You will want a dividend stock for retirement that will give you a residual income. This list offers a detailed look at leading dividend stocks that can provide steady income during retirement. Investors often seek companies with a commitment to returning value via dividends.

With changing market conditions, it is beneficial to review firms known for high dividend yields and reliable performance. The list is based on several clear criteria that help determine the overall appeal of each stock for retirement portfolios.

The evaluation considers the following key factors:

- Dividend Yield

- Payout Ratio

- Dividend Growth

- Financial Stability

- Market Position

Table of Contents

ToggleTop 15 High Dividend Stocks For Retirement

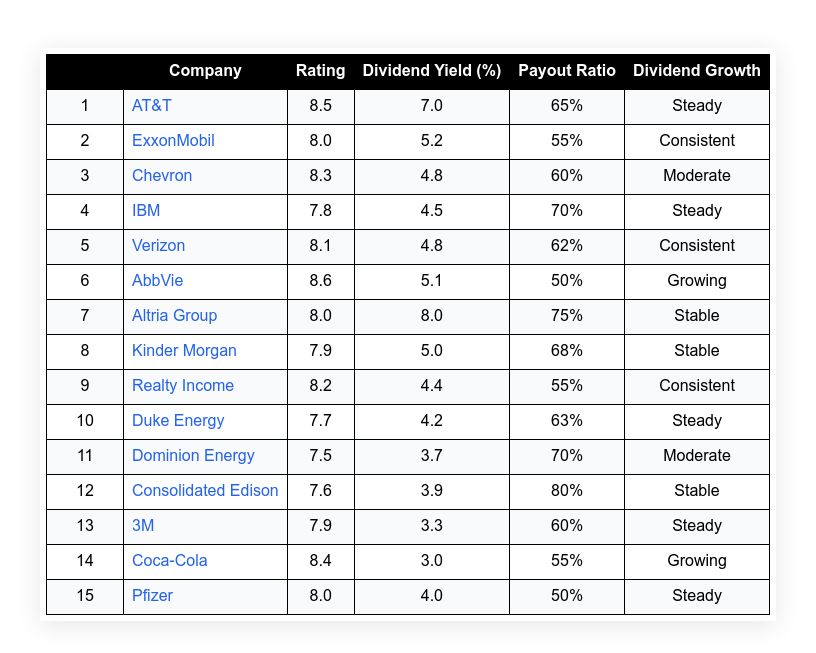

| Company | Rating | Dividend Yield (%) | Payout Ratio | Dividend Growth | |

|---|---|---|---|---|---|

| 1 | AT&T | 8.5 | 7.0 | 65% | Steady |

| 2 | ExxonMobil | 8.0 | 5.2 | 55% | Consistent |

| 3 | Chevron | 8.3 | 4.8 | 60% | Moderate |

| 4 | IBM | 7.8 | 4.5 | 70% | Steady |

| 5 | Verizon | 8.1 | 4.8 | 62% | Consistent |

| 6 | AbbVie | 8.6 | 5.1 | 50% | Growing |

| 7 | Altria Group | 8.0 | 8.0 | 75% | Stable |

| 8 | Kinder Morgan | 7.9 | 5.0 | 68% | Stable |

| 9 | Realty Income | 8.2 | 4.4 | 55% | Consistent |

| 10 | Duke Energy | 7.7 | 4.2 | 63% | Steady |

| 11 | Dominion Energy | 7.5 | 3.7 | 70% | Moderate |

| 12 | Consolidated Edison | 7.6 | 3.9 | 80% | Stable |

| 13 | 3M | 7.9 | 3.3 | 60% | Steady |

| 14 | Coca-Cola | 8.4 | 3.0 | 55% | Growing |

| 15 | Pfizer | 8.0 | 4.0 | 50% | Steady |

AT&T

AT&T is known for its long-term commitment to returning profits to shareholders. The company has a strong market presence in telecommunications and consistently pays dividends.

Investors appreciate AT&T for its stable cash flows and reliable dividend record. Its financial structure supports a recurring dividend payout, making the stock a favored choice for retirement strategies. The focus remains on maintaining steady payouts even during market shifts.

