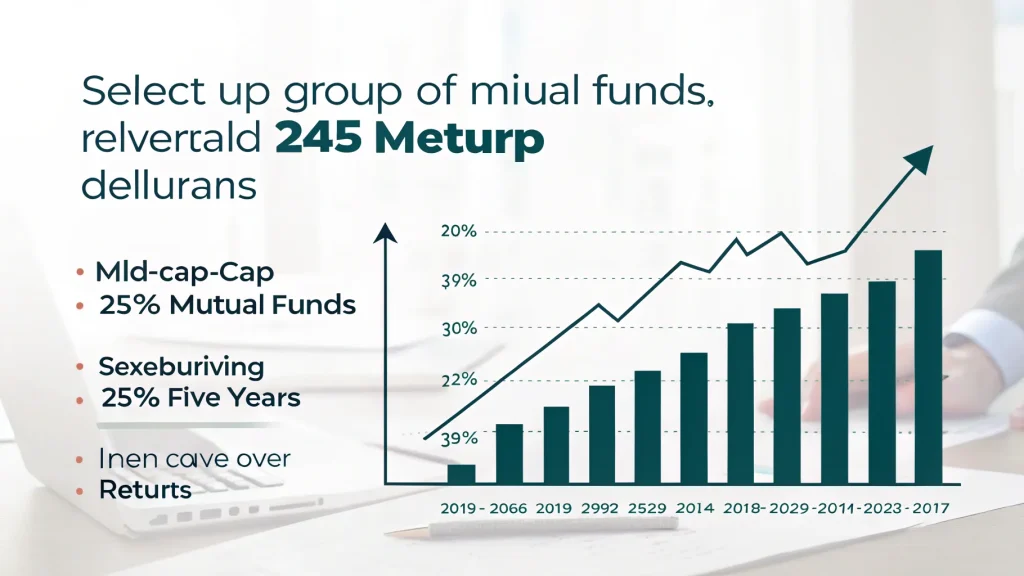

A select group of mid-cap mutual funds has demonstrated exceptional performance, generating annualized returns of 25 percent over the past five years. This impressive growth rate has positioned these funds among the top performers in their category, attracting attention from investors seeking substantial long-term gains.

The identified funds have consistently outperformed market benchmarks during this period, showcasing the potential of the mid-cap segment for wealth creation. These returns significantly exceed the average market performance, highlighting the value of strategic fund selection in investment portfolios.

Understanding Mid-Cap Fund Performance

Mid-cap funds focus on companies with market capitalizations typically ranging between $2 billion and $10 billion. These companies often represent businesses in growth phases that have established market positions but still offer substantial room for expansion.

The 25 percent annualized return from these top performers represents a dramatic growth trajectory. An investment of $10,000 in these funds five years ago would have grown to approximately $30,500 today, not accounting for taxes or additional fees.

Market analysts attribute this strong performance to several factors:

- Increased institutional interest in the mid-cap segment

- Greater operational efficiency in mid-sized companies

- Strategic positioning that allows these businesses to adapt quickly to market changes

Investment Implications

Financial advisors note that while these returns are impressive, investors should consider several factors before allocating capital to mid-cap funds. The segment typically carries higher volatility than large-cap investments but offers greater stability than small-cap alternatives.

Mid-cap funds represent an important middle ground in many diversified portfolios,” explains a market analyst familiar with these funds. The 25 percent returns we’ve seen from top performers demonstrate the growth potential when fund managers successfully identify companies with strong fundamentals and expansion opportunities.

The consistent performance over a five-year period suggests these funds have maintained disciplined investment approaches through varying market conditions, including the significant volatility experienced during recent years.

Risk Considerations

Despite the strong historical performance, investment professionals caution that past returns do not guarantee future results. Mid-cap stocks can experience significant price swings during market corrections or economic downturns.

The funds achieving these exceptional returns typically share certain characteristics:

They maintain diversified holdings across multiple sectors, employ rigorous fundamental analysis in stock selection, and often have experienced management teams with proven track records. Many also maintain reasonable expense ratios, allowing more of the returns to flow through to investors.

Sector allocation has played a key role in the success of these funds, with many maintaining strategic positions in technology, healthcare, and consumer discretionary companies that have shown strong growth trajectories.

As interest rates and economic conditions evolve, the performance leadership among fund categories may shift. However, the mid-cap segment continues to attract investors seeking growth potential beyond what typical large-cap investments might offer.

For investors considering these high-performing funds, financial advisors recommend examining factors beyond just the return numbers, including risk metrics, management stability, and how these investments would complement existing portfolio holdings.