on volume with no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, digital wallet, and much more completely free of charge.

Go Cardless is a UK company that operates a global payments network that helps small businesses and enterprises collect direct debit payments, offering transparent pricing.

Comparing the two: Both Go Cardless and Due offer payment processing solutions for businesses of all sizes all over the world. Go Cardless offers industry specific solutions while Due has a general solution. Due offers a direct processing solution with rates starting at 2.8% or lower depending on volume with no hidden or monthly fees. In addition, Due offers features such as invoicing, time tracking, project management, digital wallet, and much more completely free of charge.

Go Emerchant is a payments processing company that offers EMV processing, mobile payments, iPad POS, a payment gateway, recurring billing, shopping cart capability and a QuickBooks plugin.

Comparing the two: Both Go Emerchant and Due offer payment processing capabilities such as online payments, mobile payments, recurring billing, and a shopping cart-plugin. Go Emerchant offers POS systems and EMV/Credit Card machines while Due does not yet have POS functionality in place. Due offers credit card processing at a flat 2.8% fee or lower depending on volume with no monthly or hidden costs. Due offers additional features such as time tracking, digital wallet, project management, invoicing, and much more.

Send money to anyone in the US using an email address or phone number. It’s fast, easy, and free to send directly from a debit card, bank account, or Wallet Balance.

Comparing the two: Google Wallet and Due both allow users to send money for free across the platform either from a linked card, bank balance, or digital wallet balance. Due offers additional features such as payment processing, time tracking, hosted checkout for online businesses, project management, invoicing, and much more. Due offers credit card processing at a flat 2.8% fee or lower depending on volume with no monthly or hidden costs.

Green Dot offers reloadable pre-paid debit cards that provide an effective way to make payments and to get paid by those who use them.

Comparing the two: Both Green Dot and Due allow users to add, send, receive, and manage money across their respective platforms. Green Dot allows users to do so with a pre-paid debit card or Green Dot Card, Due has a digital wallet which allows users to send money on the platform using money in their Due accounts. You can also send money bank to bank using Due. In addition, Due offers features such as payment processing, invoicing, time tracking, project management, and much more completely free of charge.

HiFX offers international money transfers that are quick, easy, and secure to over 127 countries.

Comparing the two: Both HiFX and Due offer online money transfers and online invoicing to businesses of all sizes worldwide. Due offer’s payment processing with the lowest rates in the industry starting at 2.8% flat or lower depending on volume with no hidden or monthly costs. In addition, Due offers features such as a digital wallet, invoicing, time tracking, project management, and much more completely free of charge.

IBS Payment Solution offers international solutions for merchants, including credit card processing, ACH and check processing, high risk merchant accounts, mobile payment processing, payment gateways, POS terminals, internet and ecommerce accounts, and shopping cart integration.

Comparing the two: Both Due and IBS Payment Solution offer credit card processing, ACH/eCheck processing, internet and commerce accounts, and shopping cart integration. IBS Payment Solution offers POS systems and in-store payment processing which Due does not yet offer. To get an idea on pricing, you can submit a quote online with IBS. Due offers credit card processing at a flat 2.8% fee or lower depending on volume with no monthly or hidden costs. Due offers additional features such as time tracking, digital wallet, project management, invoicing, and much more.

Ingenico ePayments is an international payments company that provides advanced data analytics, fraud management solutions, and cross-border commerce expertise in addition to its payment processing capabilities.

Comparing the two: Both Ingenico ePayments and Due offer payment processing, online payments, and data/analytics to businesses of all sizes worldwide. Ingenico ePayments offers POS systems and in-store payment processing which Due does not yet offer. To get an idea on pricing, you can submit a quote online with Ingenico. Due offers credit card processing at a flat 2.8% fee or lower depending on volume with no monthly or hidden costs. Due offers additional features such as time tracking, digital wallet, project management, invoicing, and much more.

International Bancard provides domestic and international payment solutions for companies in over 60 industries. These services include credit card processing, EMV, check acceptance, loyalty and gift cards, and marketing and shopper analytics. They also offer payment software solutions.

