Whether you like it or not, online invoicing is a necessity for businesses of all sizes. However, not all business owners are familiar with the basics and importance of invoices. To help you, we have proudly created “The Ultimate Guide to Invoicing” also knows as the best ever “Invoicing Guide”.

Throughout this guide you’ll discover what exactly an invoice is, how it affects your business, examples of invoices, and tips to help you get paid on time.

Table of Contents

ToggleWhat is an Invoice?

Also known as a “bill,” “statement,” or “sales invoice” an invoice is defined by Investopedia as:

“A commercial document that itemizes a transaction between a buyer and a seller. An invoice will usually include the quantity of purchase, price of goods and/or services, date, parties involved, unique invoice number, and tax information. If goods or services were purchased on credit, the invoice will usually specify the terms of the deal, and provide information on the available methods of payment.”

Invoices are non negotiable and are typically used to keep track of inventory, accounting, and tax purposes. For most organizations, an invoice is sent out after shipping a product or following the completion of a service with the expectation of it being paid in-full by a specified date. As Investopedia notes, “the total amount due becomes an account payable for the buyer and an account receivable for the seller.”

The Origin and Evolution of Invoices

The first known use of the term “invoice” occurred in 1560. It is a modification of Middle French – the plural version of which means “dispatch of goods.”

As noted by the United Nations Economic Commission for Europe, the traditional invoicing process “has always been part of a wider set of business processes in trade.” This process includes: “placing and acceptance of an order, fulfilment of the order, delivery of goods, and the final payment.”

Until recently, invoices were paper-based. This created several drawbacks that delayed payment. Some of the concerns with paper-based invoices, according to the UNECE, include:

- creation and entry errors on both sides

- high operational costs per invoice on both sender and receiver side

- even more costs in the case of errors or disputes

- involvement of multiple systems

For the last several years, business partners have relied more frequently on electronic invoicing, also known as e-invoicing, through services like our company Due. This is simply the electronic transfer of billing and payment information between the supplier and buyer.

For buyers, the benefits of e-invoicing include:

- reduction in costs

- faster processing and payment cycle

- improved cash flow management

- increase in accuracy

- reduction in late payment fees, fraud, and duplicate invoices

For suppliers, the benefits of e-invoicing include:

- faster payments

- increase in productivity

- fewer rejected invoices

- improved cash flow management

- additional finance options

As for managers, e-invoicing will assist with any green initiatives that your organization has implemented, as well improving visibility and strengthening supplier/customer relationships.

Types of Invoices

There are several different types of invoices businesses can create. The most common invoices used are:

- Proposal/Bid/Pro Forma. An expectation of how much a business is going to charge for goods or services. As opposed to a bill, this is a preliminary appraisal.

- Interim Invoice. Invoices that are sent out weekly or monthly during a long-term project.

- Recurring Invoices. Used for recurring customers. E-invoicing can automate these invoices.

- Past Due Invoices. Sent when an account is past due. Includes original invoice and interest accrued.

- Final Invoice. An invoice that is sent out following the completion of a project.

If a business has international buyers or suppliers, they will most likely have to create one of the following invoices.

- Commercial Invoice. This is required by customs to determine the value of imported goods for taxes and duty fees and includes information like the goods being transported, the country of origin, total declared value, and transportation/insurance costs.

- Consular Invoice. A commercial invoice that has been visaed by the consul of the importing country resident in the exporting country.

- Customs Invoice. An extended commercial invoice.

How to Create an Invoice

Whether you’re a small business owner, freelancer, or in charge of handling invoices for a large corporation, there are essential components needed to create an invoice.

Professional Header

The first component of an invoice is the professional header. The header will usually consist of your business name, or full name if you’re self-employed, at the top of your invoice in an easy-to-read font.

It will also include your contact information – mailing address, phone number, email address, and website – underneath your business name. To help make your business name stand out in the header consider using a larger font or making it bold.

