Have you ever wondered about the top-ranking stocks of the last 100 years? I have. Here are 11 stocks that have shown strong performance over the last 100 years. The list highlights companies that have consistently delivered solid returns, maintained stable dividends, and influenced their industry segments over decades. The purpose is to provide an objective, data-backed evaluation to assist investors and enthusiasts in understanding long-term success factors. The criteria used to review these stocks include:

- Historical Return Performance

- Dividend Consistency

- Market Impact

- Longevity and Stability

- Legacy and Innovation

Each company’s performance is measured against these points. The following sections include a detailed table followed by individual breakdowns for each of the 11 companies.

Table of Contents

ToggleTop 11 Performing Stocks Of The Last 100 Years

| Company | Rating | Historical Return | Dividend Yield | Market Impact | Legacy | |

|---|---|---|---|---|---|---|

| 1 | Coca-Cola | 9.5 | High | Steady | Global | Iconic |

| 2 | IBM | 9.2 | High | Consistent | Pioneering | Enduring |

| 3 | 3M | 9.0 | Strong | Reliable | Innovative | Resilient |

| 4 | Johnson & Johnson | 9.3 | Steady | Reliable | Influential | Trusted |

| 5 | Procter & Gamble | 9.1 | Consistent | Steady | Wide-Reach | Long-Lasting |

| 6 | General Electric | 8.8 | Variable | Moderate | Wide-Reach | Historic |

| 7 | ExxonMobil | 8.9 | Strong | Steady | Global | Legacy-Rich |

| 8 | Merck & Co. | 8.7 | Steady | Reliable | Influential | Long-Term |

| 9 | AT&T | 8.5 | Steady | Acceptable | Wide-Reach | Enduring |

| 10 | DuPont | 8.4 | Moderate | Variable | Historical | Established |

| 11 | McDonald’s | 8.3 | Steady | Reliable | Expanding | Popular |

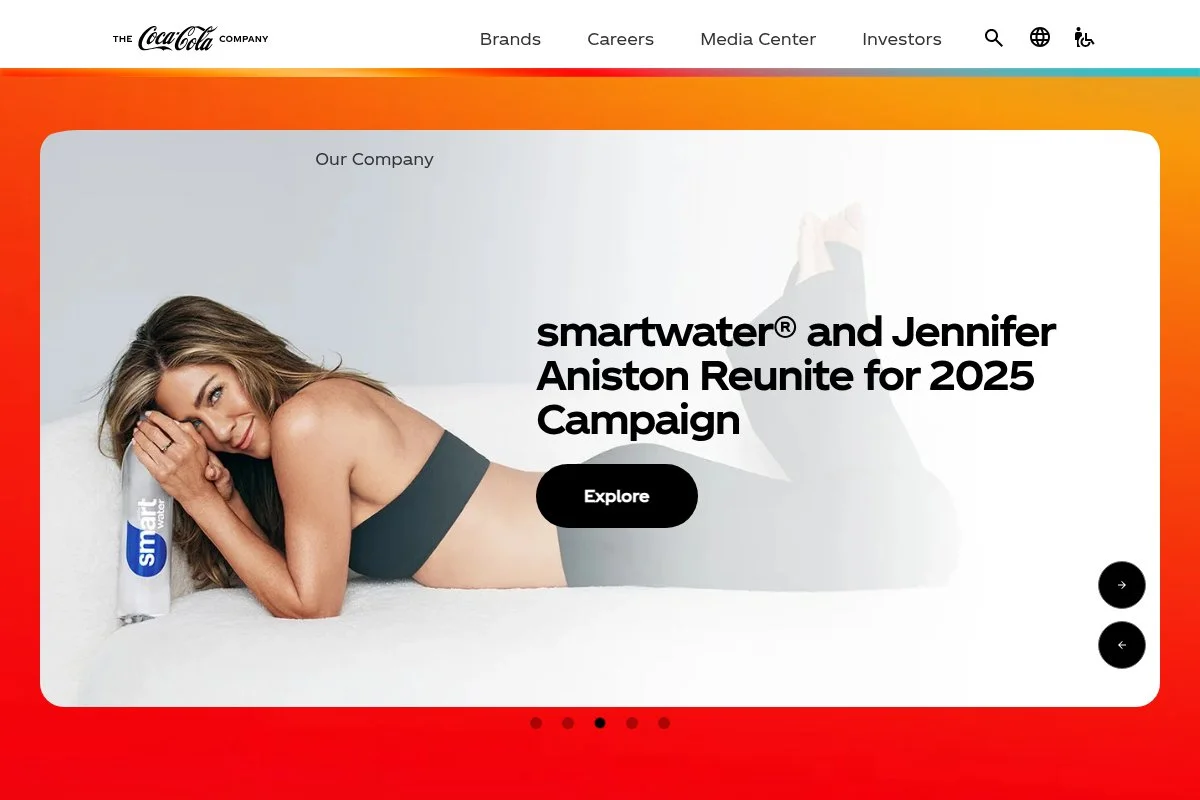

Coca-Cola

Coca-Cola has shown strong performance over many decades. The company built its reputation on a consistent product and global advertising. Its brand is recognized worldwide. Investors have seen steady dividends and significant capital gains from its long history. The focus on quality and market presence remains clear, even during challenging economic times.

Historical Return: High

Dividend Yield: Steady

Market Impact: Global

Legacy: Iconic

| Summary of Online Reviews |

|---|

| “Investors value its enduring brand strength,” with steady dividend payments often noted. |