Comparing the two: Both Due and International Bancard provide domestic and international payment solutions such as payment processing, eCheck/ACH processing, and reporting/analytics. International Bancard offers POS systems, SMB funding solutions, and gift/loyalty cards which Due does not yet have available. To get an idea on pricing you need to inquire further online. Due offers credit card processing at a flat 2.8% fee or lower depending on volume with no monthly or hidden costs. Due offers additional features such as time tracking, digital wallet, project management, invoicing, and much more.

Intuit Payments works with Quickbooks Online to accept payments from customers, including through mobile and desktop versions. Features include a free card reader, automatic updates with Quickbooks when payments are received, and the ability to accept credit cards like Visa, Mastercard, Discover, and American Express.

Comparing the two: Intuit Payments offers payment processing through Quickbooks payments. Through this you can accept payments on any device. If you want to pay as you go, the prices are 2.4% + $0.25 per transaction for swiped cards, 3.4% + $0.25 for keyed cards, and $0.50 per ACH transfer. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, project management, and much more.

iPayDNA is headquartered in the UK and is considered to be one of the trusted high risk merchant account providers for worldwide merchants.

Comparing the two: Both iPayDNA and Due allow users to use accept payments online using invoices, e-commerce plugins and API, and eChecks. iPayDNA uses a payment gateway, in order to get an idea on pricing you need to submit a quote online. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, project management, and much more.

iZettle makes game-changing payment tools that empower small businesses, including its intuitive point-of-sale app and card reader. There are no startup costs, no contracts, and no monthly fees.

Comparing the two: Both iZettle and Due offer payment processing capabilities to companies of all sizes. iZettle only offers a POS solution while Due only offers an online solution at the moment. Both services charge a flat transaction fee with no startup costs or monthly fees. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, project management, and much more.

Klarna is a Scandinavian company that provides payment solutions for e-stores all over the world.

Comparing the two: Both Klarna and Due offer an online payment processing solution for e-commerce businesses worldwide. To get an idea on pricing you need to inquire online. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, project management, and much more.

Magic Pay is a merchant services company specializing in online and mobile payments, including 120 international currencies. The company also processes ACH and provides POS equipment.

Comparing the two: Both Due and Magic Pay offer online payment processing, ACH processing, and online invoicing to companies of all sizes worldwide. Magic Pay offers POS systems which Due does not yet have in place. For online payment processing Magic Pay’s pricing starts at $15/month + 2.20% + $0.30 per transaction. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, project management, and much more.

Mastercard is a technology company in the global payments industry that operates the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories.

Comparing the two: Mastercard provides the infrastructure for companies of all sizes to utilize several payment processing technologies to improve their business. Both Due and Mastercard offer payment processing capabilities. You can see what Mastercard charges for interchange fees online. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

Merchant e-Solutions offers international credit card processing online, in-person, and mobile for all types of industries, including retail and hospitality.

Comparing the two: Merchant e-Solutions and Due both offer online payment processing for businesses of all types. Merchant e-Solutions offers brick and mortar payment processing and offers industry specific solutions. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

Moneris Solutions offers a wide range of payment platforms and technology, including countertop and wireless terminals, mobile and tablet versions, online payments, in-app payments, and self-serve and kiosk. They also provide currency conversion as well as gift and loyalty programs.

Comparing the two: Moneris and Due both offer online payment processing for businesses of all types. Moneris offers industry specific solutions as well as POS systems which Due does not yet have in place. Due offers other features such as, time tracking, digital wallet, invoicing, project management, and much more. To get an idea of pricing you have to submit a quote online with Moneris. Due charges a flat 2.8% or lower for payment processing depending on volume with no hidden or monthly fees.

M-Pesa is a way for those in other countries to send and receive money through their Vodaphone smartphones.

Comparing the two: M-Pesa and Due both allow users to send and receive money on their respective platforms. Due allows users to use their digital wallet to send money to other users on Due. M-Pesa is limited to sending money to other Vodaphone smartphone users. Due offers other features such as payment processing, time tracking, digital wallet, invoicing, project management, and much more.

Net Spend is a leading provider of reloadable prepaid cards and prepaid corporate cards.

Comparing the two: Net Spend provides reloadable prepaid cards to their users that allow for quicker payment, efficient money management, and seamless budgeting. Due offers other features such as payment processing, time tracking, digital wallet, invoicing, project management, and much more.

