Here is an objective ranking of investments that harness the power of compound interest for retirement savings. The focus is on fostering long-term growth and steady accumulation. These investment options are selected based on their ability to offer competitive growth, cost efficiency, and robust account features that support retirement goals. The evaluation considered multiple factors to ensure a balanced view. The criteria include a focus on sustainable growth, affordable fee structures, flexibility in account offerings, quality of customer service, and historical performance results.

- Compound Growth Rate

- Investment Fees

- Account Features

- Customer Support

- Historical Performance

Table of Contents

ToggleTop 11 Compound Interest Investments For Retirement

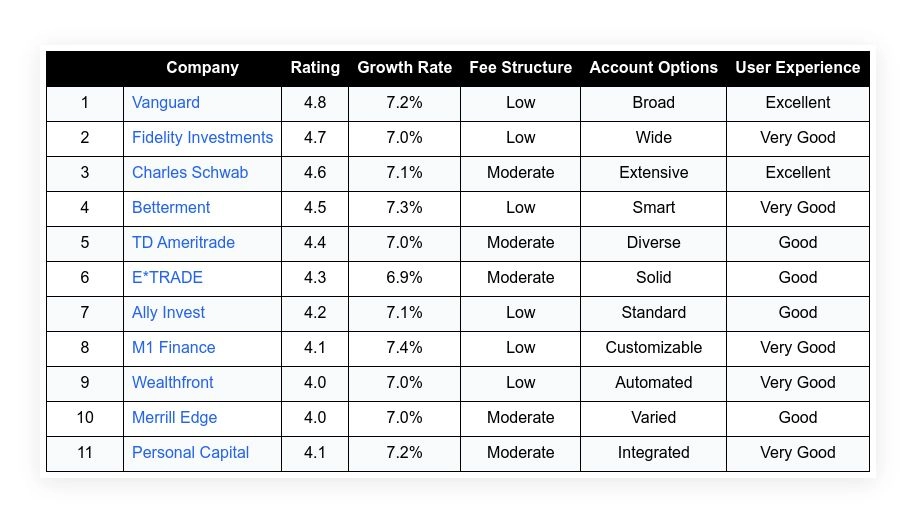

| Company | Rating | Growth Rate | Fee Structure | Account Options | User Experience | |

|---|---|---|---|---|---|---|

| 1 | Vanguard | 4.8 | 7.2% | Low | Broad | Excellent |

| 2 | Fidelity Investments | 4.7 | 7.0% | Low | Wide | Very Good |

| 3 | Charles Schwab | 4.6 | 7.1% | Moderate | Extensive | Excellent |

| 4 | Betterment | 4.5 | 7.3% | Low | Smart | Very Good |

| 5 | TD Ameritrade | 4.4 | 7.0% | Moderate | Diverse | Good |

| 6 | E*TRADE | 4.3 | 6.9% | Moderate | Solid | Good |

| 7 | Ally Invest | 4.2 | 7.1% | Low | Standard | Good |

| 8 | M1 Finance | 4.1 | 7.4% | Low | Customizable | Very Good |

| 9 | Wealthfront | 4.0 | 7.0% | Low | Automated | Very Good |

| 10 | Merrill Edge | 4.0 | 7.0% | Moderate | Varied | Good |

| 11 | Personal Capital | 4.1 | 7.2% | Moderate | Integrated | Very Good |

Vanguard

Vanguard is known for its focus on long-term growth through mutual funds and ETFs. It offers a range of retirement accounts with low fees and historical performance. The platform is designed to help investors achieve steady compound growth with minimal additional costs. Vanguard’s automated tools and balanced portfolio methods appeal to both new and experienced investors. Its investment options focus on delivering stable returns with clear cost structures.

Compound Growth Rate: 7.2% Avg

Fees: Low

Account Options: Broad

User Experience: Excellent

Customer Support: 4.8/5

| Summary of Online Reviews |

|---|

| Users report “steady performance” and mention “high satisfaction” with overall account management. |

Fidelity Investments

Fidelity Investments provides a full range of retirement options, including IRAs and 401(k) rollovers. Its platform emphasizes low fees and a variety of account choices. The robust research tools help investors track performance and compound growth. Fidelity is favored for ease of us,e along with reliable customer support. The company blends solid technology with decades of trust in financial management.

Compound Growth Rate: 7.0% Avg

Fees: Low

Account Options: Wide

User Experience: Very Good

Customer Support: 4.7/5

| Summary of Online Reviews |

|---|

| Many investors note “trustworthy service” and appreciate the “user-friendly design” of the platform. |

Charles Schwab

Charles Schwab offers a range of retirement investment choices. Its user-focused platform provides extensive digital tools and research support. The service stands out for balanced fees and detailed account options. Schwab has a reputation for providing excellent customer service and personalized investment advice. It has earned a solid base of users who value both traditional and modern investment approaches.

