Are you missing out on ways to lower your taxes this year? That often dreaded time of the year is upon us! If you haven’t filed yet, there might be some money-saving moves to make.

Table of Contents

ToggleWays You Can Still Lower Your Taxes for 2021 and Beyond

Of course, we all want to pay less in taxes (legally, of course) but are you actually taking those steps? There might be some deductions available that you’re forgetting. And even better, there are some deductions that can bring you more benefits beyond your tax bill!

So before you close the folder on your stack of tax papers, consider these three ways to lower your taxes for 2021. Keep these recommendations in mind for next year, too!

Lower your taxes with retirement contributions

While the deadline might be closed for 401k contributions for 2020, there are other retirement accounts out there. IRAs (individual retirement accounts) can be opened on an individual basis, and they can certainly help you lower your taxes. You can make contributions to IRAs up until Tax Day, April 15th.

Most retirement account contributions are tax-deductible. Any money you put inside gets subtracted from your taxable income, dollar for dollar. This means the amount of money you are responsible for paying taxes on will be smaller. This means the amount you owe will be smaller too!

The exception to this is the Roth IRA. You do not deduct any contributions you have made to a Roth IRA!

Deducting Traditional IRA Contributions

Opening and funding a traditional IRA is a great way to lower your taxes for the year. The annual limit on this account is $6,000, or $7,000 if you are over age 50. Are you behind on retirement savings and have some money set aside? This might be a good option to explore.

When you contribute $6,000 to a traditional IRA, $6,000 will be deducted from your taxable income. If you are filing your own taxes, you should make sure to have in your records how much you contributed for the year. Didn’t get a form from your custodian or account manager? You can use a recent, accurate statement that shows the amount contributed.

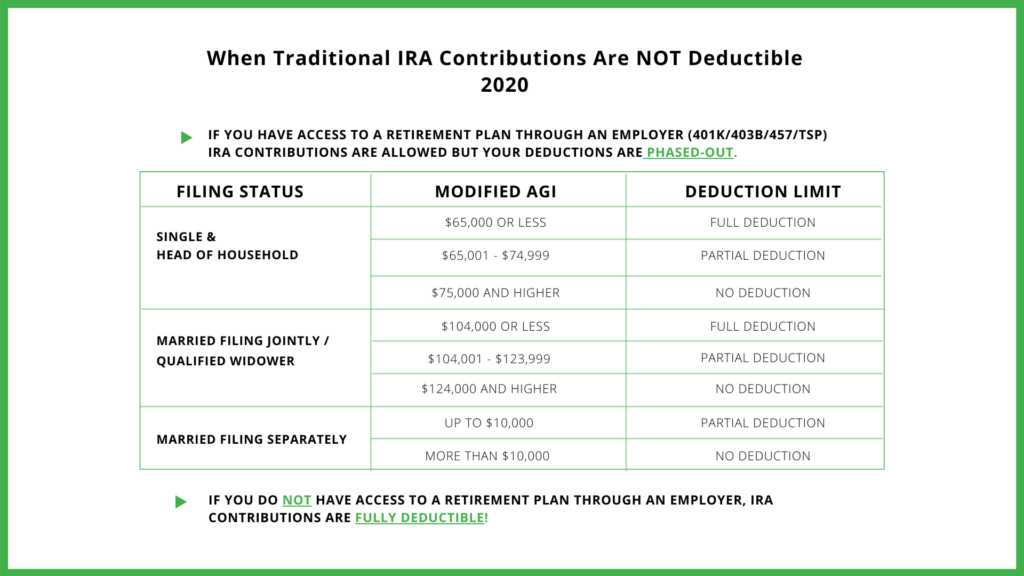

Be aware of the income limitation to whether or not these contributions will be fully deductible! If you have access to an employer plan like a 401k or 403b, you will have to pay attention to this limitation. However, if you don’t have access to an employer plan though, you may contribute and deduct the full annual amount.

Do you have access to a retirement plan at work? Check out the table below before making contributions to a Traditional IRA.

AGI: Adjusted gross income

If you have access to a retirement account through work, and your income puts you in the ‘partial deduction’ or ‘no deduction’ category. You might want to re-consider contributing to this account.

This means your contributions are NOT going to be deducted. Since the money in these accounts gets taxed when you pull it out, that’s basically volunteering for double taxation. Read on for more possible ways to lower your taxes instead!

Lowering taxes with retirement contributions if you’re self-employed

If you are self-employed, chances are you are pretty aware of things you can write off to help lower your taxes. But beyond your software subscriptions, percentage of your internet, home-office, and work-related mileage — what else can help lower your tax bill this year?

