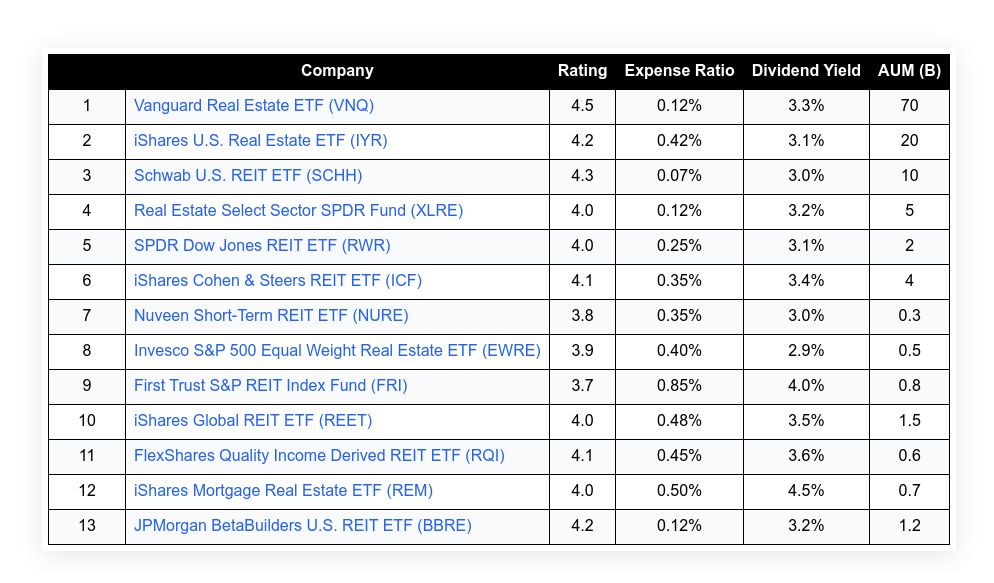

This list provides investors with a selection of 13 REIT ETFs that may be suitable for long-term retirement portfolios. The list is designed to guide investors toward products with attractive yields, reasonable fees, and stable asset management. REIT ETFs offer access to diversified property investments, consistent income, and a mix of growth and value strategies. The evaluation follows clear and measurable criteria to support informed decisions. The key factors used to assess these ETFs include:

- Expense Ratio

- Dividend Yield

- Fund Size (AUM)

- Recent Performance

- Market Coverage

Each option is ranked and reviewed based on these factors to help investors choose the product that aligns best with their retirement strategy.

Table of Contents

ToggleTop 13 Reit Etfs For Retirement

| Company | Rating | Expense Ratio | Dividend Yield | AUM (B) | |

|---|---|---|---|---|---|

| 1 | Vanguard Real Estate ETF (VNQ) | 4.5 | 0.12% | 3.3% | 70 |

| 2 | iShares U.S. Real Estate ETF (IYR) | 4.2 | 0.42% | 3.1% | 20 |

| 3 | Schwab U.S. REIT ETF (SCHH) | 4.3 | 0.07% | 3.0% | 10 |

| 4 | Real Estate Select Sector SPDR Fund (XLRE) | 4.0 | 0.12% | 3.2% | 5 |

| 5 | SPDR Dow Jones REIT ETF (RWR) | 4.0 | 0.25% | 3.1% | 2 |

| 6 | iShares Cohen & Steers REIT ETF (ICF) | 4.1 | 0.35% | 3.4% | 4 |

| 7 | Nuveen Short-Term REIT ETF (NURE) | 3.8 | 0.35% | 3.0% | 0.3 |

| 8 | Invesco S&P 500 Equal Weight Real Estate ETF (EWRE) | 3.9 | 0.40% | 2.9% | 0.5 |

| 9 | First Trust S&P REIT Index Fund (FRI) | 3.7 | 0.85% | 4.0% | 0.8 |

| 10 | iShares Global REIT ETF (REET) | 4.0 | 0.48% | 3.5% | 1.5 |

| 11 | FlexShares Quality Income Derived REIT ETF (RQI) | 4.1 | 0.45% | 3.6% | 0.6 |

| 12 | iShares Mortgage Real Estate ETF (REM) | 4.0 | 0.50% | 4.5% | 0.7 |

| 13 | JPMorgan BetaBuilders U.S. REIT ETF (BBRE) | 4.2 | 0.12% | 3.2% | 1.2 |

Vanguard Real Estate ETF (VNQ)

Vanguard Real Estate ETF (VNQ) offers stable income and broad exposure to U.S. real estate. The fund provides access to a variety of real estate investment trusts, making it a popular choice for retirement portfolios. Investors find comfort in its low fee structure and extensive trading volume. With a long history of steady performance, VNQ stands out for reliability and consistent payouts. The ETF focuses on quality assets that sustain dividends and capital growth over time.

