Do you want an objective ranking of the top six stocks in the FAANG space as defined by current market trends and financial performance? Here it is. This list aims to help investors and market watchers identify companies with strong financials and a history of innovation.

The featured companies play a pivotal role in the technology and digital services sectors, continuing to shape global market dynamics. The analysis is supported by multiple factors that reflect both historical performance and future potential. The evaluation is based on the following criteria:

- Market Performance

- Innovation Index

- Financial Health

- User Engagement

- Global Reach

Table of Contents

ToggleTop 6 Faang Stocks

| Company | Rating | Market Performance | Innovation | Financial Health | |

|---|---|---|---|---|---|

| 1 | Apple Inc. | 9.5 | 9.7 | 9.3 | 9.8 |

| 2 | Microsoft | 9.4 | 9.5 | 9.0 | 9.7 |

| 3 | Alphabet Inc. | 9.2 | 9.3 | 9.4 | 9.2 |

| 4 | Meta Platforms | 8.8 | 8.7 | 8.9 | 8.8 |

| 5 | Amazon.com, Inc. | 8.7 | 8.5 | 8.6 | 8.9 |

| 6 | Netflix | 8.3 | 8.2 | 8.4 | 8.1 |

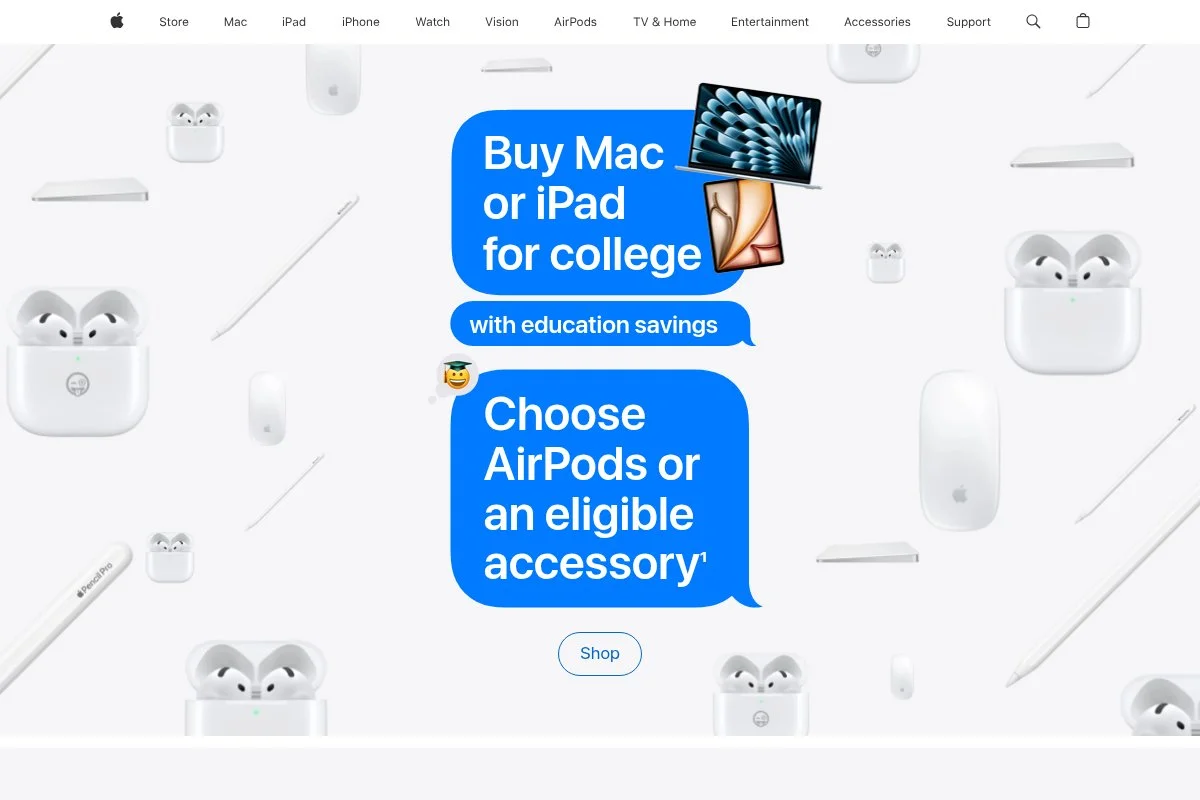

Apple Inc.

Apple Inc. is known for its strong brand and a history of delivering high-quality products that users trust. The company consistently shows impressive financial metrics and commands a loyal customer base. Its innovations in hardware and software have set benchmarks in multiple industries. Investors appreciate the resilience demonstrated in market fluctuations and the continued growth in revenue streams. The ability to integrate design with technology has also helped Apple remain competitive on a global stage. Its retail strategy and digital services provide stable revenue alongside its flagship devices.