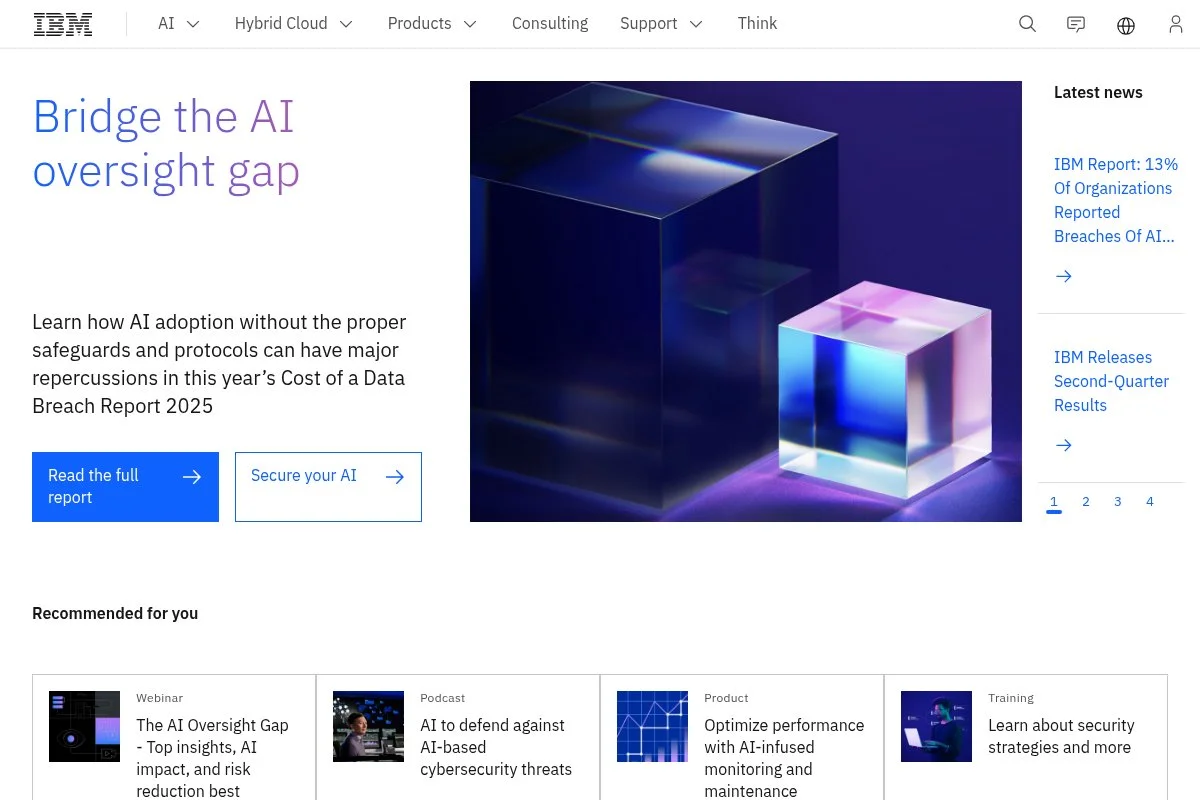

IBM

IBM has a long history of innovation and steady performance. Its work in computer technology has provided strong support in various sectors. The company strikes a balance between research and reliable dividend payouts. Long-term investors appreciate its focus on stability and gradual growth. Its commitment to service and solutions has helped it remain relevant for over a century.

Historical Return: High

Dividend Yield: Consistent

Market Impact: Pioneering

Legacy: Enduring