Being self-employed means, there are even more IRA options that can help lower what you owe. Consider the SEP-IRA, which you can contribute up to 25% of your self-employment income, to a max of $57,000 for 2020.

These accounts are nearly as easy to set up as a traditional IRA, and they allow you to save more than the $6,000 (or $7,000 if over age 50) limit. Again, you have until April 15th to make contributions for 2020!

The SEP-IRA isn’t the only self-employed option out there! Any contributions to a Solo 401k or a SIMPLE IRA are also tax-deductible. Saving for your future is always a good thing. And when can you get a tax deduction for it? Even better.

Since we are fast approaching tax-filing time, don’t wait for a form confirming any last-minute contributions you make! If you have your taxes done for you, you can bring a recent statement showing your contributions for the year instead. Most retirement account statements will have a section that shows total 2020 contributions, along with any for 2021 as well.

Contribute to your HSA

Contributing to a Health Savings Account, or HSA, is another great way to lower taxes. Granted, not everyone has access to one of these accounts, so if you don’t, don’t feel left out.

One of the requirements of an HSA is to be on a high-deductible health insurance plan, which is not necessarily a good thing. But for people on these plans, HSA’s can be a great way to both prepare for those expensive, high-deductibles, and save some money.

If you have access to an HSA, you should know that all of your contributions are tax-deductible! When you put money inside these accounts, it will be subtracted from your taxable income, just like retirement account contributions. Putting money inside your HSA is a great way to lower your taxes for the year.

If you need more persuasion, there are even more benefits that come with an HSA. You can use the money inside to pay for qualified medical expenses, tax-free. Then, when it is used for medical expenses, that money is not taxed when it comes out.

Because the money in your HSA can also be invested, you are tapping into the power of compounding interest and market gains as well! Any growth inside your account is, again, not taxed, giving you a third money-saving benefit.

Just like Individual Retirement Accounts, HSA’s also have the contribution deadline of April 15th. If you have access to an HSA but have not opened or funded it yet, now is the time!

Donate to charity

What better way to lower your taxes than by helping others? Charitable donations can also be deducted from your taxable income. You should understand the rules for being able to deduct those donations, though.

When you file your taxes, there are two ways you can take deductions. Taking the standard deduction is most common, and it is a straightforward deduction from your income. However, taking the standard deduction typically means you cannot write off donations.

Itemizing your deductions is when you add up all of your possible deductions and deduct those instead of the standard deduction. This method allows you to write off individual donations. While most people opt for the standardized deduction, it’s worth seeing which one will lower the amount you owe the most.

New $300 Charitable Tax Deduction for 2020

As of 2020, there is a special new deduction in place. If you take the standard deduction, you can now deduct up to $300 of charitable contributions. As per the IRS website;

“Following special tax law changes made earlier this year, cash donations of up to $300 made before December 31, 2020, are now deductible when people file their taxes in 2021.

The Coronavirus Aid, Relief and Economic Security (CARES) Act, enacted last spring, includes several temporary tax changes helping charities, including the special $300 deduction designed especially for people who choose to take the standard deduction, rather than itemizing their deductions.”

Prior to this exception, you would only be able to deduct charitable contributions if you choose to itemize your taxes. This means those who opt for the more simple, standard deduction, don’t necessarily see the dollar-for-dollar write-off from their donations.

The new $300 tax deduction allows those who donated throughout 2020 to write off up to $300 of their donations, on top of the standard deduction.

If you donated last year and planned on taking the standard deduction, don’t forget about this new tax deduction! If you donated more than $300 last year, it’s worth running both of your tax scenarios, taking the standard deduction versus itemizing. If you can lower your taxes more by itemizing, that’s the direction to go!

If you want to check to make sure your donations are eligible for deductions, you can use the IRS’s Tax Exempt Organization search tool.

When is it important to lower your taxes?

