Here are some ideas to assist individuals planning for retirement with clear and practical insights. The selection process focused on apps that help users manage savings, track investments, and prepare for future retirement needs. Each app is assessed based on easily verifiable factors. These evaluations are based on well-defined criteria. The criteria for the assessment include:

- User Experience

- Fee Structure

- Investment Options

- Retirement-Specific Tools

- Customer Support

The detailed analysis that follows helps users choose the app that fits their retirement strategy. Each selection was judged on functionality, clarity, and service reliability.

Table of Contents

ToggleTop 13 Investment Apps For Retirement

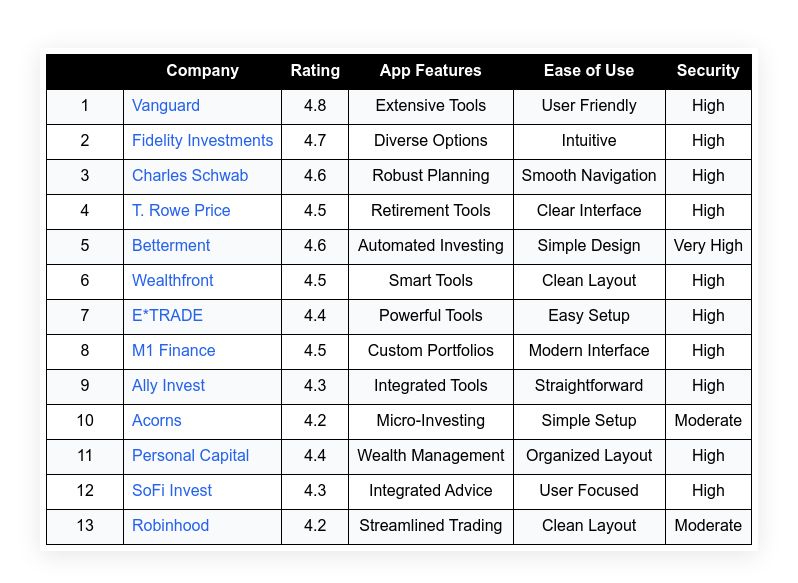

| Company | Rating | App Features | Ease of Use | Security | |

|---|---|---|---|---|---|

| 1 | Vanguard | 4.8 | Extensive Tools | User Friendly | High |

| 2 | Fidelity Investments | 4.7 | Diverse Options | Intuitive | High |

| 3 | Charles Schwab | 4.6 | Robust Planning | Smooth Navigation | High |

| 4 | T. Rowe Price | 4.5 | Retirement Tools | Clear Interface | High |

| 5 | Betterment | 4.6 | Automated Investing | Simple Design | Very High |

| 6 | Wealthfront | 4.5 | Smart Tools | Clean Layout | High |

| 7 | E*TRADE | 4.4 | Powerful Tools | Easy Setup | High |

| 8 | M1 Finance | 4.5 | Custom Portfolios | Modern Interface | High |

| 9 | Ally Invest | 4.3 | Integrated Tools | Straightforward | High |

| 10 | Acorns | 4.2 | Micro-Investing | Simple Setup | Moderate |

| 11 | Personal Capital | 4.4 | Wealth Management | Organized Layout | High |

| 12 | SoFi Invest | 4.3 | Integrated Advice | User Focused | High |

| 13 | Robinhood | 4.2 | Streamlined Trading | Clean Layout | Moderate |

Vanguard

Vanguard offers a solid platform with a focus on low-cost retirement strategies. The app supports long-term investment planning. It provides a range of retirement accounts and a variety of funds. Users can track investments and access research tools easily. Vanguard has a longstanding record of customer trust and service reliability. The interface is clean and assists investors in making sober choices.

Investment Options: Broad fund selection

Fee Structure: Low expense ratios

User Experience: Clean and intuitive

Mobile Functionality: Responsive design

Customer Support: Efficient service

| Summary of Online Reviews |

|---|

| Users state “the platform is straightforward” while highlighting “excellent customer care” in reviews. |

Fidelity Investments

Fidelity Investments is known for its wide range of account options and retirement planning tools. The app provides in-depth research and user-friendly charts. Investors appreciate the logical organization of features that make retirement planning easier. Fidelity has a strong record in managing retirement investments. The layout is designed to offer clear access to data and resources.

Investment Options: Extensive portfolio

Fee Structure: Fair pricing

User Experience: Logical and clear

Mobile Functionality: Smooth operation

Customer Support: Responsive teams

| Summary of Online Reviews |

|---|

| Reviewers mention “clear navigation” and praise the “variety of investment tools” available. |

Charles Schwab

Charles Schwab offers a full suite of tools for planning retirement. The app emphasizes clarity in presenting investment data. Investors can access a variety of mutual funds and index options for retirement savings. The design focuses on making complex data easy to understand. A range of educational materials supports new and seasoned investors alike.

Investment Options: Diverse funds

Fee Structure: Competitive fees

User Experience: Clear and precise

Mobile Functionality: Well organized

Customer Support: Helpful assistance

| Summary of Online Reviews |

|---|

| Users report “efficient app performance” with “transparent fee details” as a key benefit. |

T. Rowe Price

T. Rowe Price emphasizes long-term retirement planning with clear guidance. The app offers access to retirement calculators and detailed market information. Its design allows users to manage diverse retirement portfolios with ease. The firm has a long record in the investment field. Investors find the interface easy to navigate and appreciate the in-depth educational resources.

