Retirement often feels like a far-off dream for busy entrepreneurs. You’re so focused on the day-to-day demands of running a business that planning for your eventual exit seems like a luxury you can’t afford.

But ignoring retirement planning is a risky gamble that could leave you financially unprepared when you decide to transition out of your business. The key is leveraging your small business proactively to maximize your nest egg.

In this comprehensive guide, we’ll explore various strategies to help business owners like you retire comfortably:

- Why retirement planning is critical for entrepreneurs

- Tax-advantaged accounts to turbocharge retirement savings

- Building passive income streams into your business

- Preparing your business for a smooth succession

- And much more

Arm yourself with the knowledge you need to leverage your small business for a secure retirement future. The time to start planning is now.

Table of Contents

ToggleWhy Retirement Planning Matters for Small Business Owners

Building a business from scratch requires tremendous sacrifice. Long hours, financial risk, non-stop stress—it’s the price we pay to follow our dreams.

But will all those sacrifices pay off down the road when you’re ready to retire? Or will you still be chained to your small business, unable to leave without sinking into poverty?

Unfortunately, too many entrepreneurs reach retirement age without adequate savings. They become forced to work well past 65 just to make ends meet.

Don’t let that happen to you. With some planning and business-oriented money-saving tips now, you can leverage your business to retire comfortably instead of reluctantly slaving away.

Here are powerful reasons to prioritize retirement planning today:

Enjoy a Bigger Nest Egg

Saving for retirement is a challenge for any working adult. But as a small business owner, you have advantages.

Retirement accounts like SEP IRAs and Solo 401(k)s allow much higher contribution limits compared to conventional plans, while staying organized and keeping track of your contacts can also contribute to a successful retirement plan.

Funding these accounts now supercharges your retirement savings. For example, in 2023 you can contribute up to $22,500 to a Solo 401(k), plus up to 25% of your compensation. That’s huge!

With consistent contributions at those levels, your retirement savings can snowball into a sizable nest egg.

Reduce Your Tax Burden

As a small business owner, you get hammered by taxes. Self-employment taxes, income taxes, payroll taxes—it never ends.

But tax-advantaged retirement accounts offer a legal way to lower your taxable income. Money you contribute isn’t taxed until you withdraw it in retirement.

That tax break leaves more money in your pocket today. And your investments grow tax-free for decades, ultimately reducing your lifetime tax burden.

Attract and Retain Talent

Does your small business have employees? Offering a quality retirement plan can help attract and retain top talent.

Workers today expect good benefits. And retirement plans give you a competitive edge in hiring.

Plus, when key employees do eventually retire, you’ll need a succession plan in place. Retirement accounts help facilitate smooth transitions.

Enjoy Peace of Mind

Above all, retirement planning gives you peace of mind. You can rest easy knowing your business is set up to provide long-term financial security.

No more stressing about how you’ll pay the bills after retiring. No more working yourself to the bone into your 70s.

With a well-funded retirement plan and a solid understanding of up-to-date small business statistics, you can confidently leave your business on your own terms.

Tax-Advantaged Retirement Accounts for Entrepreneurs

Okay, you’re convinced retirement planning is imperative. But where do you start?

For small business owners, the most powerful savings tool is a tax-advantaged retirement account. Options like SEP IRAs, SIMPLE IRAs, and Solo 401(k)s allow you to save far more than conventional plans.

Let’s compare the pros and cons of each so you can make the best choice.

SEP IRA

A SEP IRA, short for Simplified Employee Pension, is a special retirement account for small business owners and self-employed folks.

Pros of a SEP IRA:

- Easy to set up and administer

- Allows high annual contributions

- All contributions are tax deductible

- Only employer makes contributions

Cons of a SEP IRA:

- Limited to employer contributions only

- No catch-up contributions if over 50

- Must include all employees in plan

With a SEP IRA, in 2023 you can contribute up to 25% of compensation or $22,500 per year, whichever is less. This allows substantial tax-advantaged savings.

A SEP is also easy to establish at nearly any bank or brokerage. Just fill out some forms and you’re ready to start contributing. Use this guide from the IRS to learn more.

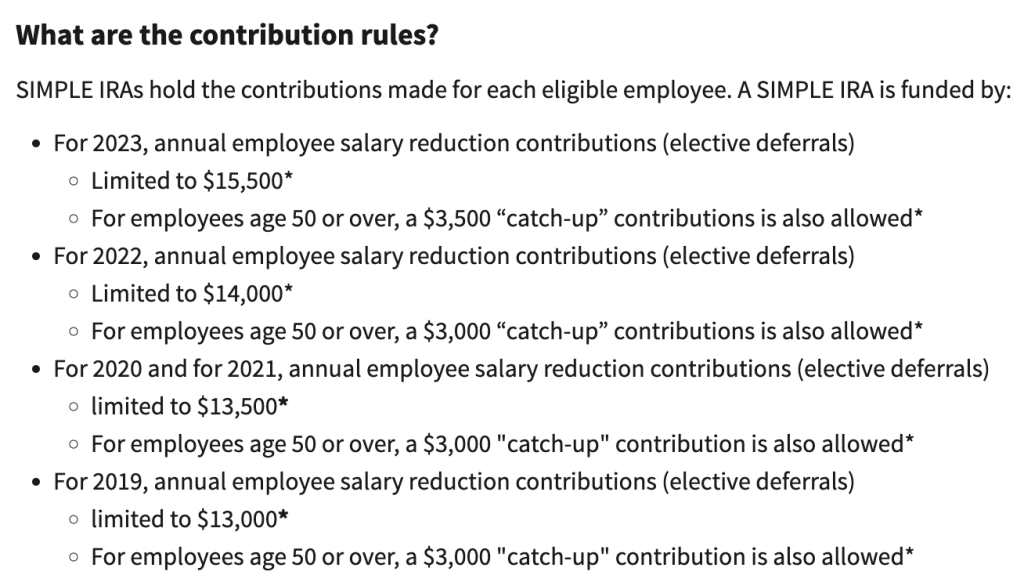

SIMPLE IRA

The SIMPLE IRA is another retirement plan designed for small businesses. SIMPLE stands for Savings Incentive Match Plan for Employees. It’s a retirement plan for small businesses with 100 or fewer employees.

