It’s hard to know what direction to go when you are a new investor. Here are ways you can explore to build your portfolios. Investment strategies vary widely, and beginners benefit from understanding options that match their comfort levels and financial goals.

This beginner list has data-backed rankings to help you identify methods that are both safe and rewarding. These strategies cover low-risk approaches as well as methods that offer potential for growth with measured risk exposure. The evaluation of each strategy was based on several key criteria:

- Risk Level

- Potential Return

- Ease of Implementation

- Beginner Suitability

- Historical Performance

Table of Contents

ToggleTop 13 Investment Strategies For Beginners

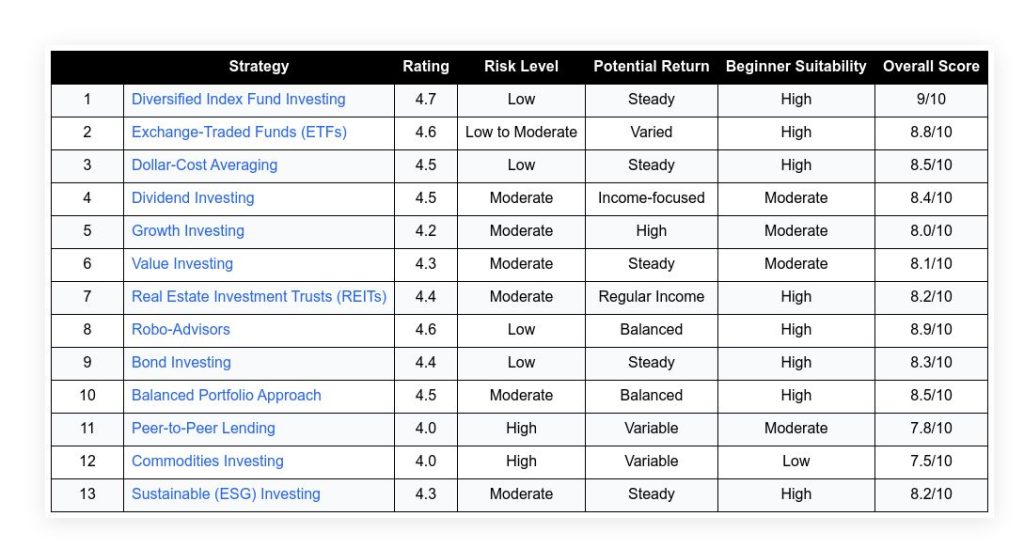

| Strategy | Rating | Risk Level | Potential Return | Beginner Suitability | Overall Score | |

|---|---|---|---|---|---|---|

| 1 | Diversified Index Fund Investing | 4.7 | Low | Steady | High | 9/10 |

| 2 | Exchange-Traded Funds (ETFs) | 4.6 | Low to Moderate | Varied | High | 8.8/10 |

| 3 | Dollar-Cost Averaging | 4.5 | Low | Steady | High | 8.5/10 |

| 4 | Dividend Investing | 4.5 | Moderate | Income-focused | Moderate | 8.4/10 |

| 5 | Growth Investing | 4.2 | Moderate | High | Moderate | 8.0/10 |

| 6 | Value Investing | 4.3 | Moderate | Steady | Moderate | 8.1/10 |

| 7 | Real Estate Investment Trusts (REITs) | 4.4 | Moderate | Regular Income | High | 8.2/10 |

| 8 | Robo-Advisors | 4.6 | Low | Balanced | High | 8.9/10 |

| 9 | Bond Investing | 4.4 | Low | Steady | High | 8.3/10 |

| 10 | Balanced Portfolio Approach | 4.5 | Moderate | Balanced | High | 8.5/10 |

| 11 | Peer-to-Peer Lending | 4.0 | High | Variable | Moderate | 7.8/10 |

| 12 | Commodities Investing | 4.0 | High | Variable | Low | 7.5/10 |

| 13 | Sustainable (ESG) Investing | 4.3 | Moderate | Steady | High | 8.2/10 |

Diversified Index Fund Investing

This strategy focuses on investing in index funds that track broad market indexes. It allows investors to gain exposure to a wide range of assets. The risk is kept low while offering steady returns over time. New investors benefit from the simplicity and low cost associated with these funds.

The data shows that diversified index funds often mirror overall market performance. They suit those who prefer a dependable investment route without intensive monitoring. The strategy minimizes individual stock risks through diversification. Its historical performance indicates consistent growth in long-term portfolios.

Risk Level: Low

Potential Return: Steady

Ease of Use: Very High

Beginner Suitability: Excellent

Historical Performance: Solid

| Summary of Online Reviews |

|---|

| Users state that this method “has helped them build steady wealth” with consistent positive results and clear benefits over time. |

Exchange-Traded Funds (ETFs)

ETFs offer a flexible investment option that combines the benefits of mutual funds and individual stocks. They trade on exchanges like a stock. This strategy offers low costs and easy portfolio diversification. Beginners appreciate ETFs for their transparency and liquidity.