Nochex is a global payments company that provides a way for businesses to accept all major debit and credit cards most places in the world. Other services include recurring payments, online payments, multi-seller payments, and telephone payments.

Comparing the two: Both Due and NoChex offer payment processing, recurring payments, and online payments to businesses of all sizes worldwide. To get an idea on pricing you can apply for free online. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

PacNet Services offers local-currency payment solutions to Internet and direct response marketers all around the world.

Comparing the two: Both PacNet Services and Due offer merchant services like credit card processing, check processing, a hosted e-commerce payment page, and much more. To get an idea on pricing you can apply for free online. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

PayAnywhere helps a company accept credit cards with their iPhone, iPad and Android with PayAnywhere Mobile or by using PayAnywhere Storefront.

Comparing the two: PayAnywhere only offers mobile reader and storefront payment processing solutions while Due only offers online payment processing options at the moment. Due charges a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

PayFast offers secure online payment processing for South Africa, helping individuals, businesses, and charities to accept payments online.

Comparing the two: Both PayFast and Due offer online payment processing, recurring billing, and much more. PayFast only operates for South African businesses and online stores. They charge 3.9% + R2.00 for credit card processing. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

PayLane is an online payments provider that lets companies accept payments online in multiple currencies.

Comparing the two: Both Due and PayLane offer payment processing, digital wallet, online invoicing, and a hosted payment page to businesses of all kinds worldwide. PayLane charges 2.85% + $0.25 per transaction. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

Payment Vision is an international payments company that provides ACH, online bill pay, check by phone, card payments, virtual terminal, mobile pay, API bill pay and IVR bill pay.

Comparing the two: Both Due and Payment Vision offer online payments, credit/debit card processing, ACH payments, and much more for businesses of all sizes worldwide. To get an idea on pricing you can submit a quote for free online. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

PayPal offers a convenient and safe way to pay vendors, friends, and family through linking to a bank account or debit or credit card.

Comparing the two: Both allow users to send, receive, and process payments online. In addition, they both offer invoicing and digital wallet functionality. PayPal offers mobile card readers and POS systems which Due does not yet have in place. PayPal charges 2.9% + $0.30 per transaction with no hidden or monthly fees for processing. Due charges 2.8% or lower for credit card processing depending on volume with no hidden or monthly fees. ACH transfers and all other features on Due are completely free. These features include: time tracking, reporting, recurring billing, project management, and much more.

This company is a UK’s leading payments and cash services network, offering a way to pay bills, transfer money, top up your mobile account, pay for parking, or pick up online shopping.

Comparing the two: PayPoint is mainly focused on offering payment options for various use cases/industries. For example, you can use PayPoint to pay for pre-paid energy bills, transport, parking, eLottery, and much more. Due is an online payments platform that can handle payment processing, time tracking, project management, digital wallet, invoicing, and much more for businesses of all sizes. Due charges 2.8% flat or lower depending on volume with no hidden or monthly costs. All other features on Due are completely free.

Paytm is an international payment tool to use for shopping, mobile recharge, bill payments, movie ticketing experience and more.

Comparing the two: Paytm is a payment tool that allows you to load money onto your Paytm account and make payments for various uses such as movies, events, hotels, flights, financial services, and much more. Due is an online payments platform that can handle payment processing, time tracking, project management, digital wallet, invoicing, and much more for businesses of all sizes. Due charges 2.8% flat or lower depending on volume with no hidden or monthly costs. All other features on Due are completely free.

PayUBiz is India’s top payment gateway provider. They have won many awards for their simple, cost-effective payment solutions that help Indian companies with a way to accept payments from more people.

Comparing the two: Both PayUBiz and Due offer payment processing for companies of all sizes. PayUBiz focuses on companies located in India but they can handle transactions from international cardholders as well. Due offers worldwide payment processing services. For credit cards PayUBiz charges 2.95% + a one time integration fee. Due charges 2.8% or lower for credit card processing depending on volume with no hidden or monthly fees. ACH transfers and all other features on Due are completely free. These features include: time tracking, reporting, recurring billing, project management, and much more.

Planet Payment delivers innovative payment processing, including gateway processing and multi-currency solutions to numerous countries all over the world as well as credit card processing and merchant solutions.