Market Performance: 9.7

Innovation Index: 9.3

Financial Health: 9.8

User Engagement: High

Global Reach: Extensive

| Summary of Online Reviews |

|---|

| “The user experience is exceptional and the customer support receives praise,” noted several reviewers. |

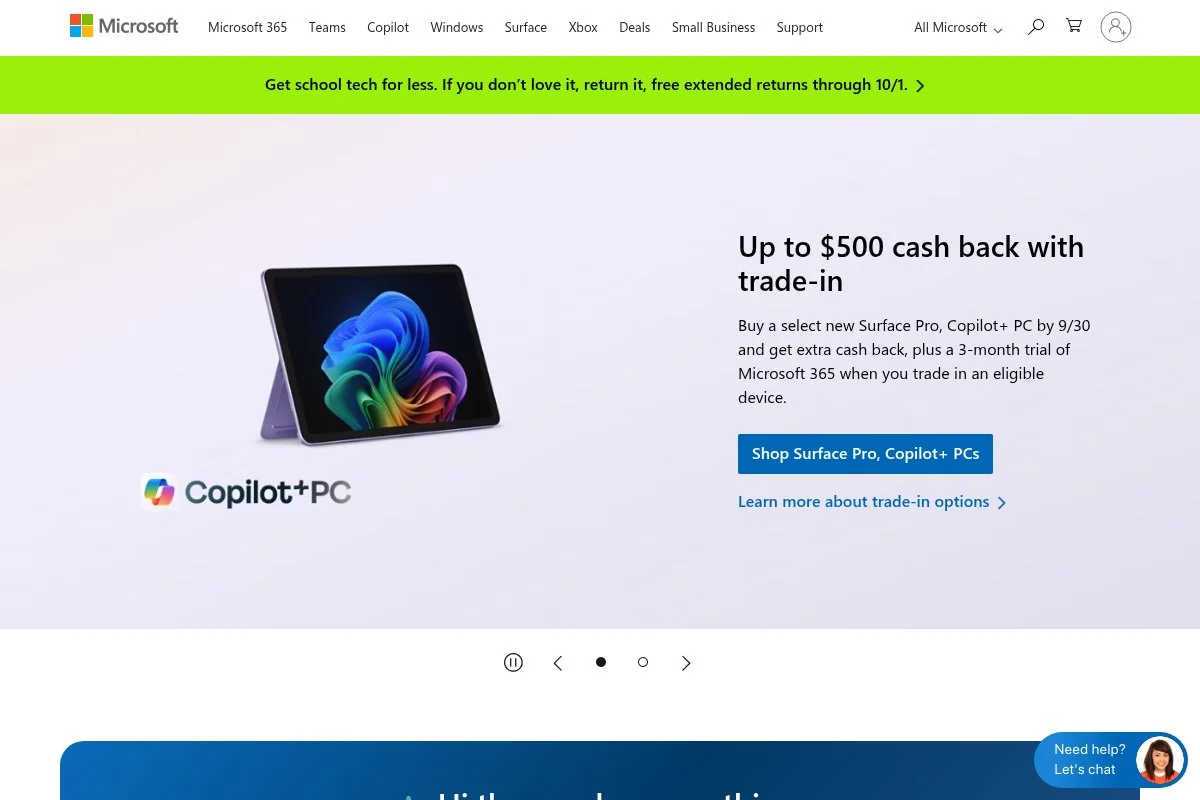

Microsoft

Microsoft stands out with its diversified business model and consistent performance across multiple segments. Its software, cloud computing, and productivity tools have attracted a broad customer base. The company excels in maintaining market stability while investing in future technologies. A strong commitment to research and development has kept it at the forefront of both business and consumer markets. Its financial results reflect efficiency, and improved global reach affords it a competitive edge in various sectors. The company’s strategic acquisitions further bolster its strong market presence.

Market Performance: 9.5

Innovation Index: 9.0

Financial Health: 9.7

User Engagement: Elevated

Global Reach: Worldwide

| Summary of Online Reviews |

|---|

| “Users praise its reliability and consistent performance in cloud solutions,” several experts commented. |

Alphabet Inc.

Alphabet Inc. is a leader in digital advertising and search technologies. The company displays a strong commitment to evolving its services and has successfully integrated experimental projects into its core business. Its financial reports reflect steady revenue growth and solid performance in competitive sectors. Analysts note the impressive efforts in researching areas such as artificial intelligence and cloud computing. Alphabet’s expansion of digital services continues to drive its market performance with a focus on user-friendly innovations.

Market Performance: 9.3

Innovation Index: 9.4

Financial Health: 9.2

User Engagement: High

Global Reach: Far-reaching

| Summary of Online Reviews |

|---|

| “Consumers appreciate the intuitive design and effective services across Alphabet’s platforms,” shared various reviews. |