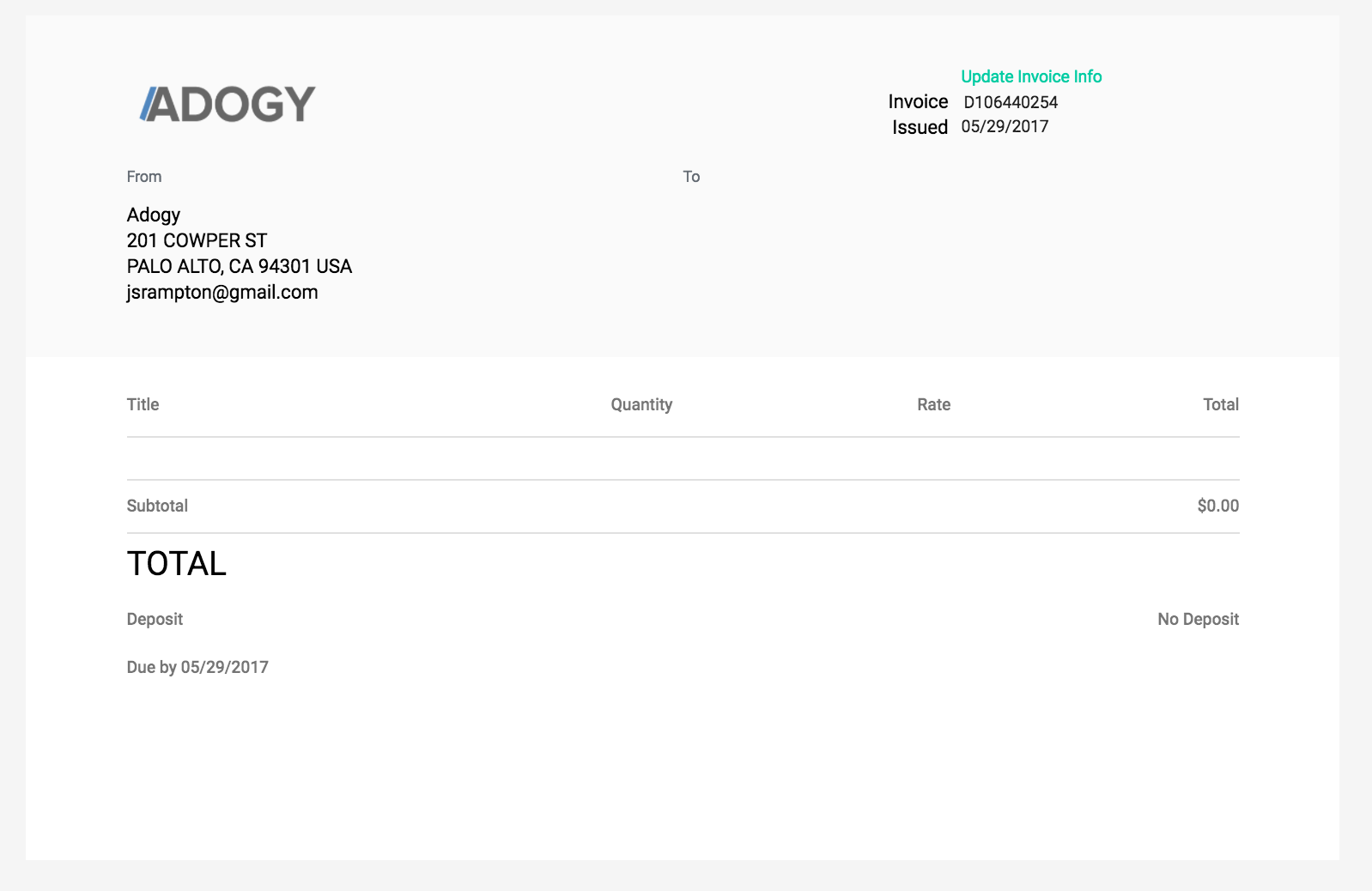

An example of a header would be as follows:

John Smith

1234 Main Street

Small Town, CA 12345

555-123-4567

johnsmith.com

If you have a logo for your organization you would want to include that at the top of your invoice header as well.

The Client’s Contact Information

After creating a custom header, you’ll want to add your client’s information to the invoice. This information should be the recipient’s name, address, and phone number. You’ll want to place this information below the header, but on the opposite side. For example, if your header was placed on the upper right side of the invoice, then the client’s information will be located on the left side below the header.

