You know those videos where something you didn’t know existed blew your mind?

My experience was exactly the same when I discovered some basic money hacks that led to me becoming a millionaire. Sadly, I had to learn these money hacks the hard way.

The good news is that I’m going to share them with you so you won’t have to make the same mistakes. As a result, these six money hacks will help you save money, build wealth, and become a millionaire.

So, what are we waiting for? Let’s dive in.

Table of Contents

Toggle1. Understand compound interest.

My first money hack is understanding compound interest.

Perhaps you don’t consider compound interest a money hack. However, those who understand its power truly understand its significance. If that describes you, then you’re already headed for millionaire status.

How powerful is compound interest? In the opinion of Albert Einstein, one of the smartest people of all time, compound interest is the eighth wonder of the world. According to Einstein, “Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t, pays it.” The math behind this quote shows that it’s not an exaggeration at all.

What if I offered you the option of an immediate cash payment of one million dollars or a magic penny that doubled every day for 30 days?

It’s natural for people to jump at the first million-dollar deal they see. However, if you double your penny for 30 days, you’ll be surprised to see that on day 30, your penny will be worth over $5,000,000.

Let me give a more specific example.

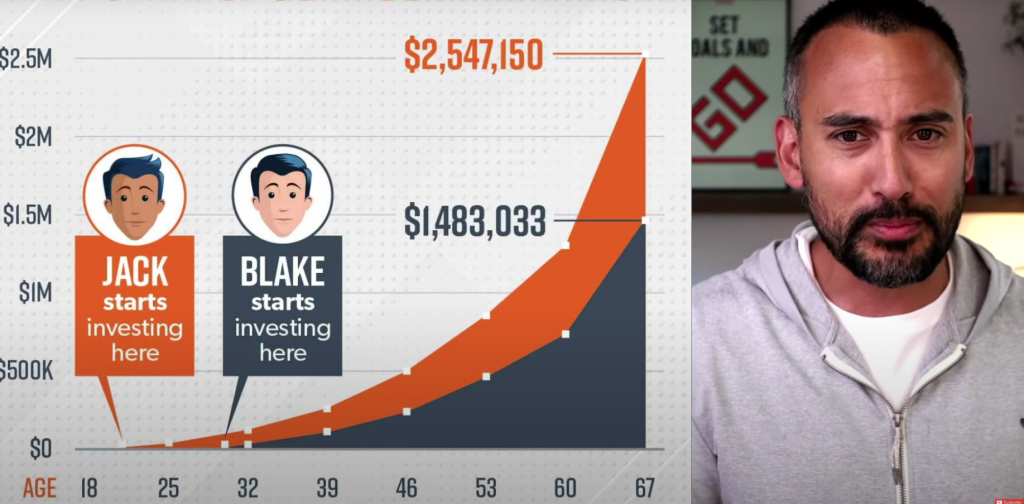

So, we have brothers named Jack and Blake.

Jack began investing at the age of 21 and contributes $2,400 per year. At the age of 30, Jack decides he no longer wants to invest, so he stops contributing.

Blake, on the other hand, is a bit of a procrastinator. As a result, he starts investing $2,400 a year when he is 30 years old. However, he does so for the next 37 years until he turns 67.

I’m going to assume that they are making a return of 11.6%, which is in line with the S&P 500. As a recap, Jack started at 21 and stopped at 30. So he has put in $21,600 of his own money. Keeping up the pace, Blake puts in $91,200 to make up for the lost time.

Who has the most money at 67?

At first, you might think it’s Blake. After all, he’s saved over $91,000 in 37 years. And, altogether, he’s got a cool $1.48 million. Jack, however, has over $2.5 million dollars. How? Because he started earlier than Blake.

And that my friends, is why Albert Einstein was infatuated with compounding interest

2. Set a reminder to check your credit report.

Another money hack that I wish I had known was setting reminders to check my credit report. But it’s stupidly easy to set a reminder nowadays. All you have to do is say Hey, Siri, Google, or Alexa, remind me to check my credit report.

Why are reminders such a big deal? According to reports, 34% of Americans have errors on their credit reports. We’re talking about one out of three. And I was one of them once upon a time.

Back when I was living in California, I joined a gym. It cost me about $20 a month. I then moved to the Midwest, where this particular gym doesn’t have a franchise. Apparently, I thought that moving from California meant I was no longer required to pay for the gym membership. No harm, no foul, right?

That was a costly mistake.

The gym marked me as being delinquent on my credit report. Sadly, I wasn’t aware of this until after I checked my credit report. If you aren’t aware, you can destroy your credit report by not paying a bill.

Due to my delinquency, my credit score suffered. In fact, it was in the lower 600s. Yeah, it was that bad.

Please set a reminder on your phone to go to annualcreditreport.com to check your credit report. Prior to the Covid-19 pandemic, you could request a free report per year. You can now check your credit every single week through the reporting agency.

Does that mean that you need to check your credit report every single week? Of course not. The exception, though, is if you have some sort of identity theft or you know that you have some issues with your credit. But, for most folks, you’ll be fine with checking your credit report once or twice a year.