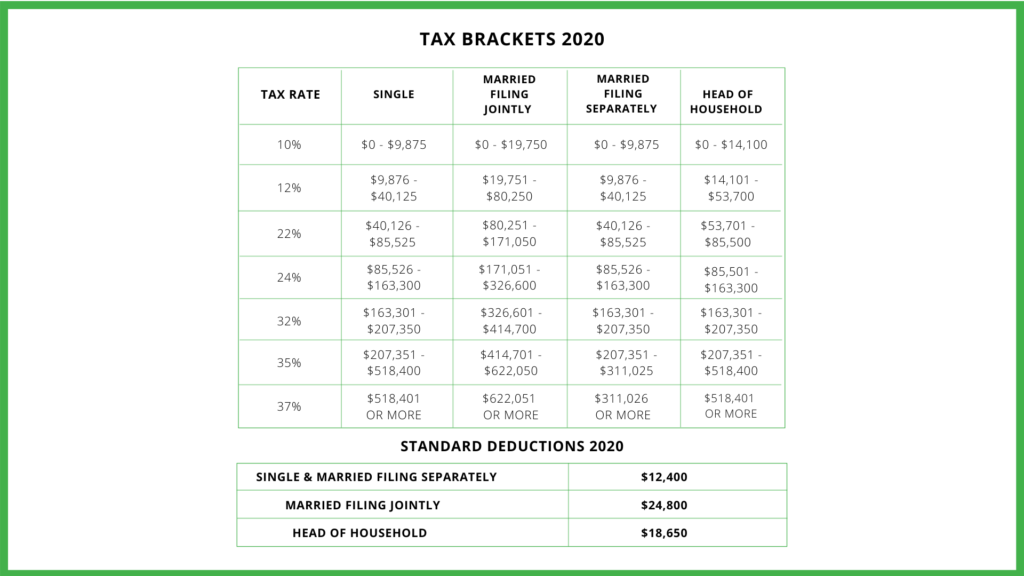

Besides the obvious answer of “always,” people who are teetering on the edge of a tax bracket should pay special attention to these tax-lowering tips. Since the US works with a marginal tax system, our income is taxed at different rates.

If you find yourself just entering a new tax bracket, making a contribution to one of these accounts or donating to charity could be enough to keep you out of the next bracket!

Check out the tax table below for an example.

Once you subtract your deductions, you will arrive at your taxable income. You should use a tax professional or software to find your actual amount, not guess.

Say you are filing as single and find your taxable income at $45,000. This income puts you into the 22% bracket, but just by a few thousand dollars. That means the money in this bracket is going to be taxed at 22%, significantly higher than the previous bracket at 12%.

If you want to avoid paying this higher tax rate on this chunk of money, making a contribution of $5,000 to a traditional or SEP IRA would lower your taxable income by that amount.

After making and deducting that contribution, your taxable income would be $40,000. This would prevent you from entering the higher, 22% tax bracket at all.

This concept works whether you are single, married, filing jointly, filing separately, or head of household. There are situations where this is more beneficial than others, as in the example above. The jump from the 12% to 22% bracket is significant.

However, the jump between the 22% and 24% bracket is less so. It is always nice to lower your taxes, which contributions to an IRA or HSA will do regardless, but be aware of the situations where it is even more useful.

Those that find themselves just entering the 32% bracket, or who are in the higher tax brackets, may find a lot of benefit from this strategy.

What if you already filed your taxes?

If you already filed your taxes but still want to add to any tax-deductible accounts for 2020, you will need to file an amended return. This requires a Form 1040-X. Remember, you have until April 15th, or Tax Day, to contribute to IRAs and HSAs.

This is also the deadline for filing your taxes, so don’t push this too close to the deadline. This year 2021, you have until May 17th to file your individual taxes because of COVID-19.

If you need to file for an extension to make sure your taxes are completed on time, now is the time! Many people feel pressure and anxiety when it comes to taxes and deadlines, so don’t let the deadlines sneak up on you.

Filing for yourself has never been easier, but if you are entering the territory of amendments and extensions, you might want to consider seeking professional help.

The more forms you have to file, the more complicated your tax situation gets. Working with a tax professional can help minimize costly errors, and make sure you are getting all of the deductions possible.

Lower your taxes for next year

If you do not feel like amending your taxes but want to benefit from these strategies in the future, start now. You can start saving in IRAs and HSAs for the 2021 tax year. When you are ready to file your taxes next year, these contributions will be ready to be deducted.

What if you haven’t filed your taxes yet, but don’t have enough money lying around to make a huge impact on your taxable income? You should also start contributing to these accounts for 2021 now.

Saving a couple of hundred dollars a month in an IRA or HSA will go a long way for your future! Plus, saving throughout the year is normally easier than making a last-minute lump sum.

Remember all of the benefits that come beyond just lowering your taxes. Saving for your future is a necessity that many don’t give enough attention to until it’s too late. Donating to charities is also a way to be helping others and improve society, as well as helping lower your tax bill.

Image Credit: karolina grabowska; pexels