Maybe you can’t come up with a million to invest — but you could likely save up $30,000 with some work on your part. This list offers clear investment options for an amount of 30,000. It presents different methods that suit a variety of risk levels and return expectations. Investors may find it useful to compare traditional and modern options. The article explains each option with care and lists quantifiable measures for informed choices. The evaluation rests on several factors. The criteria include:

- Return Potential

- Risk Level

- Management Fees

- Liquidity

- User Satisfaction

Table of Contents

ToggleTop 11 Ways To Invest 30,000

| Company | Rating | Return Potential | Risk Level | Liquidity | Fees | |

|---|---|---|---|---|---|---|

| 1 | Vanguard | 9.2 | High | Medium | Very High | Low |

| 2 | Fidelity | 9.0 | High | Medium | High | Medium |

| 3 | Robinhood | 8.5 | Very High | High | High | Low |

| 4 | Betterment | 8.8 | High | Low | Very High | Low |

| 5 | Fundrise | 8.4 | Medium | Medium | Medium | Medium |

| 6 | RealtyMogul | 8.2 | Medium | Medium | Medium | Medium |

| 7 | Coinbase | 8.0 | Very High | High | High | High |

| 8 | LendingClub | 7.8 | Medium | Medium | Medium | Medium |

| 9 | Ally Bank | 7.6 | Low | Low | Very High | Low |

| 10 | Schwab | 7.4 | Medium | Low | High | Low |

| 11 | Acorns | 7.2 | Low | Low | Medium | Low |

Vanguard

Vanguard is known for its low-cost investment options and index funds. The firm provides a wide range of funds that suit different risk appetites. It offers good tools for both new and experienced investors. Vanguard emphasizes transparency and steady growth. Many users appreciate its ease of use and customer support. The company has seen strong performance over many years. Investors often choose Vanguard for its balanced risk and well-managed fees. Metrics display stable returns paired with low expense ratios. The service supports diversified portfolios.

Return Potential: High

Risk Level: Medium

Management Fees: Low

Liquidity: Very High

User Satisfaction: High

| Summary of Online Reviews |

|---|

| “Investors praise the clear fee structure” and “steady performance over time.” |

Fidelity

Fidelity offers a solid mix of mutual funds and stock options. The platform has a user-friendly interface and reliable research tools. It covers both conservative and growth investments. Users gain access to detailed market insights that assist with decision-making. Fidelity is known for competitive fees and comprehensive customer service. The firm’s technology supports quick access to account details and educational resources. Its wide choice of funds gives investors flexibility. Data shows steady improvement in investor returns. Fidelity remains a trustworthy option for many investors.

Return Potential: High

Risk Level: Medium

Management Fees: Medium

Liquidity: High

User Satisfaction: High

| Summary of Online Reviews |

|---|

| “Clients appreciate the insightful research tools” with “responsive support.” |

Robinhood

Robinhood is popular for trading stocks and options at no commission. The app presents a simple and modern interface. It attracts investors who favor quick execution and real-time data. The firm places emphasis on accessibility for newer investors. Many reviews highlight the ease of opening accounts and placing trades. Robinhood offers flexible ways to invest smaller sums without large fees. The service provides useful educational content that aids investment decisions. It performs well in user interface clarity and overall digital experience.

