What’s the best way to fund your retirement? Well, I wish could answer that, definitively, for you. But, unfortunately, how you will save for retirement is dependent on your financial circumstances, as well as your unique retirement goals.

While there are numerous options at your disposal, two of the most prominent are annuities and 401(k) plans. However, despite their similarities, both of these popular retirement savings vehicles have distinct differences and specifics about when each can be withdrawn.

My money, however, is on annuities? Why? Well, this guide will describe why a retirement annuity is better than a 401(k).

Table of Contents

ToggleAnnuity vs. 401(k)

Before going any further, let’s have a brief overview of an annuity and 401(k).

What are annuities?

An annuity is simply a contract between you and an insurance company. The insurer promises you periodic payments for a certain period in exchange for your money. Or, in some cases, until a specified event occurs, such as the annuity owner’s death, aka the annuitant.

Depending on your current situation, you can receive these payments in a series of monthly, quarterly, or annual installments for life. Or, you could receive one lump sum. In addition, you can grow your nest egg tax-deferred and guarantee a reliable income stream when you retire by investing in tax-deferred accounts sold by insurance companies.

Moreover, you decide when you’ll benign receiving these payments.

With an immediate annuity, monthly payments begin immediately following a lump sum payment — usually in the range of $100,000 or more. Payments on a deferred annuity generally start after the contract is signed so that you can make smaller contributions throughout years or even decades. This type of annuity is actually similar to your 401(k) contributions.

What is a 401(k)?

In a 401(k), qualified employees of an employer can invest and save for the future, which like annuities, is tax-deferred. However, a 401(k) is not available to everyone. 401(k)s are only available if the company you work for offers them.

In short, a 401(k) plan is tied to an employer, while an annuity is not.

But, what happens if you switch jobs? Of course, you could leave the annuity in place. But, it may be better for you to roll the money over from the old 401(k) into the 401(k) of your new employer or into an IRA.

The decision to contribute to your 401(k) and how much you will contribute each paycheck is entirely up to you within the parameters of the plan and IRS contribution limits. Employers may also contribute to the plan, but it’s entirely up to them.

401(k) contributions are deducted before taxes, so you lower your income tax bill by contributing to one. In addition, the money you contribute will not be taxed until you withdraw it from the plan, just like with annuities.

How Are Annuities and 401(k)s Similar?

A 401(k) and an annuity share several characteristics that make them both attractive options for saving for retirement. However, they also have their fair share of drawbacks.

- Long-term savings. Contributions to deferred annuities and 401(k)s can be made gradually. That means you can make a series of payments instead of one lump sum payment.

- Tax-deferred growth. You’ll only pay taxes when you take withdrawals from a traditional 401(k) or annuity. In other words, the gains you make in both are tax-deferred.

- Early withdrawal penalties. The IRS generally imposes a penalty on withdrawals before you turn 59 ½ (usually 10% of the amount withdrawn, plus applicable taxes). However, if you take substantially equal periodic payments (SEPPs), you can make a penalty-free early withdrawal from an annuity or 401(k). When you reach 59 ½, you can begin withdrawing money from either account. Depending on your situation, you may be able to take what you need to supplement your retirement and Social Security. Unlike annuities, when your 401(k) savings are depleted, they’re gone.

- Assets pass outside of probate. By naming a beneficiary on a 401(k) or annuity, those assets are not subject to probate and can be directly transferred to the named beneficiary.

How Are Annuities and 401(k)s Different?

A 401(k) plan is only available to employees whose employers offer them. On the flips side, anyone can purchase an annuity. Contributing to a 401(k) is impossible if your employer doesn’t offer one. However, self-employed individuals can set up their own 401(k)s.

Another key difference? Fees.

Checking the fees, you pay for your 401(k) is typically relatively easy. First, request an explanation of any fees charged to your account from your plan administrator. It’s often more challenging to figure out how much annuity fees will cost you. Additionally, fees for annuities, benefit riders, and more may be steep.

Other distinctions between annuities and 401(k)s include;

Contribution limits.

With an annuity, you can invest as much money as you want. However, there is a 401(k) contribution limit. As of 2022, the individual contribution limit is $20,500 (or $27,000 if you’re 50 or older), while the combined employer and employee contribution limit is $61,000 (or $67,500 if you’re 50 or older).

Guaranteed income.

Annuity payments can be locked in for life depending on the type of annuity and its riders. Unfortunately, 401(k)s don’t generally have such lifetime withdrawal options.

Sales commissions.

A 401(k) plan does not pay employers any compensation for employee participation. Agents, however, are paid commissions for selling both 401(k)s and annuities to your employer. As such, you may be talked into a program that doesn’t work for your retirement needs. These are both excellent options — just be sure to do your due diligence.

