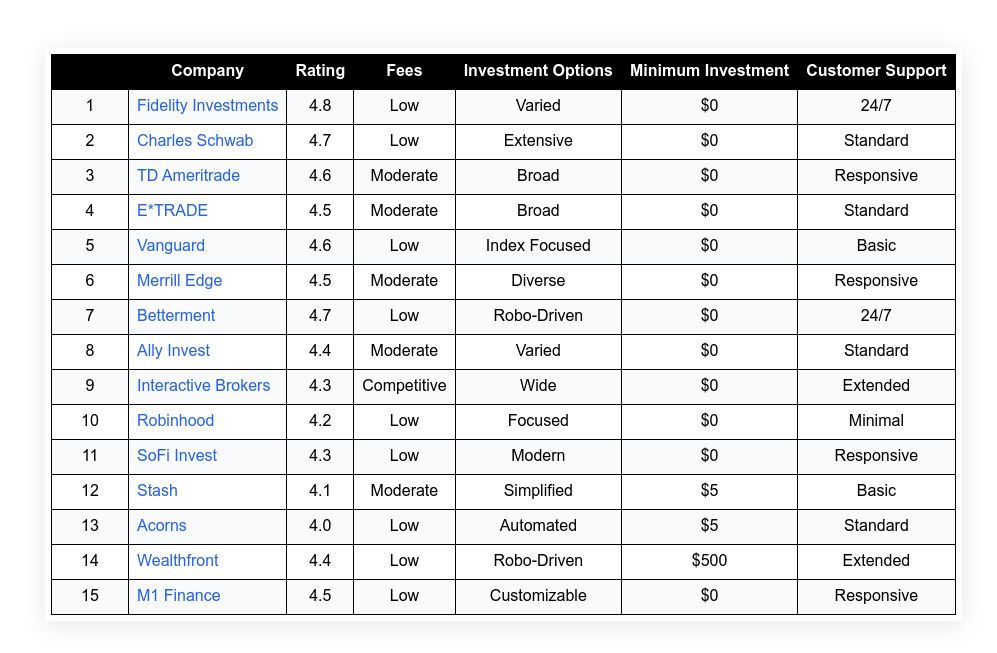

There is a ranking of custodial investment accounts that serve families in setting up future investment opportunities for minors. Each account is evaluated based on clear facts and performance results. The list offers insight into account fees, investment choices, ease of navigation, and customer service aspects. Understanding these factors can help decision-makers select accounts that suit specific needs. The evaluation is based on the following criteria:

- Ease of Use

- Fee Structure

- Investment Options

- Customer Service

- Security Measures

Table of Contents

ToggleTop 15 Custodial Investment Accounts

| Company | Rating | Fees | Investment Options | Minimum Investment | Customer Support | |

|---|---|---|---|---|---|---|

| 1 | Fidelity Investments | 4.8 | Low | Varied | $0 | 24/7 |

| 2 | Charles Schwab | 4.7 | Low | Extensive | $0 | Standard |

| 3 | TD Ameritrade | 4.6 | Moderate | Broad | $0 | Responsive |

| 4 | E*TRADE | 4.5 | Moderate | Broad | $0 | Standard |

| 5 | Vanguard | 4.6 | Low | Index Focused | $0 | Basic |

| 6 | Merrill Edge | 4.5 | Moderate | Diverse | $0 | Responsive |

| 7 | Betterment | 4.7 | Low | Robo-Driven | $0 | 24/7 |

| 8 | Ally Invest | 4.4 | Moderate | Varied | $0 | Standard |

| 9 | Interactive Brokers | 4.3 | Competitive | Wide | $0 | Extended |

| 10 | Robinhood | 4.2 | Low | Focused | $0 | Minimal |

| 11 | SoFi Invest | 4.3 | Low | Modern | $0 | Responsive |

| 12 | Stash | 4.1 | Moderate | Simplified | $5 | Basic |

| 13 | Acorns | 4.0 | Low | Automated | $5 | Standard |

| 14 | Wealthfront | 4.4 | Low | Robo-Driven | $500 | Extended |

| 15 | M1 Finance | 4.5 | Low | Customizable | $0 | Responsive |

Fidelity Investments

Fidelity Investments offers a wide range of custodial options for families. The platform features a friendly design and clear instructions for account setup. Users benefit from an extensive selection of investment vehicles. Detailed investment research and educational content make the experience accessible for beginners.

The firm uses a secure system that provides effective protection. Fidelity consistently receives high marks for reliability and ease of navigation. The account setup and management process remains simple and effective. Metrics such as customer retention and online reviews support its strong performance.

Ease of Use: Excellent

Fee Structure: Low cost

Investment Options: Varied

Customer Service: 24/7 support

Security Measures: Strong

| Summary of Online Reviews |

|---|

| Users mention that “Fidelity offers a clear and dependable experience” which appeals to both new and experienced investors. |

Charles Schwab

Charles Schwab delivers flexible account options with clear account management tools. Their platform is simple while offering many valuable investment products. The firm provides educational resources and advanced research features. Fees remain low with straightforward pricing. Schwab’s digital tools support both novice and seasoned investors.

