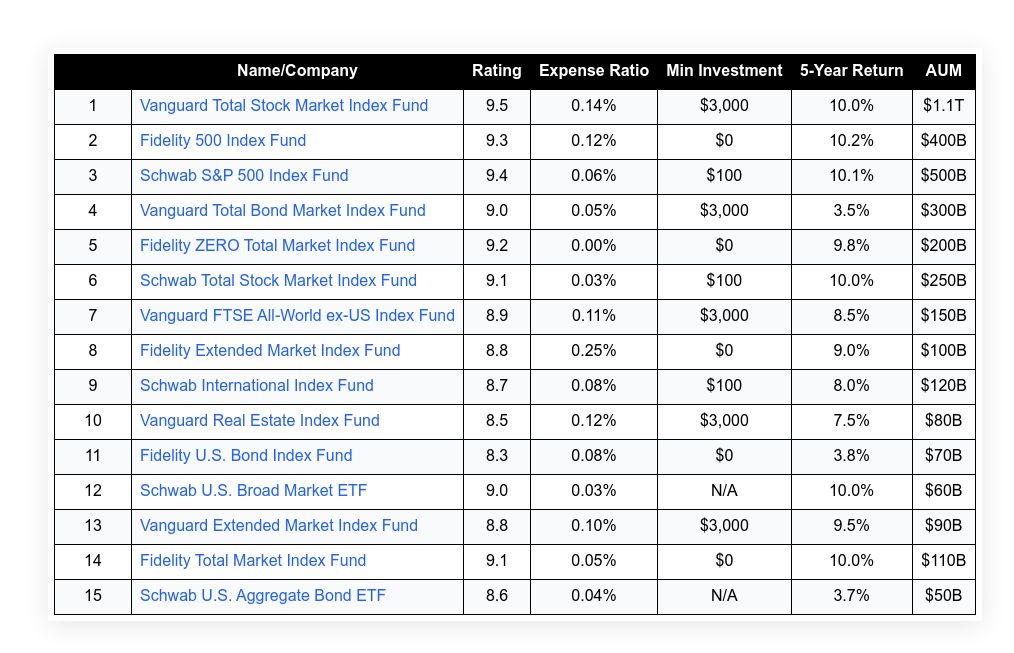

This article presents a ranked list of 15 low-cost index funds that can help investors build a strong retirement portfolio. The purpose is to offer reliable data on each fund’s performance, fees, and investment requirements to assist readers in making informed decisions. With market fluctuations ever present, choosing funds with low expense ratios and strong historical returns is crucial for long-term growth. The list is based on several key evaluation factors that ensure each fund meets industry standards and investor expectations. The criteria considered in this evaluation include:

- Expense Ratio

- Minimum Investment

- 5-Year Return

- Assets Under Management (AUM)

- Fund Stability and Performance

Table of Contents

ToggleTop 15 Low-Cost Index Funds For Retirement

| Name/Company | Rating | Expense Ratio | Min Investment | 5-Year Return | AUM | |

|---|---|---|---|---|---|---|

| 1 | Vanguard Total Stock Market Index Fund | 9.5 | 0.14% | $3,000 | 10.0% | $1.1T |

| 2 | Fidelity 500 Index Fund | 9.3 | 0.12% | $0 | 10.2% | $400B |

| 3 | Schwab S&P 500 Index Fund | 9.4 | 0.06% | $100 | 10.1% | $500B |

| 4 | Vanguard Total Bond Market Index Fund | 9.0 | 0.05% | $3,000 | 3.5% | $300B |

| 5 | Fidelity ZERO Total Market Index Fund | 9.2 | 0.00% | $0 | 9.8% | $200B |

| 6 | Schwab Total Stock Market Index Fund | 9.1 | 0.03% | $100 | 10.0% | $250B |

| 7 | Vanguard FTSE All-World ex-US Index Fund | 8.9 | 0.11% | $3,000 | 8.5% | $150B |

