Some customers still like to use traditional checks, but to save time and money new technology has allowed those paper checks to be converted into a digital version known as an echeck that is then processed through the Automated Clearing House (ACH) network. This is a fast, secure, and efficient way to offer an additional payment option to customers while saving on transaction fees that are higher when accepting debit and credit cards.

That’s why more companies all over the world are offering echecks as an option, including numerous merchants and small business owners that recognize the benefits of offering this extra payment method.

If you are looking for assistance in getting your echeck payment method set up and managed, consider any of these top 101 echeck companies:

Due is an online invoicing and payments company that offers a wide range of payment options, including echecks as well as a digital wallet feature and credit card processing. Its echeck option includes domestic and global options.

ACH Direct provides for single and recurring e-check, ACH, and credit card processing payments. It provides a way for businesses to accept e-checks via online, telephone, or point of sale includes unique reporting tools. Other features offered include identity verification, check verification, payment gateway, and NSF check recovery.

ACH Payments delivers single and recurring e-check management, debit and credit transactions, robust reporting, automated NSF handling, conversion handling, secure data handling and tokenization capability for integration clients, and a single point of origination for using its systems to transmit credit card payments and use risk mitigation tools. Other features include a payment gateway, check verification, credit card processing, mobile and online payments, identity verification, and Canada EFT processing.

ACHQ provides ACH, Check 21, check conversion, check by phone, Internet check, risk management and recurring billing payment processing services for businesses of all sizes. They offer easy set-up and a range of pricing to suit various needs. They also partner with a wide range of companies to deliver additional value-based services.

Advanced Merchant Group helps companies handle everything from accepting out-of-state checks to taking large check amounts. The company has a comprehensive electronic check conversion and check processing service. It also provides services for mobile payments, e-commerce, gift and loyalty programs and Point of Sale (POS) equipment.

Adyen offers a way to get paid within a single solution whether it is online, in-store, or in-app. They include over 250 payment methods, including echecks, and they conduct transactions in over 150 currencies.

Aliant Payments provides echeck and ACH processing along with a host of merchant services like debit card and credit card processing, recurring billing, check guarantee, online payments and ecommerce processing. They also offer high risk processing for those companies that require this service.

Allied Wallet is an innovative, affordable payment processing solution that helps ecommerce companies around the world offer more payment options to their customers. They feature ACH/echeck solutions, multiple currency acceptance, global payment processing, ewallet and more.

AllTrust Networks integrates a range of business processes to support a variety of identity management, check cashing, Check 21 electronic deposits, third party check review or check guarantee needs. They also provide a an extensive library of APIs that help a company to build custom solutions using platform and back-end services.

Amarillo National Bank has a complete echeck processing and ACH solution for its business customers, including check guarantee, check conversion, and Check 21.

Areto Systems is an affordable payment processor that is available for companies all over the world. It offers an online payment gateway that includes alternative payment options like echecks, ACH, bank transfers, and credit card processing.

Authorize.net ensures the secure transmission of transaction data by managing the routing of transactions through the Internet instead of a phone line. The Authorize.Net Payment Gateway is available 24/7 for processing transactions that include echeck/ACH, credit and debit cards, mobile payments, and online payments. Specific solutions are available for online merchants, retail merchants, mail order and telephone order merchants, and mobile merchants.

Bank of America has a host of merchant services for its U.S. business customers, including echeck acceptance and conversion through Telecheck as well as mobile payments and online payments for debit and credit cards.

Bill.com epayments is the cheapest, most convenient way to get paid electronically. There are no set-up or monthly fees. It can be set up for one-time or recurring payments direct from customers’ bank accounts or credit cards.

Bluefin Payments offers electronic and ACH payments through its Pay Me Now virtual payment service. It also offers credit card processing, recurring billing, shopping cart services, ACH equipment and more.

BluePay is a well-respected payments company that was voted one of the best payment gateways. It provides a way for businesses to accept all major credit cards, debit cards and ACH payments (BlueChex) with fast and secure account verification.

BlueSnap is a global payments technology company that drives higher payment conversions for ecommerce merchants w/APIs and hosted pages. It offers a wide range of payment options for businesses, including echecks.

CCNow is an online retailer and provider of online checkout services that includes payment and alternative payment options like ACH/echeck and more.

Century Business Solutions has a full range of echeck services along with POS solutions, gift and loyalty programs, mobile payment services, shopping carts, retail POS, payment gateways, and merchant tools.