Comparing the two: Both offer payment processing capabilities to a multitude of businesses types. Planet Payment offers a gateway solution that is catered to specific industries and currencies. Due offers a direct processing solution that can fit the needs of businesses of all sizes.

ProPay is a processing company that provides a way to accept credit cards anywhere at anytime, including a card reader, app, or desktop application. It offers flexible merchant services and provides a ay to make payments globally, working with multiple currencies. It also can be used with QuickBooks.

Comparing the two: Both offer online payment processing solutions for businesses of all sizes. ProPay offers more industry specific solutions with a much larger suite of features and integrations than Due. However, Due offers a very simple set of features that encompass all the needs of a business for free. Due charges a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

Razorpay is a modern payment gateway for India with simple pricing and easy integration.

Comparing the two: Both Due and Razorpay offer payment processing, a hosted checkout, and reporting/analytics for businesses of all kinds. Due charges 2.8% or lower for credit card processing depending on volume with no hidden or monthly fees. ACH transfers and all other features on Due are completely free. These features include: time tracking, digital wallet, recurring billing, project management, and much more.

Rev Worldwide has created a global payments network with innovative payment solutions that adapt to local currencies and languages. They also offer mobile payment solutions for a wide range of industries.

Comparing the two: Rev Worldwide focuses more on international payment capabilities as well as mobile payment options. Due offers a very simple set of features that encompass all the needs of a business for free. Due charges a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: payment processing, online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

Rush Card is a prepaid Visa labeled debit card that also offers direct deposit features.

Comparing the two: Rush Card allows you to load money onto a pre-paid Visa labeled debit card where you can make purchases on-line or in-store. Due is an online payments platform that can handle payment processing, time tracking, project management, digital wallet, invoicing, and much more for businesses of all sizes. Due charges 2.8% flat or lower depending on volume with no hidden or monthly costs. All other features on Due are completely free.

Sage is a UK-based international payments company that offers merchant accounts and a wide range of payment acceptance options, including invoice, phone, online, and face-to-face. It also integrates with Sage accounting software.

Comparing the two: Both provide a large suite of accounting and payment features for businesses of all sizes. To get an idea on pricing go to their website to see a visual breakdown of fees based on payment plans. Due charges a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: payment processing, online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

Samsung Pay turns a Galaxy device into a wallet, holding debit and credit cards, loyalty cards, membership cards, and gift cards to use at checkout in the most locations in the world. Businesses can attract more customers by offering this payment option.

Comparing the two: Samsung Pay allows you to link several cards to your smartphone and make payments from any card via your device. Here at due, we offer similar functionality by providing users with a digital wallet in which they can make payments with. Due only allows users to make payments online at the moment, with in-store capabilities on the roadmap. Due offers additional features such as payment processing, time tracking, reporting, invoicing, project management, and much more.

Seamless is a global mobile payments company that provides prepaid top-up systems and mobile payment services for mobile operators, distributors, retailers and consumers. The company has the proprietary transaction switch ERS 360˚ for top-ups to mobile operators and distributors, and SEQR for mobile payments in stores, on-line and in-app.

Comparing the two: Seamless essentially allows its users to turn their smartphone’s into a mobile wallet which they can top-up and pay for a huge suite of products both on-line and in store. Due is an online payments platform that can handle payment processing, time tracking, project management, digital wallet, invoicing, and much more for businesses of all sizes. Due charges 2.8% flat or lower depending on volume with no hidden or monthly costs. All other features on Due are completely free.

Secure Trading offers payment equipment and services, including recurring payments, alternative payments, and multi-currency payments.

Comparing the two: Both Due and Secure Trading offer international payment processing, recurring payments, and a hosted checkout for e-commerce. Depending on which features you want to utilize the fees for using Secure Trading may differ, inquire online for free to get an idea on pricing. Due charges a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

ShopSite is an international e-commerce development company that offers a way to start an online business, build and manage an online store, and provide ways to manage inventory, merchandising, marketing, and payments. They offer a wide range of payment methods that provide online retailers with a way to attract more customers.