Return Potential: Very High

Risk Level: High

Management Fees: Low

Liquidity: High

User Satisfaction: Good

| Summary of Online Reviews |

|---|

| “Users value the commission-free trades” with “intuitive app design.” |

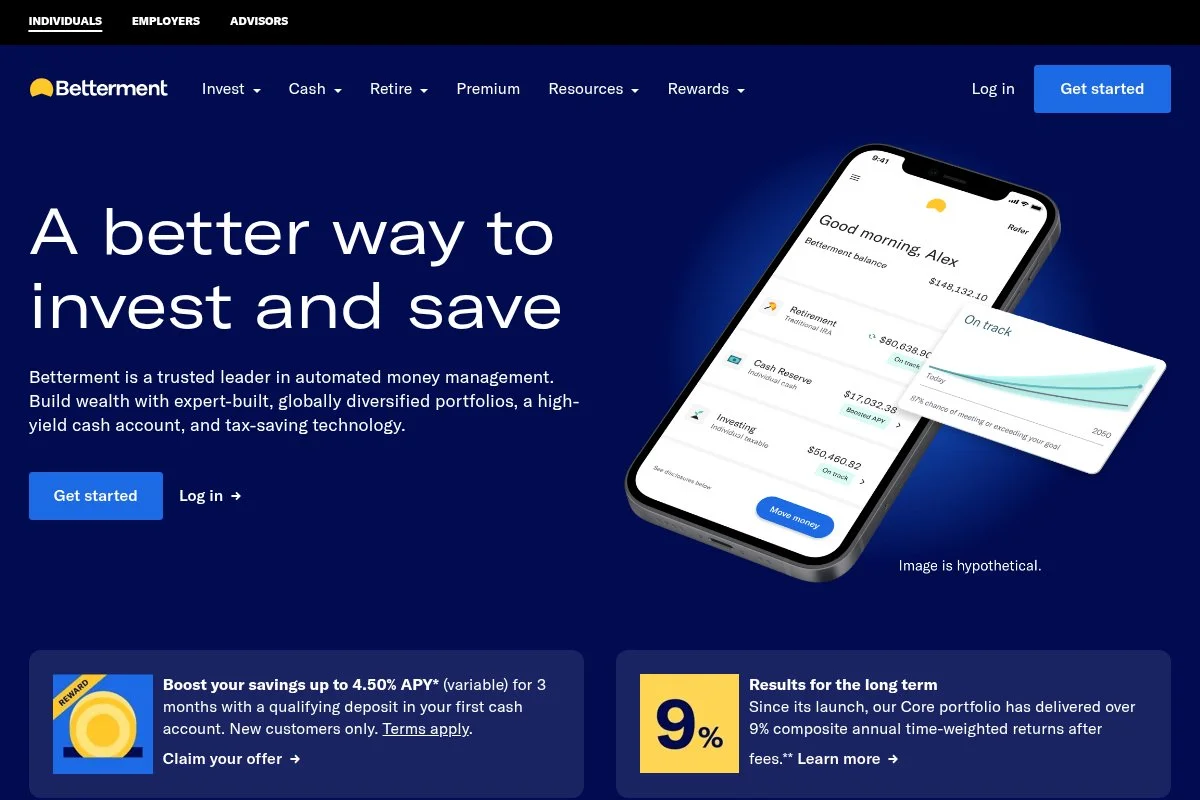

Betterment

Betterment focuses on automated advice and portfolio management. The service uses algorithms to help build and maintain balanced portfolios. It suits investors who need guidance without meeting with advisors. The firm provides tools that monitor risk and adjust allocations when needed. Documentation shows consistent account growth and lower fees than some traditional advisors. Users find the layout clear and the reports easy to understand. Betterment offers a modern approach and steady performance metrics. It is seen as a reliable solution for passive investors looking for simplicity in managing funds.

Return Potential: High

Risk Level: Low

Management Fees: Low

Liquidity: Very High

User Satisfaction: High

| Summary of Online Reviews |

|---|

| “Clients report a stress-free investment experience” with “clear performance dashboards.” |

Fundrise

Fundrise provides opportunities in real estate via online platforms. The option suits those who prefer a non-traditional asset class. Investors can purchase stakes in commercial or residential projects with a smaller entry cost. The company offers a range of portfolios with varying exposure and risk. Data shows gradual gains over extended periods. Users enjoy clear project details and regular updates. Fundrise makes investing in property accessible without full property management. The option is popular with investors who want a mix of income and growth potential.

