Customers, entrepreneurs, and financial institutions have all felt the impact of FinTech over the last several years. In fact, it’s banks are expected to invest more than $20 billion on technologies by 2017. RegTech is one of the more recent technologies involved in the FinTech revolution.

In this article, we’re going to define RegTech, share its origins, and explore how it’s going to impact and benefit both customers and businesses.

Table of Contents

ToggleWhat is RegTech?

The Financial Conduct Authority (FCA), a regulatory body in the United Kingdom, describes RegTech as the “adoption of new technologies to facilitate the delivery of regulatory requirements.”

“I would define it as technological advancement that assists those focused on compliance and regulatory-related activities in their professions,” Kari Larsen, counsel at Reed Smith LLP in New York, and formerly in the Enforcement Division of the Commodity Futures Trading Commission, tells Bloomberg BNA. “So making it easier, swifter, more complete, more efficient to monitor compliance and regulatory obligations.”

Alan Meaney (CEO of FundRecs) further explains in a Deloitte report that “Like FinTech, PayTech, and many other combinations of XXXTech, RegTech is another example of an industry that is being changed rapidly by software. There has been technology used at various levels in the Regulatory space for over 20 years. However, what the new RegTech label recognises is that the gap between software and non-software enabled services has widened significantly.”

Javier Sebastián, BBVA Research’s expert in digital regulation, adds that companies who are “harnessing the capabilities enabled by new technologies such as cloud computing, big data, and cryptocurrency and blockchain, are devising solutions to help companies across all sectors of activity ensure that they comply with regulatory requirements. In the financial sector, regtech is deemed a subarea of what is generically known as fintech.”

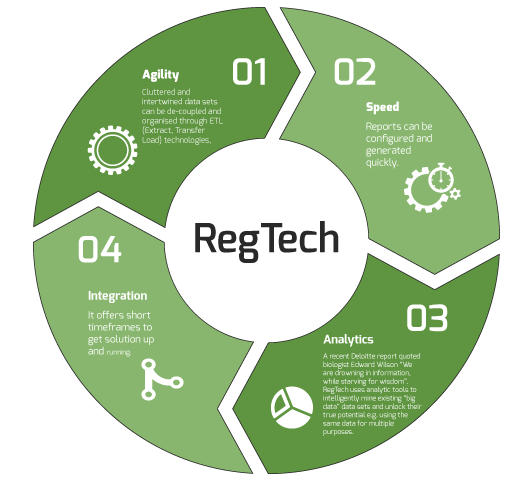

Despite the fact that technology has been used to address regulatory requirements, RegTech, according to Deloitte, is an exciting development that contains the following characteristics:

- Agility – Cluttered and intertwined data sets can be de-coupled and organised through ETL (Extract, Transfer Load) technologies,

- Speed – Reports can be configured and generated quickly.

- Integration – It offers short timeframes to get solution up and running.

- Analytics – A recent Deloitte report quoted biologist Edward Wilson “We are drowning in information, while starving for wisdom”. RegTech uses analytic tools to intelligently mine existing “big data” data sets and unlock their true potential e.g. using the same data for multiple purposes.

As the Deloitte report continues, “Data is meaningless unless it is organized in a way that enables people to understand it, analyze it and ultimately make decisions and act upon it i.e. by creating consumable information.” Ultimately, RegTech will be use those characteristics and information to enable more efficient and effective regulation and compliance.

The Origins of RegTech

Numerous events led to the development of RegTeech. “The credit crisis of 2008 and the heavy level of financial services regulation that followed created a perfect vacuum of innovation in banks,” writes Falguni Desai in Forbes. “Following the credit crisis, banks have been slapped with several new regulations and dealt heavy fines and penalties for non-compliance.” Because of this, banks have been forced to “pay more attention to their back offices and spend more on compliance and risk management programs than ever before.”

“For many years post-crisis, the only growing area of personnel, of hiring, in banks was in compliance,” Andres Portilla, IIF’s managing director for regulatory affairs, told Bloomberg BNA. By November 2015, the FCA issued a “call for input” on developing regtech. The result? The formation of a RegTech working group by the IIF.

“It’s not a coincidence that we are seeing things more in regtech and in fintech at the same time,” says Bart van Liebergen, IIF’s associate policy adviser for regulatory affairs and also a member of the working group. “We are seeing improvements in technology across the board — and we are seeing them used, on the one hand, in new funding models, and on the other hand, ventures are saying, ‘Hey, we can use this in compliance as well.’