Charge.com provides ACH processing and echeck processing to even high-risk businesses with same-day fund delivery. Charge.com’s echeck processing accounts feature a Virtual Terminal and website API. The company’s other services include merchant accounts, mobile and wireless credit card processing, and electronic keypad terminals.

Chase provides its business banking customers with the ability to accept and process echecks, ACH, credit and debit cards, and more. It focuses on domestic online, virtual, and mobile payment options for its business customers.

Check Gateway is an ACH/echeck expert as well as offers other services like payroll processing, collections, a merchant center, fraud checks and remote deposit capture.

CheckNet has a range of electronic check services, including online payment processing, recurring payment processing, Check 21, Net Deposit, accounts receivable check conversion, check verification and conversion, and lockbox. Other services provided by the company involve collections and a range of merchant services.

Citi has a wide range of payment tools for small business customers, including ACH and echecks, debit and credit card processing, and more. It also offers international online and mobile payment acceptance.

CrossCheck has echeck programs that automate check authorization and deposit for a business. Features include remote deposit capture, back-office check conversion, check processing with recovery services, and check guarantee.

Cybersource helps customers in the U.S. and around the world to process payments online, including echecks, ACH, debit and credit cards and more. It deals with multiple currencies and platforms, offering compliance, convenience, security and value.

Deluxe eChecks are the first check-based service that allows businesses to create and send payments to anyone from anywhere via the Internet. No additional software or investments in new technology are required. Deluxe echecks are designed for any business or person with a checking account. Unlike ACH and direct deposit options, Deluxe eChecks don’t require a merchant account, specialized equipment, or payee banking information.

Deposit Checks offers ACH/echeck processing that gives businesses a next day deposit, low fees, and access to all banks. Services include one-time or recurring ACH transactions. They also provide check readers and scanners as well as QuickBooks processing.

Docdata Payments is an international company based out of the Netherlands that provides solutions for all types of payments for businesses all over the world, including bank transfers, check conversions, payment cards and more.

Dwolla serves U.S. customers and businesses with a payments platform that includes multiple ways to pay, including ACH and echecks. It uses a dashboard so payments, verifications, and transactions can all be viewed and managed effectively.

Dynamics Payment focuses on echeck/ACH processing, Check 21, remote deposit and mobile remote deposit. Other services include integrated POS solutions, ecommerce platforms, cash advance, EMV, and mobile payments.

eCheck Direct enables companies of all sizes to accept checks by phone, fax or web, offering a cheaper solution than ACH and credit card payment processing. Payment is immediate. The solution comes with a 30-day free trial. There are no setup, per transaction, or processing fees.

E-complish has specialized payment solutions for ACH/echeck, credit cards, and mobile environments. Services include pay by text, pay by phone, recurring payments, virtual payments, hosting payments, batch payments, and API developer solutions for custom payment tools.

ECS is part of the U.S. Alliance Group that offers numerous payment processing solutions, which includes credit and debit card payments, online payments, ATMs, electronic checks, gift cards, and bill payments all made for anything from a small business to a large company.

Elavon is a payment processing company that offers echecks as well as multiple payment methods for paying by mobile and online.

Electronic Merchant Services offers a way to converts paper checks into electronic checks and delivers the same speed as a credit card transaction. Other services include shopping cart solutions, payment gateways, website design, cash advances, POS, mobile processing, payment card processing, and gift and loyalty card processing.

EPX offers its customers a way to initiate electronic check transactions through its Virtual Terminal. Other services include credit card processing, ecommerce, and mobile. The company has been a longstanding service provider of international electronic payment options for companies all over the world.

Electronic Payment Services offers a one-stop solution for payment processing, providing a way to accept credit cards, checks by phone, and online payments. A payment gateway is included free with each account. ACH and echecks can be processed within a company’s website for faster payout. ACH eChecks can be used for payroll, customer payments, subscriptions and more.

eMerchant Broker is a payments company that specializes in servicing high-risk businesses and merchants with a range of payment processing options, including echecks and credit and debit cards.

eMerchant Pay is a UK-based payment service provider that provides international online, mobile, and POS payment processing services to merchants across the globe, including alternative payment services like echeck through its partnership with numerous payment gateways.

EPS is built for small businesses, offering credit card and check processing services, merchant cash advance, and website and SEO services.

FirstACH focuses solely on ACH and echeck payments, offering a 30-day free trial use of their service along with low fees, friendly and knowledgeable customer service, and the highest levels of security in all its transactions.