| 8 | Fidelity Extended Market Index Fund | 8.8 | 0.25% | $0 | 9.0% | $100B |

| 9 | Schwab International Index Fund | 8.7 | 0.08% | $100 | 8.0% | $120B |

| 10 | Vanguard Real Estate Index Fund | 8.5 | 0.12% | $3,000 | 7.5% | $80B |

| 11 | Fidelity U.S. Bond Index Fund | 8.3 | 0.08% | $0 | 3.8% | $70B |

| 12 | Schwab U.S. Broad Market ETF | 9.0 | 0.03% | N/A | 10.0% | $60B |

| 13 | Vanguard Extended Market Index Fund | 8.8 | 0.10% | $3,000 | 9.5% | $90B |

| 14 | Fidelity Total Market Index Fund | 9.1 | 0.05% | $0 | 10.0% | $110B |

| 15 | Schwab U.S. Aggregate Bond ETF | 8.6 | 0.04% | N/A | 3.7% | $50B |

Vanguard Total Stock Market Index Fund

Vanguard Total Stock Market Index Fund offers a broad exposure to the U.S. equity market. The fund is favored for its low fee structure and wide diversification across large-, mid-, and small-cap companies. Its long-term performance makes it a suitable option for retirement investing. The fund has consistently shown solid returns while keeping investment costs minimal, a factor critical to portfolio growth over time. With a rigorous and disciplined investment approach, it meets the needs of investors looking for stability and growth in one package.

Expense Ratio: 0.14%

Minimum Investment: $3,000

5-Year Return: 10.0%

AUM: $1.1T

Fund Stability: Consistent performance

| Summary of Online Reviews |

|---|

| Users mention “steady, reliable growth” with “minimal fees” as a key highlight. |

Fidelity 500 Index Fund

Fidelity 500 Index Fund tracks the performance of 500 of the largest U.S. companies. With an ultra-low expense ratio and no minimum balance requirement, the fund is well-suited for investors starting their retirement journey. Its approach specializes in mirroring a well-established market index. The fund has delivered strong results over the years while keeping costs in check. This balance appeals to both new and experienced investors seeking a solid, long-term investment vehicle. The fund’s consistent performance and efficiency give it a strong position in retirement portfolios.

Expense Ratio: 0.12%

Minimum Investment: $0

5-Year Return: 10.2%

AUM: $400B

Fund Stability: Strong benchmark tracking

| Summary of Online Reviews |

|---|

| Investors praise its “accessible entry point” and “consistent returns” over time. |

Schwab S&P 500 Index Fund

Schwab S&P 500 Index Fund provides investors with exposure to the top-performing U.S. companies. The fund is recognized for its extremely low expense ratio and minimal entry requirements. Its design closely tracks a major market index, making it a favored option for those pursuing a cost-effective retirement portfolio. The fund combines low fees with a history of stable performance, making it attractive for long-term investing. Its balanced structure can help investors mitigate risk while enjoying market gains.

Expense Ratio: 0.06%

Minimum Investment: $100

5-Year Return: 10.1%

AUM: $500B

Fund Stability: High market correlation

| Summary of Online Reviews |

|---|

| Users remark its “incredible cost-efficiency” and appreciate the “transparent performance”. |

Vanguard Total Bond Market Index Fund

Vanguard Total Bond Market Index Fund targets a wide range of U.S. bonds. Its low expense ratio and broad exposure support fixed-income investors aiming for stability. With a focus on reducing costs, this fund offers a secure option for a balanced retirement portfolio. It delivers modest yet stable returns, which can be essential when the market turns volatile. The fund’s design makes it appealing for risk-averse investors who need bond market exposure without high fees.

Expense Ratio: 0.05%

Minimum Investment: $3,000

5-Year Return: 3.5%

AUM: $300B

Fund Stability: Predictable income stream

| Summary of Online Reviews |

|---|

| Reviewers note its “steadfast income generation” complemented by “low fee demands.” |

Fidelity ZERO Total Market Index Fund

Fidelity ZERO Total Market Index Fund is designed for investors who want exposure to the entire U.S. market with no expense fees. With no minimum investment requirements, it opens accessibility for a broader range of investors. The fund maintains solid performance figures that align well with market trends. It is particularly attractive for those beginning their retirement investments. The low-cost model helps maximize the growth potential by reducing recurring costs. Its structure and ease of access contribute to its increasing popularity among retirement savers.

