There’s an old picture of me that says everything you need to know about how I used to live.

In the photo, I’m sitting at my desk holding my newborn son, a half-written blog post on the screen, and a Blackberry in my hand. Back then, I was running my financial planning business 40+ hours a week, working on my blog for 20 hours, and trying to be a new father.

Last updated: February 2026

That seemed normal to me — grinding non-stop, responding to emails at midnight, and always “plugged in.” However, I was trapped in the same cycle I warned clients against: trading time for money.

The wake-up call didn’t come until a few years later. I stopped asking, “How much can I make per hour?” and started asking, “How much do I make when I’m not working?”

All of a sudden, everything changed because of that one mindset shift.

As a result, I embarked on a long (and sometimes messy) journey toward true passive income — where your money and ideas work for you, rather than against it. I want to share with you how my journey has evolved over the last few years: nine ways I earn passive income each month and what you can learn from them.

This isn’t a self-promotional post. Instead, it’s proof that financial freedom is real — as long as you’re willing to build it.

Table of Contents

Toggle1. Dividends: The Gateway to Passive Income

One of my first sources of passive income is dividends, which are a classic.

I launched my Grow Your Dough Challenge to help beginners unlock the power of dividend investing with the simple goal of showing beginners how easy it is to open an account, deposit some money, and start investing. A $1,000 investment turned into a full-blown dividend portfolio experiment.

For simplicity’s sake, I used Robinhood, deposited $100,000, and began investing in dividend-paying stocks like American Express, Verizon, and Starbucks.

Even with way too much cash in the portfolio, it earns me about $127 per month in dividends.

Additionally, I receive $97 in dividends each month from my M1 Finance portfolio, which includes growth stocks such as Apple, Tesla, and Nike.

That’s roughly $224 in dividend income each month that shows up without me having to do anything.

Lesson: You don’t need to be a day trader or a stock expert. Start with a straightforward account, invest regularly, and let compound growth take care of the rest.

2. Interest: Putting Idle Cash to Work

Almost everyone has glanced at their savings account statement and laughed at the interest payment.

As an example, I have over half a million dollars parked in a large, traditional bank. How much did that account earn me? A measly $22.43 per month. Yes, that’s real.

Back when BlockFi was operational, I used it to experiment with high-yielding investments: I put $25,000 into USDC, and it earned around 8.6% APY, which equaled about $156 per month. This came with risks, not FDIC coverage, custody risk, regulatory uncertainty, and BlockFi eventually failed.

With BlockFi gone, where can you put idle cash (or stablecoin capital) to work?

Invest in high-yield savings and FDIC-insured accounts for a safer (lower yield) option.

For the most conservative approach, opt for FDIC-insured cash vehicles, which trade on yield for security:

- The current yield on high-yield online savings accounts is over 4%+ APY at many institutions.

- You should also consider no-penalty CDs, money market accounts, and high-yield checking accounts.

The money in these accounts is safe and easily accessible. But you won’t see the double- or triple-digit returns advertised by crypto platforms.

Alternatives with higher yields (higher risk): crypto and DeFi.

There are still crypto-based options, but tread carefully if you are comfortable with more risk.

Since BlockFi is no longer available, here are some alternatives (with all the caveats):

- Nexo offers an “Earn” account for U.S. users that allows them to earn rewards on stablecoins, but regulatory issues have caused some disruptions.

- In some cases, Ledn offers interest-earning accounts for stablecoins and BTC, with yields of up to 10% on USDC.

- Depending on demand, lock-up terms, and platform risk, crypto lending/staking platforms usually pay 4-10% interest on stablecoins.

A word of caution, however. The FDIC does not insure these. Defaults, protocol hacks, regulatory clampdowns, and platform insolvency are all risks you should be aware of.

Lesson: Be sure to keep enough cash on hand for emergencies, but make sure the rest is earning real returns. You can also take advantage of higher yields — as long as you understand the risks involved.

3. Real Estate (Without the Headaches)

I’m not the guy flipping houses or fixing leaky faucets at 2 a.m. Instead, I invest in real estate online.

Fundrise, for example, is a platform for crowdfunding real estate notes.

For years, I have received $116.66 per month from a private REIT I invested in. As a result of my investments in residential and commercial projects with Fundrise, I receive an additional $43 in dividends each month.

With no tenants, no repairs, no late-night phone calls, that’s $160 per month in passive real estate income.

Lesson: Investors aren’t the only ones who should consider real estate. With crowdfunded platforms and private REITs, you don’t need to own any properties to earn income from real estate.

4. YouTube: Evergreen Content That Keeps Paying

It’s now time to have some fun.

Whenever people see my YouTube channel, they assume all my income comes from new videos. Nope.

Despite no longer promoting them, two videos I made over five years ago still earn about $1,000 a month. When a video hits, YouTube keeps paying you long after you’ve moved on.

Overall, my channel generates $5,000 in ad revenue per month. That’s not counting sponsorships, affiliates, or course sales — just ads.

Lesson: In the long run, content is an asset. It doesn’t matter what you produce today, whether it’s videos, blogs, or podcasts, the work you do today can pay off for years to come.

5. Blogging: The Ultimate Passive Machine

Of all my income sources, my blog Good Financial Cents is still my favorite.

I launched it well over a decade ago to share financial advice. This passion project evolved into a business—and now a significant source of income.

Affiliate marketing, referrals to financial tools, investment apps, and banks, and banner ads generate most of the blog’s income. Building tiny money habits early in your blogging career compounds significantly over time. Since much of the content is evergreen, it continues to generate revenue for years after it’s published.

It’s possible to generate over $30,000 in a single month with a lean team managing updates and partnerships. In 2025-2026, with improved AI tools and automation, many bloggers have reduced their workload while maintaining or increasing revenue.