Studies indicate that ETFs can provide balanced returns with moderate risk. Investors use ETFs to track various market segments. The approach is straightforward and well-suited for those who wish to manage risk while exploring market trends. It serves as a practical entry point into more varied investments.

Risk Level: Low to Moderate

Potential Return: Varied

Ease of Use: High

Beginner Suitability: Excellent

Historical Performance: Reliable

| Summary of Online Reviews |

|---|

| Feedback includes phrases like “offers clear advantages in diversification” and “provides flexibility and liquidity” for new investors. |

Dollar-Cost Averaging

This approach involves consistently investing a fixed amount over time, regardless of market conditions. It helps minimize the impact of market volatility. By spreading out the purchase times, investors lower the risk of entering at market peaks.

Beginners find this method approachable due to its systematic nature. Historical data shows that dollar-cost averaging can smooth out market fluctuations over long periods. Its ease of implementation makes it a favored option among first-time investors. The strategy requires discipline and long-term commitment, making it a steady tool for portfolio building.

Risk Level: Low

Potential Return: Steady

Ease of Use: High

Beginner Suitability: Excellent

Historical Performance: Proven

| Summary of Online Reviews |

|---|

| Reviewers report that the tactic “reduces emotional decision-making” and shows consistent growth over time, with steady benefits noted. |

Dividend Investing

This method prioritizes stocks that pay regular dividends. It offers the chance to receive recurring income while benefiting from stock value appreciation. Investors who choose this strategy often enjoy both cash returns and capital growth. It requires careful selection of companies with a strong track record of dividend payments.

Beginners value the clarity of income streams provided by dividend investing. Data from past performance suggests that companies with stable dividend histories may also offer resilience during market downturns. This strategy suits those seeking a mix of income and growth, without the need for constant market vigilance.

Risk Level: Moderate

Potential Return: Income-focused

Ease of Use: Moderate

Beginner Suitability: Good

Historical Performance: Consistent

| Summary of Online Reviews |

|---|

| Users note that dividend investing “offers a reliable income stream” with steady payouts and balanced growth opportunities. |

Growth Investing

Growth investing focuses on stocks with high potential for expansion. This strategy involves selecting companies that are expected to grow their earnings rapidly. While it may carry moderate risk, the potential for above-average returns attracts many new investors. The approach requires a long-term view and careful research.

Many beginners appreciate growth investing for its focus on future potential rather than current valuations. Historical market trends show that strategic growth stocks can help build wealth over time. The method suits investors who are comfortable with moderate volatility in pursuit of capital gains.

Risk Level: Moderate

Potential Return: High

Ease of Use: Moderate

Beginner Suitability: Fair

Historical Performance: Encouraging

| Summary of Online Reviews |

|---|

| Investors comment that growth investing “can yield significant returns” with optimistic outlooks and high future potential. |

Value Investing

Value investing involves buying stocks that seem undervalued in price compared to their fundamentals. This method appeals to those seeking to acquire quality assets at competitive prices. The approach relies on analyzing company metrics and market trends.

Beginners can find comfort in the relative predictability of established companies that trade below their intrinsic value. Data on price adjustments over time supports this method as a way to profit from market corrections. Investors who choose value investing typically do so with a patient approach, waiting for the market to recognize a stock’s true worth.

Risk Level: Moderate

Potential Return: Steady

Ease of Use: Moderate

Beginner Suitability: Good

Historical Performance: Reliable

| Summary of Online Reviews |

|---|

| Comments often include “a patient approach pays off” along with “solid returns in the long term” from careful stock selection. |

Real Estate Investment Trusts (REITs)

REITs offer a way to invest in real estate without owning physical property. This strategy provides exposure to property markets through publicly traded companies. It is attractive for those seeking a regular income via dividends. The approach combines the benefits of real estate investment with the liquidity of stocks.

Many new investors appreciate REITs for their ability to generate consistent cash flow. Historical data shows that REITs can perform well during various market cycles. The method allows beginners to build a diversified portfolio that spans traditional asset classes and real estate.

Risk Level: Moderate

Potential Return: Regular Income

Ease of Use: High

Beginner Suitability: Excellent

Historical Performance: Steady

| Summary of Online Reviews |

|---|

| Reviews mention that users appreciate REITs for “providing regular cash flow” and “offering a practical entry into real estate markets”. |

Robo-Advisors

This approach uses automated platforms to manage portfolios based on risk tolerance and goals. Robo-advisors offer low-cost, algorithm-based management and are a practical choice for newcomers. The system generates diversified portfolios, rebalancing them automatically over time.