First Data uses TeleCheck to provide its customers with ACH and echeck services as well as delivers services for merchants of all sizes, including credit and debit card acceptance.

Forte is a payments company that offers a payment gateway as well as echeck processing that allows a company to process echecks at the point-of-sale (POS) mobile, online, and pay-by-phone. Companies can receive instant payments and serve customers who still want to pay by check.

FTNI’s online payment solutions deliver multiple ways to securely accept single and recurring online ACH, echeck and credit/debit card payments. The payment platform can automatically post transaction details to a company’s back-office accounting or CRM platform.

GD Pay helps small and medium-sized businesses to accept ACH and echecks as well as offers Check 21 and electronic check conversion services. It also offers merchant services, payment gateways, reseller services, education and technical support.

Global Processing Systems has the equipment and solutions to help companies of all sizes with echeck acceptance and guarantee. It also provides assistance with credit card equipment, online payments, gift cards, recurring payments, and web design and shopping carts for all types of merchants and businesses.

Green.Money has a secure gateway to create and process echecks, including single echeck, recurring echecks, and batch upload echecks. Customer data can also be stored while reports can be downloaded. The company touts itself as the fastest check gateway in the world and the first to build a 100% Internet-based, non-ACG processing platform capable of image processing to all of the banks in the United States.

Heartland offers a wide range of payment solutions for numerous industries. Payment processing includes echecks, debit cards, and credit cards. They also have solutions for lending, mobile ordering, payroll, gift cards, POS, billing, mobile and loyalty programs.

Hyperwallet is an online and mobile payments processing company that processes all types of payments, including echecks, across multiple currencies.

- Ignite Payments

Ignite Payments is a First Data company that delivers virtual check services, which allows merchants to accept and process echeck payments using Secure Sockets Layer (SSL) encryption. Global Gateway VirtualCheck transactions are captured through the First Data Global Gateway payment gateway, and check batches are automatically presented for settlement each day.

Ingenico provides a way to transfer and receive money all over the world with a wide range of options that include echecks and bank transfers as well as credit and debit card payments both online and via mobile device. The company also has other programs for ecommerce companies and businesses like loyalty and gift cards, analytics, and more.

Instabill is a payment company that serves the U.S. and the world with ACH and echeck payment processing as well as credit card processing, fraud protection, merchant accounts for traditional and high-risk merchants, payment gateways, and multi-currency transactions.

Intelligent Payments is a global company that provides a range of payment handling services, including over 60 alternative methods that offer echeck, ACH, bank transfer, and card payments as well as mobile payment options. The company also has specialized products for analytics and secure payment tools.

iTransact is a payment processing company that offers ACH and echeck services, including Redicheck that only comes with a small transaction fee and a monthly fee. Customers can pay with a check through iTransact’s secure server. The company also offers a range of other payment processing services like a traditional merchant account, POS equipment and software, virtual terminal, payment gateway, mobile processing and data analytics.

Merchant Account Providers offers all types of merchants and restaurants with a host of payment options, including high-risk and bad credit merchants. These payment services include echeck and ACH processing, merchant cash advance, mobile processing and more. Benefits of this company are no application fee, low rates, next day funding, and 24.7 service and support.

Merchant Advisors helps small businesses accept checks online through its low-cost echeck service. They also provide for checks by phone, check guarantee, Check 21, and check conversion. Other services include a comprehensive small business loan program and a host of merchant services.

The Merchant Equipment Store offers merchant equipment and merchant account services for echecks, POS, credit and debit card processing, fraud detection and more.

MersaTech offers check guarantee service as well as echecks, debit and credit card processing, ACH processing, gift and loyalty programs, merchant cash advances, online payment gateway and POS equipment.

Moneris delivers echeck conversion procession that includes verification and guarantee. Their other services offer gift and loyalty cards, POS solutions, mobile services, EMV, ACH direct debit, recurring payments, and merchant reports.

My Echeck offers many echeck services for almost any application, including personal, business and government payments. In addition to its web services, the company offers a customizable mobile payment app, eMobile Pay: Card Free Wallet. MyECheck is also a leading mobile payment system licensor and develops custom mobile payment solutions for corporations and payment service providers.

National ACH Electronic payment processing is made for medium-to-large companies that have high-volume processing as well as processing for high-risk merchants. Applying for an account is free. The company has an extensive network of banks, providing access to secure, long-term merchant account solutions with nearly unlimited processing capacities.