Lesson: Having a blog is like owning digital real estate. In the same way as a property, each post you publish can gain value, attract visitors, and generate revenue in the long run.

6. Private Investments and Startups

Besides stocks and real estate, I’ve invested in a few private deals — startups and partnerships where I can provide capital and mentoring.

In some cases, dividends are paid quarterly, while in others, equity returns are paid over the long term. Despite its higher risk, it is also one of the most rewarding parts of my portfolio — both financially and personally. As of 2026, alternative investments and accredited investor opportunities have become more accessible through platforms democratizing wealth creation.

Lesson: Once you have a stable passive income foundation, diversify into opportunities that are aligned with your passions and expertise.

7. Online Courses and Digital Products

Back in the day, I created online courses to help people learn about investing and building wealth.

Although I’m no longer actively launching new courses, I continue to generate steady revenue from my email list and evergreen funnels.

Lesson: Create a product based on what you know. Your expertise can be turned into an income stream that runs 24/7 by teaching online.

8. Royalties: Getting Paid for Work You Did Years Ago

Many people think royalties are only for rock stars or best-selling authors, but anyone who creates something-books, courses, photos, or music-can earn from it afterward.

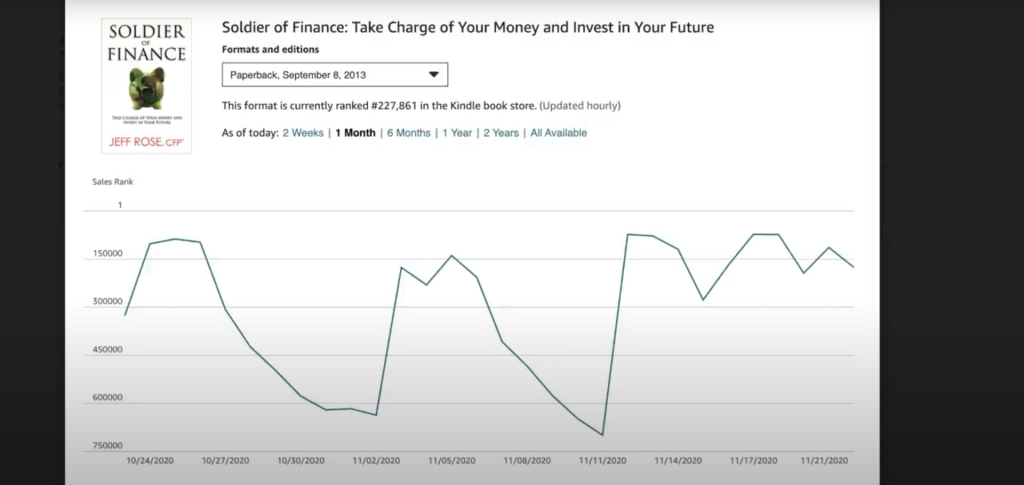

For me, that “something” was my book Soldier of Finance, published back in 2013. Despite not making me rich, it still brings in small, steady checks — about $160 last quarter. Although I haven’t promoted it for years, sales keep trickling in. As an example, book sales increased again after I relaunched my YouTube channel.

Lesson: When you create once and get paid again, you’re creating a ripple effect.

9. Sellable Assets: Turning Years of Work into Ongoing Income

Selling my financial planning practice has been my biggest passive income source.

It didn’t start passively — I worked hard and slept little to build a business that eventually ran without me. Eventually, it became a tradable asset.

It was a completely hands-off deal, involving an upfront payment and monthly installments over seven years totaling about $10,700 a month today.

Lesson: The real prize isn’t money, it’s the freedom to work because I want to, not because I have to.

The Bottom Line: Knowledge Isn’t Power — Action Is

People love to say, “knowledge is power.” But that’s only half true.

Knowledge has the potential to be powerful. The real power, however, lies in taking action based on what you know.

I’m grateful when I look back at that photo, the stressed-out dad juggling a baby, a Blackberry, and a blog. There was a part of me that was hungry enough to start something.

If you’re in that phase right now, don’t give up. You just need to shift your focus from working harder to working smarter. Start by building one passive stream. After that, another. Building multiple income streams starts with knowing your options. Our guide to online income covers multiple methods for earning, while resources on moving from paycheck to paycheck to financial freedom provide actionable 12-month roadmaps.

Soon you’ll realize your money doesn’t need you every minute of the day.

That’s the freedom you’re pursuing. And it’s worth every bit of effort to get there.

FAQs

What exactly counts as “passive income”?

Passive income is money that flows in after the initial work has been completed. In reality, it’s not zero work but rather it’s front-loaded work — you create the system once (like a blog, YouTube channel, or dividend portfolio), and it keeps earning long after you step away.

How long does it really take to build multiple income streams?

Usually, it takes months or years — not days. It took nearly two years for my blog to earn real money. It’s all about consistency: one small step every week compounds quickly. Once one stream is stable, stack another.

Do I need a lot of money to start earning passive income?

No. Your first investment could be $50 in a dividend stock, hundreds in a high-interest savings account, or even your time creating digital content. It’s not about size; it’s about momentum. The earlier you start, the faster compounding and growth kick in.

How “passive” is passive income really?

Maintenance is required for every stream. A blog needs to be updated, properties need to be managed, and portfolios need to be rebalanced. The goal isn’t to create zero work — it’s to develop scalable systems that eventually require minimal supervision.

What’s the biggest mistake people make when trying to build passive income?

Trying too many things at once. Focus beats frenzy every time. Don’t chase the next shiny opportunity until you’ve nailed the first one. By doing so, you’ll learn more effectively, avoid burnout, and achieve tangible results sooner.

Image Credit: Karola G; Pexels