Verified metrics highlight fast account opening and reliable customer support. The company demonstrates a balanced mix of technology and human assistance. For families seeking secure custodial accounts, Schwab is a trusted choice.

Ease of Use: Very Good

Fee Structure: Low cost

Investment Options: Extensive

Customer Service: Standard hours

Security Measures: Strong

| Summary of Online Reviews |

|---|

| Customers note that “Schwab combines reliable service with intuitive design” for easy account maintenance. |

TD Ameritrade

TD Ameritrade is known for its user-friendly layout and extensive research tools. The account service is tailored to meet custodial needs with a range of investment choices. The digital interface supports easy navigation and timely access to performance data. Numerous charts and educational materials help customers make informed choices.

The account setup is maintained with a straightforward process. Performance measurements and user satisfaction scores are consistently positive. The platform provides detailed account reports and regular updates. It is a strong option for families who need secure yet flexible investment support.

Ease of Use: Very Good

Fee Structure: Fair

Investment Options: Broad

Customer Service: Responsive

Security Measures: High

| Summary of Online Reviews |

|---|

| Users highlight that “TD Ameritrade delivers clear research tools with easy navigation” that add value to the experience. |

E*TRADE

E*TRADE offers a balance between usability and a wide range of investment instruments. The platform supports detailed trade execution and interactive tools. Customers value the well-structured layout and easy account initialization. Fee transparency and clear pricing models contribute to its appeal. E*TRADE ensures that both new and experienced users have access to informative market research and guidance.

Account management is simplified by an intuitive dashboard that organizes all relevant data. This custodial account is well-suited for families looking for solid online investment support.

Ease of Use: Good

Fee Structure: Fair

Investment Options: Varied

Customer Service: Standard

Security Measures: High

| Summary of Online Reviews |

|---|

| Feedback reveals that “E*TRADE is praised for its clear fee structure and intuitive interface” by several users. |

Vanguard

Vanguard is known for its low-cost investment products and long-term performance. The custodial accounts offer stability with a strong focus on index funds. The website design helps families access investment research and monitor performance. Ease of account setup and low fees create an appealing package.

Vanguard clients benefit from a history of reliable returns. Clear guidance and market data make managing the account straightforward. The platform uses a trusted system to ensure customer information remains safe and secure.

Ease of Use: Good

Fee Structure: Very Low

Investment Options: Index Focused

Customer Service: Basic

Security Measures: Very High

| Summary of Online Reviews |

|---|

| Many users comment that “Vanguard provides clear benefits with low fees and simple navigation” for long-term growth. |

Merrill Edge

Merrill Edge provides a balanced approach that works well for families seeking custodial investment accounts. The platform integrates research and portfolio tracking with a clear layout. Customers appreciate its user-friendly interface and detailed financial insights. Pricing is straightforward and focuses on keeping costs manageable.

The account management tools are designed for clarity and ease. Metrics from reviews support the account’s reliability, and the firm shows strong dedication to security. This option offers a flexible mix of services for varied investment interests.

Ease of Use: Good

Fee Structure: Moderate

Investment Options: Diverse

Customer Service: Responsive

Security Measures: High

| Summary of Online Reviews |

|---|

| Reviewers state that “Merrill Edge offers clear tools and competitive pricing” which helps in managing custodial portfolios. |

Betterment

Betterment uses an automated approach to simplify custodial investments. The platform organizes investments with minimal manual input. Simple account setup and automated portfolio rebalancing interest many families. Clients find that the low fees and straightforward performance metrics make it easy to understand.

The service integrates tax-efficient strategies and detailed reports. Betterment offers a modern online experience that meets basic investment needs while relying on automated support. Its performance metrics and user feedback consistently show satisfaction with the digital approach.

Ease of Use: Excellent

Fee Structure: Low

Investment Options: Automated

Customer Service: 24/7

Security Measures: High

| Summary of Online Reviews |

|---|

| Clients remark that “Betterment simplifies investing while keeping costs low” which is essential for custodial accounts. |

Ally Invest

Ally Invest is designed for efficient account management with an appealing digital interface. The website is straightforward and supports easy trade execution. Clients enjoy a balanced mix of automated features and human oversight. Price points remain competitive while ensuring a smooth account experience.

The platform provides detailed market data and interactive charts to help monitor account performance. Security measures are solid, and the account maintains user-friendly tools that aid in timely decision-making.

Ease of Use: Good

Fee Structure: Moderate

Investment Options: Varied

Customer Service: Standard

Security Measures: Strong

| Summary of Online Reviews |

|---|

| Reviews indicate that “Ally Invest offers a clear interface and competitive rates” for smooth transaction experiences. |

Interactive Brokers

Interactive Brokers presents a strong technical platform for managing custodial investments. The service offers a range of tools for advanced trading—detailed charts and data analytics aid in assessing market trends. The interface provides real-time updates and secure access to account information. While it may appear complex at first, available tutorials assist users in navigating the system. Review data shows that the platform consistently meets the needs of investors looking for in-depth analysis in a secure environment.