What technologies are essential in a RegTech solution?

There are a wide variety of technologies being used in RegTech solutions. However, as Sebastián points out, “they all need to be cloud-based.” This will “ensure that they are responsive and flexible enough.This includes big data and data visualization techniques as well as blockchain technologies used as immutable ledgers of shared information.

Other applicable technologies, according to Bloomberg BNA, include machine learning, “biometrics, the interpretation of unstructured data such as e-mails and Facebook posts, and the use of application programming interfaces (APIs).” These tools will be used for “aggregating big data, modeling risk for bank stress-testing, monitoring of capital-requirement compliance, updating compliance manuals, improving anti-money laundering and know-your-customer (KYC) programs and preventing fraud and in-house violations.”

BBVA Research noted some other technologies involved in RegTech. For example, there is data mining and analytics tools, such as machine learning, computational statistics, complexity and statistical physics algorithms (also known as deep learning). Visualization tools assist in the understanding and reporting of multiple heterogeneous data sources while not requiring programming skills. Then there is real-time and system embedded compliance/risk evaluation tools to enhance operational efficiency and effectiveness. Software integration tools may soon allow those off-the-shelf accounting and compliance tools to interact directly with regulatory reporting systems. Predictive coding as well as open platforms and networks that are used for data sharing and format standards are also considered integral technologies for RegTech.

The RegTech ecosystem

For a RegTech solution to be successful, collaboration between the following players will be essential so that barriers like forming a common solution, establishing a set of standards, understanding complex regulations, and help firms and regulators “build more efficient, automated, compliance processes,” as opposed to “solely on the next deadline rather than examining the interlinkages between them” can be overcome. There are a number of stakeholders involved in the RegTech ecosystem:

- Regulators will open dialogue and gather market views in order to promote innovation and create common integrated standards.

- RegTech firms will develop solutions to meet the needs of businesses and regulators.

- Professional services firms will be responsible for “driving cohesion of regulatory standards, institution needs and vendor solutions” as well as connecting providers and users.

- Financial institutions will adopt and develop RegTech solutions.

When these parties work together, the will be able to drive innovation within the RegTech industry, develop advanced data analytics capabilities, and reduce the cost of compliance in financial services. In fact, banks are already using technological tools so that they can meet regulatory requirements. For regulators, when they become of the benefits, they will also embrace RegTech solution.

The benefits of RegTech

As EY’s 2015 Global Governance, Risk and Compliance Survey found, “adoption of RegTech will provide operational efficiencies and cost benefits when applied to current compliance and risk management practices” in the short term. RegTech will solutions will do the following:

- Drive “down the cost of compliance by simplifying and standardising compliance processes through automated mapping of regulatory risks to key business processes, thereby reducing the need for manual and duplicate checks.”

- Utilize “sustainable and scalable solutions, allowing for flexibility and growth as business needs change.” This will help enterprises “move away from rigid enterprise risk management systems.”

- Assist firms “proactively identify risks and issues” by using “scenario analytics and horizon scanning for new regulations.”

- Allow “controls and risk frameworks to be linked seamlessly” when RegTech solution work with enterprise-wide governance and risk and control platforms.

“In the long term, the key benefit of RegTech will be its ability to enable innovation while enhancing consumer confidence through better customer experience,” the survey reports. “New RegTech platforms are also expected to allow seamless compliance reporting.”

More specifically, RegTech will provide the following long-term benefits. First, the customer experience will become enhanced thanks to the development of a robust fraud platform that will keep their financial information secure. Second, these same technologies will be used “to protect the financial health of institutions and prevent disruption of market agility and integrity. Third, there will be improved governance due to “transparency and proactive reporting of risks and compliance.” Finally, early adopters will set trends and gain insights so that they’ll gain a competitive edge.

“Direct benefits are going to be mainly linked to improvements in customer identity management, fraud control – essentially in connection with payment methods – which will ultimately lead to safe end-customer operations,” says Sebastián. “This benefit will also ripple across other areas of the organization, allowing to improve control over internal processes and reduce potential errors that may result in a regulatory breach, compromising customer protection. He also noted that RegTech solutions will also develop a “more transparent and controlled global financial system, making it harder, if not impossible, for a financial crisis to occur as a result of deficiencies in this area.”

