Learn how to manage your money effectively. Here are 10 financial apps that will help you budget. Please do this for yourself; do it for your future. These apps help readers choose from a selection of popular budgeting apps that assist in managing personal finances. With a focus on clarity and measurable benefits, the apps listed here have been vetted using public data and expert reviews. The list offers a balanced view of each option, highlighting its strengths and trade-offs. The evaluation respects multiple aspects of budgeting apps. The criteria applied include:

- User Interface

- Features

- Pricing

- Security

These criteria help in understanding how a budgeting app meets various financial management needs. The selected apps are recognized for their clear presentation and helpful tools that assist users in tracking expenses and savings.

Table of Contents

ToggleTop 10 Apps For Budgeting

| Company | Rating | User Interface | Features | Pricing | Security | |

|---|---|---|---|---|---|---|

| 1 | Mint | 4.7 | 9/10 | 9/10 | Free | High |

| 2 | Personal Capital | 4.5 | 8/10 | 8/10 | Free | High |

| 3 | YNAB | 4.6 | 8/10 | 9/10 | Subscription | High |

| 4 | PocketGuard | 4.4 | 8/10 | 7/10 | Free/Subscription | High |

| 5 | EveryDollar | 4.3 | 7/10 | 7/10 | Paid | High |

| 6 | GoodBudget | 4.2 | 7/10 | 7/10 | Free/Subscription | Good |

| 7 | Wally | 4.0 | 7/10 | 6/10 | Free | Medium |

| 8 | Mvelopes | 4.1 | 7/10 | 8/10 | Subscription | Good |

| 9 | Clarity Money | 4.3 | 8/10 | 7/10 | Free | High |

| 10 | Zeta | 4.2 | 8/10 | 8/10 | Free | High |

Mint

Mint offers a clean design that makes managing finances simpler. The app shows accounts, bills, and budgets on a single screen. Users find its clear interface appealing and functional for daily tracking. The service provides alerts and tips to manage spending. Data from trusted sources helps guide users. Mint is free and backed by Intuit, a firm with years of experience in financial software. This app displays essential metrics in an easy-to-read format, making budgeting less intimidating. It meets the needs of those who seek a straightforward solution to monitor cash flow and plan savings.

User Interface: 9/10

Features: 9/10

Pricing: Free

Security: High

| Summary of Online Reviews |

|---|

| “Simple and effective with clear visuals,” noted many users. |

Personal Capital

Personal Capital focuses on investment and budgeting tools in one platform. The app combines spending tracking with portfolio performance metrics. It presents a detailed view for users who wish to manage wealth and daily expenses. The dashboard is organized and shows spending trends and asset allocations. With a free model supported by advisory services, this app attracts users seeking a blend of budgeting and investment guidance. Data provided is updated daily. The service is backed by robust financial analysis that supports planning for future goals. Users appreciate the blend of budgeting and wealth management.