Comparing the two: ShopSite allows users to create their own e-commerce page where they can integrate with various payment methods to accept payments for their online business. Due allows users to use a hosted checkout on their already existing e-commerce website that allows them to accept payments online. ShopSite charges monthly fees based on how many features you want to access + whatever fees the respective payment method charge. Due charges a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: payment processing, online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

SimbaPay is the best solution for sending money to family and friends in Africa with numerous secure payment methods that can be selected.

Comparing the two: Simba Pay allows you to send money to friends and family in African from a variety of different payment methods. You can either send money bank to bank or via an eWallet. Due also allows you to send money anywhere in the world using a digital wallet. Here at due, we offer additional features such as payment processing, time tracking, reporting, invoicing, project management, and much more.

Skrill is a London-based digital payments company that is developing global payment solutions for businesses and consumers, including making it easier to send money to family and friends using just an email address and password.

Comparing the two: Both Skrill and Due allow you to link a credit card, debit card, and bank account to the platform and send money only using an email address. Both Skrill and Due also have a digital wallet which allows you to hold money on your account and make instant payments with your account balance. Here at due, we offer additional features such as payment processing, time tracking, reporting, invoicing, project management, and much more.

Snapcash, created in partnership with Square, is a fast way for Snapchatters to exchange money within the Chat feature. Once Snapchat users have linked their debit card in the app, they can send Snapcash to anyone in their contact list who is eligible to receive Snapcash.

Comparing the two: Both Snapcash and Due allow users to send money to other users on the platform. In order to send money on Due, all you need is the end-user’s email address. Snapcash only allows you to send money to other users on the app, and only if they have opted to accept Snapcash. Due offers additional features such as payment processing, time tracking, reporting, digital wallet, invoicing, project management, and much more.

Now a part of Capital One, Spark is a platform that helps people build online stores, including accept payments online, as well as assists merchants with in-store payments with a mobile app and card reader, giving customers multiple ways to pay.

Comparing the two: Both offer online payment processing solutions for businesses of all sizes. Spark offers POS systems, tax planning, and business IQ which Due does not yet have in place. Due offers a very simple set of features that encompass all the needs of a business for free. Due charges a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

Square creates tools that help sellers of all sizes start, run, and grow their businesses. Square’s point-of-sale service offers tools for every part of running a business, from accepting credit cards and tracking inventory, to real-time analytics and invoicing. It also offers Square Cash for payments.

Comparing the two: Both allow process payments online and access company analytics through a back-end dashboard. Square offers mobile card readers and POS systems which Due does not yet have in place. Square’s pricing depends on how you accept the cards (keyed, swiped, tapped, etc..), reference the website for more information. Due charges 2.8% or lower for credit card processing depending on volume with no hidden or monthly fees. ACH transfers and all other features on Due are completely free. These features include: time tracking, reporting, recurring billing, project management, and much more.

Starting Business is a UK company that offers specialized payment processing solutions for offline and online businesses, enabling companies to accept payments in a convenient and safe manner. This includes credit and debit card processing, mobile pay, e-checks, merchant accounts and co-branded cards.

Comparing the two: Both Starting Business and Due offer credit card, debit card, ACH, and eCheck processing to online businesses. Starting Business offers in-store payment processing which Due does not yet have available. Starting Business also provides packages that allow you to essentially “start” your business including templates for legal paperwork, bank accounts, etc…Due is an online payments platform that can handle payment processing, time tracking, project management, digital wallet, invoicing, and much more for businesses of all sizes. Due charges 2.8% flat or lower depending on volume with no hidden or monthly costs. All other features on Due are completely free.

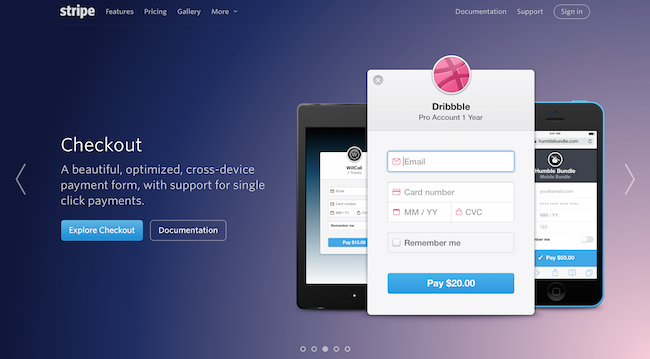

Stripe is the world’s largest developer-oriented commerce company, helping small and large companies accept web and mobile payments.