National Processing features solutions or ACH, echeck, credit card, and online payment processing. The company also can help with telephone and mail orders, gift cards, ecommerce sites and mobile payments. There are no contracts with this low-rate payment processing service.

Native Merchant Services is a comprehensive merchant, processing, and payments company. It allows companies of all sizes to accept echecks as well as process debit and credit cards, do batch and recurring processing, and more. They also offer a free credit card terminal for any merchant that has over $10,000 in processing each month. Other features include a merchant rewards program, merchant cash advance, POS solutions, and QuickBooks integration.

Netteller offers a way to transfer money easily online or by mobile device, including serving as a network for echecks as well as debit and credit cards.

NPC providees for a range of echeck services, including Check 21, personal check acceptance, check guarantee, checking by phone and checking at point-of-sale. The company also has numerous merchant support services for other types of payment options.

Pacnet Services is a Canadian company that offers numerous payment methods for businesses, such as check processing online and conversion, echecks and ACH, direct debit, multicurrency payouts, card processing, and more.

Pathfinder Payment Solutions has an echeck and ACH processing solution that helps businesses electronically debit an approved payment right from a customer’s checking account to their business bank account. Companies can view and manage their Pathfinder account online with myPathfinder that allows them to initiate and modify payments and receive extensive real-time reporting.

Paychex offers echeck and ACH processing that includes special features like a QuickBooks plugin, mulitple ecommerce and payment gateways, and electronic check conversion. The company also offers credit card and debit card processing, mobile and online payments, and POS solutions as well as payroll processing.

Payment Alliance also offers echeck conversion, check verification and guarantee, and one time or recurring ACH. Other services include solutions for merchants, ATMs, gift and loyalty cards, mobile solutions, ecommerce and telephone orders, and marketing solutions.

Payoneer is a payments company that lets businesses and merchants accept and transmit money around the world in over 150 currencies by using a range of payment options that include echecks and bank transfers as well as payment cards. The company also specializes in helping companies do and receive mass payments.

PayPal is a longtime online payments company that individuals and businesses all over the world trust for transactions. They offer an echeck payment service as one of their many payment tools, including bank transfers, debit and credit card processing, and invoicing.

PayPoint is a UK-based company that enables companies around the world to accept and transmit many payment types in various currencies to banks and bank accounts across all major financial institutions. It also offers a mobile and online platform, including Virtual Terminals for echeck payments online.

PaySimple is a cloud-based, service commerce platform that is designed especially for small businesses. Payment options include echecks, which includes easy setup and use. Other features include credit card processing, ACH, mobile payments, online payments, recurring billing, and electronic invoicing.

PayStand is a B2B payments platform that allows companies to accept payments like echeck and ACH processing, ecash and Bitcoin, mobile payments and credit cards for one flat rate of zero percent plus a micro fixed fee. Various plans all include Web-based checkout plus the option for direct bank debit and secure bank authorization.

PayZang PayZang is a leading provider of payment services to merchants and companies of all sizes. They offer deposit services, deposit initiation, online credit card processing, remote deposit capture, ACH processing and multi-channel payment acceptance. They provide a virtual check system that allows for echecks for those that prefer this payment method.

Piracle provides echeck and ACH solutions through its Create-A-Check solution, which makes the transition from checks to electronic payments easy. The company also provides other services, including numerous payment solutions, check printing equipment, and invoice solutions.

Prolific Business helps its customers accept ACH payments through their web-based Virtual Terminal, or they can integrate directly to their own website. Other features include set-up one time or recurring debit payments as well as check guarantee and check verification. Prolific Business has numerous other services available, such as merchant services, gift and loyalty programs, marketing solutions, business loans, and software.

Pro Payments specializes in echeck and ACH processing and offers other payment and accounting services that include mobile processing, bill presentment, online hosted checkout and QB integration features.

Punchey helps companies to process payments from bank accounts directly through the Punchey Virtual Terminal or mobile apps. Processing echecks works with Punchey’s complete product line, including Virtual Terminal, Recurring Billing, eInvoicing and mobile payment apps (Android & iOS). Payments with echecks typically are deposited into a business bank account within 2-3 business days. The company also offers gift cards, deal vouchers, and POS equipment as part of its overall payment solution.

QuickBooks provides a way to accept all types of payments from customers, including ACH, echecks, debit and credit cards, and instant bank transfer. It integrates with the accounting software’s features, offering a complete solution for a merchant and small business owner.

