As we cruise into the last few months of 2020, it’s easy to get wrapped up in looking FORWARD. Many people are already asking: what will 2021 bring? People are setting goals and talking about Q1 in last Q3 and early Q4, but the year has two quarters left. So we’ve got some time.

Before you get swept up in the rush of 2021, which is right around the corner; take some time to assess your 2020. Covid-19 happened, it’s been hard and we’re going to pull through this. Unemployment is at an all time high. Highest since the Great Depression. Every business owner should make time to go through their financials, their marketing, and client list at the end of the year. Get to know those companies that helped you pull through this. Those that stuck with you. Evaluate the good, the bad and the ugly.

Understanding what you were able to do and what you couldn’t or didn’t do this year is the first step to a successful next year. I like planning early, so now is the time. You can use this year’s Covid-19 Business Assessment to accomplish much more in 2021.

Table of Contents

ToggleHere are five steps to conducting your end of year Covid-19 business assessment.

Follow The Money

Check your monthly and annual profit and loss statements. Where did your money come from in 2018? What outlets served you best, and which ones didn’t perform as you’d hoped?

Get clear on how your income streams performed. Then, in 2021, you can lean into the ones that did well, and lean away from the ones that didn’t perform so well.

What Did You Enjoy?

Life and work should be about so much more than just the profit. What kind of work did you enjoy doing? How can you do more of that in 2019, and less of what you don’t like?

Take the time to sort through the day to day tasks of your business, and identify the ones you actually get pleasure from doing. The ones that you don’t enjoy doing should go onto a list to either be changed or outsourced in 2019.

Did You Meet Your Employees Expectations?

Over the past 12 months have you become more or less of a company? Are you employees happier than they were 12 months ago?

Employees are sometimes hard to please, especially when it comes to payments. You really can’t please everyone, but you should strive to really push your employees to become better, and encourage them to push you to become a better leader. Amazing employees don’t happen overnight, most are nurtured for years to become better and better.

Should you invest in your employees? Absolutely. I once heard a statement;

What if I train my employees and they become so good that they leave? Bigger question you should ask yourself? What happens if I don’t train them and they stay?

Are you Becoming the Business Owner you’re meant to be?

I get asked all the time about business: Are you moving towards the business owner you’re meant to be? Can you answer this questions honestly? On a scale of 1-10, no BS, how are you doing? 1 being terrible, 10 being exactly who you want to be. Which are you. If you answer anything below a 7, that’s ok. It just means that your business assessment is working and you have some room to grow.