Expense Ratio: 0.12%

Dividend Yield: 3.3%

AUM: $70B

Performance: 8% (1-Year)

| Summary of Online Reviews |

|---|

| “Steady income and low fees,” many users note its consistent return track record. |

iShares U.S. Real Estate ETF (IYR)

iShares U.S. Real Estate ETF (IYR) is known for its wide market exposure and reliable dividend income. Investors appreciate its balanced focus on income generation and capital appreciation. The ETF holds a diversified mix of properties, rooted in a strong underlying index. Its managed approach keeps expense levels reasonable. The fund attracts investors who value both liquidity and steady growth.

Expense Ratio: 0.42%

Dividend Yield: 3.1%

AUM: $20B

Performance: 7% (1-Year)

| Summary of Online Reviews |

|---|

| “Offers diverse exposure,” users value its balanced mix and consistent yield. |

Schwab U.S. REIT ETF (SCHH)

Schwab U.S. REIT ETF (SCHH) is a favored option among cost-conscious investors. It emphasizes low fees and reliable income. The ETF tends to attract those who prioritize affordability and steady dividend payouts. Its portfolio includes a mix of established REITs that support long-term income. The fund is noted for its ease of trading and attractive operational structure.

Expense Ratio: 0.07%

Dividend Yield: 3.0%

AUM: $10B

Performance: 7.5% (1-Year)

| Summary of Online Reviews |

|---|

| “Low costs drive appeal,” with many investors praising its fee structure. |

Real Estate Select Sector SPDR Fund (XLRE)

Real Estate Select Sector SPDR Fund (XLRE) provides exposure to a focused set of U.S. real estate stocks. The fund aims to track a specific index with a strong focus on large, reliable real estate companies. Its structure supports regular income and balanced growth. The ETF is appreciated for its straightforward approach and moderate fees. Investors find that XLRE offers focused market access with a clear dividend policy.

Expense Ratio: 0.12%

Dividend Yield: 3.2%

AUM: $5B

Performance: 7% (1-Year)

| Summary of Online Reviews |

|---|

| “Focused and efficient,” reviews highlight its simple and direct approach. |

SPDR Dow Jones REIT ETF (RWR)

SPDR Dow Jones REIT ETF (RWR) seeks to reflect the performance of established real estate stocks. Its portfolio is designed for investors who value income and market exposure. The fund distinguishes itself with a focused strategy on dividend-paying properties. Although its fee is moderately higher compared to some peers, it offers access to a solid selection of real estate investment trusts. The ETF meets the needs of investors who look for steady income and manageable risk.

Expense Ratio: 0.25%

Dividend Yield: 3.1%

AUM: $2B

Performance: 6.5% (1-Year)

| Summary of Online Reviews |

|---|

| “Solid selection of REITs,” users generally appreciate its targeted focus. |

iShares Cohen & Steers REIT ETF (ICF)

The iShares Cohen & Steers REIT ETF (ICF) is known for a concentrated portfolio of leading real estate stocks. It is suited for investors seeking focused exposure to a select range of REITs. The fund has a balanced approach that supports both yield and moderate growth. Its fee structure remains acceptable given the specialized selection. ICF has earned attention for its consistent income payments and targeted market strategy.

Expense Ratio: 0.35%

Dividend Yield: 3.4%

AUM: $4B

Performance: 7.2% (1-Year)

| Summary of Online Reviews |

|---|

| “Focused and reliable,” investors enjoy its steady dividend stream. |

Nuveen Short-Term REIT ETF (NURE)

Nuveen Short-Term REIT ETF (NURE) focuses on real estate investments with shorter durations. With an emphasis on stability, the fund supports income generation while reducing interest rate exposure. Its risk profile is well suited for those who prefer lower volatility. Though the asset size is smaller than many competitors, its strategy has earned favorable reviews for reliability. The ETF provides a niche approach in the broader market of REIT investments.

