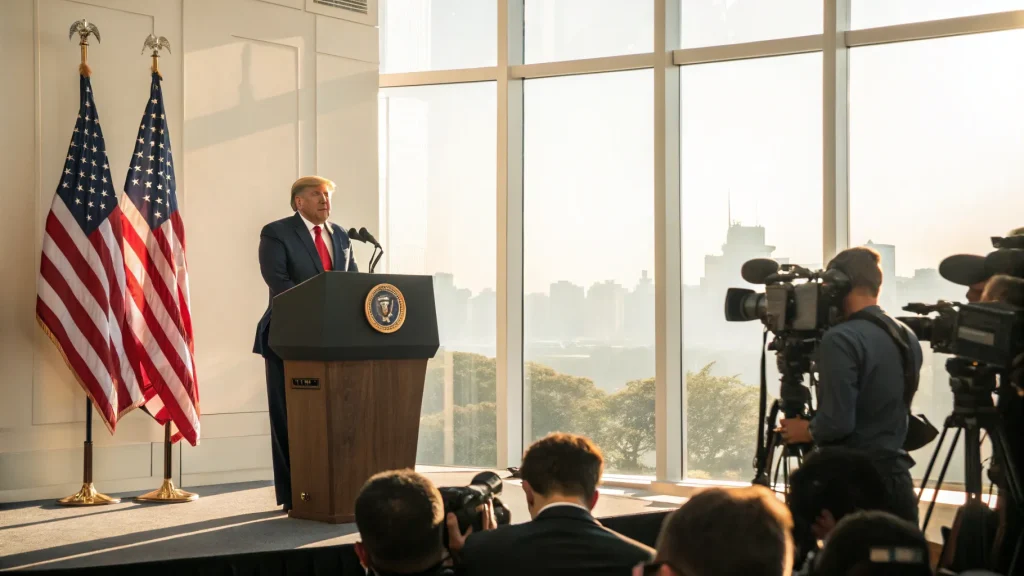

President Donald Trump has announced he is exploring the possibility of implementing a tariff “rebate” program that would return money to American consumers. The proposal comes amid ongoing discussions about economic policies and trade strategies.

Trump’s consideration of a tariff rebate represents a departure from his well-known stance on international trade. While the former president has long advocated for tariffs on imported goods, this potential rebate system suggests an attempt to offset any negative impacts these trade policies might have on American consumers.

Unclear Implementation Details

Despite the announcement, specific details about how such a rebate program would function remain largely undefined. The former president has not clarified whether these rebates will be distributed as direct payments, similar to stimulus checks or tax credits, or through some other mechanism.

Economic analysts are questioning several aspects of the proposed plan:

- How would eligibility for rebates be determined?

- What would be the funding source for these payments?

- How would the program be administered?

The lack of specifics has left both supporters and critics speculating about the practical implications of such a policy. Trade experts note that tariffs typically generate revenue for the government while raising prices on imported goods for consumers.

Economic and Political Context

Trump’s tariff rebate proposal emerges against a backdrop of ongoing concerns about inflation and economic uncertainty. The concept appears to acknowledge that tariffs can increase costs for American consumers while attempting to mitigate those effects.

This approach represents a significant shift in messaging around tariff policy,” said an economic policy expert who requested anonymity. It suggests an awareness that tariffs can create financial pressure on households.

The timing of Trump’s announcement has led some political observers to view it as part of a broader economic policy positioning. The former president has consistently emphasized trade policy as a cornerstone of his economic approach.

Potential Impact

If implemented, a tariff rebate program could have wide-ranging effects on both the economy and consumer behavior. Economists suggest that the impact would depend heavily on the program’s structure, eligibility requirements, and funding mechanisms.

Consumer advocates have expressed cautious interest in the concept, noting that any program returning money to households could provide financial relief. However, trade policy specialists question whether such a program would address the fundamental economic effects of tariffs on supply chains and pricing.

The proposal also raises questions about how such rebates would interact with existing tax structures and government assistance programs. Without additional details, it doesn’t remain easy to assess the potential scope and effectiveness of the proposed rebate system.

As discussions around this proposal continue, economists, policymakers, and consumers will closely monitor developments for more concrete information on how such a program might be structured and implemented.