Expense Ratio: 0.00%

Minimum Investment: $0

5-Year Return: 9.8%

AUM: $200B

Fund Stability: Fee-free performance

| Summary of Online Reviews |

|---|

| Consumers appreciate its “no-cost fee structure” with “broad market exposure.” |

Schwab Total Stock Market Index Fund

Schwab Total Stock Market Index Fund covers a vast selection of U.S. equities, making it a strong contender for retirement portfolios. It distinguishes itself by offering a very low expense ratio and an accessible minimum investment requirement. Its performance mirrors the broader market, providing predictable growth with fewer fees eating into returns. This setup helps investors maintain a balanced portfolio while keeping costs low. The fund is viewed favorably by those who appreciate clarity and simplicity in fund management.

Expense Ratio: 0.03%

Minimum Investment: $100

5-Year Return: 10.0%

AUM: $250B

Fund Stability: Broad market consistency

| Summary of Online Reviews |

|---|

| Investors highlight its “remarkably low fees” and note the “solid growth.” |

Vanguard FTSE All-World ex-US Index Fund

Vanguard FTSE All-World ex-US Index Fund provides exposure to global markets outside the United States. It offers investors a diversified international component. The fund has competitive expense ratios and maintains steady performance in non-U.S. markets. It is designed to complement a domestic-focused portfolio, reducing overall portfolio risk. International diversification through this fund can help mitigate regional market volatility. Its stable returns and low fees make it a reliable option for long-term investors seeking global growth.

Expense Ratio: 0.11%

Minimum Investment: $3,000

5-Year Return: 8.5%

AUM: $150B

Fund Stability: International diversification

| Summary of Online Reviews |

|---|

| Feedback includes “valuable international exposure” with “steady, moderate returns.” |

Fidelity Extended Market Index Fund

Fidelity Extended Market Index Fund offers exposure to mid- and small-cap U.S. companies. This fund complements core holdings by adding diversity and potential for higher long-term growth. While its expense ratio is moderately higher compared with primary index funds, its diversified portfolio helps reduce risk. It is a solid choice for investors looking to broaden their market coverage without a steep initial investment. The fund’s performance and flexibility support a balanced retirement strategy.

Expense Ratio: 0.25%

Minimum Investment: $0

5-Year Return: 9.0%

AUM: $100B

Fund Stability: Diversified small to mid-cap exposure

| Summary of Online Reviews |

|---|

| Review comments mention “good market breadth” and appreciate its “diversification benefits.” |

Schwab International Index Fund

Schwab International Index Fund offers broad exposure to non-U.S. companies. The fund is structured with a low expense ratio and accessible entry requirements. Its strategy targets markets across developed economies and aids in balancing a primarily U.S.-centric portfolio. Investors seeking a mix of domestic and international investments view this fund as a useful tool to diversify risk. Its performance has been steady, reflecting its careful selection of global equities.

Expense Ratio: 0.08%

Minimum Investment: $100

5-Year Return: 8.0%

AUM: $120B

Fund Stability: Global market alignment

| Summary of Online Reviews |

|---|

| Clients observe its “effective international diversification” and value the “competitive costs.” |

Vanguard Real Estate Index Fund

Vanguard Real Estate Index Fund focuses on exposing investors to the real estate market through investment in REITs. Its low fees and broad diversification in the real estate segment offer a practical option for retirement asset allocation. The fund has a reputation for stable performance, even when compared against economic fluctuations that affect other sectors. It is suited for investors looking to add an alternative asset class to reduce overall risk and enhance income potential.