When you have a good credit score, you can get lower interest rates on credit cards, mortgages, and student loans. Additionally, a lower interest rate means lower payments. You can then throw that extra cash into your savings or investments like a Roth IRA, stocks, bonds, ETFs, or real estate.

How to repair your credit score.

What can you do to improve your credit score? I’ll give you a few pointers to get you started;

- Keep your bills current by paying them on time.

- Maintain an open account. The longer you keep your accounts, the better your credit score will be.

- Use less than 30% of your credit.

- Your score will improve if you keep hard inquiries below 1 every 12 months.

[Related: Single Millionaire: How to Spot a Terrible Money Match]

3. Get your rate verified.

My third hack? Getting my rate verified.

Let me break this down for you.

You receive a Verified Approval when an underwriter reviews and approves your income, assets, and credit. It’s often used when making major purchases, like a home or car.

It’s a pretty straightforward process. Among the items you need to submit are your W-2s, tax returns, pay stubs, and bank statements. If you would like to know exactly what we need for your situation, please speak with a home loan expert.

If you qualify for a verified approval, you can be confident that your loan will close once it is reviewed. As a result of everything being verified, sellers and their agents can also be certain that your loan will close. Having this advantage can make a big difference in a competitive market.

But getting your rate verified is also important when you want to refinance. For instance, I had a friend who was going to refinance his mortgage with the bank he’s been doing business with for over two decades. Luckily, before he signed the paperwork, he checked out the rates from competitors.

His bank wasn’t offering him the best rate. He actually found someone else that was going to give him a quarter of a percent lower. You might think that’s not much. However, we are talking about a mortgage of half a million dollars. That’s around $20,672 in savings.

So if he didn’t get that verified, he would have paid $20,000 more.

A refinance could save you hundreds or even thousands if you have the lowest rate on anything. So, it definitely pays to do some homework before crossing your i’s and t’s.

4. Do a savings challenge.

In high school, I desperately needed money hack number four. As a college student, even more so. In this case, I’m talking about doing a savings challenge.

There are a number of different types of savings challenges. However, let’s first identify the importance of this. Each year, the Federal Reserve Board conducts this study, and in 2021, they found that 35% of Americans could not afford a $400 expense. As a result, they had no cash on hand to cover the unexpected. Their only option was to borrow the money or use a credit card, or just flat-out not be able to pay for this expense.

It sounds unbelievable, doesn’t it? Unfortunately, that’s the truth. There are a lot of people who don’t have enough money to make ends meet.

One way around this is to actually make savings fun. And a savings challenge does just that.

Here’s a story for you. I used to balance my checking account by withdrawing $20-40. Once I got my ATM receipt, I checked the balance to see what I had. Honestly, I probably couldn’t cover a $400 expense, either. And it wasn’t really an effective way to stay on top of my finances.

Suffice it to say, I was all over these money-saving challenges. As soon as I heard about the 52-Week Savings Challenge, I was hooked.

So, how does the 52-week savings challenge work? It’s really quite simple. The first week you save a dollar. The second week, you save $2, the third week, $3, and so on. You saved $52 by the 52nd week.

Sure. Maybe this sounds hokey to you. I’ll tell you something, though. At the end of the challenge, if you stick with it for the full 52 weeks, you will have earned over $1,378. What’s even sweeter? That doesn’t take interest into account.

And guess what else? Say a $400 expense pops up. No worries. You can swing it by withdrawing this cash from the $1,378 you have stashed away.

5. Unsubscribe from retailers.

This is another hack I could have definitely used back in the day. It’s likely you needed it as well.

So, why is this an amazing hack? It’s simply unsubscribing.

What am I talking about here? Getting stuff out of sight and out of mind.

According to reports, 87% of Americans make impulse purchases. Nah. That’s not you, right? Well, think about your last trip to the grocery store. There is no doubt in my mind that you made an impulse purchase. Whether it was a BOGO deal or that candy bar while checking out.

Many factors influence your decision to make impulse purchases, but one of the most significant is having it in your face. In other words, keep it out of sight if you don’t want to make an impulse purchase. That simply means unsubscribing. After all, the average person receives over 100 emails per day!

So, let’s say you bought something from a retailer in the past. They’re going to keep bombarding you with sales and promotions. And, some of the deals can be awfully tempting. It is possible to opt-out of receiving these messages by reporting spam or unsubscribing from all marketing emails.

What if you signed up for an SMS service? You’re getting taxed on the latest deals as well. So, go ahead and block that number.

I get it. It seems like a lot of work. But, many free services will automatically unsubscribe you from all marketing and spam emails that you receive. Some of these services Unroll.me, Sanebox, or Clean Email.

Bonus hack: Follow the S.J.S.P. principle.

What’s the S.J.S.P. Principle? Well, it’s something that I came up with. And it stands for stop justifying your stupid purchases.

So what exactly qualifies as a stupid purchase? Liabilities are like designer sneakers, jet skis, or McMansions.

New cars also fall into this category. Why? As soon as you drive a new car off the lot, its value begins to decrease. According to Carfax, which records automobile histories, their value depreciates by 20% within the first year of ownership.

The smart thing to do is to buy assets instead. Real estate, insurance policies, money, and stocks and bonds are examples of things that appreciate in value over time.