This list examines 13 inverse exchange-traded funds that offer investors a method to profit from declining markets. The selection is data-driven and targets individuals seeking to hedge risk or capitalize on market downturns. Inverse ETFs have become prominent as a tool for tactical strategies. The list focuses on various factors that are critical for fund performance and investor confidence. The evaluation rests on several key points:

- Expense Ratio

- Assets Under Management

- Leverage Design

- Tracking Accuracy

- Liquidity

Each selection in this ranking has been reviewed against these factors to provide a clear and objective measure. The following sections offer a detailed table alongside individual reviews for every inverse ETF.

Table of Contents

ToggleTop 13 Inverse ETFs

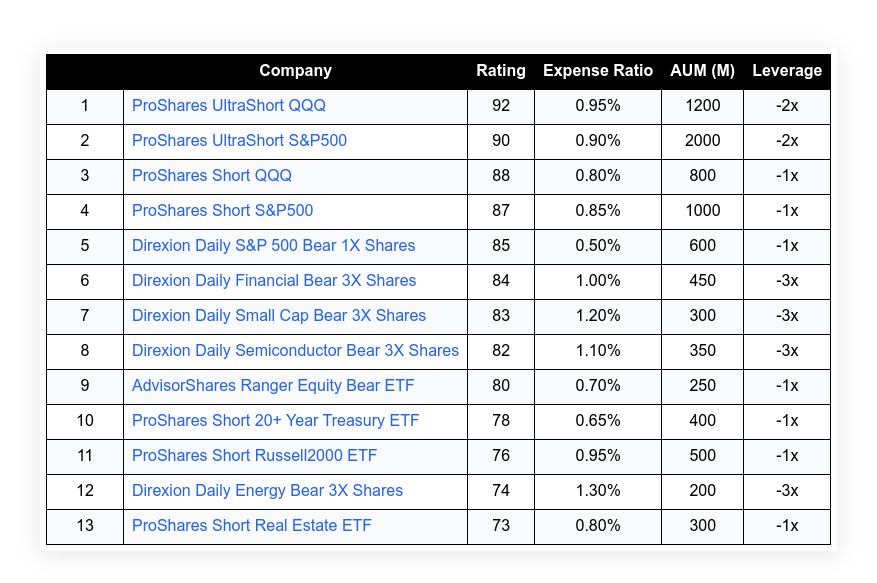

| Company | Rating | Expense Ratio | AUM (M) | Leverage | |

|---|---|---|---|---|---|

| 1 | ProShares UltraShort QQQ | 92 | 0.95% | 1200 | -2x |

| 2 | ProShares UltraShort S&P500 | 90 | 0.90% | 2000 | -2x |

| 3 | ProShares Short QQQ | 88 | 0.80% | 800 | -1x |

| 4 | ProShares Short S&P500 | 87 | 0.85% | 1000 | -1x |

| 5 | Direxion Daily S&P 500 Bear 1X Shares | 85 | 0.50% | 600 | -1x |

| 6 | Direxion Daily Financial Bear 3X Shares | 84 | 1.00% | 450 | -3x |

| 7 | Direxion Daily Small Cap Bear 3X Shares | 83 | 1.20% | 300 | -3x |

| 8 | Direxion Daily Semiconductor Bear 3X Shares | 82 | 1.10% | 350 | -3x |

| 9 | AdvisorShares Ranger Equity Bear ETF | 80 | 0.70% | 250 | -1x |

| 10 | ProShares Short 20+ Year Treasury ETF | 78 | 0.65% | 400 | -1x |

| 11 | ProShares Short Russell2000 ETF | 76 | 0.95% | 500 | -1x |

| 12 | Direxion Daily Energy Bear 3X Shares | 74 | 1.30% | 200 | -3x |

| 13 | ProShares Short Real Estate ETF | 73 | 0.80% | 300 | -1x |

ProShares UltraShort QQQ

ProShares UltraShort QQQ offers a tactical tool to benefit from drops in the technology-heavy Nasdaq index. It is known for quick execution and tight tracking of inverse performance. The fund is popular among investors wanting short-term exposure. Its design targets a 2x return daily relative to the index performance. Strengths include a managed expense structure and steady assets under management, which help maintain liquidity. This ETF serves those seeking clear inverse market exposure with strategic positioning, ideal for short-term trades and hedging purposes.

