Have you ever thought, “I’ll start investing when I have more money?” If so, let’s put an end to that mindset. In just five easy steps, I’ll show you how to turn $5, the price of an expensive coffee, into $1 million.

This isn’t a gimmick or get-rich-quick scheme. It’s not a lottery ticket. Rather, it’s math, mindset, and compound interest — the single most powerful way to build wealth.

So grab that $5, and let’s break it down.

Table of Contents

ToggleStep 1: Get $5 (Seriously)

It doesn’t matter if you have to check under the couch cushions, raid your car’s console, go through the pockets of coats, or sell something you don’t need. Your mission, if you choose to accept it, is to find five bucks.

Why start so small? When it comes to investing, the hardest part is not finding money, but getting started.

The majority of people never begin investing because they believe it requires thousands of dollars. In reality, you can get started with almost nothing. As soon as you save your first $5, your mindset changes. You start thinking like an investor.

That mental shift is where wealth begins.

Step 2: Repeat Step 1 (Every Day)

Having found your first $5, let’s make it a habit.

For the next 30 days, save $5 every day. By the end of the month, that’s $150.

Sounds simple, right? However, most people think it’s too small to matter, so they don’t pay attention. The truth? What separates those who dream of wealth from those who build it is their daily discipline.

If you want to find your $5 each day, here are a few painless ways:

- Brew coffee at home instead of buying it.

- Pack lunch twice a week.

- Skip one streaming service — you probably don’t need five.

- Sell an old gadget collecting dust or clothing you no longer wear.

As long as you make this a habit, you’ll save money without changing your lifestyle.

Step 3: Invest Your $150 Every Month

Having built a habit of saving, it’s time to put your money to work.

Saving money is a good thing. Investing, however, multiplies it.

Historically, the U.S. stock market returns 8–10% per year on average. For this example, we’ll use 10%. Even though that might not seem like much, it adds up over time.

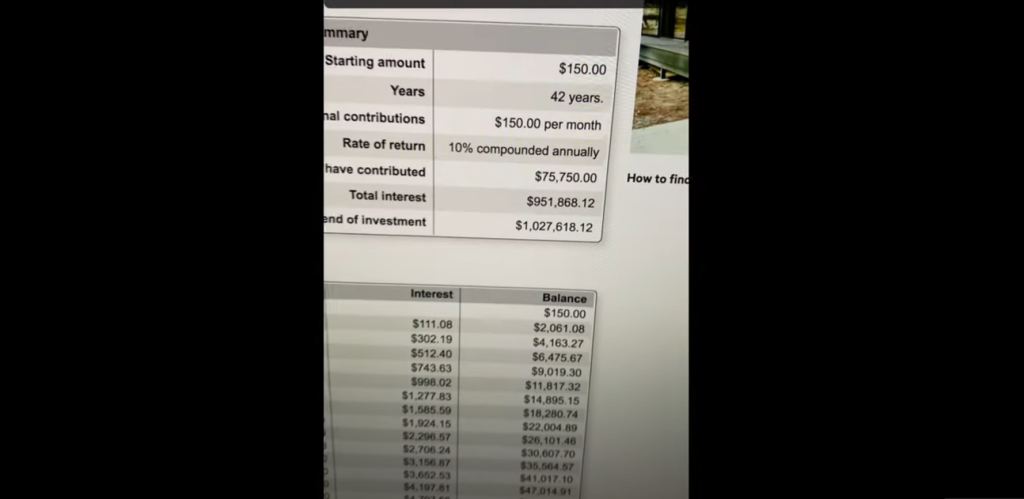

With a 10% annual return on $150 per month, you’ll have $1,027,618.12 at the end of 42 years.

Yes, you read that right. One million dollars. From $5 a day.

There’s no complicated strategy or day trading involved. Time and consistent investing are all you need.

Step 4: Forget About It (and Let Compound Interest Work Its Magic)

One of the great things about compound interest is that you can almost forget about it once you start.

For 42 years, you invested $150 every month. There is no need to monitor the market every day. There’s no need to panic when prices drop (because they will). You just have to stay consistent.

Think of your investments as a slow cooker. Set it, forget it, and let time handle the rest.

To give you a sense of perspective:

- In 10 years, you’d have around $28,000.

- After 20 years, you’d have around $114,000.

- At the end of 30 years, about $317,000.

- After 42 years… over $1 million.

There is one magic ingredient: time. By starting early, you will require less investment to achieve your goals. For the same savings goal, you’ll need to save significantly more each month if you wait even five years.

So don’t wait for the “perfect” moment — just start.

Step 5: Open an Investment Account (and Get Free Stocks While You’re At It)

Are you ready to make this a reality? Now is the time to open an investment account.

There are tons of great platforms out there, such as M1 Finance, Robinhood, Fidelity, and Webull.

Even better? New users can receive free stocks or cash bonuses from several investing apps. That’s like getting paid to start investing. For example, if you open and fund a SoFi Active Invest account today, you could get up to $3,000 in stock

You can set up automatic transfers of $150 per month or whatever amount you like once your account is open. It should be automated so that it doesn’t require your attention. When it’s on autopilot, consistency is easier.

Next, try something simple like:

- Low-cost index funds, like S&P 500 ETFs

- Dividend-paying stocks

- Or a robo-advisor if you want a hands-off approach

You don’t need to know everything about investing to get started. All you have to do is take that first step and keep going.

The Real Lesson: Wealth Is Built on Habits, Not Windfalls

Here’s what I hope you take away from this:

The secret to becoming a millionaire isn’t luck. It’s all about habits.

To build wealth, many people believe they need a big salary, a business, or an inheritance. However, small, consistent actions lead to massive results over time.

It may not make a difference in your life this month if you save $5 a day. Over the years, though? It can provide you with freedom, security, and options that most people can only dream of.

Remember, your first $5 investment isn’t just about money. The goal is to prove to yourself that you are capable of taking control of your financial future.

Once you do that, you’re no longer just a saver. You’re a wealth hacker.

Final Thoughts: Don’t Wait. Start Today.

I challenge you to do the following:

Find $5 today, yes today. Open an investment account. Set up your first recurring transfer.

Don’t wait until you’re “ready.” You’ll never feel 100% ready to invest. Compounding loses its power every day you wait.

$5 might seem small, but it is the seed of something much bigger.

After a while, when you start adding zeros to your account balance, you’ll look back and realize-this is where it all started.

FAQs

Do I really need 42 years to reach $1 million?

Not necessarily. With time and consistency, the math works. By increasing your monthly contributions or earning higher returns, you can get there faster. In any case, staying consistent and starting early are the most essential principles.

What if I can’t save $5 every day?

If necessary, start small. Even $2 or $3 a day adds up. Initially, build the habit, then increase it as your income rises.

What’s the best beginner investment for this plan?

Low-cost S&P 500 index funds are hard to beat. In addition to providing immediate diversification, it aligns with the market’s long-term performance.

Why does time beat timing?

A lot of people try to “time the market.” They want to buy or sell at just the right time. However, time in the market always beats timing it.

The longer you keep your money invested, the more it compounds. Every dollar earns interest, and that interest earns interest. It’s exponential growth, and it’s how ordinary people quietly earn millions.

The best part? It doesn’t require expertise. Consistency is all you need.

What’s the biggest mistake new investors make?

Quitting too early. When the market dips or growth feels slow, people panic. Real wealth is built by investing and letting compound interest do the work.