Comparing the two: Both offer online payment and payment processing capabilities for businesses of all sizes. Stripe is more oriented to the developer audience and provides a multitude of API’s for a suite of payment use-cases. Stripe charges 2.9% + $0.30 per transaction for payment processing. Due charges 2.8% or lower for credit card processing depending on volume with no hidden or monthly fees. ACH transfers and all other features on Due are completely free. These features include: time tracking, reporting, recurring billing, project management, and much more.

The Transaction Group offers U.S. and international merchant accounts and card processing services.

Comparing the two: Both Due and The Transaction Group offer international online credit card processing for businesses of all sizes. The Transaction Group offers POS and EMV terminals for in-store processing as well, Due does not yet have this functionality. To get an idea on pricing apply online now. Due charges a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

Tipalti is an automated global mass payment system redefines how online ad networks, affiliate networks, crowdsourcing and online market-places pay their partners.

Comparing the two: Both offer payment functionality to businesses of all sizes. Tipalti is focused more on larger companies and offers industry specific solutions. They specialize in offering custom solutions to redefine the account payables process for businesses. Due offers a very simple set of features that encompass all the needs of a business for free. Due charges a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

Total Merchant Services helps a business accept all payment types anywhere, including Apple Pay, Google Wallet, NFC, gift and chip cards, debit and credit cards and Android Pay. It offers terminal and card readers, POS, online payment solutions, financing, and marketing, including loyalty cards. It also helps businesses become EMV compliant.

Comparing the two: Both offer an e-commerce solution for payment processing. Total Merchant Services offers POS systems and in-store payment acceptance which Due does not yet offer. Here at due, we offer additional features such as payment processing, time tracking, reporting, invoicing, project management, and much more.

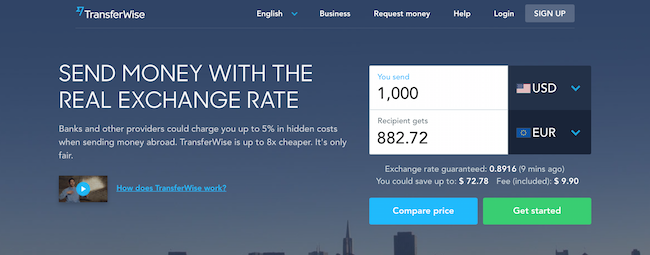

Transferwise lets people send money between countries with lower fees and transparent pricing, including one-day turnaround on payments.

Comparing the two: Transferwise uses a unique method to allow users to send money across borders and or exchange currencies. For example, If User A in the United States wants to send money to User B in Italy, the transaction will go like this: User A will add their money to a US Dollar pool, a small fee will be taken and the money will be deposited in User B’s account as Euros that are taken out of the Euro pool. Due is an online payments platform that can handle payment processing, time tracking, project management, digital wallet, invoicing, and much more for businesses of all sizes. Due charges 2.8% flat or lower depending on volume with no hidden or monthly costs. All other features on Due are completely free.

TSYS Merchant Solutions provides seamless, secure, and innovative solutions across the payments spectrum, including issuer processing, merchant acquiring, and prepaid program management.

Comparing the two: Both TSYS and Due offer merchant solutions for businesses of all sizes. To get an idea of pricing, you need to submit a quote online with TSYS. TSYS offers POS systems while Due is only online at the moment. Due offers a very simple set of features that encompass all the needs of a business for free. Due charges a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

USBank offers domestic and international payments processing for debit and credit cards, ACH/e-check, and mobile payments, including working in a wide range of currencies.

Comparing the two: Both Due and USBank offer domestic and international payment processing, ACH/eCheck processing, and many more merchant solutions. USBank offers mortgage and financing options for small businesses as well. Due offers a very simple set of features to users free of charge. These features include: online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

Vantiv is a payments company that offers in-store and online payment options to help many types of businesses and organizations offer options for their customers. They feature terminals, POS systems, and the ability to accept debit and credit card payments, mobile payments, gift cards, prepaid cards, and ACH and eCheck. They handle domestic and international payment processing.

