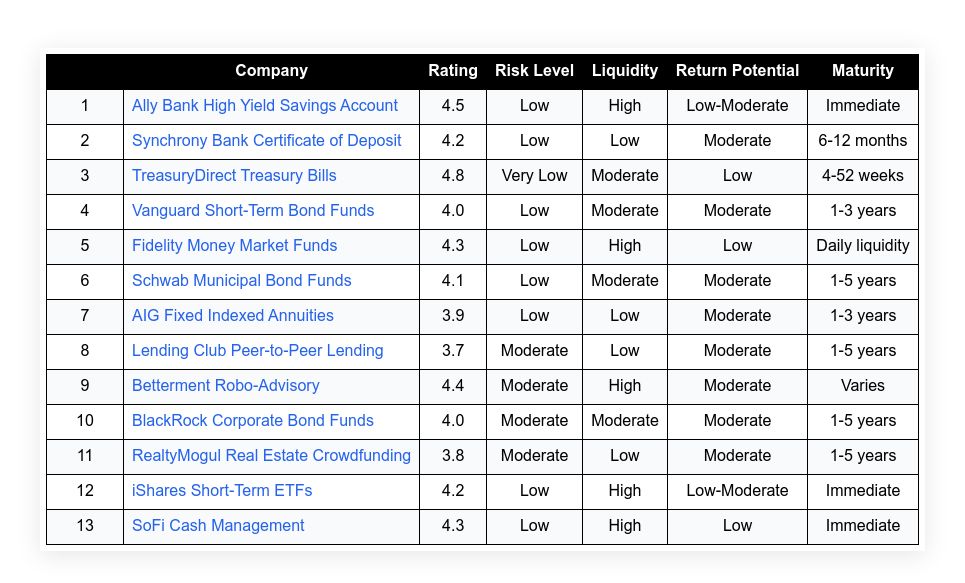

You’ll always want to compare various financial tools that offer quick access to funds while preserving capital. Here’s our list of 13 of the leading options for short-term investments for retirement. The selection draws on current market data and reviews from trusted sources. Readers find a variety of choices that balance safety and return potential. The criteria used to evaluate these options include:

- Risk Level

- Liquidity

- Return Potential

- Maturity Term

- Ease of Access

Each option is chosen for its ability to provide short-term accessibility without compromising on the security needed during retirement.

Table of Contents

ToggleTop 13 Short-Term Investments For Retirement

| Company | Rating | Risk Level | Liquidity | Return Potential | Maturity | |

|---|---|---|---|---|---|---|

| 1 | Ally Bank High-Yield Savings Account | 4.5 | Low | High | Low-Moderate | Immediate |

| 2 | Synchrony Bank Certificate of Deposit | 4.2 | Low | Low | Moderate | 6-12 months |

| 3 | TreasuryDirect Treasury Bills | 4.8 | Very Low | Moderate | Low | 4-52 weeks |

| 4 | Vanguard Short-Term Bond Funds | 4.0 | Low | Moderate | Moderate | 1-3 years |

| 5 | Fidelity Money Market Funds | 4.3 | Low | High | Low | Daily liquidity |

| 6 | Schwab Municipal Bond Funds | 4.1 | Low | Moderate | Moderate | 1-5 years |

| 7 | AIG Fixed Indexed Annuities | 3.9 | Low | Low | Moderate | 1-3 years |

| 8 | Lending Club Peer-to-Peer Lending | 3.7 | Moderate | Low | Moderate | 1-5 years |

| 9 | Betterment Robo-Advisory | 4.4 | Moderate | High | Moderate | Varies |

| 10 | BlackRock Corporate Bond Funds | 4.0 | Moderate | Moderate | Moderate | 1-5 years |

| 11 | RealtyMogul Real Estate Crowdfunding | 3.8 | Moderate | Low | Moderate | 1-5 years |

| 12 | iShares Short-Term ETFs | 4.2 | Low | High | Low-Moderate | Immediate |

| 13 | SoFi Cash Management | 4.3 | Low | High | Low | Immediate |

Ally Bank High-Yield Savings Account

Ally Bank offers a high-yield savings account designed for preserving principal with easy access. The account is managed by a long-standing financial institution known for its user-friendly digital tools. It features competitive interest rates and transparent policies. The funds are available on demand while offering better returns than standard savings.