Pros:

- Easy to set up and administer

- Employer matching contributions required

- Participants can contribute up to $15,500 in 2023

Cons:

- Limited investment options

- Mandatory employer match can be costly

- Only available to companies with 100 or fewer employees

With a SIMPLE IRA, employees can contribute a percentage of their salary each pay period. Employers are required to make either:

- A matching contribution up to 3% of compensation

Or

- A 2% non-elective contribution for all eligible employees

Check out this SIMPLE IRA guide to learn more about the requirements and rules.

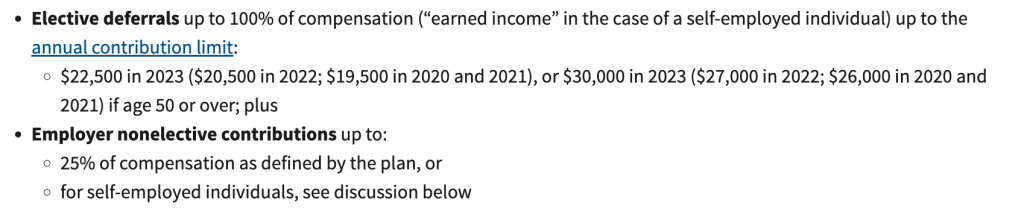

Solo 401(k)

The Solo 401(k) is a retirement account targeted to self-employed individuals and small business owners with no full-time W-2 employees (except a spouse).

Pros:

- Allows very high contribution limits

- Can make both employee and employer contributions

- Loans allowed from the plan

- Roth contributions permitted

Cons:

- More complex to administer than SEP or SIMPLE IRA

- Annual IRS filings required

- Trustee fees can be high

In 2023, you can contribute up to $22,500 as an employee, plus up to 25% of compensation as an employer (max $66,000 total). Solo 401(k)s offer tremendous tax-advantaged savings potential.

Learn more in this Solo 401(k) guide from the IRS.

Generating Passive Income from Your Small Business

In addition to leveraging tax-advantaged accounts, smart entrepreneurs generate ongoing passive revenue streams that will continue paying out during retirement.

Here are a few ways to transform your small business into a passive income machine:

License Your Intellectual Property

Do you have proprietary products, software, or technology? Consider licensing your intellectual property (IP) to other companies for an ongoing royalty fee.

For example, you could license your software as a service (SaaS) product to other businesses in exchange for 5% in royalties. Or license your patented technology to manufacturers for a 2% cut of sales.

Licensing converts your IP into a lifetime revenue stream with minimal effort on your part. Just collect those recurring royalty checks year after year.

Franchise Your Business

One of the fastest ways to scale up passive income is franchising your small business. This allows you to open up hundreds of locations nationally or globally while collecting an upfront franchise fee and ongoing royalty payments.

For instance, a franchise fee of $25,000 per location plus 5% royalties creates significant cashflow with minimal day-to-day involvement. Franchising is complex but can be very lucrative.

Invest in Income-Producing Assets

Use your business profits to invest in assets that produce ongoing income, like dividend stocks, rental properties, or peer-to-peer lending platforms.

The key is picking investments that generate cashflow with minimal maintenance and management on your part. Then reinvest the payouts for compound growth.

Preparing Your Small Business for a Smooth Transition

The final piece of the retirement puzzle is readying your business for a successful transition once you’re ready to sell or pass the baton.

Proper succession planning ensures your business continues to thrive in your absence, keeping its value high. It also paves the way for a smooth leadership transition.

Here are some tips:

Groom Your Successor

Identify a successor and groom them years in advance. Train them to eventually take over your role. This retains business knowledge and ensures uninterrupted leadership.

Create a Transition Plan

Outline a detailed transition plan for handing off ownership, management, and strategic direction. Set clear timelines for the new leadership takeover.

Address Legal and Financial Issues

Consult lawyers and accountants to tie up any loose ends around the company’s legal structure, ownership equity, valuation, taxes, and accounting.

Communicate with Employees and Customers

Be transparent about the transition and maintain trust. Assure employees and customers it’s “business as usual” under the new leadership.

With the right succession strategies, you can transition out on your own terms while keeping your business running smoothly without you.

Start Planning Your Small Business-Funded Retirement Now

Retirement may feel distant, but the time to start planning is now.

With the strategies we’ve covered today—tax-advantaged accounts, passive income streams, succession planning—you have a blueprint for leveraging your small business to retire comfortably.

No more fretting and uncertainty about how you’ll afford to leave your business. You’re equipped with actionable steps to lock in financial security for your later years.

The key is taking that first step:

- Set up a Solo 401(k) or other retirement account ASAP

- Explore passive income ideas that fit your business

- Map out a transition plan for the future

Small, consistent actions today will compound into huge rewards down the road. You’ve worked hard to build this business. Make sure it takes care of you well into retirement.

[Related: 4 Considerations to Make Before Selling Your Company in This Economy]