| Summary of Online Reviews |

|---|

| “A reliable partner in technology,” with steady innovation as a key theme. |

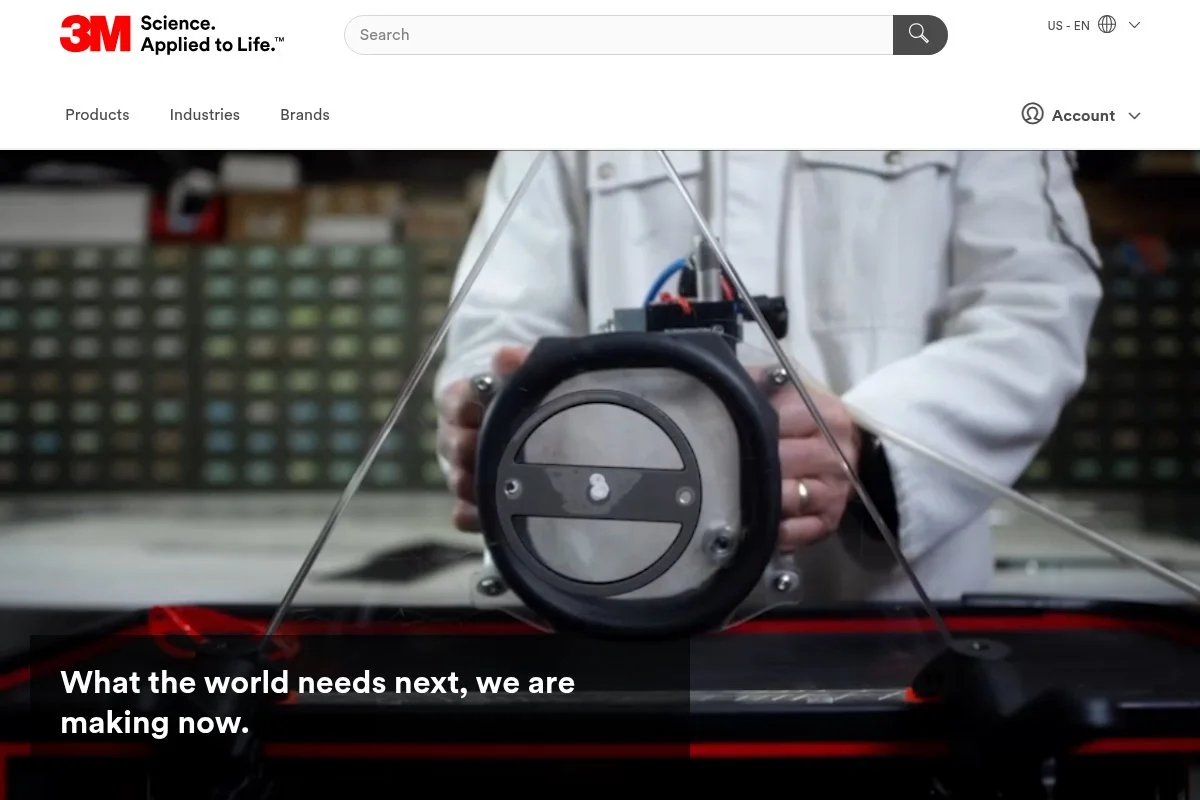

3M

3M is recognized for its diverse product offerings and consistent performance. The company has sustained a reputation built on quality and innovation. Its research and development lead to widely used consumer and industrial products. Financial returns have remained strong due to steady dividend payments. Investors find comfort in its ability to maintain market leadership.