Dividend Yield: 7.0%

Payout Ratio: 65%

Dividend Growth: Steady

Financial Health: Strong

Market Position: Leading

| Summary of Online Reviews |

|---|

| Users mention “consistent dividend payouts” and note “strong customer service” in discussion forums. |

ExxonMobil

ExxonMobil stands as a significant energy producer with a reputation for steady dividend payments. Its cash flows remain supported by global energy demand. The firm’s financial indicators and market performance continue to attract retirement investors. Its dividend yield and consistent performance are well documented. The company prioritizes operational efficiency and managing expenses wisely.

Dividend Yield: 5.2%

Payout Ratio: 55%

Dividend Growth: Consistent

Financial Health: Stable

Market Position: Global Leader

| Summary of Online Reviews |

|---|

| Investors report “steady income generation” and praise “strong management practices”. |

Chevron

Chevron is a well-established oil and gas company that delivers reliable dividends. The firm maintains strong operational efficiency and prudent capital allocation. Its dividend yield and payout ratio offer comfort for long-term income seekers. Investors value Chevron for its risk management and steady performance. The company consistently meets market expectations and preserves its market share.

Dividend Yield: 4.8%

Payout Ratio: 60%

Dividend Growth: Moderate

Financial Health: Solid

Market Position: Industry Leader

| Summary of Online Reviews |

|---|

| Market observers comment on “steady dividend increases” and highlight “efficient capital management”. |

IBM

IBM, a historic tech company, is known for steady and dependable dividend distributions. The firm has adapted its business model over time to retain profitability. Its ongoing dividend commitment appeals to conservative investors. IBM shows its strength in preserving customer relationships and investing in innovation. The financial metrics and strategic direction add to its credibility for long-term income planning.

Dividend Yield: 4.5%

Payout Ratio: 70%

Dividend Growth: Steady

Financial Health: Resilient

Market Position: Trusted Brand

| Summary of Online Reviews |

|---|

| Reviewers express “appreciation for the consistent dividends” and note “solid technology investments”. |

Verizon

Verizon stands out in the communications sector with stable dividend payouts. The company remains focused on improving network quality and customer service. Its financial performance supports regular dividend increases.

Investors find comfort in Verizon’s steady revenue streams and market share preservation. The record of consistent dividend maintenance makes the stock appealing for retirement income.

Dividend Yield: 4.8%

Payout Ratio: 62%

Dividend Growth: Consistent

Financial Health: Sound

Market Position: Top Tier

| Summary of Online Reviews |

|---|

| Users mention “steady communication services” along with “reliable dividend triggers” on finance blogs. |

AbbVie

AbbVie is a leading biopharmaceutical company recognized for its growing dividend and steady income returns—the firm benefits from a diverse drug portfolio and healthy market share. Financial disclosures support its ability to sustain dividend payments. The business model is geared to improve its profitability year over year. Investors rely on AbbVie for its clear dividend payment record and growing research results.

Dividend Yield: 5.1%

Payout Ratio: 50%

Dividend Growth: Growing

Financial Health: Sound

Market Position: Leading Biotech

| Summary of Online Reviews |

|---|

| Feedback includes “impressive dividend increases” and “strong drug pipeline” on investment boards. |

Altria Group

Altria Group is a major player in the tobacco industry. Its dividend yield remains one of the highest among its peers. The company features a strong dividend policy supported by cash flow generation. Financial figures and market observations highlight its focus on shareholder returns. The established brand and steady performance present a favorable option for retirement income investors.

Dividend Yield: 8.0%

Payout Ratio: 75%

Dividend Growth: Stable

Financial Health: Mature

Market Position: Industry Leader

| Summary of Online Reviews |

|---|

| Investors comment on “high yield performance” and cite “consistent payouts” in online forums. |

Kinder Morgan

Kinder Morgan is an energy infrastructure company that has earned a place among high dividend stocks. Its operations focus on pipeline transportation and storage.

The stable payout ratio and attractive yield make it a choice for income-focused investors. Financial data show that the company manages its debt well while providing steady distributions. The firm remains a steady performer despite market volatility.

Dividend Yield: 5.0%

Payout Ratio: 68%

Dividend Growth: Stable

Financial Health: Reliable

Market Position: Significant Player

| Summary of Online Reviews |

|---|

| Commentators note “steady dividend returns” and mention “sound operational management”. |

Realty Income

Realty Income is a real estate investment trust noted for its regular monthly dividend payments. The organization benefits from diversified retail properties and long-term leases. Its investment model provides a steady income source that appeals to risk-averse investors. Realty Income prioritizes stability and measured growth. The resulting dividend distribution supports long-term retirement planning.

