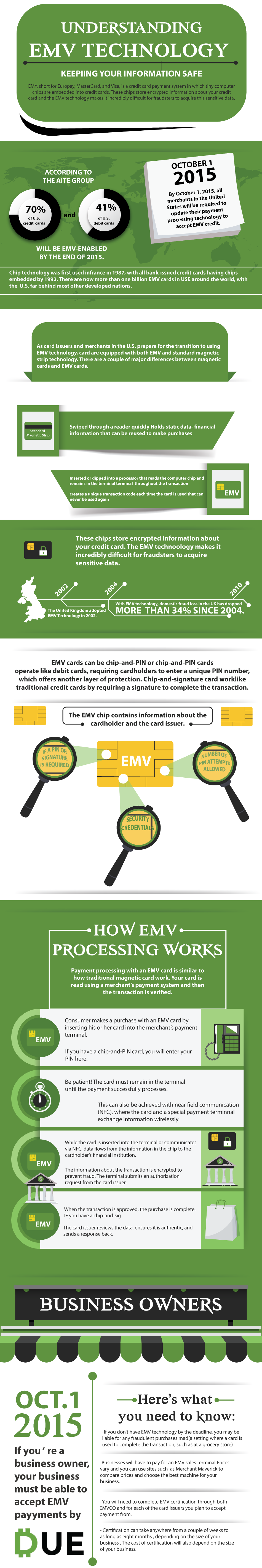

On October 1, 2015 all merchants in the United States were required to update their payment processing technology to be compatible with EMV technology. EMV short for Europay, MasterCard, and Visa is a payment method that uses tiny chips embedded into credit cards to make payments as oppose to using the magnetic strip.

As card issuers and merchants are making the shift towards EMV, card’s are currently equipped with both EMV and the standard magnetic strip, or magstripe, technology. The major difference between these two technologies is security.

Magstripe cards are swiped through a card reader where financial information is held and can be used to make future purchases. EMV cards are inserted into the card reader and remain in the terminal for the entire transaction while they generate an encrypted code that can never be used again. This added layer of security makes it more difficult for fraudsters to acquire sensitive financial data.

How EMV Processing Works

Payment processing with an EMV chip card is very similar to how the traditional magstripe cards work. Your card is read using a merchant’s payment technology, encrypted data is then sent to the processor where the transaction is verified. Here’s the basic process:

- Consumer makes a purchase with an EMV card by inserting his or her card into the merchant’s payment terminal. If you have a chip-and-PIN (debit) card, you’ll enter your pin number at this time.

- Your card then must remain in the terminal for quite some time while your data is being encrypted and the transaction is verified. This can also be achieved with a near field communication (NFC) terminal where the transaction is processed wirelessly.

- While your card is inserted, data flows from the information stored in your chip to the cardholder’s financial institution. All information is encrypted for fraud prevention. Then, the terminal submits an authorization request form the card issuer.

- The card issuer reviews the data, ensures that it’s in fact authentic, and then sends a response back.

This process takes a bit longer than the traditional magstripe method, which has caused a bit of backlash in the adoption of EMV. Nonetheless, the technology is constantly improving and we’re on our way to a safer transaction environment.

What Business Owners Need to Know

As more and more business owner’s switch over to EMV technology it’s important to understand the implications of the shift. Here are a few things you need to know if you’re a business owner shifting from traditional magstripe technology to EMV.

- If you haven’t yet made the change to EMV, you may be liable for any fraudulent purchases made from your point of sale terminal (this only applies to physical card transactions, such as a grocery store).

- You will have to purchase a EMV merchant terminal. Prices vary quite a bit, we suggest using Merchant Maverick to compare prices and choose the right machine for your business.

- You need to complete EMV certification through both EMVCO and each of the card issuers you plan to accept payments from.

- Certification can take anywhere from a couple weeks to eight months, depending on the size of your business and expected transaction volumes. The cost of certification is also dependent on the size of your business.

Now that you know what it takes, we strongly suggest taking the necessary steps to adopt EMV and other relevant payment technology for your business.

The Future of EMV Technology

Like the majority of new technologies, things will improve over time. First and foremost, merchants will continue to adopt EMV which will make consumer use of EMV more consistent. In addition, card issuers are making strides to educate the market on EMV and it’s benefits. For example, MasterCard urged the industry to introduce forums like the EMV Migration Forum and the Payments Security Taskforce which allowed the industry to work cohesively in improving the EMV landscape.

MasterCard also introduced a technology called mChip Fast which essentially prioritizes the most important parts of the transaction that are most crucial for security. This way, consumers can make transactions at a similar speed to the magstripe readers.

Patty Walters, head of security products at Vantiv says, ““Innovations like M/Chip Fast will help balance significant improvements in payments security with technologies that can help merchants accelerate the flow of their checkout lanes. We look forward to helping implement new technologies – like this – that help accelerate the EMV process.”

While it isn’t perfect yet, we can expect to see many improvements to this technology over the coming years.