Investment Options: Reliable funds

Fee Structure: Transparent costs

User Experience: Easy navigation

Mobile Functionality: Smooth interactivity

Customer Support: Accessible guidance

| Summary of Online Reviews |

|---|

| Clients highlight “consistent performance” and note “clear financial planning guidance” on the platform. |

Betterment

Betterment is noted for its automated investment advice and easy-to-use interface. The app helps users set up retirement accounts effortlessly. Investors can access diversified portfolios managed by algorithms. The system offers clear data and periodic updates, making it simple to monitor progress. Betterment emphasizes cost efficiency and streamlined account management.

Investment Options: Automated portfolios

Fee Structure: Low costs

User Experience: Streamlined design

Mobile Functionality: Responsive controls

Customer Support: Effective chat support

| Summary of Online Reviews |

|---|

| Users mention “effortless account setup” and share “satisfaction with low fees” after using the app. |

Wealthfront

Wealthfront provides smart planning tools for retirement. The app integrates investment management with automated advice. Investors can view tailored portfolio recommendations and retirement projections. The interface presents data clearly and encourages disciplined saving. Wealthfront’s design focuses on keeping investment tracking simple and efficient.

Investment Options: Tailored portfolios

Fee Structure: Competitive pricing

User Experience: Clear dashboard

Mobile Functionality: High performance

Customer Support: Reliable assistance

| Summary of Online Reviews |

|---|

| Users report “intuitive planning features” along with “consistent performance updates”. |

E*TRADE

E*TRADE is an established service that aids retirement planning with clear market research and diverse options. Its app enables investors to monitor trades, savings, and retirement funds simultaneously. The visual layout is tidy and supports a smooth workflow for regular investors. The service offers data security and consistent updates, making it a solid choice for retirement planning.

Investment Options: Varied selections

Fee Structure: Transparent fees

User Experience: Easy account management

Mobile Functionality: Reliable performance

Customer Support: Prompt responses

| Summary of Online Reviews |

|---|

| Clients remark “a well-organized interface” with “legible investment details”. |

M1 Finance

M1 Finance offers a mix of automated and customizable investment planning. The app allows users to create personalized portfolios alongside pre-built templates. Investors find the design uncluttered, offering essential retirement planning tools without extra confusion. The service emphasizes control and clarity in managing long-term finances with a user-centred design.

Investment Options: Custom portfolios

Fee Structure: No trading fees

User Experience: Organized interface

Mobile Functionality: Fast responsiveness

Customer Support: Competent assistance

| Summary of Online Reviews |

|---|

| Users mention “good balance between automation and control” and highlight the “simplicity of design”. |

Ally Invest

Ally Invest provides a clear and practical app for retirement investing. The platform integrates investment data with spending and banking features. The interface is designed for simplicity. It offers useful planning tools and timely updates. The app supports investors who want an integrated experience without leaving other financial services.

Investment Options: Multiple instruments

Fee Structure: Competitive charges

User Experience: Straightforward design

Mobile Functionality: Consistent performance

Customer Support: Reliable contact

| Summary of Online Reviews |

|---|

| Reviewers mention “ease of consolidation of accounts” and note the “balance of features” on the platform. |

Acorns

Acorns is popular among new investors for its simple approach to investing spare change. The app rounds up spending and invests the difference in diversified funds. It offers a straightforward setup for retirement accounts. Users appreciate the clear progress tracking and automated saving. The design is clean and makes starting small investments simple.

Investment Options: Micro-investments

Fee Structure: Flat fees

User Experience: Extremely simple

Mobile Functionality: Reliable alerts

Customer Support: Accessible help

| Summary of Online Reviews |

|---|

| Users express “satisfaction with low entry barriers” and note “transparent fee structures”. |

Personal Capital

Personal Capital provides a detailed dashboard that combines account tracking with retirement planning tools. The app merges investment management with budgeting features. It helps users monitor their net worth while planning retirement savings. The interface prioritizes data clarity and offers visual charts that aid in financial decisions. Personal Capital is suitable for those who seek a detailed view of their financial status.

Investment Options: Broad asset classes

Fee Structure: Transparent model

User Experience: Data-rich layout

Mobile Functionality: Integrated charts

Customer Support: Professional service

| Summary of Online Reviews |

|---|

| Clients mention “powerful visual tools” and point out “comprehensive account overviews”. |

SoFi Invest

SoFi Invest offers a balanced approach to retirement planning. The app combines investing with personal financial advice. It presents clear investment options and transparent fee details. The design includes simple navigation to monitor portfolios. SoFi Invest is suited for users looking for an integrated way to plan retirement alongside everyday financial needs.

Investment Options: Varied choices

Fee Structure: Clear pricing

User Experience: Integrated design

Mobile Functionality: Fast and clear

Customer Support: Helpful agents

| Summary of Online Reviews |

|---|

| Users note “a smooth integration of advice and trading” with “quick access to updates”. |

Robinhood

Robinhood is popular for its simplicity and streamlined trading experience. While known for commission-free trades, it also offers tools that help investors monitor retirement portfolios. The app provides real-time updates and straightforward account summaries. It is ideal for those who prefer an uncluttered interface and quick access to investment details.

Investment Options: Basic portfolio management

Fee Structure: No commission fees

User Experience: Minimalist design

Mobile Functionality: Quick trading features

Customer Support: Standard support

| Summary of Online Reviews |

|---|

| Users mention “an extremely simple app experience” with “quick trade execution” as a benefit. |

Final Thoughts

Investors planning for retirement find several apps with trustworthy features and intuitive designs. Each option in this list provides secure investment solutions, clear fee structures, and user-friendly interfaces. The selections cover both automated advice and self-managed portfolios. Users can choose based on the level of guidance they seek and their comfort with technology. The evaluation focused on practical features such as investment diversity, transparent costs, ease of use, mobile functionality, and support quality. The list aids individuals in aligning their retirement goals with the platform that meets their needs.