Retirement is tricky. Oscar Wilde said it best. “When I was young I thought that money was the most important thing in life; now that I am old I know that it is.”

Unfortunately, a majority of Americans may not have enough money to live comfortably and enjoy their golden years.

According to a MagnifyMoney poll of more than 2,000 Americans, 59% say they will never be able to save enough for retirement. Additionally, according to a Bankrate survey, 52% of Americans feel they don’t have enough money to fund their retirement. Approximately 16% of respondents are unsure whether they’re on track, but 21% say they’re on track. And, a mere 11% indicated that they were ahead of schedule.

However, rising debt rates and housing costs already weighed on Americans’ retirement savings. As an example, Gallup reported that 46% of non-retirees said that they won’t be financially comfortable in retirement.

Of course, that was before the pandemic.

In the aftermath of COVID-19, many people found themselves unable to contribute to their retirement savings because of job losses, higher health care costs, and unexpected family and caregiving responsibilities. For some, withdrawals from retirement savings were necessary.

The MagnifyMoney survey found that 48% of those with a retirement savings account had stopped saving or decreased their contributions during the financial crisis. Roughly 1 in 6 have not begun to save again since then. In addition, 39% of respondents drew from their accounts or borrowed money to cover necessities.

According to Bankrate, 51% of those with accounts like 401(k) plans or individual retirement accounts (IRAs) had made an early withdrawal, including 20 percent who did so since the pandemic began in early 2020.

No wonder 40% of Americans say it will take a miracle to retire comfortably, according to another survey.

Table of Contents

ToggleRoadblocks to Retirement: Insufficient Income and Overwhelming Debt

Keeping your finances on track when you aren’t earning enough or are facing massive student or credit card debt can be challenging — to say the least.

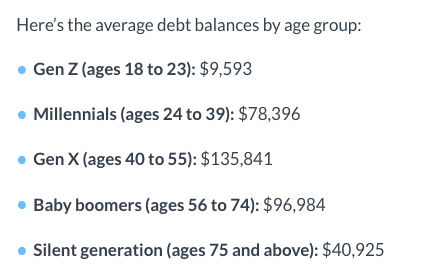

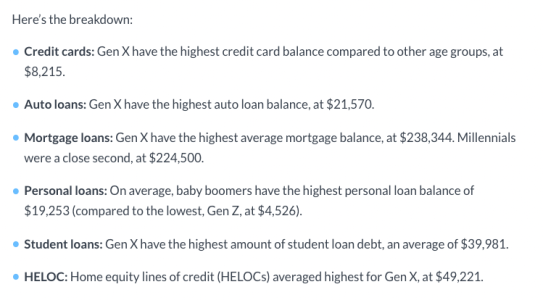

In the MagnifyMoney survey, almost 30% of survey participants said they weren’t earning enough money to meet their contribution goals. 15% said debt was holding them back from meeting their contributions. In fact, Americans are awash in debt, with an average of $90,460 in consumer debt. This includes everything from credit cards to mortgages and student loans.

Additionally, 11% of respondents had to use their retirement savings to cover emergency expenses, while 8% offered financial assistance to family members during the pandemic.

42% of those affected by Covid lost their income because of Covid, which led to a quarter of survey respondents having to delay retirement. Interestingly, it was the younger generation of savers who said they’ll have to delay retirement the most.

Approximately a quarter of Gen Zers and a little less than a third of millennials and Gen Xers (41 to 55) said the crisis would disrupt their plans. Among baby boomers (56 to 75), only 11% agreed.

Additional retirement financial risks.

Although Covid was a factor, it wasn’t the only one. Two-thirds, or 64%, of respondents, said their retirement funds weren’t where they wanted them to be prior to a pandemic. Other retirement roadblocks include;

- Longevity. We are living longer than ever, resulting in retirements lasting 25, 30, or even 40 years. When more years are spent in retirement, the more likely it is that other financial detours will occur.

- Inflation. Inflation, such as we have experienced over the past two decades, can deflate a retiree’s ability to maintain purchasing power in retirement.

- Sequence of return. In certain retirement assets, market pullbacks can pose a major challenge for money withdrawals. As withdrawals are used for purchases, that money is no longer sitting in the account awaiting a market recovery.

- Withdrawal rate. Traditionally, it was suggested that retirees could withdraw 4% of their initial savings annually. With historically low-interest rates and bond yields, a lower withdrawal rate may now be needed to help ensure that a retirement nest egg will remain sustainable.