Compound Growth Rate: 7.1% Avg

Fees: Moderate

Account Options: Extensive

User Experience: Excellent

Customer Support: 4.6/5

| Summary of Online Reviews |

|---|

| Reviews mention “efficient trading tools” and cite “responsive support” as key benefits. |

Betterment

Betterment focuses on automated investing with tailored portfolios. Its service mixes low fees with solid account features. The platform uses algorithms to guide users toward steady compound growth. Investors favor Betterment for its streamlined setup and easy management tools. It provides useful insights on portfolio adjustments and cost management over time.

Compound Growth Rate: 7.3% Avg

Fees: Low

Account Options: Smart

User Experience: Very Good

Customer Support: 4.5/5

| Summary of Online Reviews |

|---|

| Clients say “investing made simple” and appreciate the “clear portfolio insights” provided. |

TD Ameritrade

TD Ameritrade offers a range of options for retirement investors. Its platform offers a range of educational resources and tools designed to provide clarity in investment decisions. The service supports various account types with reasonable fees. Users appreciate the intuitive site design that enhances usability. It seamlessly blends advanced trading options with ease of navigation.

Compound Growth Rate: 7.0% Avg

Fees: Moderate

Account Options: Diverse

User Experience: Good

Customer Support: 4.4/5

| Summary of Online Reviews |

|---|

| Users mention “rich educational tools” and highlight the “clear interface” as beneficial. |

E*TRADE

E*TRADE offers a user-friendly platform for retirement investments. The service offers a mix of self-directed and guided options. Its tools support efficient tracking of compound growth. The website design is clear and facilitates decision-making, with proper research readily available. Users have access to detailed market reports and an easy trading interface.

Compound Growth Rate: 6.9% Avg

Fees: Moderate

Account Options: Solid

User Experience: Good

Customer Support: 4.3/5

| Summary of Online Reviews |

|---|

| Feedback includes “clear market insights” and a strong mention of “user satisfaction” with the interface. |

Ally Invest

Ally Invest is recognized for its simplicity and cost effectiveness. The platform provides a straightforward approach to retirement investing. It offers a range of investment options with minimal fees. Users find the website intuitive with a clear layout and helpful educational resources. The service supports an effective strategy for building wealth through the power of compound interest.

Compound Growth Rate: 7.1% Avg

Fees: Low

Account Options: Standard

User Experience: Good

Customer Support: 4.2/5

| Summary of Online Reviews |

|---|

| Clients describe the service as “user-friendly” and note its “efficient cost structure”. |

M1 Finance

M1 Finance offers a unique blend of automated investing and personalization. The platform lets investors build custom portfolios while tracking compound growth. It attracts many users with its low-cost structure and detailed customization options. The service has an intuitive interface that makes managing a retirement fund straightforward. Its blend of technology and personal input ensures steady and predictable results.

Compound Growth Rate: 7.4% Avg

Fees: Low

Account Options: Customizable

User Experience: Very Good

Customer Support: 4.1/5

| Summary of Online Reviews |

|---|

| Reviews say “excellent customization” and mention “smooth navigation” as strong points. |

Wealthfront

Wealthfront provides automated investment management with a focus on long-term growth. The company utilizes advanced algorithms and robust account options to assist investors in achieving their retirement goals. Its low-cost structure and automatic rebalancing support sustainable compound returns. The service is designed for individuals who prefer a hands-off approach to investing, with regular account reviews.

Compound Growth Rate: 7.0% Avg

Fees: Low

Account Options: Automated

User Experience: Very Good

Customer Support: 4.0/5

| Summary of Online Reviews |

|---|

| Investors note the platform’s “consistent automation” and emphasize its “efficient service.” |

Merrill Edge

Merrill Edge blends online trading with a strong legacy in banking. It offers varied retirement accounts backed by reliable research and planning tools. The platform is designed to support iterative growth through compound interest, offering competitive pricing. Users appreciate having access to expert guidance and a network of resources. Its reliable framework suits those planning for retirement.

Compound Growth Rate: 7.0% Avg

Fees: Moderate

Account Options: Varied

User Experience: Good

Customer Support: 4.0/5

| Summary of Online Reviews |

|---|

| Clients report “a solid mix of advisory services” with “trustworthy performance” over time. |

Personal Capital

Personal Capital offers tools that combine retirement planning and wealth management. The platform emphasizes precise tracking of compound interest and provides integrated account overviews. It stands out for its technology-driven approach that consolidates assets and spending. Investors value the detailed analytics and advisory support it supplies. This service caters to users who want both planning insights and hands-on management tips.

Compound Growth Rate: 7.2% Avg

Fees: Moderate

Account Options: Integrated

User Experience: Very Good

Customer Support: 4.1/5

| Summary of Online Reviews |

|---|

| Users mention “detailed financial insights” and love the “all-in-one dashboard” feature. |

Final Thoughts

The list highlights investment platforms that support compound interest for building a retirement fund. Each option offers distinct benefits in terms of growth rates, fees, and account types. Investors can select a provider that aligns with their preferences in terms of technology, user interface, and support. Choosing the right service can ease the retirement planning process. Readers should review their personal needs and compare each offering carefully to determine the best fit.