If you do not have an address for the business or person that you’re invoicing, then you can just include their name and email address.

Invoice Number and Date

Across from the recipient’s information, you’ll add the details of your invoice. This information will include the following on separate line:

- Invoice Number

- Date prepared

- Payment due date

- Preferred payment option

How you number your invoice is completely up to you. One of the more common ways in writing the invoice number would be: “Invoice: 00001.” Some organizations prefer to organize their invoices by name of the client. For example, if you have a client named Sam’s Pizza, the invoice number could be: “SP 00001.”

No matter how you decide to number your invoices, always use a sequential order of when the invoice was created so that you can easily track and organize your invoices.

The payment due date is also up to your own discretion. Most invoicing systems use either a 30 day, 45 day or 60 day timeframe. If you have an agreement with your client, then you would include that date. For example, if you were to get paid on the 15th of every month, then that would be the due date of the invoice.

If you expect to be paid immediately, then you want to state “Due upon receipt”.

Underneath the due date you need to specify how you preferred to be paid. Do you want to be paid by check, credit card, or a payment gateway like PayPal?

Itemized Breakdown of Services

This part of the invoice will usually include five columns that contain the following:

- Services: This is the description of either the work you performed, such as writing an article like “10 Best Pizzerias in San Francisco,” or the goods that were purchased, like a “Pizza Cutter”.

- Date: This would be the date that the service was performed or when a product was purchased.

- Quantity: This includes either how many hours you worked, how many articles you wrote, or how many products you sold.

- Rate: This is the price you are charging for your goods or services.

- Hours: If you paid by the hour, then this column would include how many hours you spent completing a task.

- Subtotal: This would be the total amount the you are charging for your goods or services.

Finally, you need to calculate the total, subtotal plus sales tax, delivery fees, or any other additional fees. The total should be in bold so it clearly stands out.

Terms and Conditions

Underneath the total you will include any additional information, such as terms and conditions. Some examples would be return policy on goods, how many days the client has to pay before incurring a late fee, any discounts or description on any additional fees.

You’ll also want to include a simple “Thank you” to your client to show you appreciate their business.

How You Will You Be Paid

If you are sending your invoice electronically with a system like Due.com, then it should already specify how you’ll want to be paid for your products or services. As a reminder, however, if you are paid through PayPal, make sure you provide your PayPal email. If you wish to be paid by check, include your address and who to make the check out to.

Why It’s Important For Businesses to Invoice

Regardless of the size of your business, or even if you’re a sole proprietor, invoices are one of the most essential elements to your survival. Without invoices, you won’t be able to bring in that much-needed income, as well as protect yourself in certain situations.

With that in mind, here the main reasons why invoices are so important for business owners.

You Get Paid

This is the most obvious reason. Receiving prompt payment from a client means you will be able to pay your bills, such as payroll, rent, electricity, etc. By using an online invoicing service, you can quickly and efficiently receive payments for your goods or services. In fact, most electronic invoices can be completed with just one click of a button.

For example, if you accept payments through PayPal, your client can pay the invoice as soon as they receive the notification – sometimes in just a couple of minutes!

Additionally, you can speed the payment process up by reducing the time of a billing cycle. As opposed to using the traditional 30 day cycle, make your cycle only 14 days or offer your clients a discount if they pay quickly.

Record Keeping

Another purpose of invoices is to manage of how much your business is earning and spending. With invoices, you can keep track of when a product was sold, when a project was completed, and how much money you made. Furthermore, invoices are a great to see which clients have paid their debt and which bills remain outstanding. This not only allows you to keep an eye on the status of your business, but also can be used to estimate future earnings.

Record keeping can also be used to see how employees are performing with sales, since you can view how many items they have sold. Additionally, you can use time tracking tools through services like Due.com to see how long a project takes either you or team members to complete.

Tax Purposes

The last thing that a business owner wants to deal is either being audited or receiving a fine from the IRS. However, if your business has a record of all of its sales invoices by maintaining an organized system of sequentially numbered invoices, you’ll reduce the chances of being audited, since the IRS will have evidence that you have reported your income.