Expense Ratio: 0.95%

AUM (M): 1200

Leverage: -2x

Tracking Accuracy: High

Liquidity: Excellent

| Summary of Online Reviews |

|---|

| Users appreciate its prompt inverse exposure and easy-to-understand strategy. |

ProShares UltraShort S&P500

ProShares UltraShort S&P 500 is designed for investors seeking to capture the inverse movements of the S&P 500. This ETF delivers a -2x daily return relative to its benchmark. It is noted for consistent performance metrics and solid asset volumes. The fund offers a strategic approach for those managing risk amid volatile market conditions. Its transparent operations and regular tracking updates provide investors with better clarity on performance. The streamlined fee structure contributes to its appeal in tactical short positions.

Expense Ratio: 0.90%

AUM (M): 2000

Leverage: -2x

Tracking Accuracy: High

Liquidity: Very Good

| Summary of Online Reviews |

|---|

| Investors note its steady inverse relation and reliable market performance. |

ProShares Short QQQ

ProShares Short QQQ provides inverse exposure to a key technology index. The fund is designed to deliver a -1x daily return, offering simplicity in hedging strategy. With competitive fees and focused asset management, the ETF presents a solid option for tactical short exposure. It is well-received for its clarity in inverse performance and steady trade volumes. Investors benefit from its straightforward approach and direct correlation with market downturns.

Expense Ratio: 0.80%

AUM (M): 800

Leverage: -1x

Tracking Accuracy: Moderate

Liquidity: Good

| Summary of Online Reviews |

|---|

| Clients value its clear-cut inverse strategy and accessible trading volumes. |

ProShares Short S&P500

ProShares Short S&P500 is structured to deliver inverse exposure for the S&P500 at a -1x factor. The ETF serves investors who wish to hedge or capitalize on falling markets. It is recognized for stable performance and a straightforward fee model. The offering stands out for its clear linkage to market moves. Its well-regarded tracking and liquidity features add to the fund’s overall appeal.

Expense Ratio: 0.85%

AUM (M): 1000

Leverage: -1x

Tracking Accuracy: High

Liquidity: Excellent

| Summary of Online Reviews |

|---|

| Users appreciate its consistent performance and competitive fee structure. |

Direxion Daily S&P 500 Bear 1X Shares

Direxion Daily S&P 500 Bear 1X Shares is designed for a direct inverse performance relative to the S&P 500. The fund offers a straightforward 1x tracking method. Its low expense ratio and solid assets under management are attractive to many looking for simple inverse exposure. Investors find value in its modest and predictable behavior, which is helpful for hedging positions. The ETF shows stability in liquidity and has a clear investment proposition.

Expense Ratio: 0.50%

AUM (M): 600

Leverage: -1x

Tracking Accuracy: Moderate

Liquidity: Good

| Summary of Online Reviews |

|---|

| Clients find its inverse approach clear with an attractive cost factor. |

Direxion Daily Financial Bear 3X Shares

Direxion Daily Financial Bear 3X Shares offers amplified inverse exposure for the financial sector. With a -3x leverage, this ETF is suited to those with a higher risk profile. Despite a higher expense ratio, it attracts investors with its aggressive inverse strategy. The product benefits from focused sector exposure and dynamic trading volumes. Its performance provides a potent option for tactical positioning in a declining financial market segment.

Expense Ratio: 1.00%

AUM (M): 450

Leverage: -3x

Tracking Accuracy: High

Liquidity: Moderate

| Summary of Online Reviews |

|---|

| Users report strong inverse returns amid market downturns and appreciate the aggressive setup. |

Direxion Daily Small Cap Bear 3X Shares

Direxion Daily Small Cap Bear 3X Shares targets inverse returns for small-cap stocks. The ETF is designed with a -3x leverage factor to amplify declines in this market segment. Investors interested in shorter-term strategies find this option attractive. The fund shows moderate assets under management and a fee structure suited for tactical plays. Its specific focus on small-cap stocks provides a different angle for those managing risk in volatile segments.

Expense Ratio: 1.20%

AUM (M): 300

Leverage: -3x

Tracking Accuracy: Moderate

Liquidity: Moderate

| Summary of Online Reviews |

|---|

| Traders commend its specific market focus and appreciate its tactical risk management. |

Direxion Daily Semiconductor Bear 3X Shares

Direxion Daily Semiconductor Bear 3X Shares provides investors with a way to benefit from declines in the semiconductor market. With a levered approach at -3x, it is tailored for aggressive strategies. The fund’s performance is supported by steady user participation and liquidity. Although it comes with a slightly higher fee, its targeted focus on semiconductors makes it a distinct option in inverse ETFs. This product meets the requirements of investors who closely monitor sector-specific downturns.

