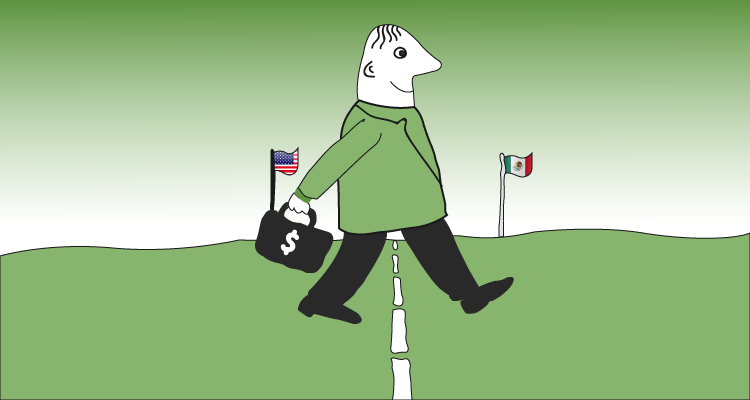

More people moving and interacting with others in various countries. Hence, it’s not surprising that an effective solution for moving money around the world continues to be in greater demand. The go-to option for international wire transfers has typically been to visit your bank. However, while a financial institution can provide international wire transfers, it doesn’t make them the best way to move money around the world. This is mostly because they often tack on some exorbitant transfer fees and lower exchange rates.

Other Options for International Wire Transfers

This means searching for other ways to send an international wire transfer like an online money transfer provider or other online payments company. Some factors to consider include the exchange rate, transfer fees, transfer method and processing time. If you can save time and money while getting the best exchange rate, you have reached an ideal method for conducting an international wire transfer.

The best global wire transfer is the one that fits your specific needs. There are some key differences between companies and the type of international wire transfer you select. For example, you might be able to do a forward contract. This means you can lock in a current exchange rate for a future transaction. However, you may only be able to do a transfer at the current exchange rate available.

Other companies may provide a feature where you can schedule recurring international wire transfers. Some companies want you to use money from your account. Others have the option of using a credit card to fund the international wire transfer.

Factors to Consider

Other things to consider are the ways the recipient can access the funds you send. While some companies only allow for bank account transfers, others will let recipients pick up the funds from different branch locations. There are also differences in terms of how fast your recipient can access the money you are wiring them. The timing can be minutes to many business days.

Doing research can help you get the best international wire transfer experience possible. Take the time to look at each company and compare exchange rates. Examine fee structures, including whether it is a flat fee or based on a percentage of the amount of money you are wiring. Other factors to consider include the maximum and minimum amounts you are allowed to transfer, any special offers or promotions, and the fine print that may list additional fees.

While you want the best value for money, other components like security, service, and reliability are also important to consider. Security is especially important in lieu of numerous money transfer scams, data breaches, and other fraud common among today’s financial transactions. When doing research, consider online review sites that offer insights on the performance and value of each international wire transfer company. Also, review company websites to see how much you can learn about their wire transfer process.

After considering all these factors, you most likely will realize that transfer services are the best way to handle an international wire transfer. Many of these services work for both B2B and P2P transactions. Transfer service offerings provide online and mobile access to complete these international transactions.

A Cross-Border Payment Option

By cutting out this middleman from the transaction like TransferMate does for its clients, you get better service, speed, and costs. Therefore, it is a much better match for your needs. To learn more about how Transfermate’s international wire transfer service works, click here.