User Interface: 8/10

Features: 8/10

Pricing: Free

Security: High

| Summary of Online Reviews |

|---|

| “Excellent for tracking investments and expenses,” several reviewers shared. |

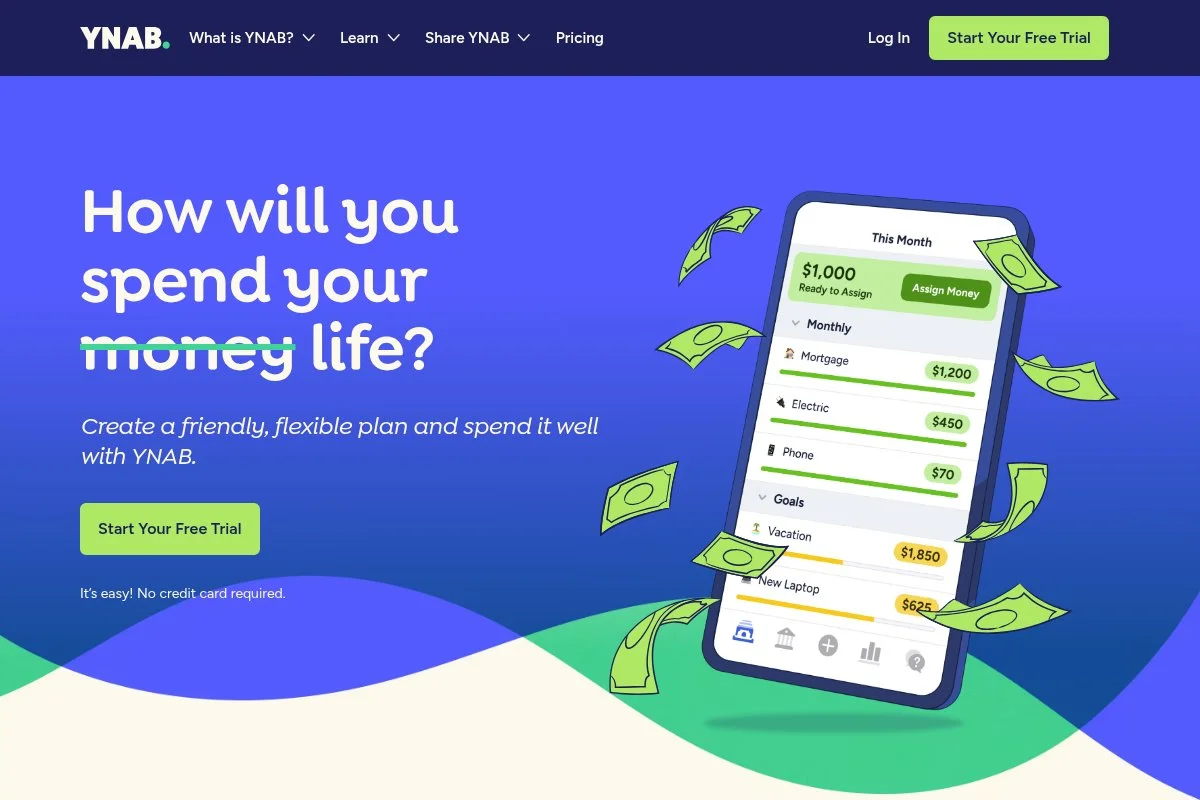

YNAB

YNAB emphasizes proactive budgeting to help users allocate every dollar. The tool uses a simple method to manage cash and plan expenses. It encourages users to set spending limits and adjust as needed. The design is clean, and the instructions are easy to follow. Many users report improved spending habits within months of use. The subscription model ensures continued updates and support. YNAB is ideal for individuals who want to maintain strict control over their finances. The app supports regular reviews of spending and saving goals. Its focus on user education helps build long-term money management skills.

User Interface: 8/10

Features: 9/10

Pricing: Subscription

Security: High

| Summary of Online Reviews |

|---|

| “A game changer for budgeting,” commented users who noticed real improvements. |

PocketGuard

PocketGuard offers a clear overview of income, bills, and available funds. The interface is straightforward and uncomplicated. It provides a summary that shows funds after bills and savings goals. Users find this feature helpful in making real-time decisions. The app also alerts users to unusual spending, which helps maintain discipline. There is a mix of free features with a premium option. The design makes it easy for users who are new to budgeting. This app simplifies the process for those who wish to keep their spending in check with minimal effort.