Users appreciate the hands-off nature and transparent fee structures. Studies indicate that robo-advisors perform well in maintaining balance during market fluctuations. This method combines technology with clear investment strategies. It is ideal for those who prefer ease and efficiency without requiring extensive market knowledge.

Risk Level: Low

Potential Return: Balanced

Ease of Use: Very High

Beginner Suitability: Excellent

Historical Performance: Consistent

| Summary of Online Reviews |

|---|

| Clients report feeling that the platform is “efficient and easy to use” with “transparent management and steady returns”. |

Bond Investing

Investing in bonds is a conservative strategy aimed at preserving capital and earning regular interest. Bonds are fixed-income securities that offer stability over time. New investors find bond investing appealing because it provides a lower risk compared to equities.

Historical trends indicate that bonds can help reduce overall portfolio risk during market uncertainties. This approach suits those who seek a steady income stream through scheduled interest payments. It is an effective way to balance risk without the need for daily oversight or market timing.

Risk Level: Low

Potential Return: Steady

Ease of Use: High

Beginner Suitability: Excellent

Historical Performance: Stable

| Summary of Online Reviews |

|---|

| Observers highlight that bond investing “offers stable income” and is praised for its reliability in tempering market swings along with consistent performance. |

Balanced Portfolio Approach

This strategy advocates for holding a mix of asset classes to manage risk and return. The balanced portfolio approach combines equities, bonds, and sometimes other assets to create a diversified investment mix. It is a favored option for many beginners looking to minimize volatility while still benefiting from growth opportunities.

Data shows that a well-balanced portfolio can yield steadier outcomes in different market conditions. The approach requires periodic reviews and adjustments but remains accessible to those new to investing. It is valued for its simplicity and capacity to moderate market fluctuations.

Risk Level: Moderate

Potential Return: Balanced

Ease of Use: High

Beginner Suitability: Excellent

Historical Performance: Reliable

| Summary of Online Reviews |

|---|

| Investors mention that a balanced portfolio “smooths out market volatility” with consistent returns and efficient risk management. |

Peer-to-Peer Lending

This method allows investors to lend money to individuals or businesses online. Peer-to-peer lending can offer attractive returns compared to traditional deposit accounts. It involves a higher risk, and investors must evaluate the creditworthiness of borrowers thoroughly.

Many beginners use this strategy to diversify beyond stocks and bonds. Data shows that although returns may vary, disciplined lending practices can yield reliable income. The process is streamlined by platforms that handle borrower screening, making it accessible yet cautious. It suits investors who are ready to accept higher risk for the possibility of improved yield.

Risk Level: High

Potential Return: Variable

Ease of Use: Moderate

Beginner Suitability: Fair

Historical Performance: Mixed

| Summary of Online Reviews |

|---|

| Users remark that peer-to-peer lending “offers potential for higher yields” while noting variations in borrower performance and associated risks. |

Commodities Investing

Investing in commodities involves buying assets such as gold, oil, or agricultural products. This strategy provides an alternative to traditional asset classes and can act as a hedge against inflation. Commodities are known for high variability and require careful timing. Beginners should approach this method with caution due to its greater volatility.

Historical performance indicates that commodity prices can swing significantly with market conditions. However, for investors seeking diversification beyond conventional stocks and bonds, this strategy may offer occasional rewards when timed well.

Risk Level: High

Potential Return: Variable

Ease of Use: Low

Beginner Suitability: Caution Advised

Historical Performance: Unsteady

| Summary of Online Reviews |

|---|

| Comments include statements like “offers diversity outside conventional markets” with “a need for careful analysis” due to price swings. |

Sustainable (ESG) Investing

ESG investing focuses on companies with strong environmental, social, and governance practices. This strategy appeals to investors who want their money to support responsible business practices. It is evaluated using broad sustainability criteria and often attracts investors looking for long-term stability.

Research shows that companies scoring high in ESG ratings may also offer competitive returns while mitigating reputational risks. For beginners, this approach provides an opportunity to align investments with personal values without sacrificing performance. The method has gained traction with evidence of steady performance in diverse market conditions.

Risk Level: Moderate

Potential Return: Steady

Ease of Use: High

Beginner Suitability: Excellent

Historical Performance: Reliable

| Summary of Online Reviews |

|---|

| Investors say that ESG strategies offer “meaningful alignment with personal ethics” and are praised for “balancing stability with future potential”. |

Final Thoughts

As you can see, as a new investor, you can use clear options to build yourself a strong portfolio. Each method appeals to different comfort levels and risk tolerances. An understanding of the balance between risk and return is essential.

Beginners are encouraged to choose strategies matching their financial goals. Whether a beginner prefers steady approaches or is open to higher variability, data show that thoughtful planning leads to success.