The service includes straightforward online management. Customers appreciate its clear fee structure and solid customer support.

Risk Level: Low

Liquidity: High

Return Potential: Low-Moderate

Maturity: Immediate

Ease of Access: Online and mobile

| Summary of Online Reviews |

|---|

| “I value the clarity and ease of use,” noted several users. Many mention the fast service and reliable support. |

Synchrony Bank Certificate of Deposit

Synchrony Bank provides a Certificate of Deposit that suits short-term needs. The CD offers a fixed rate over a set period. It is supported by a trusted bank that focuses on clear terms and interest forecasts. Investors find the product dependable for preserving funds while earning a moderate return. The fixed term helps in planning retirement efficiently.

The platform provides clear maturity dates and straightforward renewal options.

Risk Level: Low

Liquidity: Low

Return Potential: Moderate

Maturity: 6-12 months

Ease of Access: Online application

| Summary of Online Reviews |

|---|

| “Reliable and consistent,” users often mention the straightforward setup and trusted bank backing. |

TreasuryDirect Treasury Bills

TreasuryDirect allows investors to buy Treasury bills directly from the government. These bills are among the safest investments available. The full faith of the government backs them. Purchasers decide on short-term durations and obtain steady returns. The platform is designed for security and ease. Its straightforward interface makes purchasing simple, even for those new to government securities.

Risk Level: Very Low

Liquidity: Moderate

Return Potential: Low

Maturity: 4-52 weeks

Ease of Access: Direct online access

| Summary of Online Reviews |

|---|

| “Offers unmatched security,” several investors appreciate the government backing and simple interface. |

Vanguard Short-Term Bond Funds

Vanguard offers bond funds designed for those seeking short-term growth with lower volatility. The funds mix government and corporate securities. They are tailored for investors who prefer steady income with moderate exposure to risk. Vanguard is noted for low fees and efficient management. The fund’s strategy supports capital preservation while generating regular distributions, making it suitable for retirement planning.

Risk Level: Low

Liquidity: Moderate

Return Potential: Moderate

Maturity: 1-3 years

Ease of Access: Fund management portal

| Summary of Online Reviews |

|---|

| “Low fees and clear strategy,” investors report steady returns while feeling secure about overall exposure. |

Fidelity Money Market Funds

Fidelity provides money market funds ideal for preserving cash while earning a modest return. These funds focus on high-quality, short-term debt instruments. They offer daily liquidity, making funds readily available.

Fidelity is respected for its clear fee structure and reliable online tools. It serves investors looking for stability and quick access to cash without excessive risk exposure.

Risk Level: Low

Liquidity: High

Return Potential: Low

Maturity: Daily liquidity

Ease of Access: Online oversight

| Summary of Online Reviews |

|---|

| “Simple and effective,” many investors enjoy the daily access and clarity of trading options. |

Schwab Municipal Bond Funds

Schwab offers municipal bond funds for investors seeking tax advantages and a steady income. These funds invest in municipal bonds with shorter durations. The service is managed by a reputable firm known for cost-efficient management. Investors find the product beneficial for its balance between gain and security. The online platform affords clear access to performance data and fund composition.

Risk Level: Low

Liquidity: Moderate

Return Potential: Moderate

Maturity: 1-5 years

Ease of Access: Online tools

| Summary of Online Reviews |

|---|

| “Tax benefits matter,” several users value the combination of safety and tax efficiency. |

AIG Fixed Indexed Annuities

AIG presents fixed indexed annuities that secure principal and offer modest growth linked to an index. This product is designed for individuals seeking protection with the opportunity for additional earnings. AIG’s more extended history in insurance adds to the trust factor. The annuities feature structured terms that suit many short-term strategies and are managed with clear, predictable outcomes.

