Companies have offered businesses numerous ways to complete transactions, including business checks, wire transfers, ACH and credit and debit cards. As financial technology has evolved to meet the digital age with more businesses communicating online, business payments have had to change to fit the new online environment where expectations have grown.

Companies and their customers, vendors and suppliers, outsource talent and employees and others expect a wider range of business payment options that they can access online and through their mobile devices, greater ease for conducting global business payments, and higher security.

In a world of instantaneous results, they also want to see faster transaction speeds. To explain the world of business-to-business (B2B) payments, we put together a Slide Share presentation that explains the various types of payments, industry trends, security risks and solutions for avoiding fraudulent charges and losses.

Part 1

The first part of the SlideShare presentation covers the history of B2B payments, offering a number of key dates and developments that illustrates the very slow shift from paper to virtual cash. The timeline starts in 1850 with the launch of American Express to the 1920s where the first bank card appeared to the growth in business credit card use between 2012 and 2014 with these now accounting for 10 percent of all B2B payments.

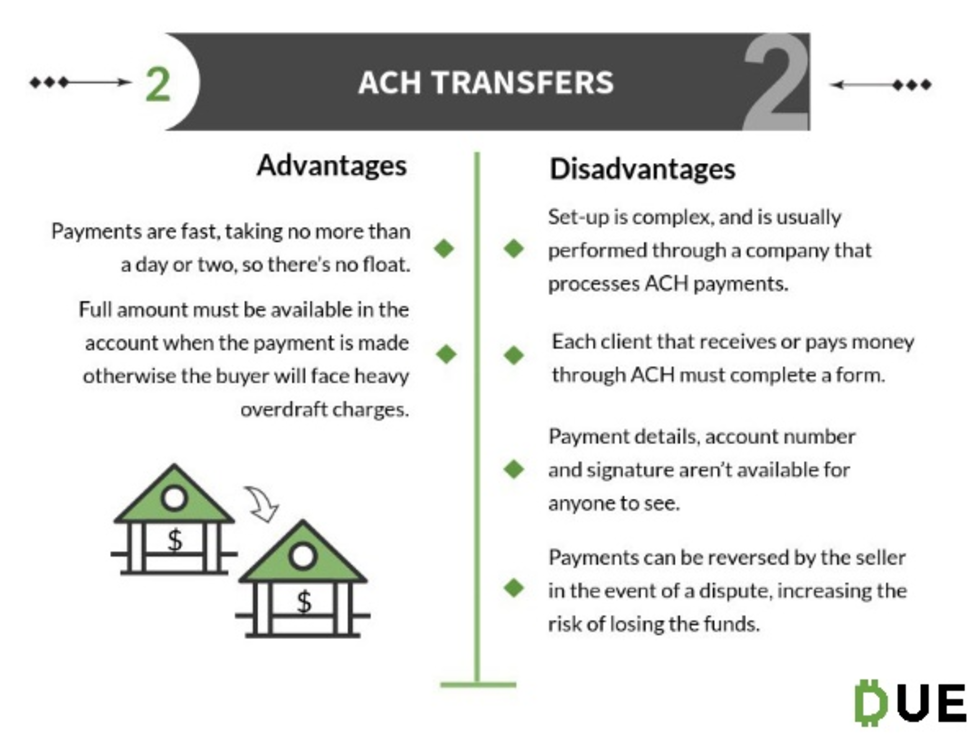

ACH emerged in 1974 and grew to $22 billion in payments by 2014. In 2014, PayPal also introduced group invoicing, which facilitated mass payments for companies and provided a new area of opportunity for payment companies. Another big development was the launch of Software-as-a-Service (SaaS) platform for invoicing, which appeared in 2000 and has grown steadily since then.

Each of these developments over the course of B2B payments history has moved the environment and the businesses that operate within it closer to mass adoption of digital payment processes. However, there are a number of reasons why all businesses have yet to change from traditional payment platforms related to specific concerns that linger.

