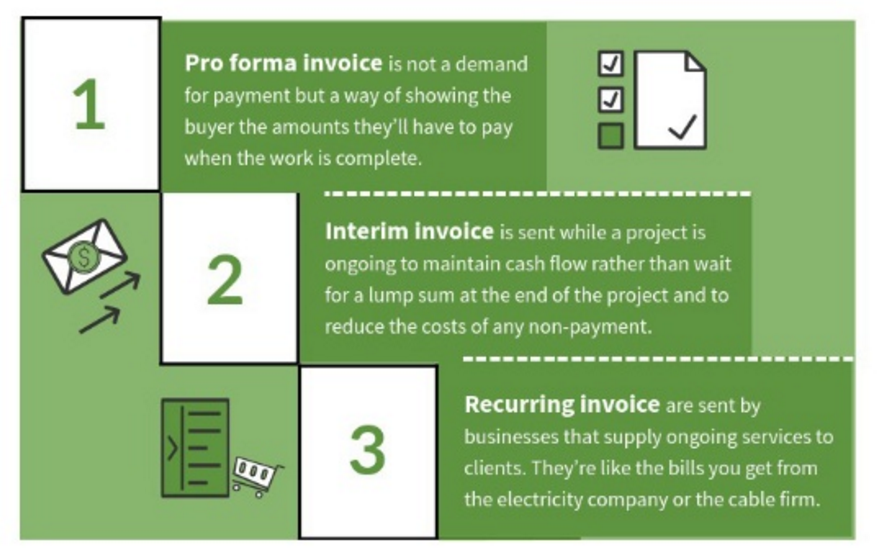

Depending on the type of client and business, there may be different types of invoices that you will need to send out. It’s important to know which types of invoices are out there for utilization, and how these kinds of invoices are used.

It’s also important to understand what kind of information should be on all types of invoices. We have put together a SlideShare presentation on the six different kinds of invoices and what they’re used for.

There are six main types of invoices.

The pro forma invoice is actually a notice that shows a client the amount they will need to pay when the project is completed and is not used as a demand for payment.

An interim invoice is a way to take a large project and break the payment down into multiple payments that corresponds to completion of a certain portion of the project. The interim invoice covers that amount of money and provides a way to help with cash flow during large projects.

The recurring invoice is for ongoing services and is typically for the same amount like for a membership or subscription.

A past due invoice reminds the customer that they have not yet paid and should take this invoice and settle up.

The final invoice is sent out at the end of a project to let the customer know everything is done.

The miscellaneous invoice can serve as a way to get payment for just about anything and does not necessarily have to follow an invoice format.

While there are variations among these invoices, there is some information that should be consistently presented (every single time) on your invoice.

The essential elements on an invoice include:

Company details for both the person sending the invoice and the client, including name, address, and phone numbers.

A heading that states it is an invoice as well as a date and invoice number. A list of items for payment should be included, such as services rendered, products sold, expenses, and any other costs like taxes or fees.

A clear total and a description of the payment terms. While the payment terms may have been previously agreed upon, they should be restated on each invoice to reinforce that agreement.

No one may actually enjoy the invoicing process, but it helps to know how to do it correctly because this saves additional time and money as well as reduces the hassle that you will feel in handling your billing tasks.

The smoother invoicing process you can make, the less like a chore it will feel in the long run, especially when you start adding clients and need to do more invoices each billing period.

Be sure to check below for our full SlideShare presentation on the types of invoices and the essential information that your invoices should contain for an enhanced client experience and faster payment.