Risk Level: Low

Liquidity: Low

Return Potential: Moderate

Maturity: 1-3 years

Ease of Access: Through an agent

| Summary of Online Reviews |

|---|

| “Steady and secure,” customers appreciate the fixed returns with limited exposure risks. |

Lending Club Peer-to-Peer Lending

Lending Club offers a marketplace where investors can lend to qualified borrowers. The platform allows diversification across many loans. It suits investors willing to accept moderate risk for a chance of higher returns. The process is managed online with clear loan documentation. Users can track repayments and monitor portfolio performance easily. This option may suit those intending to add an alternative income stream to their retirement plan.

Risk Level: Moderate

Liquidity: Low

Return Potential: Moderate

Maturity: 1-5 years

Ease of Access: Online platform

| Summary of Online Reviews |

|---|

| “A diverse lending experience,” many investors note clear terms and automated tools that ease monitoring. |

Betterment Robo-Advisory

Betterment uses algorithms to manage portfolios with a focus on long-term outcomes. For short-term investors, its managed strategy adjusts for market conditions. Its digital platform provides a clear view of performance and fees. Investors appreciate the straightforward account setup and periodic rebalancing. The approach offers a balance between risk and reward while ensuring funds are allocated efficiently.

Risk Level: Moderate

Liquidity: High

Return Potential: Moderate

Maturity: Varies

Ease of Access: Online app

| Summary of Online Reviews |

|---|

| “User-friendly and reliable,” investors praise the automated service and transparent fee structure. |

BlackRock Corporate Bond Funds

BlackRock provides corporate bond funds that offer moderate returns for investors willing to take measured risks. The funds incorporate high-grade corporate bonds maturing in the short term. Investors see stable income along with exposure to corporate debt markets. The management team focuses on risk control and detailed portfolio screening. This product suits retirement portfolios that need steady performance with moderate liquidity.

Risk Level: Moderate

Liquidity: Moderate

Return Potential: Moderate

Maturity: 1-5 years

Ease of Access: Fund management portal

| Summary of Online Reviews |

|---|

| “Balanced and steady,” many users value the mix of income and reduced volatility in their investments. |

RealtyMogul Real Estate Crowdfunding

RealtyMogul gives investors a chance to participate in real estate projects with shorter timeframes. Crowdfunding options can make funds available after a set period. The website provides detailed information about each project. It is ideal for investors wanting exposure to real estate without the complexity of property ownership. The platform supports clear investment terms and performance data.

Risk Level: Moderate

Liquidity: Low

Return Potential: Moderate

Maturity: 1-5 years

Ease of Access: Online portal

| Summary of Online Reviews |

|---|

| “A new way to invest in real estate,” investors appreciate the transparency in project details and expected timeframes. |

iShares Short-Term ETFs

iShares offers exchange-traded funds that focus on short-term bonds and debt instruments. These ETFs allow investors to track a specific market segment with quick access to funds. They provide daily liquidity and a straightforward online trading experience. This product suits investors seeking simplicity and clear pricing structures. The ETF platform is well known for its transparency and low expense ratios.

Risk Level: Low

Liquidity: High

Return Potential: Low-Moderate

Maturity: Immediate

Ease of Access: Online markets

| Summary of Online Reviews |

|---|

| “Efficient and low cost,” investors cite clear pricing and prompt trade execution as major benefits. |

SoFi Cash Management

SoFi provides cash management services that combine high-yield interest with easy digital access. The account allows investors to manage funds with minimal fees and clear online oversight. It offers immediate liquidity and straightforward account monitoring.

The service is designed to integrate with other SoFi products for a smooth financial experience. Investors enjoy a modern user interface and dependable customer support.

Risk Level: Low

Liquidity: High

Return Potential: Low

Maturity: Immediate

Ease of Access: Digital platform

| Summary of Online Reviews |

|---|

| “Modern and reliable,” many users note the convenient access and smooth integration with other services. |

Final Thoughts

The options above highlight choices that blend ease of access with the security needed for retirement funds. Recognized institutions support each alternative and offer unique features. Investors can compare products based on risk, liquidity, and expected return. The selections suit a variety of retirement strategies and short-term needs. The data provided assists in choosing the option that meets specific financial goals.