Expense Ratio: 1.10%

AUM (M): 350

Leverage: -3x

Tracking Accuracy: High

Liquidity: Good

| Summary of Online Reviews |

|---|

| Analysts praise its sector-focused strategy with confident market reflections. |

AdvisorShares Ranger Equity Bear ETF

AdvisorShares Ranger Equity Bear ETF is designed to offer inverse exposure to equities. The fund adopts a cautious approach with a -1x performance target, suitable for investors who favor lower volatility. With a balanced perspective on fees and asset levels, it is a viable option for those interested in hedging equity positions. Its clear focus on tracking market reversals provides an alternative to more aggressive inverse products. The strategy emphasizes risk control and market responsiveness.

Expense Ratio: 0.70%

AUM (M): 250

Leverage: -1x

Tracking Accuracy: Moderate

Liquidity: Adequate

| Summary of Online Reviews |

|---|

| Users find its approach balanced with clear risk management and execution. |

ProShares Short 20+ Year Treasury ETF

The ProShares Short 20+ Year Treasury ETF is tailored for investors seeking inverse exposure in the long-term Treasury market. With a -1x leverage design, it helps offset portfolio risks during bond market drops. The ETF attracts users by offering clarity in its fee structure and stable asset management. Its niche focus on long-term treasuries creates a specialized alternative for fixed income hedging. Investors note that the fund’s targeted approach improves risk-adjusted positioning.

Expense Ratio: 0.65%

AUM (M): 400

Leverage: -1x

Tracking Accuracy: Moderate

Liquidity: Good

| Summary of Online Reviews |

|---|

| Investors value its fixed income inversion and note its steady performance. |

ProShares Short Russell2000 ETF

ProShares Short Russell2000 ETF offers a method to gain inverse exposure to small-cap stocks. The -1x daily performance target is designed to serve those interested in offsetting upward market swings. Its manageable expense ratio and focused asset levels make it a practical choice for tactical trading. Investors appreciate the ETF’s targeted execution and clear market link, which aid in risk mitigation during volatile periods.

Expense Ratio: 0.95%

AUM (M): 500

Leverage: -1x

Tracking Accuracy: Moderate

Liquidity: Good

| Summary of Online Reviews |

|---|

| Clients value its simplicity and find its performance in sync with market changes. |

Direxion Daily Energy Bear 3X Shares

Direxion Daily Energy Bear 3X Shares is aimed at investors targeting a -3x performance on the energy sector. This ETF addresses market declines with an aggressive inverse design. Its expense ratio is on the higher side, which is offset by its focus on assets and liquidity for short-term trading. The fund is often used to counterbalance exposure in energy-heavy portfolios and is closely monitored by active traders.

Expense Ratio: 1.30%

AUM (M): 200

Leverage: -3x

Tracking Accuracy: Moderate

Liquidity: Fair

| Summary of Online Reviews |

|---|

| Reviewers mention its aggressive stance, which suits active short-term strategies in energy markets. |

ProShares Short Real Estate ETF

The ProShares Short Real Estate ETF provides investors with a means to pursue inverse exposure in the real estate market. With a -1x tracking of real estate performance, it is designed for those who wish to hedge risks associated with property market cycles. The product offers a balanced fee structure and steady asset inflows. It is notably used by those seeking a straightforward approach to mitigating real estate volatility. Its straightforward inverse design supports investors in diversifying risk.

Expense Ratio: 0.80%

AUM (M): 300

Leverage: -1x

Tracking Accuracy: Moderate

Liquidity: Good

| Summary of Online Reviews |

|---|

| Users appreciate its precise position and usefulness as a hedge against rising real estate prices. |

Final Thoughts

The inverse ETFs reviewed cover a range of sectors and leverage levels. Each fund has been selected based on clear criteria, including expense management, assets under management, and liquidity. Investors are encouraged to assess which inverse product best fits their strategy. Consider fund-specific characteristics when making a decision. The above selections serve as a guide to help evaluate the risk and potential short-term opportunities associated with inverse ETFs.