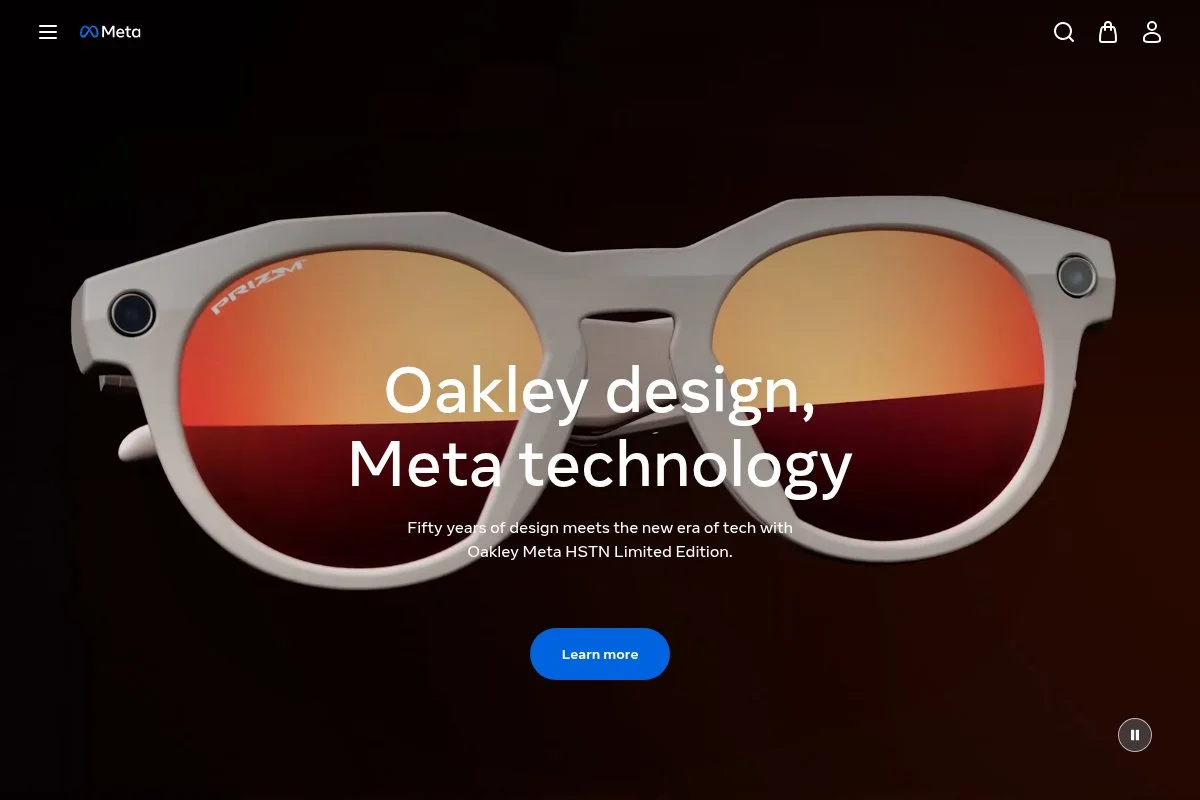

Meta Platforms

Meta Platforms focuses on social interaction and digital connectivity. The company has evolved its offerings to include virtual reality and other immersive technologies. Steady growth in user engagement and advertising revenue remains apparent in its recent reports. The focus on community building and targeted ad services strengthens its market position. Investors view Meta as a company with strong potential in adapting to emerging trends. The strategic outlook emphasizes digital expansion and improved service integration.

Market Performance: 8.7

Innovation Index: 8.9

Financial Health: 8.8

User Engagement: Very High

Global Reach: Extensive

| Summary of Online Reviews |

|---|

| “Feedback often highlights its user interface as engaging and intuitive,” as noted by various users. |

Amazon.com, Inc.

Amazon.com, Inc. is lauded for its dominant presence in e-commerce and digital services. Its efficient logistics network and customer-centric approach contribute to solid revenue growth. The company continually evolves its cloud services, digital streaming, and smart devices to meet shifting consumer preferences. Its continuous investment in technology and infrastructure supports strong operational metrics. The solid balance sheet and effective market strategies have enhanced its position in the technology and retail sectors.

Market Performance: 8.5

Innovation Index: 8.6

Financial Health: 8.9

User Engagement: Elevated

Global Reach: Worldwide

| Summary of Online Reviews |

|---|

| “Customer reviews emphasize the fast delivery and reliable service provided by Amazon,” according to market feedback. |

Netflix

Netflix is a major player in the streaming industry, offering a diverse selection of content that attracts audiences worldwide. Its pricing model, user interface, and content quality have helped it maintain a large subscriber base. The company regularly updates its library, resulting in sustained viewer interest and high engagement levels. Its data-driven approach supports content development and service enhancements. Financial performance tracks steady gains despite fierce competition, making Netflix a reliable choice for entertainment consumers.

Market Performance: 8.2

Innovation Index: 8.4

Financial Health: 8.1

User Engagement: High

Global Reach: Broad

| Summary of Online Reviews |

|---|

| “Subscribers comment on the extensive content library and engaging shows that keep them returning,” several users mentioned. |

Final Thoughts

The ratings and analysis reveal varied strengths among the top six stocks. Apple and Microsoft lead with strong financial stability and impressive market performance. Alphabet and Meta Platforms also show consistent results and innovation in digital services, while Amazon and Netflix continue to impress with their customer-oriented approaches. Each company represents unique opportunities for investors, with metrics that suit different investment goals. Readers can choose based on their focus, whether on technological innovation, digital connectivity, or market resilience.