Invoices can also be used to file taxes accurately so you’ll have the information needed to figure out how much you owe in taxes.

Legal

Another situation that business owners do not want to face are lawsuits. For example, what if a customer claims that you did not deliver the products or services that they requested? An invoice is evidence that either the goods or services were provided. In other words, an invoice is a record that the sale occurred.

On the other hand, invoices can also be used by a small business in a court of law as evidence that a customer has not paid for the goods of services you provided.

Clarifies Your Work/Products

If you want to avoid any conflicts or misunderstandings, then you want to describe what exactly you’re billing your customers for. This can be especially useful if you are providing a service that the client doesn’t exactly understand. For example, designing a website for a hardware store may sound expensive to the owner. If you described exactly how many hours it took you to add HTML page s or build forums, they can see how much work you’ve put into the project.

Branding Your Invoice

You want to come across as a professional to your clients, right? One of the most effective ways in doing so is by creating a professional invoice.

Besides including the basics of an invoice – contact information, description of goods/services, cost per item, and total amount due – you want to include the logo of your business. Not only does this illustrate to your clients that you are a professional, it helps with branding since it showcases your brand’s voice.

Marketing your Invoice

Your business can also use the data from invoices to help with future marketing campaigns and strategies. For example, if you notice most of you sales occur on Friday evenings, then you could target your customers by reaching out to them through email or social media at that time. Invoices also show what your most popular products are and your business’s earning trends.

The Importance of Cash Flow For Your Business

As noted earlier, invoices are an essential factor for the success of a business. Additionally, the money that you bring into your business, whether online or offline, from the products that you sell of the services that you provide are an important component of your business’s cash flow.

What is Cash Flow?

Entrepreneur defines cash flow as:

The difference between the available cash at the beginning of an accounting period and that at the end of the period. Cash comes in from sales, loan proceeds, investments and the sale of assets and goes out to pay for operating and direct expenses, principal debt service, and the purchase of asset.

When your business brings in more cash then it sends out, you have a positive cash flow. If you are spending more than you are bringing in, then you have a negative cash flow. If your business has positive cash flow, it’s a strong indicator that it is financially healthy – if you don’t have a positive cash flow, you run into the risk of bankruptcy.

Why Cash is King

You’ve probably heard the old adage “cash is king.” Without properly managing your finances you’re putting the survival of your company in jeopardy, regardless if it’s an eCommerce site or brick and mortar store.

When your business has positive cash flow, it accomplishes the following:

- Pay Off Debt – When you launch a business you have to take on debt, like real estate, equipment, and inventory, to start and operate the business. By having positive cash flow you will be able to meet those debt obligations by avoiding late payments and loan defaults.

- Business Growth – When you are no longer restricted to paying off debt, you can use that cash to grow your business. Positive cash flow allows you to move to a larger location, invest in research and development, hire new employees, provide training for employees, and purchase new technology. If your business does not grow, it can become stale.

- Provides a Safety Net – Another reason why positive cash flow is so important for the survival of your business is that it provides a safety net. There will be times when you need to repair a piece of equipment or have a buffer in times of economic downturns. Positive cash flow allows your business to continue to operate without having to worry about taking on additional debt.

- Makes Your Business Appealing – Finally, positive cash flow can help make your business more appealing to lenders or investors. If lenders or investors can see your business has a positive cash flow, they will not be as hesitant to lend you money when you need it.

How to Practice Good Cash Flow

Practicing good cash flow management can be easily achieved by doing the following:

- Be aware of when, where, and how your cash needs have to be addressed.

- Know how to address cash needs.

- Be prepared to meet cash needs, such as having a strong relationship bankers and creditors.

By having a strong invoicing system in place, you can stay on top of your cash flow by monitoring how much money you’re bringing in.

Payment Options

Now that you know just how important cash flow is for your business, it’s time to explore the most common payment options for small businesses.

Cash

Accepting cash is a speedy and convenient way to get paid for your products and services since you don’t have to wait for bank transfers. The biggest drawback to accepting cash is that it is not the best option for remote parties.