Sage Payment Solutions is a payment specialist that offers virtual checks with prompt funds deposit, 24-hour access to reporting, automated recurring billing, and lower processing costs than credit cards. There is also no installation required and it’s easy to use. The company also offers check conversion at the point-of-sale and Check 21 as well as debit and credit card processing for online, in-store, and mobile applications.

Seamless Chex makes it possible for businesses to accept checks by phone, fax, or web at a faster rate than credit cards or ACH without paying high fees.

Skrill brings all online payments and payment details together in one place to oversee payments, including the option for echeck payments, serving as a gateway to process those types of payments.

Smart2pay is a European company that specializes in alternative payment methods, including the ability to send echecks and ecash to others around the world while using a compliant and standardized way to make and receive payments.

Soar Payments has a complete credit card processing, ACH processing, echecks, payment gateway, and chargeback management service for companies in the U.S. and around the world. It offers special services for high-risk and offshore companies and merchants along with traditional low-risk companies.

Square allows a business to accept checks, credit and debit cards, and other forms of payment thanks to its reader that helps transform every payment into a digital payment. The company prides itself on offering low rates and easy set-up for businesses of all sizes, particularly small business owners.

Stripe is a payment platform made for developers so it can be completely customized to fit a business in terms of its payment needs. Options include ways to accept checks and convert checks as well as develop other online and mobile payment methods like debit and credit cards.

TheECheck.com is an alternative, echeck processing solution that was developed for the unique needs of merchants that want to serve all types of customers and have an alternative, low-cost payment option.

The Transaction Group provides echeck services to traditional and high-risk merchants and businesses. They offer an echeck program that is a unique paperless checking solution that allows customers to make payments for purchases via their bank account rather than with a credit card. All the customer needs is their bank name and account and routing numbers to complete the transactions. Merchants will receive funds from sales as early as the same day. Clearing of echecks in as little as two business days.

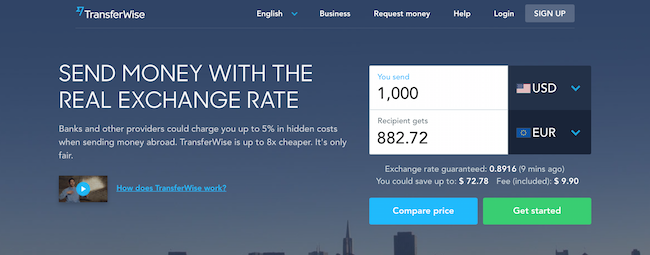

Transferwise is a global company that was founded by the same team that started Skype, and it includes investors like Sir Richard Branson backing this payments solution for global companies. The company allows users to transfer money using bank transfers and virtual checks as well as through debit and credit card transactions. It operates in multiple currencies and provides a better solution for sending money than typical wire transfer options.

Treasury Software enables customers to convert payments into electronic form, including ACH, ensuring compliance and offering speed and affordability. Files can be made and transmitted easily without complex software. The company also offers solutions for reconciling and managing business and merchant bank accounts.

TSYS Biz Solutions offers check by phone and online echeck solutions as well as online and mobile credit card processing and POS systems for merchants and small businesses.

US Bank delivers digital payment options for its business customers, including echecks. It also has a host of merchant and business payment services available for its U.S. customers.

VeriCheck has been helping businesses accept traditional and non-traditional forms of payment, including tools that verify and accept payments, prevent fraud, and recover funds. The company serves all sizes and types of merchants across the U.S. For one low price, each customer receives a multi-functional Merchant Console, which can serve all their processing and reporting needs.

Wells Fargo helps small businesses with its merchant services program that includes echecks and ACH processing as well as debit and credit card payments for both mobile and online payment platforms.

WePay is a payments platform that provides a way to accept multiple payment methods, including ACH processing, echecks, bank transfers as well as debit and credit cards.

Worldline is an epayments company that offers multiple ways to pay around the world, including digital online and mobile payments for debit and credit cards, checks, and online banking.

Xenex offers point of sale conversions so merchants can process echecks an receive instant authorization at the point of sale for face-to-face transactions. The company also offers Check 21 and ACH Debit. Other services include debit, credit, and EBT processing as well as cash advance, gift and loyalty programs, and ecommerce.

Xoom is a major payment gateway that accepts and processes echecks as well as offers a service to transfer money all over the world. It is a PayPal company.

XpressPay provides numerous ways to accept epayments, including echecks and ecash as well as online and mobile card payments. The company also provides services for recurring billing and telephone payments specifically designed for small businesses and U.S. merchants.