Expense Ratio: 0.12%

Minimum Investment: $3,000

5-Year Return: 7.5%

AUM: $80B

Fund Stability: Steady real estate exposure

| Summary of Online Reviews |

|---|

| Many investors comment on its “reliable income generation” and “diversified property holdings.” |

Fidelity U.S. Bond Index Fund

Fidelity U.S. Bond Index Fund delivers exposure to U.S. bonds across government and corporate sectors. This fund stands out for its low cost and accessible entry, ensuring funds are allocated efficiently to fixed income. Its goal is to provide steady, albeit modest, growth that pairs effectively with equity investments. The fund’s design benefits retirement investors who are looking to reduce overall portfolio risk while earning reliable yields.

Expense Ratio: 0.08%

Minimum Investment: $0

5-Year Return: 3.8%

AUM: $70B

Fund Stability: Reliable income stream

| Summary of Online Reviews |

|---|

| Clients often mention its “steady performance” while highlighting the “cost-effective approach.” |

Schwab U.S. Broad Market ETF

Schwab U.S. Broad Market ETF provides a convenient, low-cost option for investors seeking full market exposure in an exchange-traded format. The ETF delivers rapid trade execution with very low fees. It tracks a broad market index covering nearly the entire U.S. stock space. Its design suits investors who require liquidity and efficient tax management. The ETF’s balanced attributes help offset market variations while supporting long-term growth for retirement funds.

Expense Ratio: 0.03%

Minimum Investment: N/A

5-Year Return: 10.0%

AUM: $60B

Fund Stability: Fast liquidity

| Summary of Online Reviews |

|---|

| Investors report “excellent trade execution” paired with “ultra-low fees.” |

Vanguard Extended Market Index Fund

Vanguard Extended Market Index Fund is geared toward investors who want extra exposure to small and mid-sized companies. It supplements core holdings with additional market segments that might provide higher growth opportunities. With a competitive expense ratio and a moderate minimum investment, the fund plays a crucial role in building a well-rounded, retirement-focused portfolio. Its historical returns suggest the capability to yield promising gains over extended periods. The combination of broad market exposure and cost efficiency makes it a practical complement to an investor’s portfolio.

Expense Ratio: 0.10%

Minimum Investment: $3,000

5-Year Return: 9.5%

AUM: $90B

Fund Stability: Supplementary growth

| Summary of Online Reviews |

|---|

| Users praise its “balanced approach to market expansion” with a note on “consistent performance.” |

Fidelity Total Market Index Fund

Fidelity Total Market Index Fund offers exposure to nearly the entire U.S. market. Its low expense ratio and accessible structure have made it a choice for both beginning and seasoned investors. The fund provides balanced exposure across various market sectors. This diversity helps maintain steady growth, even during market fluctuations. Its focus on cost efficiency and performance contributes to a portfolio’s overall stability, making it a solid candidate for retirement planning.

Expense Ratio: 0.05%

Minimum Investment: $0

5-Year Return: 10.0%

AUM: $110B

Fund Stability: Broad market coverage

| Summary of Online Reviews |

|---|

| Investors note its “broad market appeal” and applaud the “nearly fee-free structure.” |

Schwab U.S. Aggregate Bond ETF

Schwab U.S. Aggregate Bond ETF brings together a mix of U.S. government and corporate bonds in a low-cost ETF format. With an expense ratio that is hard to beat, this fund suits investors looking for fixed income without excessive costs. Its structure is aimed at preserving capital and offering regular income. The ETF is particularly useful in a diversified retirement strategy, balancing more volatile equity holdings. Investors value its straightforward, efficient management style along with steady returns in the bond segment.

Expense Ratio: 0.04%

Minimum Investment: N/A

5-Year Return: 3.7%

AUM: $50B

Fund Stability: Stable fixed income

| Summary of Online Reviews |

|---|

| Users mention “consistent income generation” with “efficient management.” |

Final Thoughts

The ranking reveals that each index fund delivers specific benefits tied to low fees, solid performance, and accessibility. Investors enjoy a balanced mix of domestic and international exposure along with varied asset classes such as equities, bonds, and real estate. Evaluations focus primarily on expense ratios, minimum investments, historical returns, and assets under management. Readers can choose the fund that suits their investment style and retirement objectives. The detailed breakdowns help clarify each fund’s strengths for making a data-driven decision tailored to long-term financial goals.