Retirement can be scary, no matter who you are. It makes sense that some people are nervous about retirement. How much money do you really need for 20 years? What about 30 years? Will you get bored? Will you be lonely? Planning ahead and predicting the future is extremely difficult. It’s tempting to just make retirement planning tomorrow’s problem.

This seems to be the general opinion of Americans: One in five doesn’t save any of his annual income, according to Bankrate. Only 16% of people save more than 15% of their income for retirement savings, which falls within the experts’ recommendations that Fidelity recorded (10% to 20%). Add to that lifestyle inflation (the tendency of people to spend more as they make more), the major debt of younger generations, and the fact that people are living longer than ever, and it becomes clear that America is facing a major retirement crisis.

Only 20% of non-retirees have defined benefit plans such as pensions, according to the Federal Reserve, and 54% of non-retirees have defined contribution plans such as 401(k)s. The Social Security Administration records average payments at about $1,500 in January 2020. All of this data points to a problem: The three pillars of retirement — private savings, pensions, and Social Security — are showing cracks

Table of Contents

ToggleOlder Americans typically have more money saved than 18- to 30-year-olds, but the numbers just aren’t adding up.

You might be able to live on less than $15,000 a year if you’re frugal, but that amount won’t cover unplanned costs such as healthcare or assisted living. Social Security is meant to supplement your savings, not serve as a sole source of income.

Savings aside, transitioning from earned income to portfolio income requires a major mindset shift. No longer are you living off your paycheck. Changing your mindset from “work is living” to “living is living” is tough for a lot of people. Even if you’re not worried about how much you’ve saved, you might fear what your day-to-day life will look like.

The trick is to secure your future financially and internally. Preparing your finances and emotions for a huge lifestyle change will help you avoid a panicked future. By facing the unknown, you can thoroughly address all concerns and live your retired life to the fullest so you are no longer nervous about retirement.

Embarking on the Great Unknown

Many people are nervous about retirement. They see it as an “it’s all downhill from there” situation, envisioning declining health, approaching death, and impending social isolation. That’s not the case: Retirees live extremely full, rich lives. However, it’s hard to envision happiness in a situation you’ve never experienced.

I’ve personally found that it’s difficult for people to separate where their identities end and careers begin. When you base your self-worth and success on your income, it’s difficult to reestablish your sense of self in retirement.

A client of mine has backed out of retirement not once but twice. The money is there, and everything adds up. Projections show that he is on track to retire successfully and live quite comfortably off his portfolio. But he is not emotionally connected to the projections. When we further discussed what was holding him back, he said he was afraid of both becoming irrelevant and depending on portfolio income.

This should be no surprise, because money is the leading cause of stress for 44% of Americans, according to Northwestern Mutual. When people attach emotional value to money, they face futures in which every life challenge or transition will cause inordinate stress. If happiness means money, and money means job, then people learn to associate their jobs with happiness. You may really enjoy your profession, but you love the success (translation: money) that it brings you more.

To feel comfortable retiring, you may have to disassociate happiness and money and redefine who you are. Separate your position from what you love to do. If you’re an executive, you may love leading people. If you’re a writer, you may love reading. Retirement lets you focus on the passion behind your profession (and the other things you were too busy to do when you were working).

How to Embrace Retirement

Don’t get caught up in your fears of being isolated, bored, or sickly. Instead, take steps today to make sure you and your loved ones are protected in the future. Own what’s within your control and let go of the things that aren’t. When you address retirement ahead of time, you’ll find yourself looking forward to the freedom and opportunities that accompany it.

How to Not Be Nervous About Retirement

Below are five steps you can take today to prepare so you are nervous about retirement:

1. Visualize your retirement.

You can’t prepare for a future you haven’t really thought about. When people project about their future selves, they mostly create more idealized versions of themselves. Studies also show that people tend to think of their future selves as totally different people. The trouble is, it’s a lot harder to save money for a stranger than it is for your present-day self.

It’s healthy for us to assume that we’ll undergo constant self-improvement. We want to be more capable of gracefully dealing with the challenges we might face. To reach that point, it’s important to remember that the choices you make today shape the life of your future self.

2. Identify your fears.

By facing your anxieties head on, you can determine the likelihood of those fears becoming a reality. Next, determine what is and is not under your control. For fears you can control, think about action steps that can be taken. Work toward accepting the ones you can’t.

It’s no secret that retirement is both complicated and personal. But by staying ahead of your fears, you can better prepare for the future and free up your time to enjoy the present.