Expense Ratio: 0.35%

Dividend Yield: 3.0%

AUM: $0.3B

Performance: 5.8% (1-Year)

| Summary of Online Reviews |

|---|

| “Good choice for conservative investors,” remarks point to its lower-risk profile. |

Invesco S&P 500 Equal Weight Real Estate ETF (EWRE)

Invesco S&P 500 Equal Weight Real Estate ETF (EWRE) provides balanced exposure by weighing all securities equally. This method reduces concentration risk and supports a steady income stream. The fund is appealing to investors who value balanced representation among its holdings. Its structure favors equal treatment of companies, which in turn supports fairness in returns. EWRE is considered a solid option for investors looking to diversify their real estate investments.

Expense Ratio: 0.40%

Dividend Yield: 2.9%

AUM: $0.5B

Performance: 6.0% (1-Year)

| Summary of Online Reviews |

|---|

| “Equal weight benefits,” reviewers appreciate the fair distribution among holdings. |

First Trust S&P REIT Index Fund (FRI)

First Trust S&P REIT Index Fund (FRI) offers exposure to a broad set of REITs that pay higher yields. The fund suits investors who seek income with a higher expense ratio than some peers. Its targeted index strategy makes it a fit for those willing to trade a slightly higher fee for enhanced income potential. FRI is recognized for offering straightforward income generation and a selection of well-established real estate stocks.

Expense Ratio: 0.85%

Dividend Yield: 4.0%

AUM: $0.8B

Performance: 5.0% (1-Year)

| Summary of Online Reviews |

|---|

| “High dividend yield appeals,” feedback highlights its attractive income potential. |

iShares Global REIT ETF (REET)

iShares Global REIT ETF (REET) covers property markets across several countries. Investors gain exposure to global REITs along with steady dividend payments. The fund provides an international perspective, allowing for diversification beyond domestic markets. Its management team keeps fees in check while delivering consistent results. REET makes a good option for those who value international market exposure combined with stable income.

Expense Ratio: 0.48%

Dividend Yield: 3.5%

AUM: $1.5B

Performance: 6.3% (1-Year)

| Summary of Online Reviews |

|---|

| “Diverse global mix,” users report satisfaction with its broad international reach. |

FlexShares Quality Income Derived REIT ETF (RQI)

FlexShares Quality Income Derived REIT ETF (RQI) is designed for those who seek a balance of income and risk management. The ETF selects investments that generate steady returns. Its approach emphasizes quality and income generation from a portfolio of reliable REITs. Investors often praise its careful selection method and reasonable fees. RQI has built a reputation for moderate growth paired with attractive yield options.

Expense Ratio: 0.45%

Dividend Yield: 3.6%

AUM: $0.6B

Performance: 6.8% (1-Year)

| Summary of Online Reviews |

|---|

| “Solid balance of income and risk,” investors appreciate its steady approach. |

iShares Mortgage Real Estate ETF (REM)

iShares Mortgage Real Estate ETF (REM) gives exposure to mortgage-related real estate investments. The ETF appeals to those seeking higher dividend yields. Its portfolio includes mortgage REITs that typically pay above-average dividends. While the risk profile is slightly different from traditional REIT ETFs, many investors find its yield attractive. REM is valued for its solid income generation and steady market presence.

Expense Ratio: 0.50%

Dividend Yield: 4.5%

AUM: $0.7B

Performance: 6.0% (1-Year)

| Summary of Online Reviews |

|---|

| “Attractive yields for mortgage REITs,” many investors commend its income focus. |

JPMorgan BetaBuilders U.S. REIT ETF (BBRE)

JPMorgan BetaBuilders U.S. REIT ETF (BBRE) is tailored for investors seeking well-managed exposure to the U.S. real estate market. The fund is known for its balanced focus on both income and growth. Its management leverages a disciplined strategy that emphasizes quality investments. With a competitive expense ratio and steady dividend yield, BBRE offers a reliable option for retirement portfolios. The ETF provides a trusted pathway for investors who value disciplined management and clear objectives.

Expense Ratio: 0.12%

Dividend Yield: 3.2%

AUM: $1.2B

Performance: 7.0% (1-Year)

| Summary of Online Reviews |

|---|

| “Well-managed with clear strategy,” users praise its disciplined approach. |

Final Thoughts

Investors have a range of REIT ETFs to consider for their retirement portfolios. Each product offers distinct benefits in terms of fee structure, yield, and market exposure. The selections here present options for varying risk profiles and income objectives. This guide uses clear measures such as expense ratios, dividend yields, and assets under management to aid decision-making. The ETFs reviewed provide solid income and steady performance, making them noteworthy choices. Investors should study each option and assess which product aligns best with their long-term financial goals.