Check

Checks remain one of the most common ways to for businesses to accept payments since they are convenient, auditable, and can be sent through the mail or electronically. However, checks can sometimes take weeks to clear and can be lost in the mail.

Credit Card

Credit cards are one of the fastest and easiest ways for businesses to accept payments. They can be sent from anywhere in the world and funds are usually available immediately. One concern regarding credit card payments is that it can be expensive for merchants.

ACH

Electronic payment transfers, such as direct deposits or through gateways like PayPal, are fast and convenient with funds available immediately. While ACH may be one of the easiest ways to accept payments, most of them come with fees and will require you to set up.

Wire Transfer

Wire transfers are incredibly fast and secure. But, wire transfers are also equipped with expensive fees.

Finding the best payment solution for your business depends on your particular business. If you have an online business, then it would obviously make sense for your business to accept electronic payments since you are dealing with remote customers. It’s best to discuss which payment option works best with your business with your accountant or financial adviser.

How to Keep Track of Accounting

Keeping good records for your business is another task every business owner must learn how to do. While it may seem tedious and cumbersome, if you don’t have a solid system in place to keep track of your records, you can run into a number of problems. As noted by GoDaddy, some of these problems could result in:

- Disorganization makes filing year-end taxes more frustrating.

- You increase the chances of facing an IRS audit.

- You don’t have a clear picture on how your business is performing.

- It will make it more difficult to secure a loan.

So, how can you keep tabs on your accounting effectively?

Nolo has suggested businesses break down the bookkeeping process into three easy-to-understand steps.

Step One: Keep Your Receipts

As stated on Nolo, “Each of your business’s sales and purchases must be backed by some type of record containing the amount, the date, and other relevant information about that sale. You’ll use these to create summaries of your transactions.”

Shopify adds that you should pay extra attention to the following receipts:

- Meals and entertainment

- Out of town business travel

- Vehicle related expenses

- Receipts for gifts

- Home office receipts

Step Two: Set Up and Post to Ledgers

Your business ledger “is really nothing more than a summary of revenues, expenditures, and whatever else you’re keeping track of (entered from your receipts according to category and date).” You’ll use this information “to answer specific financial questions about your business”.

They suggest you post receipts on a regular basis and replace the traditional pen and paper ledger with bookkeeping software, which is more efficient and a real-time saver.

Step Three: Create Basic Financial Reports

You need to look at data from the following reports that you have created: a cash flow analysis, a profit and loss forecast, and a balance sheet. By combining these reports you’ll have a better understanding on how your business is performing.

You can also keep track of your accounting by keeping the following in mind:

- Keep your bookkeeping simple. No matter what business you’re in, most bookkeeping categories are the same. Use standard accounting categories and don’t over-categorize.

- Consider tax obligations. Depending on your business structure, you’ll have different tax obligations.

- Examine employees. Labor will be one of you most biggest expenses. Keep an eye on wages, overtime, and benefits. Due.com, for example, has a time tracking feature so you can see how employees are performing.

- Call an expert. A freelancer or small business owner will not require a full-time accountant or bookkeeper, but you should have a qualified professional look over your books from time to time.

- Don’t forget to get paid. Sending out an invoice can be easily overlooked when running a business by yourself. Invoicing software that easily creates invoices, reminds on you pending invoices, and has the ability to automate recurring invoices is an absolute necessity.

If you pay attention to your accounting from the beginning, you’ll reduce future headaches and legal problems. However, even if you have a system in place, you need to constantly re-evaluate your process to make sure that it’s still effective.

Invoicing Guide: How Often Should I Invoice a Client?

One of the most common questions regarding invoices is how often you should invoice a client. Unfortunately, there isn’t a one-size fits all method for this query since there are various circumstances involved. For example, a consultant will send out more invoices frequently than a small business with a major client. With that in mind, the following section will provide several suggestions on how often clients should be billed.

Do You Have Agreement to get paid online?

Prior to conducting any work for a client, both parties should have some sort of agreement or contract in place that specifies pay cycles. Of course, this will be dependent on the following situations:

- The Client’s Timeframe. Try all you want, some clients will only pay for invoices during their established timeframes. For example, your client may only send out invoices in the first of the month. Asking for a payment before that date will not guarantee that you will be paid earlier.