Dividend Yield: 4.4%

Payout Ratio: 55%

Dividend Growth: Consistent

Financial Health: Secure

Market Position: Well-Diversified

| Summary of Online Reviews |

|---|

| Online feedback includes “dependable dividend reliability” with “stable property management” remarks. |

Duke Energy

Duke Energy is a leading utility company offering predictable dividend payments. The firm has a long history of steady earnings and disciplined capital management. It serves millions of customers and maintains a solid asset base. Investors value Duke Energy for its consistency and operational efficiency. The company’s balance sheet reinforces its ability to support long-term dividends.

Dividend Yield: 4.2%

Payout Ratio: 63%

Dividend Growth: Steady

Financial Health: Stable

Market Position: Leading Utility

| Summary of Online Reviews |

|---|

| Reviews mention “steady income performance” with reflections on “solid utility operations”. |

Dominion Energy

Dominion Energy is recognized in the utilities sector for its measured dividend payments. The company focuses on energy production and distribution. Its financial figures support regular dividend distributions.

Investors find Dominion Energy appealing for its risk management and gradual dividend progress. The stock may suit those who seek a blend of safety and modest yield increases.

Dividend Yield: 3.7%

Payout Ratio: 70%

Dividend Growth: Moderate

Financial Health: Reliable

Market Position: Established Utility

| Summary of Online Reviews |

|---|

| Review quotes include “steady dividend track record” and praise for “sound operational strategy”. |

Consolidated Edison

Consolidated Edison is a utility company noted for its reliable dividend payments. Its diversified energy services and stable earnings add to its reputation. The stock is favored by investors planning for retirement due to its consistent performance and manageable payout ratios.

The company has adapted over time while holding its commitment to dividends. Its customer base and market stability make it a secure income source.

Dividend Yield: 3.9%

Payout Ratio: 80%

Dividend Growth: Stable

Financial Health: Balanced

Market Position: Established Utility

| Summary of Online Reviews |

|---|

| Forum users note “consistent payment discipline” along with “steady operational performance”. |

3M

3M has maintained a steady record of dividend payments over many years. Its diversified operations contribute to a resilient business model. With a long history of shareholder returns, the company appeals to investors seeking income stability. The stock benefits from innovations in various industrial segments. Known for operational reliability, 3M remains a solid addition to a retirement portfolio.

Dividend Yield: 3.3%

Payout Ratio: 60%

Dividend Growth: Steady

Financial Health: Stable

Market Position: Diversified Industrial

| Summary of Online Reviews |

|---|

| Customers mention “consistent dividend performance” and highlight “broad innovation capabilities”. |

Coca-Cola

Coca-Cola is a globally recognized brand that has a long record of returning value to shareholders. Its reliable cash flows support regular dividend increases. With a vast distribution network, the company maintains steady revenues.

Investors often favor Coca-Cola for its consistency and market resilience. The historical performance in dividend payment is well recorded, adding confidence to retirement strategies.

Dividend Yield: 3.0%

Payout Ratio: 55%

Dividend Growth: Growing

Financial Health: Strong

Market Position: Global Leader

| Summary of Online Reviews |

|---|

| Analysts report “stable dividend returns” along with “global brand strength” in investor chats. |

Pfizer

Pfizer, a leader in the pharmaceutical sector, offers steady dividend payments backed by diversified product lines. Its research investments and market reach deliver confidence in financial stability and future growth. The company’s commitment to shareholder returns remains evident in its payout history. Pfizer continues to support a solid dividend yield, making it attractive for retirement portfolios that value income consistency.

Dividend Yield: 4.0%

Payout Ratio: 50%

Dividend Growth: Steady

Financial Health: Secure

Market Position: Industry Leader

| Summary of Online Reviews |

|---|

| User reviews often state “dependable dividend yields” and mention “strong research results”. |

Final Thoughts

Investors seeking reliable income through high dividend stocks have many stable options. The list highlights companies that maintain balanced yields and prudent payout structures. Each stock reviewed exhibits traits that can support a retirement income plan.

Whether prioritizing cash flow stability or moderate dividend increases, selecting stocks based on clear financial indicators is vital. This guide helps in understanding each company’s performance and market position, enabling a more informed decision for diversified retirement portfolios.