Part 2

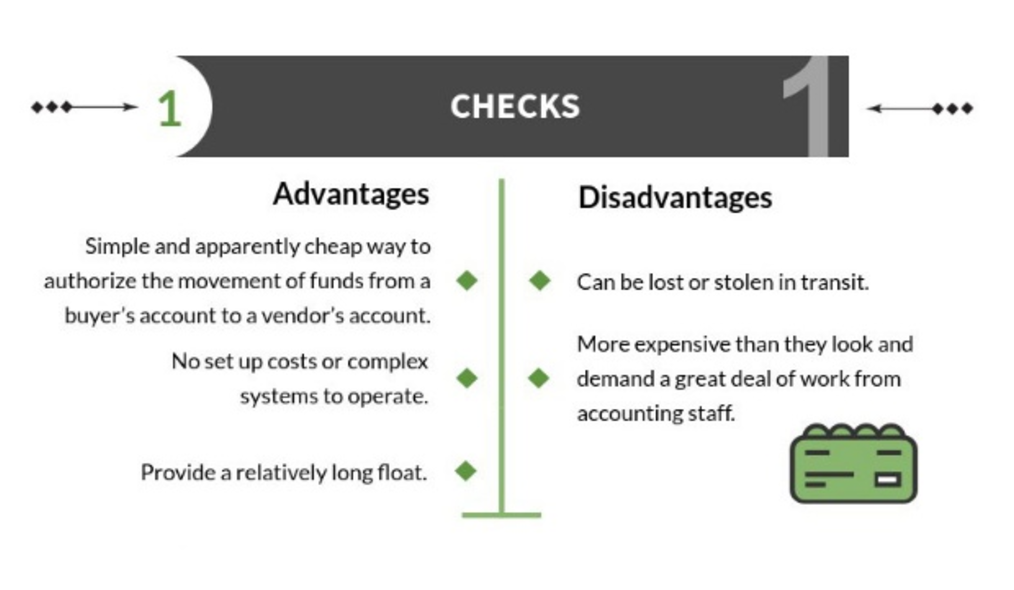

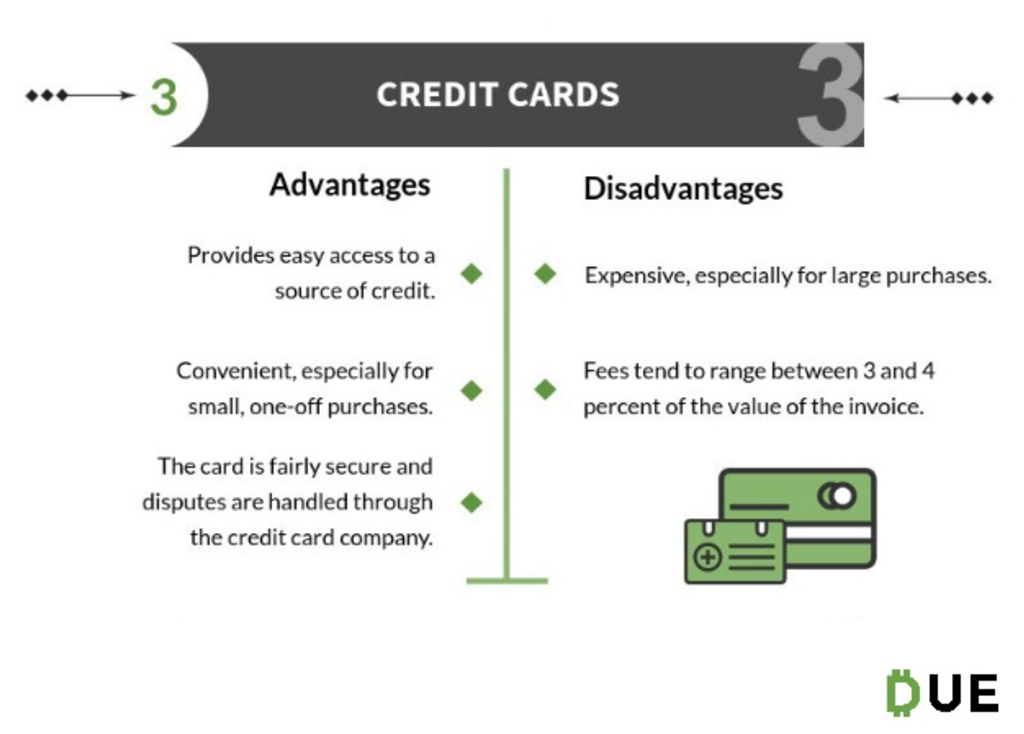

The next section of the SlideShare presentation reviews the advantages and disadvantages of using the five main ways to receive and make B2B payments. These include checks, ACH transfers, credit cards, electronic funds transfer and online payments platforms. Knowing the pros and cons of each type of B2B payment option can help you determine the right payment methods for you to use for your business based on your budget, customer base, and number of transactions.

Business payments tend to be at risk for a number of types of fraud related to checks, credit cards, ACH, wire and digital platforms. However, there are a number of signs to look out for that can help you proactively prevent fraud from adversely impacting your business. Other security recommendations include being wary of requests from free, Web-based email accounts and vitrifying changes to vendor payment locations. More suggestions were to not post any personal or financial information online or social media accounts and to use a two-step verification process for each payment that you process.

For more information about business payments, check out our SlideShare presentation.