- Your Timeframe. If you are a freelancer, it’s not uncommon for you to send out an invoice once a job is completed. However, if you have multiple clients it may be easier to send all invoices out on the same date.

- The Size of the Job. If you are working on a larger project, you should require a deposit or a retainer. For example, you may agree on 50% of the final amount upfront and receive the other half once the job is finished.

- The Relationship Between You and Your Client. If you and your client have established trust between each other, then you could agree on invoicing them prior to the start of a project. You could also send an invoice after completing a project without asking for a deposit since you know that they will pay immediately after completion.

If you and your client have agreed on payment terms, then this will guide you on when to invoice them.

What if you haven’t agreed on terms with a client? You may want to answer the following questions to help you create a payment time frame.

What is the client’s payment cycle?

Knowing when a client’s payment cycle is, as noted earlier, will determine when you are paid. For example, if your client accepts invoices on the 15th and 30th of every month, then you would send them an invoice on those dates. Don’t be afraid to ask them when their payment cycle is so you have that information for future reference – if they are a recurring client you could automate your invoice each month based on their cycle.

How much is your invoice?

If the invoice is a small amount, let’s say $200, your client shouldn’t have any problems paying that amount immediately. Additionally, you don’t want to waste your time following up on several small amounts. In this case, you should send the invoice as soon as possible.

With larger invoices, however, you should have an agreed upon date, or at least a deposit. You don’t want wait for a large payment which could influence your cash flow and strain the relationship.

Have you dealt with the client before?

If you trust your client and have worked with them in the past, this usually isn’t a concern. Freelancers, for example, will continue working for the client even if the haven’t been paid yet because they know the client will pay when the time comes. A small business owner can continue to sell goods to a client while waiting for a payment because they have never been stuck with a bill.

When do you want to track an overdue invoice?

No one wants to take time away from more pressing matters because they are following up on invoices. As mentioned earlier, your invoice is a key factor in the survival of your business, and it’s the livelihood for freelancers, so you shouldn’t have to wait over a month to be paid for your goods or services. You could avoid this by clearly specifying in your invoice when it’s time and what fees will be incurred if the payment is late.

The frequency of when you send out invoices ultimately comes down to the timeframe of your clients and what works best for you and your business. For freelancers, they should bill early and often unless a payment cycle is specified. For small business owners, they may have to be at the mercy of their client’s payment cycle.

Invoicing Guide: How to Invoice Online

Sending an invoice online is not only convenient, it’s also an incredibly fast way to receive a payment since you don’t have to wait for your client to receive the invoice in the mail – and then mail back a check to you. Typically, sending an invoice online is accomplished via email. This means that you create the invoice yourself using a template from Word or Excel and attaching it as PDF file. The other option is to use accounting software that creates the invoice electronically and then sends it directly from there – which is how you create and send invoices through PayPal.

In both situations you need to include the necessary information that was previously discussed – contact information, description of services/goods, invoice number, terms and conditions, payment options. Most importantly, online invoices must have the correct email address for the client or the individual who is handling the invoice. If you send the invoice to the wrong person, this will delay the payment process.

If you’re using invoicing software to send an invoice online the process is rather simple. New to online invoicing, start use Due to send invoices online.

You want to begin by creating your profile after signing up for an account. You need to complete the following information:

- Personal information. This includes basic information like your name and address.

- Payment terms. This is how you wish to be paid.

- Your clients. Here is you would add the names and email addresses of all your clients.

- Projects/Tasks. You can add any current projects or tasks you’re currently working on.

Creating a New Invoice

Creating a new invoice is then pretty straight forward since you have most of the basic information already placed into the system. But, here’s a quick rundown on the process.

Basic Information

- Select the client you are invoicing.

- Select the date you are sending the invoice.

- Choose your numerical Invoice ID.

- Enter the P.O. Number of your client, if applicable.

Invoice Settings

- Chose the due date of the invoice.

- Select currency information like symbol, currency code, and language.