Investment choices.

You’re permitted only specific allocations within a 401(k) plan that are governed by the plan. But, you can customize your annuity to include the investment options you want.

Principal access.

It’s possible to avoid early withdrawal penalties by taking out a loan when you need to liquidate your 401(k) early by repaying the funds within a reasonable time frame, typically five years.

However, a surrender charge can be imposed on annuities if you withdraw large amounts earlier than expected. When you have to access your funds early, you may actually lose some of the money you initially invested, along with income taxes and IRS penalties. In some cases, you may be able to borrow after some cash value has built up in an annuity.

Returns.

A 401(k) has no limits on your investment gains or losses, so you can earn or lose whatever you want from your investment. However, many annuities have both gains and losses capped. While this protects your capital, it leaves you exposed to some of the ups and downs of the market.

Why a Retirement Annuity Is Better Than a 401(k)

An annuity and a 401(k) plan can provide long-term savings, tax-deferred growth, and a way to pass assets to beneficiaries outside of the probate process. However, a financial advisor might recommend investing in an annuity later in life, especially if you’re still working and haven’t maxed out your 401(k).

If you’re in such a scenario, annuities tend to have a leg up over 401(k)s mainly because they combine investment and insurance elements.

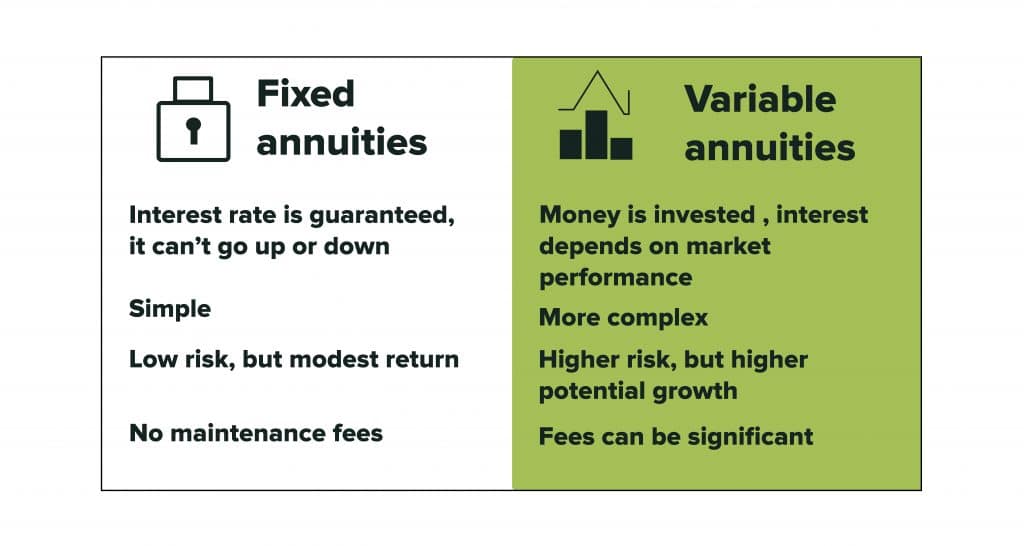

Another perk? The variety of annuities available lets you select the one that best suits your needs. At their most fundamental level, annuities fall into three categories;

- Fixed annuities guarantee a specific rate of return;

- You can participate in the stock market with a variable annuity;

- An index annuity is tied to the performance of a market index, such as the S&P 500.

It’s also worth noting that you typically make the purchase after-tax, so you don’t owe taxes on the principal when you use it as income. In addition, earnings from your investment also grow tax-deferred, so you get a boost while the annuity is in its growth phase.

An annuity is one of the three sources of protected lifetime income (pension and Social Security are the other two) that will provide you with guaranteed payments, often monthly, for the rest of your life. In other words, you’ll continue to receive payments. And, this is true even after your account balance has been exhausted.

But don’t just take my word for it. A study from 2021 suggests annuities might be a good alternative to stocks for retirement. “We find strong evidence that households holding more of their wealth in guaranteed income spend significantly more each year than retirees who hold a greater share of their wealth in investments.”

The Bottom Line

Are annuities perfect? Of course not.

Nevertheless, an annuity’s ability to generate retirement income becomes even more critical when you consider the possibility of outliving your savings. The income stream from an annuity lasts for as long as you live, so you can enjoy peace of mind when it comes to your golden years.

At the same time, depending on your circumstance, you may opt to use both. An annuity will ensure a minimum fixed income. As for the rest of your savings? It will remain in a 401(k) to continue to grow tax-deferred with higher returns.

Do you still have questions? It’s best to consult with a financial professional. They can crunch the numbers for you and determine what you’ll need versus what you would like. Most importantly, then help you determine which retirement option works best for you.