Return Potential: Medium

Risk Level: Medium

Management Fees: Medium

Liquidity: Medium

User Satisfaction: Good

| Summary of Online Reviews |

|---|

| “Investors appreciate the detailed property insights” with “steady long-term returns.” |

RealtyMogul

RealtyMogul offers investments in commercial real estate and REITs. The platform is designed for investors seeking income and asset diversification. It provides access to verified real estate projects with clear performance records. Many users report steady income through dividends and property appreciation. The process is streamlined with transparent documentation. RealtyMogul shows stable project returns and a controlled fee structure. The option is noteworthy for investors who wish to add real estate exposure to their portfolios without direct property management.

Return Potential: Medium

Risk Level: Medium

Management Fees: Medium

Liquidity: Medium

User Satisfaction: Good

| Summary of Online Reviews |

|---|

| “Users like the clear investment breakdowns” with “a balanced approach to risk.” |

Coinbase

Coinbase presents a clear path for investments in digital assets. The service makes it simple to buy, store, and sell cryptocurrencies. It offers a secure environment backed by modern safeguards. Many users note the smooth navigation and fast transaction processing. Coinbase provides educational tools to ease the entry into digital currency markets. Data shows a mix of high return potential with increased price fluctuations. The option remains popular with those who understand digital assets and wish to diversify their portfolio.

Return Potential: Very High

Risk Level: High

Management Fees: High

Liquidity: High

User Satisfaction: Fair

| Summary of Online Reviews |

|---|

| “Investors mention swift transactions” with “secure account protocols.” |

LendingClub

LendingClub makes peer-to-peer lending accessible with transparent processes. The platform allows investors to select loans that meet their return and risk goals. It shows detailed borrower profiles and repayment histories. Users appreciate the transparent setup and consistent income reports. The service features automated tools to assist in portfolio selection. Loan performance indicators back the approach with measurable returns. LendingClub offers a chance to diversify income sources beyond traditional investments.

Return Potential: Medium

Risk Level: Medium

Management Fees: Medium

Liquidity: Medium

User Satisfaction: Good

| Summary of Online Reviews |

|---|

| “Users value the detailed loan data” with “steady return streams.” |

Ally Bank

Ally Bank is known for high-yield savings and certificate options. The bank provides competitive interest rates with simple account management. It offers a secure online experience with clear statements and reports. Many account holders note that Ally Bank manages fees efficiently. The service provides tools that help in monitoring and planning savings goals. Users find the website layout straightforward and easy to navigate. The bank supports a variety of savings products that suit cautious investors looking for liquidity.

Return Potential: Low

Risk Level: Low

Management Fees: Low

Liquidity: Very High

User Satisfaction: High

| Summary of Online Reviews |

|---|

| “Customers appreciate the clear savings options” with “no hidden fees.” |

Schwab

Schwab offers fixed-income products along with other investment options. It is recognized for its transparent fee structure and wide market access. The company provides tools that help investors compare bonds and other fixed-income products. Clear charts and analysis are available on the website. Users benefit from reliable research and efficient service. Schwab is a solid option for investors who want steady income and lower volatility. The platform is designed with both safety and growth in mind.

Return Potential: Medium

Risk Level: Low

Management Fees: Low

Liquidity: High

User Satisfaction: Good

| Summary of Online Reviews |

|---|

| “Investors note the competitive bond yields” with “user-friendly tools.” |

Acorns

Acorns is designed for micro-investing and rounding up purchases. The app automatically invests spare change into diversified portfolios. It suits new investors who prefer gradual exposure over time. The company offers simple interfaces with accessible financial advice. Many users see it as a way to begin investing without large capital. Reviews mention clarity and reliable returns over more extended periods. Acorns provides a secure platform that encourages consistent investment habits.

Return Potential: Low

Risk Level: Low

Management Fees: Low

Liquidity: Medium

User Satisfaction: Moderate

| Summary of Online Reviews |

|---|

| “Users praise the effortless saving method” with “clear portfolio growth.” |

Final Thoughts

The options display varied methods to invest 30,000. Each entry shows distinct strengths and different fee structures. Investors can choose based on their priorities, like risk, liquidity, and return goals. The list helps in making real comparisons based on numerical scores and user feedback. The precise criteria assist in understanding aspects such as management fees and overall satisfaction. The information allows investors to match their personal strategy with the best option available.