- Enter tax, discount, and shipping information.

- Select your payment mode.

- You also have the option to set the invoice as recurring.

- You can also attach files to the invoice if needed.

The Invoice Description

- Select either the quantity of your billable hours or products.

- Fill out the description field on what exactly you’re billing the client for.

- Enter the price that you’re charging for your products or services.

After filling in the above information, you want to create and save your invoice. Once you’ve done that, you can send your client the invoice to their email address.

Guide to Invoicing: How to Invoice Using Your Own Site

If you want to add an extra touch of professionalism to your invoice, then you could create invoices by using your own site. Sounds confusing? Don’t worry, it’s not complicated if you use the right software.

Due.com provides such software that gives you the ability to convert your current website name, such as johnsmith.com, into a more professional option. So, johnsmith.com would become invoice.johnsmith.com when implementing this feature. Doesn’t that just look cooler than sending an invoice from your current email address or business name?

While this feature gives you the power to create an attractive domain name that separates your accounting from the rest of your site, it’s still powered by Due.com. This means you’ll need to have an account with Due.com and use the software to create and send the actual invoice.

10 Tips and Tricks to Getting Paid on Time

Creating an invoice with all of the proper information isn’t necessarily going to force your clients to pay any more quickly. And, since your cash flow relies on getting paid for your products or services, you need to not only send invoices as quickly as possible, you also need to get paid as quickly as possible. Here ten tips and tricks to you accomplish just that.

1. Send Smaller Invoices

This is a particularly useful tip for larger jobs. After all, you don’t want to send your client one huge bill that may be difficult for them to pay at once – it’s easier for a client to pay an invoice that is a couple of hundred dollars as opposed to thousands of dollars. If you haven’t agreed on a deposit or retainer, then you should send the client a series of smaller invoices until the project is complete – with payment dates that should be approved by both parties from the beginning.

Additionally, you want to make it a policy that you will not continue with a project until you receive payment for your previous work.

2. Select the Right Colors

The meaning of color for businesses has long-been studied. But, can colors also influence how fast payments are made?

Some research shows that color can in fact play a part in invoicing. For example, blue is associated with trustworthiness and professionalism. Green has a literal connection to money. So, when selecting a template, customizing, or creating a logo for your brand, you should consider those colors.

Select a color for your invoices, and brand, that not only inspires clients to pay on time, but also carefully select the colors that best match your brand’s voice.

3. Create and Sign a Contract

As noted by Howard Greenstein on Inc.com, “A contract not only protects you, but it protects the customer as well.” Before you begin any work for a client, both parties must discuss and agree on a contract that addresses deliverables and a schedule. Vito Mazza, Senior Consultant at GreenFlag Profit Recovery, suggested to Greenstein that, “In the current environment, people should start considering 20-day terms for payment instead of the standard 30 days.”

4. Be Polite

According to FreshBooks, “A simple ‘please pay your invoice within’ or ‘thank you for your business’ can increase the percentage of invoices that are paid by more than 5 per cent!”

There was no additional explanation for why being polite helps get your invoice paid more quickly, but it has been proven that manners can help establish and strengthen relationships. And, if you have a solid relationship with a client, they shouldn’t hesitate to pay you as soon as possible.

5. Stand Your Ground and Take No Prisoners

Even though you should be polite and courteous, you also need to stand your ground and be tough when it comes to invoicing. This means that you have clearly defined your terms, conditions, and policies to your clients – and you stick to them.

Additionally, don’t be afraid to follow-up on any overdue invoices. This doesn’t mean you need to be rude – just send out a friendly reminder. However, there may be situations when the gloves have to come off. If that’s the case, you may want to consider having your attorney send the client a letter or even sending them into collections.

6. Offer a Discount for Early Payments

Why not give your clients an incentive to pay early by offering a discount? It doesn’t need to be a large amount. Even a small percentage, such as 2% if paid within 10 days, could be enough to motivate the client to pay the invoice as soon as possible.

7. Communicate With Clients

Constant communication is another great way to strengthen the relationship between you and your client. And, when you have that established line-of-communication, you can casually ask the client if they received the invoice. There could have been a possibility that they have been out of town, sick, or accidentally lost the invoice.