Historical Return: Strong

Dividend Yield: Reliable

Market Impact: Innovative

Legacy: Resilient

| Summary of Online Reviews |

|---|

| “Investors praise its consistent product innovation,” with steady dividends frequently highlighted. |

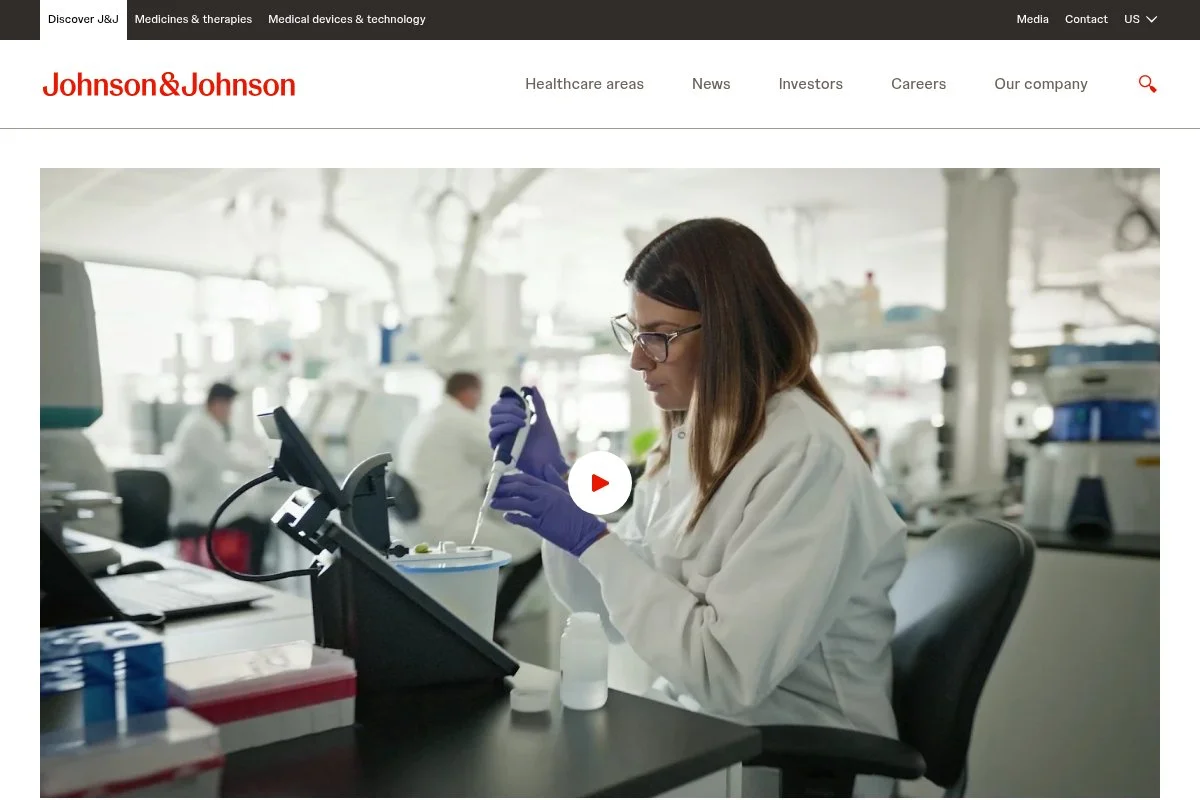

Johnson & Johnson

Johnson & Johnson has maintained a strong record with its healthcare and consumer products. The company’s market entry strategies and steady research investments have bolstered its performance over decades. Its balanced approach to growth and dividends offers consistent returns. This stock is respected for its stable business model and commitment to product quality.

