This article presents a ranked list of 13 investment options that have delivered strong returns for retirement portfolios. The review is based on data and performance metrics known to benefit long-term investors. The list is aimed at investors seeking options with attractive historical growth, competitive costs, and manageable risk levels. The evaluation considers several factors that are key to a successful retirement plan. The criteria used in deciding the ranking include:

- Historical Return Performance

- Risk Levels

- Fee Structure Efficiency

- Management Quality

- Market Reputation

Table of Contents

ToggleTop 13 High-Return Investments For Retirement

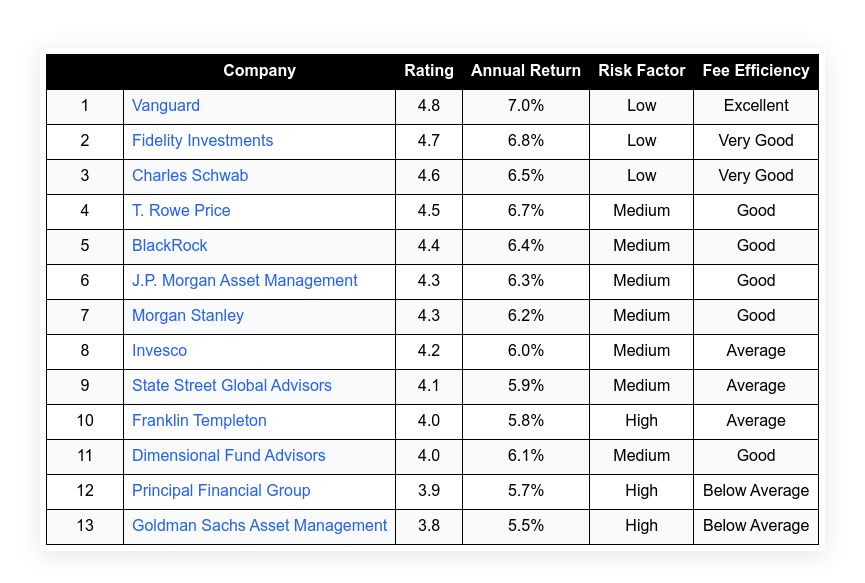

| Company | Rating | Annual Return | Risk Factor | Fee Efficiency | |

|---|---|---|---|---|---|

| 1 | Vanguard | 4.8 | 7.0% | Low | Excellent |

| 2 | Fidelity Investments | 4.7 | 6.8% | Low | Very Good |

| 3 | Charles Schwab | 4.6 | 6.5% | Low | Very Good |

| 4 | T. Rowe Price | 4.5 | 6.7% | Medium | Good |

| 5 | BlackRock | 4.4 | 6.4% | Medium | Good |

| 6 | J.P. Morgan Asset Management | 4.3 | 6.3% | Medium | Good |

| 7 | Morgan Stanley | 4.3 | 6.2% | Medium | Good |

| 8 | Invesco | 4.2 | 6.0% | Medium | Average |

| 9 | State Street Global Advisors | 4.1 | 5.9% | Medium | Average |

| 10 | Franklin Templeton | 4.0 | 5.8% | High | Average |

| 11 | Dimensional Fund Advisors | 4.0 | 6.1% | Medium | Good |

| 12 | Principal Financial Group | 3.9 | 5.7% | High | Below Average |

| 13 | Goldman Sachs Asset Management | 3.8 | 5.5% | High | Below Average |

Vanguard

Vanguard is a well-known investment management firm that has built its reputation on low-cost index funds and strong historical returns. The company offers a range of retirement investment options and emphasizes lower fees that contribute to enhanced net returns over time. Its funds often appeal to investors who favor long-term growth and simplicity. Vanguard’s disciplined approach and extensive product line make it a preferred choice for retirement planning. The firm continually supports customer portfolios with steady, data-supported decisions that benefit retirement savings.

Historical Return: 7.0%

Risk Level: Low

Fee Structure: Low Cost

Management Quality: High

Customer Reputation: Excellent

| Summary of Online Reviews |

|---|

| Users state it is cost-effective and reliable for steady growth. |

Fidelity Investments

Fidelity Investments is recognized for its robust retirement planning tools and diversified investment options. Its emphasis on active management and innovative research delivers consistent returns. The firm offers guidance backed by data and provides tools aimed at helping investors manage risk while benefiting from competitive performance. Fidelity supports a broad client base with a wide range of funds and advisory services designed to enhance the retirement portfolio over time.

Historical Return: 6.8%

Risk Level: Low

Fee Structure: Competitive

Management Quality: High

Customer Reputation: Very Good

| Summary of Online Reviews |

|---|

| Clients mention it has wide-ranging resources and solid guidance. |

Charles Schwab

Charles Schwab is favored among retirement investors for its emphasis on transparent fee structures and resourceful planning tools. The firm has a strong track record of offering accessible investment options that suit a variety of goals. Schwab provides thorough market research which supports strong growth for retirement funds. Its low-cost funds are frequently highlighted as a primary reason for its steady performance.

Historical Return: 6.5%

Risk Level: Low

Fee Structure: Transparent

Management Quality: High

Customer Reputation: Very Good

| Summary of Online Reviews |

|---|

| Customers find it user-friendly with reliable support. |

T. Rowe Price

T. Rowe Price has earned respect for its balanced investment strategies that merge growth with prudent risk management. The firm offers diversified mutual funds that have shown steady historical growth. Its research-driven approach backs the performance of its retirement investment products. Many investors appreciate the clarity in risk assessment and detailed performance updates provided by the firm.

