Nearly 1 in 5 Americans didn’t save any money in 2021. If you’re one of them and determined to double your savings account by next year, there’s one thing you need to do. First, though, visualize success. Imagine for a moment that you wake up to see your savings account is double the amount it was a year ago. You instantly feel the money stress that used to be so familiar melt away. With a solid savings, you know you can weather most financial storms. It brings a sense of security and contentment.

But, how can you get there? And what is the one thing that is most effective when it comes to doubling a savings account in one year?

Table of Contents

ToggleAutomation is the Secret Key to Savings Success

You know the drill: You get paid, you spend some money on bills and maybe some fun, and then you hope there’s enough left over to save. But what if there was a way to take the guesswork – and the effort – out of saving money? That’s where automation comes in.

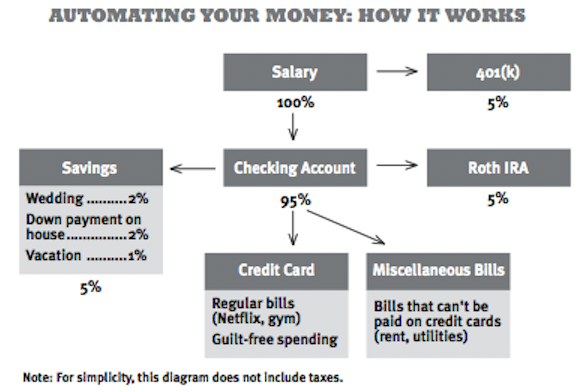

In his book “I Will Teach You to Be Rich”, Ramit Sethi encourages people to automate their money saying, “The beauty of this system is that it works without your involvement and it’s flexible enough to add or remove accounts anytime. You’re accumulating money by default.” And, that’s the way saving money should be. It should be seamless and stress free.

There are several ways to automate your savings, but the simplest is probably setting up a separate bank account for your savings and then arranging for a set amount of money to be transferred from your checking account to your savings account each month.

This method has the added benefit of helping you keep track of how much you’re saving; after all, it’s easy to lose track of $50 here or $100 there when it’s coming out of your checking account along with everything else. But when that money is sitting in a separate account, it’s a lot easier to see how your savings are growing.

Don’t Forget About Retirement

Another way to automate your savings is through employer-sponsored retirement plans like 401(k)s. Many employers will allow you to designate a certain percentage of each paycheck to go into your 401(k), and once you’ve set it up, you won’t have to think about it again.

Just make sure that you take the extra step to actually invest your savings in a fund so your hard earned money can benefit from compound interest over time.

Strategies to Boost Your Savings

If you don’t feel like you have excess funds to start automating your savings, below are some strategies you can use to increase your cash flow. More cash means you can automatically save more each month. This will help you successfully reach your goal of doubling your savings in 12 months.

Temporarily Lower Your Expenses

As anyone who has been following the news recently can attest, keeping our finances in order is more important now than ever. Not only are many of us dealing with financial hardships brought on by the pandemic and other factors, but many people struggle with overconsumption habits.

It’s too easy to say increase your savings by cutting back on your expenses. Most people know that if they lower food expenses or stop shopping online, they can boost the amount of cash in their accounts.

The problem is finding the desire to implement new habits when you have a goal to reach. So, sometimes it’s helpful to point out you only have to temporarily lower your expenses.

You won’t always have to forgo a shopping spree to the mall or drinks out with your friends. These are temporary strategies you can use to double your savings account to give you the base savings account you need to feel comfortable and content.

Become a Freelancer

One great way to double your savings in 12 months is by creating additional streams of income. There are many ways to do this, so there’s sure to be an option that fits your skills and interests.

One option is to start freelancing on the side. If you have a knack for writing, design, or programming, you can use your skills to earn money by working with clients on a freelance basis.

The rise of working on the Internet has revolutionized the way freelancers work. One of the biggest advantages is that you can choose who you work with and what projects you want to work on.

This is a lot more flexible than getting a side job delivering pizza or working at a store. When you’re a freelancer, you can make extra money but have a much greater sense of control over your work-life balance. Freelancing also allows you to work from anywhere in the world. As long as you have an Internet connection, you can work from home, a coffee shop, or even at the beach.

This gives you a level of freedom that traditional side jobs simply can’t match. Finally, freelancing can be extremely rewarding financially even if you only do it part time. You’ll need to have a good work ethic and the motivation to go out and get work. But, this can be an incredibly lucrative way to add to your savings account quickly.

Start a Small Business

If you’re looking to double your savings account within the next year, one of the best ways to do so is by starting your own business. Not only can running your own company help you generate an income that more than covers your expenses, but it also allows you to be in control of your time and financial future. However, many people put off starting their own businesses due to high startup costs and upfront investments.

Luckily, there are a number of ways to start a business on a budget. By keeping costs low and being strategic about where you invest your money and energy, you can set yourself up for success without breaking the bank. Some effective strategies for doing so might include launching a digital product or service that requires minimal overhead. For example, you could start a blog or podcast and use affiliate marketing to generate income. You could also launch an e-commerce store focused on selling products that have a high profit margin.

When it comes to providing services to others, some examples include becoming a consultant, photographer, web developer, or virtual assistant. If you have a unique skill set or talents that others are willing to pay for, there’s no reason why you can’t start your own business and begin generating an income today. This can help you not only reach your goal of doubling your savings account within 12 months, but also set you up for long-term financial success.

Refinance Your Loans

To double your savings account in just 12 months, it’s also helpful to look beyond the confines of your current financial situation. One option that may help you accomplish this goal is refinancing some of your debt, which could allow you to free up more cash each month and put those resources toward building your savings.

Ideally, refinancing your debt will require that you take out a new, lower-interest loan or line of credit to consolidate your existing debts. This can save you significant amounts of money over time and can even allow you to pay off some loans ahead of schedule.

In addition, using the extra cash from refinancing to make additional contributions to your savings account can help you reach your savings goal a lot faster.

Planning and Discipline are the Keys to Success

To summarize, if you want to double your savings account in 12 months, having a plan and staying disciplined are integral to your success. Doing so will help you avoid unnecessary spending, live within your means, and save more money each month.

While it may seem like a daunting task, remember that you can take small steps to reach your goal. Automating your savings, finding ways to earn extra money, and refinancing your debt to increase cash flow are all great ways to get started.