Comparing the two: Both Due and Vantiv offer online payments, ACH/eCheck acceptance, and payment processing. Vantiv offers POS systems, gift cards, and prepaid cards which Due does not yet have in place. Due offers a very simple set of features that encompass all the needs of a business for free. Due charges a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

Venmo is a digital wallet that lets people make and share payments with their friends.

Comparing the two: Both Venmo and Due allow you to link a credit card, debit card, and bank account to the platform and send money only using an email address. Both Venmo and Due also have a digital wallet which allows you to hold money on your account and make instant payments with your account balance. Here at Due, additional features such as payment processing, time tracking, reporting, invoicing, project management, and much more.

Visa is a global payments technology company working to enable consumers, businesses, banks and governments to use digital currency.

Comparing the two: Both Due and Visa offer payment processing capabilities. You can see what Visa charges for interchange fees online. Visa provides the infrastructure for companies of all sizes to utilize several payment processing technologies to improve their business. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

Volusion is a complete e-commerce solution, including online store development, shopping cart, inventory and payment processing.

Comparing the two: Both Volusion and Due offer an e-commerce payment processing solution for businesses of all sizes. Volusion allows users to create an online store and utilize a suite of payment functions like payment processing, marketing, secure hosting, and 900+ more features. Volusion pricing starts at $15/month for the starter pack + any transaction fees associated with the payment method. Due is an online payments platform that can handle payment processing, time tracking, project management, digital wallet, invoicing, and much more for businesses of all sizes. Due charges 2.8% flat or lower depending on volume with no hidden or monthly costs. All other features on Due are completely free.

Web-Merchant is a UK company that offers credit card processing and online payment solutions for accepting cards online or face to face.

Comparing the two: Both Web-Merchant and Due offer payment processing, reporting, invoicing, recurring billing, and much more to businesses of al sizes. Web-Merchant offers POS and in-store processing which Due does not yet have in place. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

WePay is a payments solution for group payments as well as a powerful payment option for crowdfunding sites, marketplaces, and business tools.

Comparing the two: Both Due and WePay provide payment options and business tools to businesses of all sizes. WePay provides industry specific solutions, mainly marketplaces and crowdfunding platforms. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

Western Union offers stores and an online portal to make payments, receive money, and pay bills. It also offers prepaid cards and money orders.

Comparing the two: Both Due and Western Union allow users to send and receive payments with the click of a button. Due offers a very simple set of features that encompass all the needs of a business for free. Due charges a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

Wirecard is a software and IT specialist for outsourcing and white label solutions for payment processing and issuing products.

Comparing the two: Both Wirecard and Due offer payment processing, reporting, a hosted checkout page, recurring billing, and much more to businesses of al sizes. Wirecard offers POS and in-store processing which Due does not yet have in place. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

WooCommerce is one of the world’s most popular e-commerce platforms that integrates a wide range of payment options.

Comparing the two: Both Due and WooCommerce offer e-commerce payment processing options for businesses of all sizes. Due offers a very simple set of features that encompass all the needs of a business for free. Due charges a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.

This company is an international payments gateway that offers eCommerce, virtual terminal/back-office processing and mobile payments with EMV authentication.

Comparing the two: Both WorldNet and Due offer online payment processing, reporting, recurring billing, multi-currency transactions, and much more to companies of all sizes. WorldNet offers POS and in-store processing which Due does not yet have in place. Due offers a flat 2.8% fee or lower on payment processing depending on volume and ACH transfers are completely free. Due offers additional features such as, time tracking, digital wallet, invoicing, project management, and much more.

This company is a global payments processing platform that works for small to medium sized businesses, digital businesses, and enterprise businesses, enabling businesses to accept all types of payments, including mobile payments.

Comparing the two:WorldPay and Due both enable businesses of all sizes to utilize a suite of payment features. WorldPay focuses mostly on international markets and currencies while Due is currently focused on payments in the United States. Due offers a very simple set of features that encompass all the needs of a business for free. We charge a flat 2.8% or lower for payment processing with no hidden monthly fees. ACH transfers and all other features are offered for free. These features include: online payments, reporting, time tracking, digital wallet, invoicing, project management, and much more.