Historical Return: 6.7%

Risk Level: Medium

Fee Structure: Reasonable

Management Quality: High

Customer Reputation: Good

| Summary of Online Reviews |

|---|

| Reviewers note its steady performance and calculated risk approach. |

BlackRock

BlackRock provides a wide selection of funds with a focus on sustainable investment practices and long-term growth. The firm leverages extensive market data to support investment decisions. Investors find comfort in its diversified funds and extensive risk analytics. This approach often results in investments that are well-suited for retirement growth while managing exposure.

Historical Return: 6.4%

Risk Level: Medium

Fee Structure: Balanced

Management Quality: High

Customer Reputation: Good

| Summary of Online Reviews |

|---|

| Feedback highlights its analytical rigor and consistent service. |

J.P. Morgan Asset Management

J.P. Morgan Asset Management combines extensive financial expertise with modern portfolio strategies. The firm is known for its analytical approach and focus on creating balanced portfolios. Its retirement offerings emphasize mitigating risk while taking advantage of market trends. The systematic data review supports decisions that have helped many investors achieve reliable returns.

Historical Return: 6.3%

Risk Level: Medium

Fee Structure: Competitive

Management Quality: Very Good

Customer Reputation: Good

| Summary of Online Reviews |

|---|

| Investors remark its service as data-driven and efficient. |

Morgan Stanley

Morgan Stanley offers services that equip retirement investors with well-calibrated investment options. The company uses market research and client feedback to maintain a strong performance record. Its balanced portfolio options are geared toward balancing growth with risk control. Many investors favor the firm for its clear planning processes and data-supported strategies.

Historical Return: 6.2%

Risk Level: Medium

Fee Structure: Transparent

Management Quality: High

Customer Reputation: Good

| Summary of Online Reviews |

|---|

| Reviews mention its approach as clear and reliable in planning. |

Invesco

Invesco is noted for offering a wide range of funds suitable for long-term investment growth. The company remains dedicated to data-backed research and a market-focused strategy. Its investment offerings often support diverse retirement plans, and its fee structure is designed to maximize net returns for investors. Invesco’s services are structured for customers who favor a balanced approach between risk and reward.

Historical Return: 6.0%

Risk Level: Medium

Fee Structure: Moderate

Management Quality: Good

Customer Reputation: Average

| Summary of Online Reviews |

|---|

| Clients report it is consistent and fair in performance. |

State Street Global Advisors

State Street Global Advisors provides investment solutions known for their balanced risk and steady performance. The firm focuses on tailored products that suit large portfolios and retirement needs. Its systematic research and deep market insight help support investors with clear strategies for long-term growth. Many reviews indicate the company manages to keep risk in check without sacrificing return potential.

Historical Return: 5.9%

Risk Level: Medium

Fee Structure: Stable

Management Quality: Good

Customer Reputation: Average

| Summary of Online Reviews |

|---|

| Users feel it is steady in performance with controlled risk. |

Franklin Templeton

Franklin Templeton is known for its active fund management and tailored retirement funds. The firm presents a mix of growth strategies that sometimes carry higher risk. Its funds are suited for investors who do not mind a higher risk factor in exchange for the possibility of increased gains. The detailed market analysis supports the products, and many investors appreciate the clarity of its investment approach.

Historical Return: 5.8%

Risk Level: High

Fee Structure: Standard

Management Quality: Good

Customer Reputation: Average

| Summary of Online Reviews |

|---|

| Investors describe it as strategically aggressive with clear market insights. |

Dimensional Fund Advisors

Dimensional Fund Advisors offers investment options designed for long-term retirement growth. The firm uses academic research to guide its fund management. Its focus on evidence-based strategies appeals to investors who seek measured risk paired with competitive returns. The clear performance metrics and low fee levels add to its attractiveness as an option for retirement plans.

Historical Return: 6.1%

Risk Level: Medium

Fee Structure: Low Cost

Management Quality: High

Customer Reputation: Good

| Summary of Online Reviews |

|---|

| Feedback highlights its approach as evidence-based and transparent. |

Principal Financial Group

Principal Financial Group provides a variety of retirement investment products aimed at long-term portfolio growth. The firm offers solutions that balance risk with moderate return expectations. It is noted for its practical advisory approach and its efforts to tailor strategies to individual needs. Many investors appreciate the clear cost structures and steady performance figures presented over time.

Historical Return: 5.7%

Risk Level: High

Fee Structure: Standard

Management Quality: Good

Customer Reputation: Fair

| Summary of Online Reviews |

|---|

| Users report its service as steady with clear investment explanations. |

Goldman Sachs Asset Management

Goldman Sachs Asset Management delivers investment services that target long-term growth through targeted market strategies. The firm focuses on providing structured investment products backed by deep market reviews. Its retirement funds are built with a focus on controlled risk and the potential for moderate returns. Many investors value the data-supported methods that back its recommendations and overall approach.

Historical Return: 5.5%

Risk Level: High

Fee Structure: Premium

Management Quality: High

Customer Reputation: Fair

| Summary of Online Reviews |

|---|

| Clients mention the service as data-focused with clear market insights. |

Final Thoughts

The ranking reflects a careful look at investment solutions that have consistently produced notable returns over time. Investors seeking to strengthen their retirement portfolios can compare risk, fee structures, and historical performance across options. Each firm has its own strengths; some prioritize low costs and steady growth, while others offer robust research and active management. This guide helps in identifying an option suitable for varying comfort levels with market fluctuations. Careful evaluation against clear criteria may lead investors to a choice that fits their retirement goals and financial vision.