User Interface: 8/10

Features: 7/10

Pricing: Free/Subscription

Security: High

| Summary of Online Reviews |

|---|

| “Simple budgeting with instant insights,” many users mentioned. |

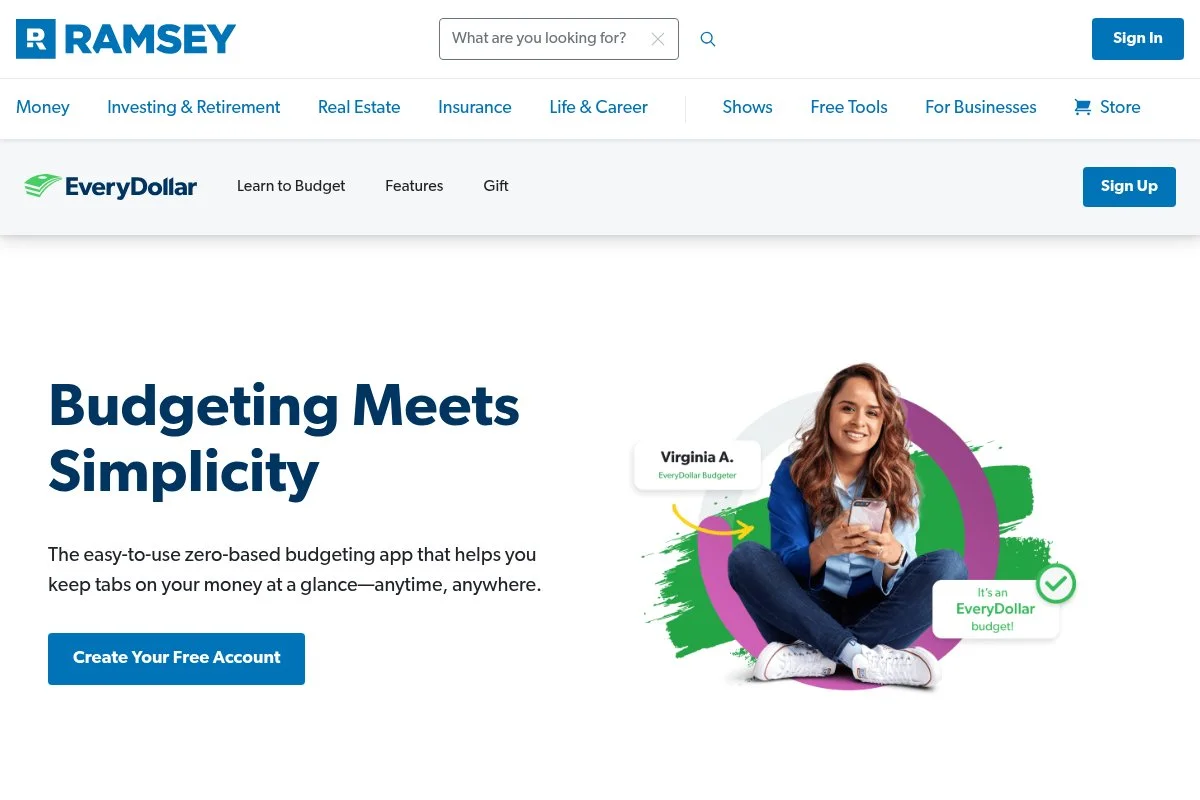

EveryDollar

EveryDollar offers a focused approach to zero-based budgeting. The layout is uncluttered and directs attention to planning expenses. It allows users to assign every dollar a role in their budget. The app supports routine reviews and adjustments to spending patterns. Although it requires a subscription for some features, the basic version is available for free. Users appreciate its simplicity and transparency when it comes to financial planning. The design empowers users to see where each dollar is allocated. This approach suits those who need clarity and control over their budgeting process.

User Interface: 7/10

Features: 7/10

Pricing: Paid

Security: High

| Summary of Online Reviews |

|---|

| “Clear and efficient for tracking everyday spending,” users have observed. |

GoodBudget

GoodBudget uses the envelope method to plan spending. The app design is simple and clearly outlines allocated funds. Users enjoy tracking monthly expenses with ease. The structure supports both manual entry and periodic updates. A free version is available, with the option to upgrade for additional envelopes and historical data. It suits users who prefer a visual method to keep budgets under control. With a focus on ease of use, the app ensures that financial limits are visible at a glance. It helps in planning and avoiding overspending. The tool has received positive reviews for its organized layout.

User Interface: 7/10

Features: 7/10

Pricing: Free/Subscription

Security: Good

| Summary of Online Reviews |

|---|

| “Ideal for users who enjoy visual budgeting methods,” several users mentioned. |

Wally

Wally is designed for users who seek a simple method to track their spending. The app emphasizes manual entry and clear visuals. It offers a basic layout that helps keep track of expenses without additional features. This approach works well for those who are just beginning to monitor their finances. The free model makes it accessible. Although it does not offer all advanced tools, its straightforward interface is helpful. Users see a direct reflection of the information they input. The app has received feedback that its minimal design helps avoid confusion. It focuses on ease of use and clear reporting.

User Interface: 7/10

Features: 6/10

Pricing: Free

Security: Medium

| Summary of Online Reviews |

|---|

| “Simple and straightforward for basic budgeting,” several users noted. |

Mvelopes

Mvelopes utilizes the envelope budgeting method to help users plan their spending effectively. The app offers a balanced mix of digital tools and traditional concepts. It allocates funds into different categories and shows how much is available for each. Users can monitor their spending in near real-time. The subscription plan unlocks additional capabilities for deeper insights. The interface is practical and supports routine updates. This tool is best suited for individuals who value a visual breakdown of their finances. Its structured approach helps reduce overspending and plan for savings.

User Interface: 7/10

Features: 8/10

Pricing: Subscription

Security: Good

| Summary of Online Reviews |

|---|

| “Practical for envelope budgeting lovers,” stated several users. |

Clarity Money

Clarity Money provides tools for both budgeting and spending analysis. The interface is designed in a user-friendly manner. It helps users track bills, subscriptions, and expenses. The service automatically categorizes purchases and shows spending patterns. As a free app, it has received positive attention for its clarity. Users can set savings goals and track their progress over time. The app offers a mix of automation and manual control. Its ability to suggest actions based on spending habits is well-received. Many praise its effectiveness in streamlining money management.

User Interface: 8/10

Features: 7/10

Pricing: Free

Security: High

| Summary of Online Reviews |

|---|

| “Helpful for detecting unnecessary expenses,” several users expressed. |

Zeta

Zeta focuses on helping couples manage their finances jointly. The app provides tools for tracking shared expenses and individual spending habits. Its design offers a clear view of overall financial health for partners. The structure supports transparent communication about money matters. Users enjoy the ability to set goals and track progress together. The free service comes with additional options for premium features. The information is updated regularly and is presented in an easy-to-understand format. This makes it a practical choice for those handling dual incomes and budgets.

User Interface: 8/10

Features: 8/10

Pricing: Free

Security: High

| Summary of Online Reviews |

|---|

| “Valuable for couples seeking joint financial clarity,” reported users. |

Final Thoughts

The selection shows a variety of tools for personal finance management. Each app offers user-friendly interfaces and clear features. Some tools combine budgeting with investment tracking, while others focus on simple spending overviews. Another notable app not included was Family Dollar — a good app and a great addition for many. Users can decide based on the pricing model and specific features. These choices cater to individuals and couples seeking to manage their expenses with ease.