Historical Return: Steady

Dividend Yield: Reliable

Market Impact: Influential

Legacy: Trusted

| Summary of Online Reviews |

|---|

| “A mainstay in healthcare stocks,” with reliability often mentioned by analysts. |

Procter & Gamble

Procter & Gamble has delivered steady returns with its wide range of consumer goods. The stock has shown durable performance with consistent dividend payments. Its focus on trusted household brands has ensured lasting customer loyalty. Investors appreciate the steady yield and the company’s long business history.

Historical Return: Consistent

Dividend Yield: Steady

Market Impact: Wide-Reach

Legacy: Long-Lasting

| Summary of Online Reviews |

|---|

| “A stock known for its steady dividend tracks,” with lasting market presence, is cited frequently. |

General Electric

General Electric has navigated many economic cycles with mixed outcomes. Its blend of industrial operations and technology segments offers a varied profile. Despite market challenges, the company holds a significant historical influence. Investors recognize its contributions to the industry, despite variations in returns over time. The brand is still recognized for its extensive history.

Historical Return: Variable

Dividend Yield: Moderate

Market Impact: Wide-Reach

Legacy: Historic

| Summary of Online Reviews |

|---|

| “A historic name in industrial sectors,” with varying returns noted during reviews. |

ExxonMobil

ExxonMobil has consistently provided strong returns for investors over many decades. Its energy operations worldwide have supported a steady yield and market influence. The stock has weathered shifts in the energy market. Its long history and reliable dividend payments remain a point of comfort for many investors.

Historical Return: Strong

Dividend Yield: Steady

Market Impact: Global

Legacy: Legacy-Rich

| Summary of Online Reviews |

|---|

| “Investors commend its consistent output in the energy sector,” with steady dividends highlighted. |

Merck & Co.

Merck & Co. has demonstrated steady performance, focusing on healthcare innovation. The company has maintained a solid dividend record and consistently developed new products. Its contributions to medical research and the development of medicines have provided consistent returns on investment. Long-term performance is supported by its commitment to quality healthcare solutions.

Historical Return: Steady

Dividend Yield: Reliable

Market Impact: Influential

Legacy: Long-Term

| Summary of Online Reviews |

|---|

| “Recognized for its significant role in healthcare,” with reliable returns often mentioned. |

AT&T

AT&T has a long history in telecommunications, with a consistent track record of investor appeal. The stock has managed to keep steady payouts through shifting market trends. Its broad network and service expansion have provided dependable results. The company’s strong market presence continues to attract long-term shareholders.

Historical Return: Steady

Dividend Yield: Acceptable

Market Impact: Wide-Reach

Legacy: Enduring

| Summary of Online Reviews |

|---|

| “Investors recognize its steady operational model,” with broad connectivity. This remark is frequent. |

DuPont

DuPont is known for its legacy in chemical manufacturing and materials science. The company has adapted its business over the decades to meet industry demands. Its stock performance reflects consistent progress with periodic adjustments in dividend payouts. The focus on research and market adaptation supports its steady reputation.

Historical Return: Moderate

Dividend Yield: Variable

Market Impact: Historical

Legacy: Established

| Summary of Online Reviews |

|---|

| “Frequently noted for its adaptability in changing markets,” with variable returns mentioned. |

McDonald’s

McDonald’s has grown into a global brand with strong market performance. The company has demonstrated its strength by adapting to consumer trends. Its focus on consistent quality and efficient operations has led to steady earnings. Investors value the stock for its dependable dividends and global restaurant network.

Historical Return: Steady

Dividend Yield: Reliable

Market Impact: Expanding

Legacy: Popular

| Summary of Online Reviews |

|---|

| “A favorite choice among investors for its consistent performance,” with global appeal as a common highlight. |

Final Thoughts

The ranking highlights companies that have consistently delivered steady returns, reliable dividends, and a clear market impact over time. Investors may consider factors such as historical returns, dividend consistency, market influence, and overall legacy when reviewing these stocks. Each business exhibits strengths that continue to support long-term performance. Readers can use this evaluation to compare stocks and select options that suit their investment focus.