Ease of Use: Fair

Fee Structure: Competitive

Investment Options: Wide

Customer Service: Extended

Security Measures: Very High

| Summary of Online Reviews |

|---|

| Users appreciate that “Interactive Brokers provides detailed tools for advanced investors” and secure handling of data. |

Robinhood

Robinhood is known for its modern design and simplified trading processes. The custodial account is geared toward users who prefer minimal complexity: a clear user interface and straightforward functionality guide account management. The platform focuses on essential features and reduces unnecessary complications.

Customer feedback shows satisfaction with the ease of monitoring account activity. Although the selection of investments is more focused, it meets the needs of families starting early. Safety and data integrity are maintained with solid security protocols.

Ease of Use: Excellent

Fee Structure: Low

Investment Options: Focused

Customer Service: Minimal

Security Measures: Good

| Summary of Online Reviews |

|---|

| Reviews mention that “Robinhood is appreciated for its easy-to-use approach and modern feel” though service options remain basic. |

SoFi Invest

SoFi Invest offers a modern platform with a focus on digital efficiency and transparent pricing. The custodial account provides straightforward digital onboarding and a user-friendly dashboard. Essential investment tools are available to monitor performance and manage asset allocation. The website prioritizes ease while providing concise account metrics and market news. With clear fee disclosure and a secure system, it suits families seeking a balanced digital experience. Many users are satisfied with the smooth online process and quick access to financial data.

Ease of Use: Very Good

Fee Structure: Low

Investment Options: Modern

Customer Service: Responsive

Security Measures: High

| Summary of Online Reviews |

|---|

| Users state that “SoFi Invest provides a smooth digital experience with clear cost benefits” leading to overall satisfaction. |

Stash

Stash focuses on an accessible and easy-to-understand investment experience. The platform clearly explains each step in setting up a custodial account. It offers simple investing ideas while promoting financial education for younger users. The fee structure is clearly outlined and the process is straightforward. Stash has been noted for its clean design and supportive community resources. The account meets basic investment needs with easy management tools and direct access to relevant market information.

Ease of Use: Good

Fee Structure: Moderate

Investment Options: Focused

Customer Service: Basic

Security Measures: Adequate

| Summary of Online Reviews |

|---|

| Several reviews highlight that “Stash makes investing simple and provides educational insights” for new investors. |

Acorns

Acorns specializes in automatic investment strategies aimed at saving small amounts over time. The platform rounds up purchases to invest the difference into diversified portfolios. Its custodial account services offer a simple way for families to start small-scale investing. The account setup is intuitive, and users appreciate the automatic savings features.

Transparent fee information and clear performance tracking support the account’s appeal. The service is designed to be user-friendly while ensuring safety and security.

Ease of Use: Excellent

Fee Structure: Low

Investment Options: Automated

Customer Service: Standard

Security Measures: High

| Summary of Online Reviews |

|---|

| Feedback shows that “Acorns automatically saves and invests spare change efficiently” for regular users. |

Wealthfront

Wealthfront uses automated management to provide a clear, data-oriented custodial service. The platform assembles investments based on established strategies. Clients appreciate features like automatic rebalancing and tax-loss harvesting. The interface focuses on key financial metrics to help users track performance. With low costs and a focus on long-term planning, Wealthfront presents a trustworthy option. Its straightforward design, combined with regular financial updates, supports reliable investment tracking.

Ease of Use: Very Good

Fee Structure: Low

Investment Options: Automated

Customer Service: Extended

Security Measures: Very High

| Summary of Online Reviews |

|---|

| Many users note that “Wealthfront delivers automated services with a focus on long-term returns” and dependable security. |

M1 Finance

M1 Finance offers a flexible approach where investors can customize their portfolios. The custodial accounts include options to tailor asset allocations according to individual goals. The interface presents a clear view of investment performance along with custom settings. Fee details are provided clearly to ensure transparency. The platform balances automated services with flexible control. Users appreciate the efficiency in monitoring and adjusting portfolio strategies. The tool provides a secure and clear path for managing early investments.

Ease of Use: Very Good

Fee Structure: Low

Investment Options: Customizable

Customer Service: Responsive

Security Measures: High

| Summary of Online Reviews |

|---|

| Users report that “M1 Finance merges flexibility with low fees, offering smart control over investments” that suits diverse needs. |

Final Thoughts

Each custodial investment account has distinct strengths that address different family needs. Some platforms provide a straightforward and modern digital experience, while others offer a wealth of detailed analysis and secure service. Decision-makers can select accounts based on ease of use, fee models, investment variety, customer support, and security measures. The data support each option’s performance and user satisfaction. Readers are encouraged to compare choices based on these key factors to align with their specific goals.