3. Talk to people.

Networking is extremely powerful. By chatting with retirees, you can learn from their experiences and identify which actions they’ve taken that you want to emulate — and which you would like to avoid.

When you do retire, find ways to pay your wisdom forward. Consider the lessons you’ve learned over the course of your career: What would you share with others? Check with your alma mater, local professional groups, etc., for mentorship programs, or consider becoming a nonprofit consultant or volunteer. Not only will you be helping others, but you’ll keep your mind sharp and loneliness at bay.

4. Define your life priorities.

Physically writing down your priorities can be powerful. When you do this, you can start thinking about how you allocate time.

For example, one priority could be your significant other. Think about how to focus on this priority: spend time doing fun activities, learn something new, or experience new places together. By first defining your priorities, you open your mind to all the ways you can honor and pursue them.

5. Figure out what you’re really good at.

What pursuits are you are truly best at? Identify three to five top talents (things you love and are great at doing). Consider how to use these talents outside of work. To which areas of your life could you bring your skill set?

You could try out a volunteer opportunity or hobby before you retire to see what you like. If you’re a great writer, for instance, you could look into opportunities to help write copy for a local school’s or nonprofit’s newsletter. If you’re more of a numbers person, you can see whether a treasurer spot is open at an organization that’s near and dear to your heart. Or maybe you’re ready for a change of pace. Move on from your office position and volunteer to help walk dogs or babysit.