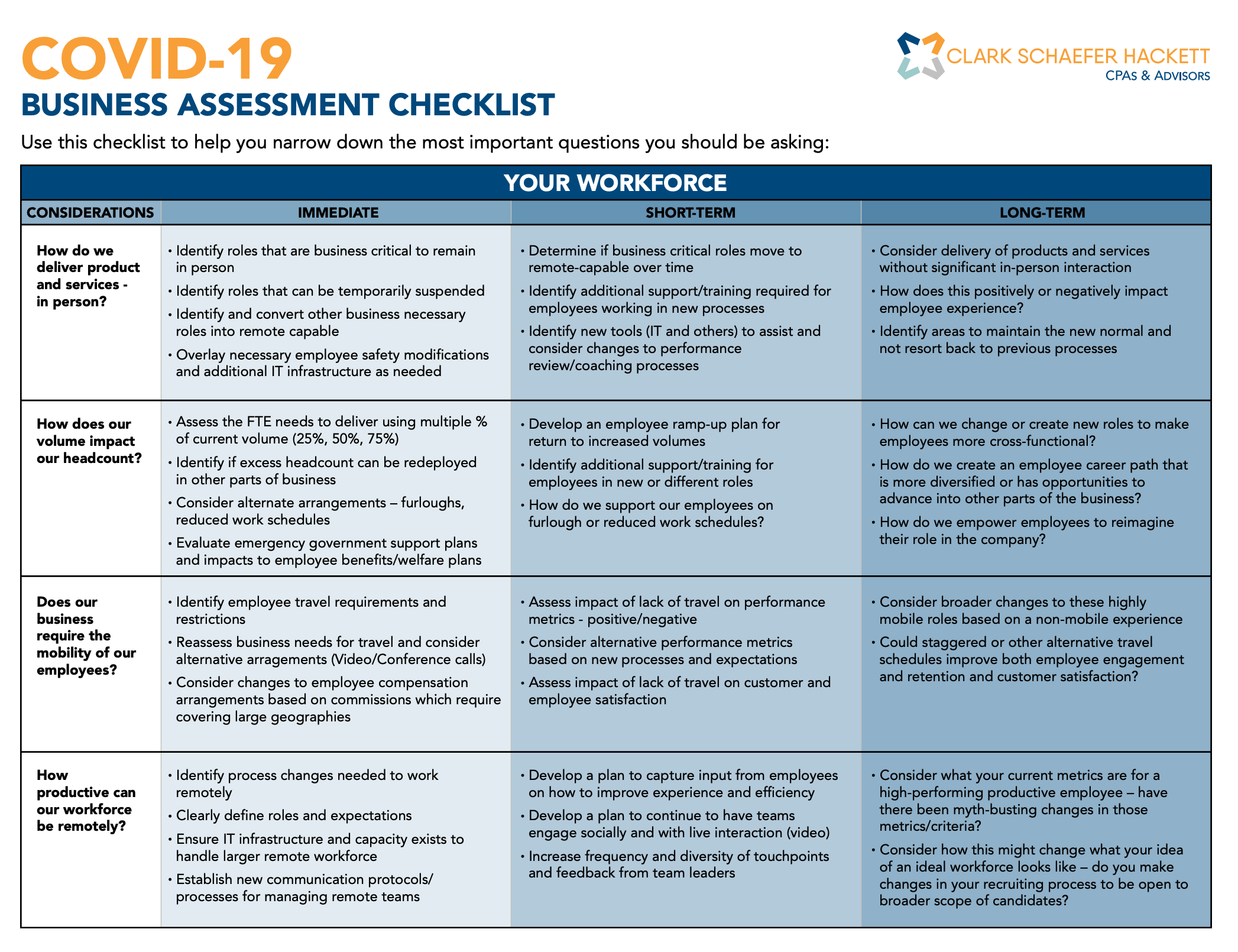

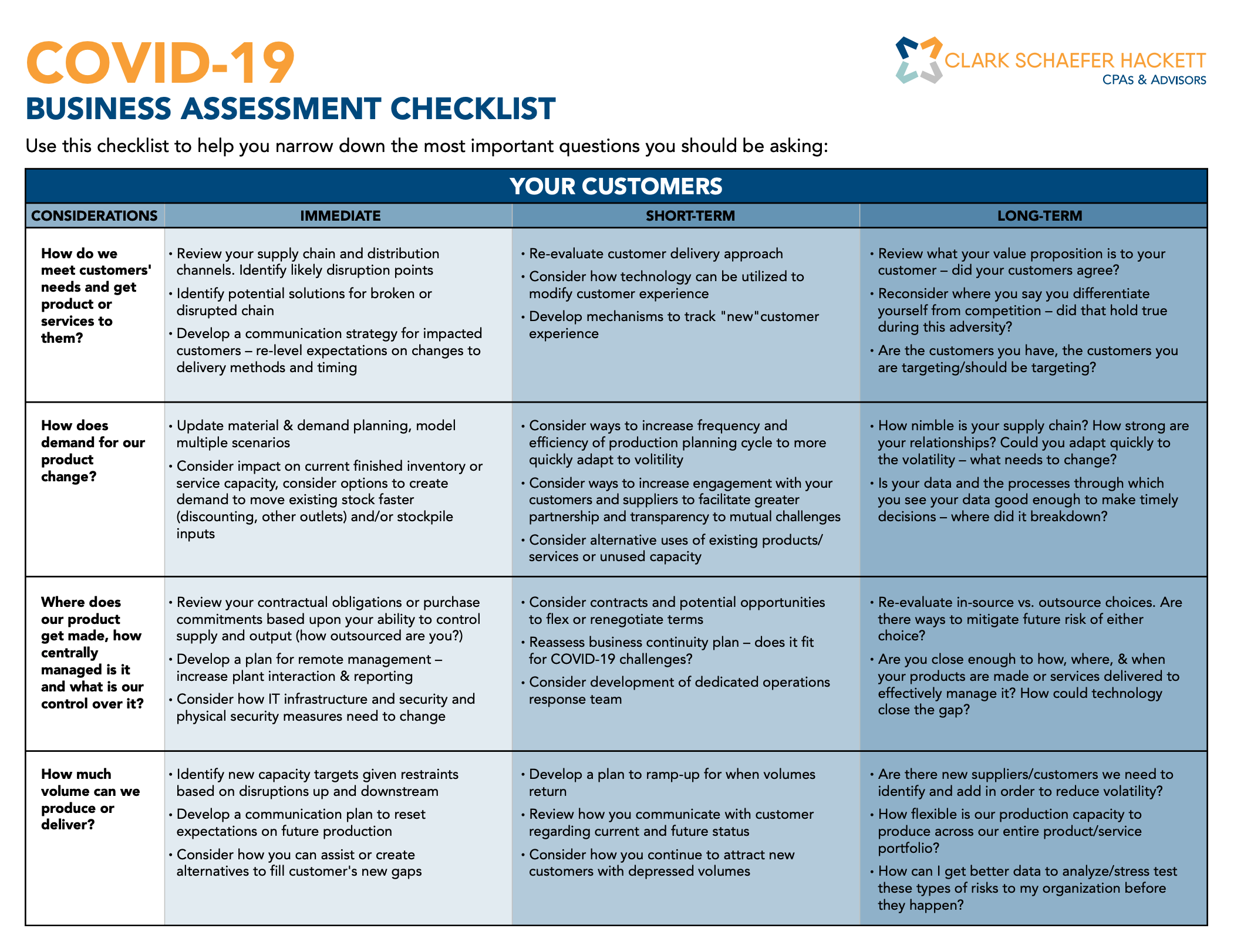

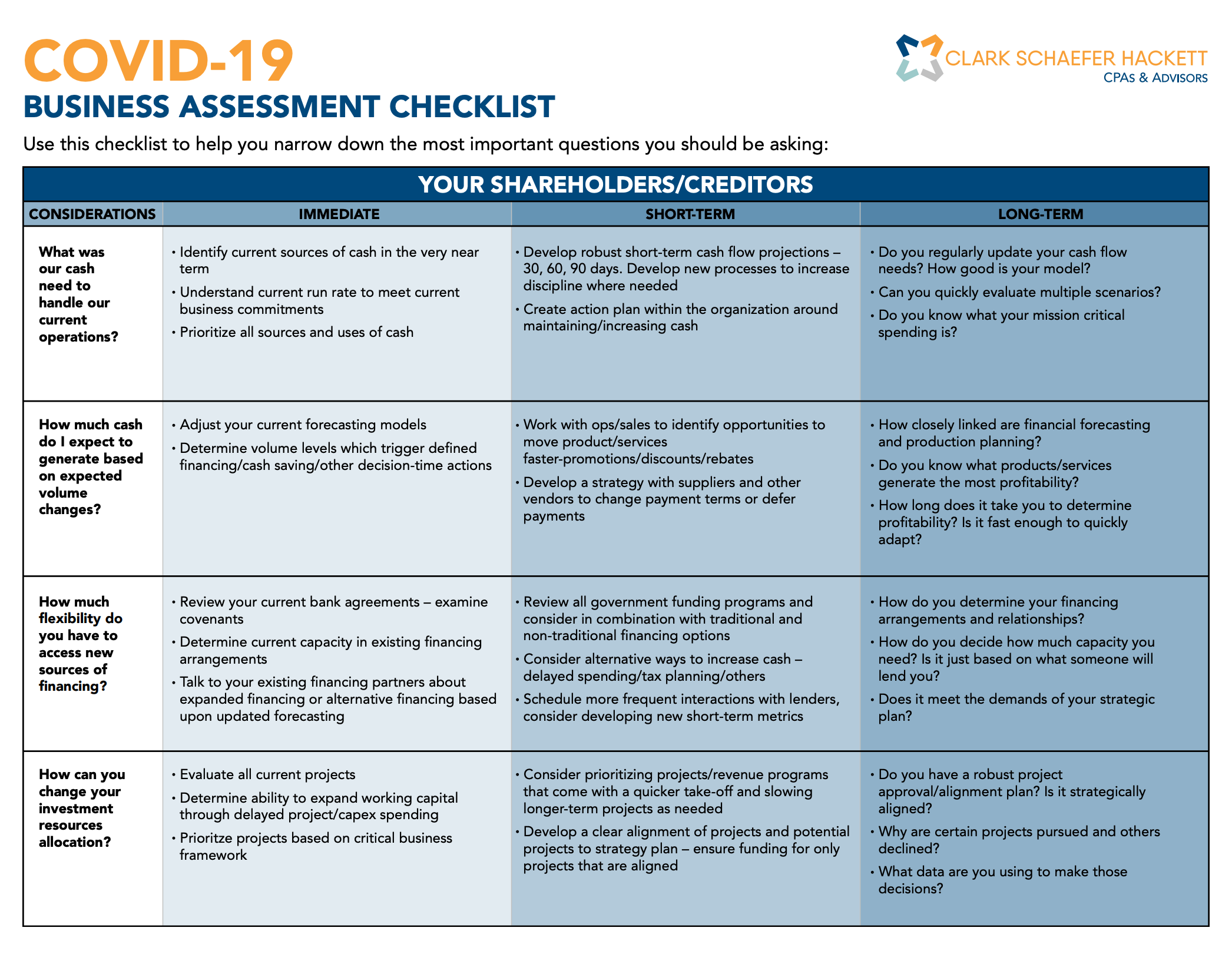

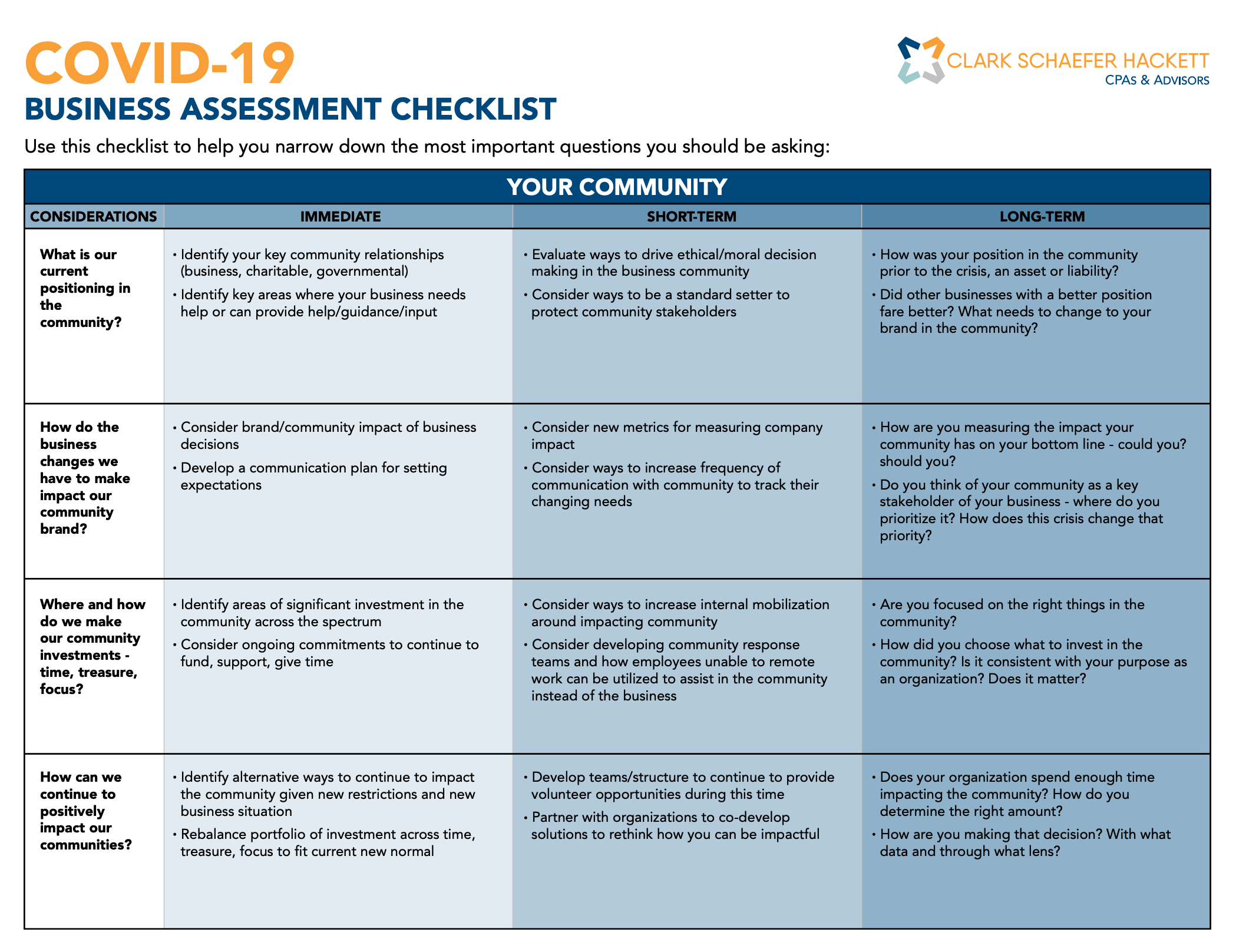

Business assessments are there to help you evaluate where you’re headed. Here is great Covid-19 Business Assessment by Clark Schaefer Consulting.

Covid-19 Business Assesment

Special thanks to Clark Schaefer Consulting for putting this together.

Did You Meet Your Goals?

This time last year, you probably set some goals for 2019. Pull them out and see how you stacked up. If you crushed all of your goals, congrats! The systems you used to set the goals, and the ones you used to meet them all are working.

If you didn’t meet them, what needs to change? Where was there a bottleneck? Where was there struggle? What was the problem?

Asking these questions at the end of the year, after reviewing a year’s worth of effort and data, will help you set better and smarter goals for 2019. You can pinpoint exactly what went well and set goals to do more of that. You can also identify what didn’t go so well, and educate yourself, or hire talent to make sure that changes in 2019.