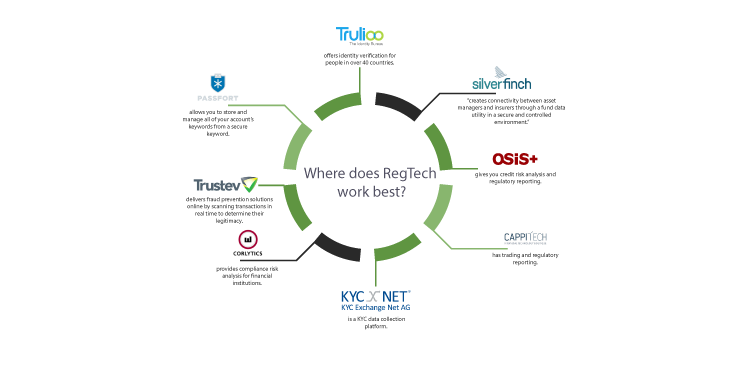

Where does RegTech work best?

Deloitte has found that RegTech solutions work best in “information based obligations and risk identification and management tools that include tools for legislation and regulation gap analysis, compliance, health checks, management information, transaction reporting, regulatory reporting, activity monitoring, training, case management and risk data warehouses.

Top Regtech Companies:

- Trulioo offers identity verification for people in over 40 countries.

- Silverfinch “creates connectivity between asset managers and insurers through a fund data utility in a secure and controlled environment.”

- Passfort allows you to store and manage all of your account’s keywords from a secure keyword.

- Trustev delivers fraud prevention solutions online by scanning transactions in real time to determine their legitimacy.

- Corlytics provides compliance risk analysis for financial institutions.

- KYC Exchange is a KYC data collection platform.

- Cappitech has trading and regulatory reporting.

- OSIS gives you credit risk analysis and regulatory reporting.

There are some specific examples of how RegTech can assist in certain types of business applications. For example, RegTech can provide real-time transaction monitoring in order to address certain anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. Since there is no one global payments standard, it can be difficult to identify suspicious transactions that occur across borders. Until that happens, RegTech companies can offer a solution in the form of platforms that bridge the communications gap between various types of systems to facilitate the compliance process.

Identity verification is another area where RegTech works best. It’s important to ensure that customer due diligence (CDD) is fulfilled by using methods like the know your customer (KYC) process. The Financial Action Task Force (FATF) has developed a set of KYC standards, but they tend to be implemented differently from country to country. RegTech solutions can use different forms of online identity verification to assist in this process.

Another application is that RegTech businesses can help financial services companies to stay current in regards to new regulations so they remain compliant. Until the emergence of RegTech this has always been challenging because multinational financial institutions tend to operate in several jurisdictions. To assist, RegTech businesses can track regional and country regulatory changes as well as conduct internal audits to make sure that companies are complying with the most current requirements.

Where is RegTech headed?

For RegTech to be successful now and into the future, it must be fully supported by governments and regulators all over the world. The UK is taking the lead to encourage the rest of the world to follow suit. In 2015, the UK announced that the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), two of the UK’s primary financial regulators, would support widespread adoption of RegTech.

In fact, the Financial Conduct Authority (FCA) has conducted research that shows that blockchain and biometrics could be the driving forces that really expand the UK’s RegTech industry. They reported that biometric technology could serve as a more efficient way to verify identity and work in collaboration with other technologies. For RegTech to work within the UK, it was believed that organizations like the FCA needed to be more engaged and collaborate more within the industry as well as introduce a certification process for those that wanted to be involved in RegTech.

Other emerging RegTech trends also provide a picture of where it may be headed in the near future. There are considerable opportunities for RegTech as it is anticipated that regulation will only continue to increase with more demand to oversee data, reporting, and operational processes. Fund managers and banks are also looking at supporting and partnering with RegTech startups to address the growing regulatory and compliance demand as well as assist in spreading adoption of RegTech solutions for payments and governance.

Since more RegTech technology is cloud-based, it opens up more chances for startups to offer these solutions, creating a low barrier to entry and helping to spread its application around the world. Global financial organizations are intent on helping RegTech companies who may solve their issue of multiple locations and various compliance issues in each market. Overall, the belief is that RegTech will only continue to grow around the world with these trends and the need to address the various challenges that have been addressed here.