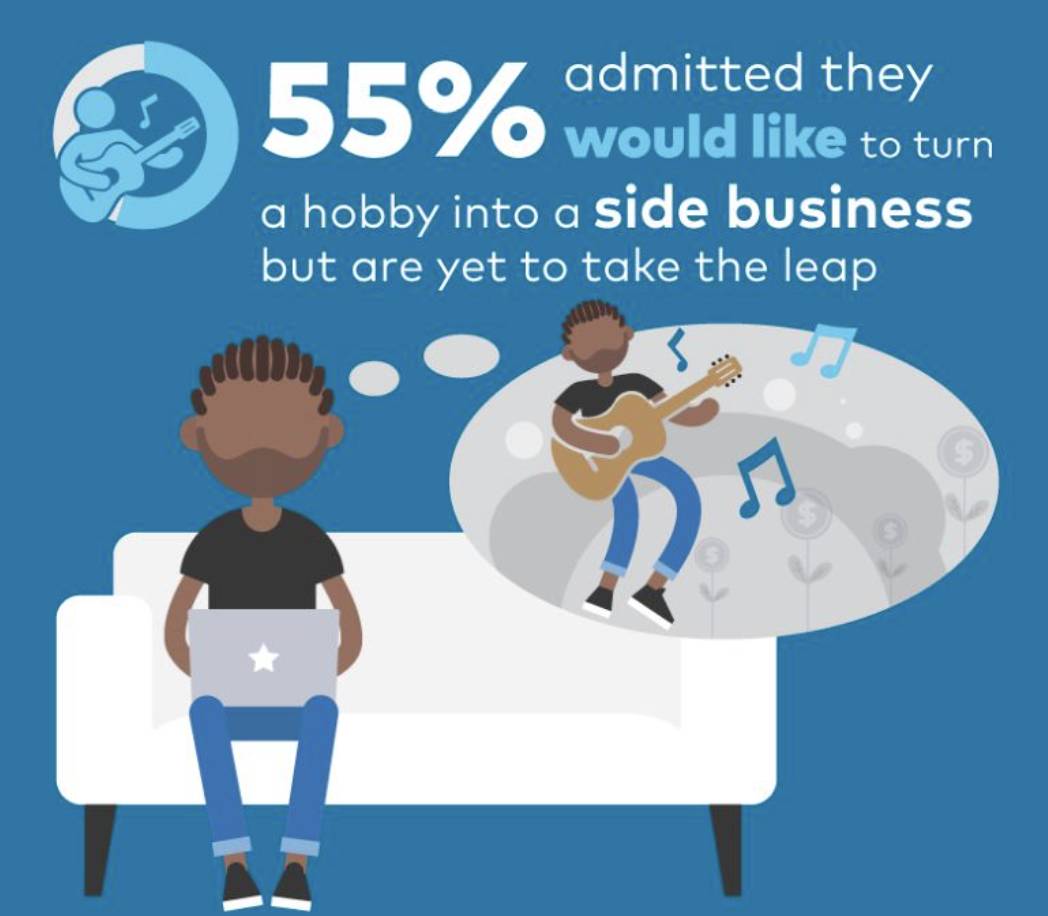

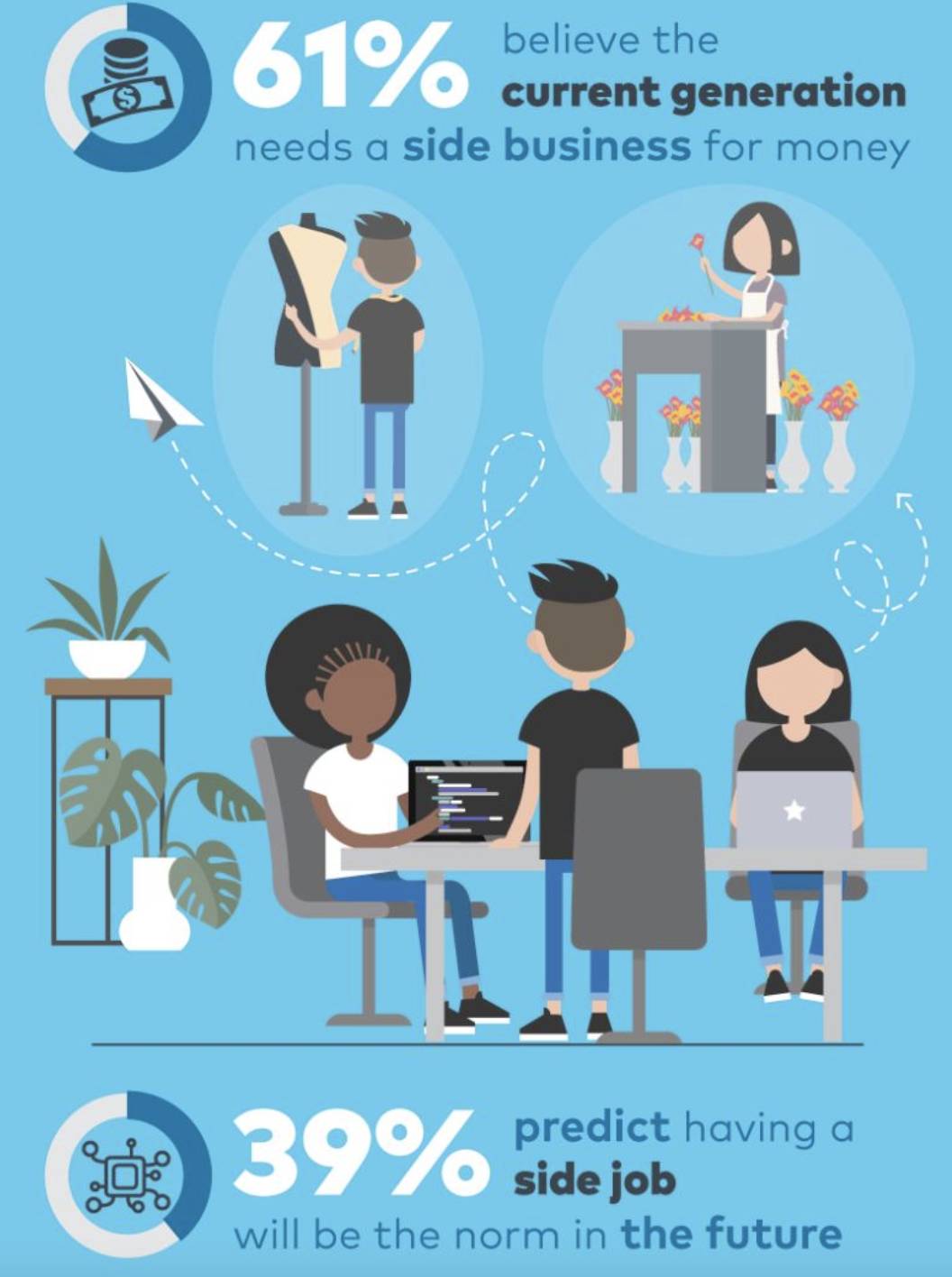

A study by South West News Service and Vistaprint revealed that half of employees want to convert their hobbies to side businesses but don’t think they’re ready yet. Retirement is the perfect opportunity to explore a potentially rewarding hobby or side business that you’ve always wanted to do.

Retirement can be scary for anyone. People fear what they don’t know and can’t predict. By facing retirement head-on and addressing the roots of your anxieties, you can beat the trepidation and come out on the other side. Retiring is the beginning of the rest of your life, not just the end of an era. Embrace the change, pursue your passions, and enjoy the fruits of a life well-lived.