- Social Security. It is crucial to know when to file for retirement benefits. In many cases, people begin their retirement benefits before they reach full retirement age.

- Healthcare. A healthy 65-year-old couple can expect to pay $12,052 per year in out-of-pocket medical expenses.

- Taxation. IRAs and 401(k)s provide most retirement savings. When withdrawn, these funds are taxed. Nevertheless, the after-tax value of those assets may be uncertain since future tax rates may be higher than they are now.

How to Get Your Retirement Savings Back on Track

Assess your current financial situation.

The very first thing you need to do is assess where you are now financially and how much you’ll need for your retirement goal. At the minimum, you need to know how much you currently have in retirement savings and what you’re contributing each month. If you still owe money on your 401(k), make a note of that as well.

In order to maximize your retirement savings, you should compare what you have now to how much you expect to need in retirement. To get back on track, increase your contributions to your retirement account. This may not seem possible, but anything you can contribute is better than nothing — even if it’s $50 a month.

Consider revising your budget.

You should also review your budget at the same time you’re evaluating your retirement plan. Simply examine your recent bank and credit card statements to see where can trim any spending. Hopefully, this will free up some additional money that can be put to good use.

“Saving for both emergencies and retirement are vitally important to current and future financial security,” says Greg McBride, CFA, Bankrate chief financial analyst. “Even a modest emergency fund acts as a buffer from early retirement account withdrawals when unplanned expenses arise, allowing the power of compounding to continue to work its magic.”

Prioritize debt repayment.

It might seem that debt repayment has nothing to do with retirement, but the two are often intertwined. After all, if you get rid of your debt, you won’t have to make those monthly payments. And, that means you can put that money towards your retirement savings. and you can save that money for retirement.

Which debt should tackle first? 401(k) loans and high-interest debt should be your top priorities. Besides being costly, if you borrowed from your 401(k), then this could result in your retirement being underfunded.

Before you make new contributions to your retirement plan, you may wish to work on paying these back. To help you manage your debt, consider taking out a personal loan or transferring your debt to a credit card. You may also want to consider part-time or freelance work until you’re debt-free.

Kick up your savings rate.

In terms of retirement savings rates, knowing how much is enough can be a challenge.

“We tend to advocate for a 15% deferral rate, and that includes both the employee and the employer contribution,” said Lorie Latham, senior defined contribution strategist at T. Rowe Price, during the firm’s 2022 retirement outlook panel.

According to Vanguard, automatic enrollment rates for those covered by those plans can be as low as 3% or less, if they also have automatic annual increases.

Contributing enough so that your employer will match at least some of your contributions is generally advisable. It’s important to bear in mind that if you’re also investing for your spouse, you will need to save even more.

As you earn raises or promotions, you can increase your retirement savings deferral rates — even if only by a little bit. McBride says this can have a considerable impact over time on your savings total.

“The habit of increasing the amount that you’re putting away can go a long way,” McBride said.

If your employer doesn’t match your retirement contributions, consider moving on. Ideally, when searching for a job, check the retirement account offered, the company match, and whether there is health insurance or other benefits that can reduce your monthly expenses.

Make investing simple.

In the absence of a 401(k), or if your contributions are already maxed out, look for other ways to save for retirement. You have plenty of time to incorporate an element of risk into your portfolio, so don’t overthink it. You might want to consider an index fund or robo-advisor to help automate your decisions.

With the help of artificial intelligence, these platforms can analyze your financial status and provide you with curated portfolios tailored to your age and financial situation. Typically, you can choose among various tax-advantaged retirement accounts with this investment method, simplifying the investing process. Even if it’s only a few dollars per month, you can automate your contributions to help you stay on track with your savings goals.

You could also use a spare-change app like Acorns. The app rounds up every purchase with the linked debit card and deposits the change in your investment or retirement fund when you make a purchase.

Contribute to an IRA.

An individual retirement account (IRA) allows you to save more money through tax advantages. But, there are two main types of IRAs.

You can deduct your contributions to a traditional IRA every year from your taxable income. The withdrawals you make in retirement will be taxed.

Roth IRAs are a great retirement investment if you don’t mind lowering your taxable income. As a result, you’ll pay taxes when you make a contribution, but when you retire and withdraw money, you won’t pay taxes. Moreover, any growth you have made in your portfolio is tax-free. Overall, with a balanced portfolio, you’ll be able to save the same amount for retirement while still maximizing your savings.