So, frequently check-in with clients by either shooting them an email, giving them a quick-call, or even stopping by for a visit.

8. Set Up a Subscription Service

If your invoicing software allows you to set up subscription and recurring payments you can easily decide how often your customers are automatically billed – either days, weeks, months, or even annually. It’s a great option if your business relies on memberships, newsletter fees, or recurring club dues. Additionally, you can use this feature to collect recurring donations or monthly payments.

Setting a subscription service takes away the need of creating and sending monthly invoices, as well as ensuring that you get paid the same time every month.

9. Make Your Physical Presence Known

While it’s no secret that adding your logo to an invoice is a great way to create brand presence, you could also create a physical presence by including a head shot of yourself. Furthermore, you can sign the invoice – either by printing it out or using an electronic signature – to continue creating a physical presence.

These simple, yet effective, ways help urge your clients to pay quickly.

10. Diversify Your Payment Options

Just because you accept PayPal doesn’t mean that all of your clients do as well. When you only accept one or two payment methods you’re making it more difficult for clients to pay you in a timely manner. By accepting multiple payment methods, such as checks, credit cards, and PayPal, you’re improving your cash flow by getting paid faster.

If you’re on the road a lot, you should definitely look into mobile payment options like Square.

State of the Invoicing Industry

So at Due we took the past 250,000 invoices that were sent and made the following conclusions:

- Average Invoice: $365

- 50% of Invoices are paid for by someone that lives within 44 miles of their home. The average invoice is paid within 22 days.

- 18% of invoices are paid for by someone that lives within 2500 miles of their home. These online invoices are paid for on average in 14 days.

- 84% of all invoices are paid. (doesn’t include invoices that are deleted by users)

- 63% of invoices are paid on-time within 30 days.

- 18% of all invoices are paid for within 24 hours of being sent.

Basically what this means is that most invoices are being paid on-time.

Scientific Proof On How To Get Paid On-time

We want every freelancer or business owner out there to get paid, and more importantly get paid online. The following are tips pulled from over 250,000 invoices that have been sent over the past year. Use these tips to get paid ontime:

- You are 3x more likely to get paid if you add a company logo to your invoice.

- You are 8x more likely to be paid on time if you put a due date to your invoice. This may sound logical but you’d be surprise how many people leave off a due date. Almost 1 out of every 4 invoices sent is sent without an invoice.

- If you put terms on your invoice you are 1.5x more likely to get paid ontime.

- You are 2x less likely to get paid if you have more than 4 people on the invoice. We see everyone open and look at the invoice but nobody claims responsibility and pays it.

- If you haven’t been paid within 90 days, only 18% of those invoices get paid. So don’t plan on having that invoice get paid at all.

What Format Should Invoices Be Sent

There are more than enough invoice templates available for you to choose from – whether it’s Word, Excel or from popular accounting software companies. But, what is the absolute best format for your invoice?

As mentioned earlier, every invoice should include:

- A professional header

- Your client’s information, as well as yours

- Itemized list of services/goods

- Your terms and conditions

- Your accepted forms of payment

- Invoice number

- Thanking them for their payment

But, what the actual design is up to you. Many online invoices now give you the ability to customize the invoice design or add a logo to your invoice. This is important because it gives you the opportunity to spread your brand’s awareness and illustrate that you’re a professional. Another way to think of this is having an excellent dinner at an upscale restaurant. The food, service, and ambience were all top-notch. The bill, however, was printed on cheap paper with ink that was barely. That may change your opinion of the restaurant just a bit.

Remember, your invoice reflects you and your brand. Illustrate that you care about the details and that you take pride in work by sending a beautifully designed invoice. Through software provided by our company Due, you can easily create and send an amazing invoice that best suits your brand. You can also upload your invoice to enhance your brand’s voice.

Invoice Template Examples:

Here is an example of how an invoice would appear if using a template from Due

Word Invoice Template

If you are using Word to create your invoices, here is a template for you to use.

Excel Invoice Template

If you are using Excel to create your invoices, here is a template for you to use.

Updated July 2020