Contributions to all traditional IRAs and Roth IRAs cannot exceed the following amounts for 2022, 2021, 2020, and 2019: $6,000 ($7,000 if you’re older than 50), or. You will be taxable if your compensation is less.

You can also open a spousal IRA if one spouse works and contributes to the other spouse’s account if you’re married and only one spouse works.

Open health savings account (HSA).

Another way to accelerate your retirement savings? Use a health savings account.

The benefits of HSAs may outweigh contributions to other retirement plan types since they are considered to be ‘triple tax advantaged’ accounts.

An individual can set money aside for qualified medical expenses under these accounts. An HSA account allows its participants to invest in mutual funds and stocks tax-free — just as long as the investments remain in the account.

You may also contribute to an HSA on a pre-tax basis, lowering your current taxable income and then use the savings to make higher contributions to another retirement account. Employed individuals who contribute to their HSAs on a pretax basis avoid Social Security and Medicare taxes (also called FICA taxes).

Additionally, HSAs allow an individual to catch up on contributions as he or she approaches retirement. If you are 55 or older, you can invest an extra $1,000 each year. And, withdrawals made to pay qualified medical expenses during retirement can be accessed tax-free, including any growth that may have accrued.

Review your social security strategy.

In your retirement plan, Social Security will certainly play a major role. “Unlike the stock market, that part of your income won’t go down and will be adjusted for inflation yearly,” Diane Davis writes for Kiplinger. “That’s why it’s important to consider when you’ll start collecting benefits.”

At 62, you can start taking Social Security, but your benefits will be reduced by 30% permanently if you decide you need it. The full retirement age for those born between 1943 and 1954 is 66. People born in 1955 through 1960 are gradually eligible for the age of 67 – and then those born after 1960 will also qualify. “If you can afford it, however, think about waiting until age 70 to claim benefits because they will increase 8% per year if you wait to take them,” advises Davis.

Survivor benefits are another thing to consider for married couples. “If the higher-earning spouse dies first, the surviving spouse will be able to take over the deceased spouse’s benefits,” she explains. “So, if the higher-earning spouse delays taking benefits, the surviving spouse will get a larger monthly benefit.”

Delay your retirement.

Retiring later isn’t the best solution for most people. At the same time, there are no doubts about its effectiveness.

Retiring later means you can save for retirement for a longer period of time while reducing your retirement costs. In addition, you have more time to grow your existing savings before you must begin to draw from them.

However, this strategy should not be relied upon solely because employees cannot always work as long as they intend. Occasionally, injury or illness force an employee to leave work unexpectedly. Therefore, even if you plan to continue working for the foreseeable future, you should save as much as possible.

Frequently Asked Questions About Retiring With Enough Money

1. How much will I need to retire?

You will need to determine the lifestyle you plan to have in retirement based on the vision you have for your future. No matter the lifestyle you select, retirement is expensive no matter what you choose.

Among retirees, it’s common to need 70 to 90% of their pre-retirement income to maintain their lifestyle. You may consider that figure high, but according to the latest Consumer Expenditure Survey from the Bureau of Labor Statistics, the average retired household (led by someone 65 or older) spends $$48,872 per year.

2. Where will my retirement income come from?

Social Security Administration data shows that retirees typically receive income from four primary sources:

- Personal Savings and Investments

- Earned Income

- Company Pension Benefits

- Social Security Income

3. When should I start saving for retirement?

Every penny earned is a penny saved, but a penny saved today could earn more in the future. In other words, if you start investing at a young age this can pay off in the long run.

4. Before I retire, is there a way for me to project my retirement income?

There are a number of reasonably accurate financial strategy computer programs available today. You should seek the advice of a retirement planning professional. These include a Certified Financial Planner, a Certified Public Accountant, or another professional experienced in retirement planning

5. How can I save for retirement?

The most common ways to save for retirement are 401(k) and IRA plans. If a 401(k) is available through work, make sure that you’re taking advantage of the employer match. Once you turn 50 (or are turning 50 by the end of the calendar year in which the plan year ends), the IRS allows you to make annual “catch-up contributions.”

However, there are lesser-known options like health savings accounts that can help address future medical expenses. And, if you’ve maxed out your other retirement contributions, you can buy an annuity to provide a guaranteed retirement income stream.