August 05, 2025

Last Updated: August 05, 2025

This article presents a ranked list of index funds that investors might consider for their retirement goals. The list is created to help guide readers who want stable, long-term investment options. Background data and market performance have informed this ranking. Each fund has been reviewed with a focus on delivering steady returns, low costs, and ease of access for everyday investors. The selection criteria include:

- Expense Ratio

- Assets Under Management

- Minimum Investment Requirement

- Historical Performance

- Investor Accessibility

Each criteria provides key insight into the fund’s long-term stability and overall suitability for retirement portfolios.

Table of Contents

ToggleTop 10 Index Funds For Retirement

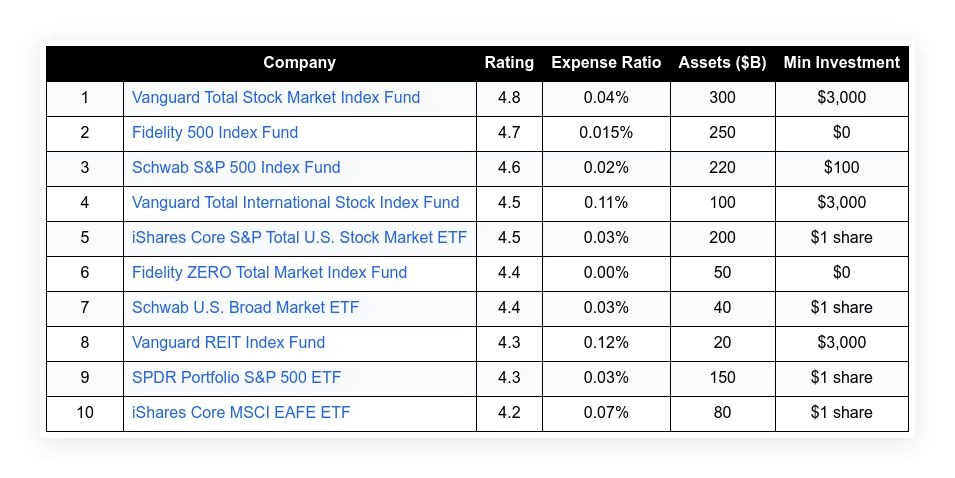

| Company | Rating | Expense Ratio | Assets ($B) | Min Investment | |

|---|---|---|---|---|---|

| 1 | Vanguard Total Stock Market Index Fund | 4.8 | 0.04% | 300 | $3,000 |

| 2 | Fidelity 500 Index Fund | 4.7 | 0.015% | 250 | $0 |

| 3 | Schwab S&P 500 Index Fund | 4.6 | 0.02% | 220 | $100 |

| 4 | Vanguard Total International Stock Index Fund | 4.5 | 0.11% | 100 | $3,000 |

| 5 | iShares Core S&P Total U.S. Stock Market ETF | 4.5 | 0.03% | 200 | $1 share |

| 6 | Fidelity ZERO Total Market Index Fund | 4.4 | 0.00% | 50 | $0 |

| 7 | Schwab U.S. Broad Market ETF | 4.4 | 0.03% | 40 | $1 share |

| 8 | Vanguard REIT Index Fund | 4.3 | 0.12% | 20 | $3,000 |

| 9 | SPDR Portfolio S&P 500 ETF | 4.3 | 0.03% | 150 | $1 share |

| 10 | iShares Core MSCI EAFE ETF | 4.2 | 0.07% | 80 | $1 share |

Vanguard Total Stock Market Index Fund

Vanguard Total Stock Market Index Fund offers broad market exposure. The fund covers nearly the entire U.S. stock market. Investors experience low operating costs and consistent performance. It has been favored among those building a long-term retirement portfolio. The fund benefits from diversified holdings and a proven track record. Its performance highlights stability in both bull and bear markets. The ratings reflect positive reviews from many users. The returns have been steady, making it appealing for risk-conscious investors. Its low expense ratio and impressive asset base add to its overall strength. The fund is designed to grow capital over time with modest initiation costs and prudent investment strategy.

Expense Ratio: 0.04%

Asset Growth: Strong

Performance: Consistent

Accessibility: High

Management: Time-tested

| Summary of Online Reviews |

|---|

| Users describe the fund as dependable and cost-efficient for long-term growth. |

Fidelity 500 Index Fund

Fidelity 500 Index Fund tracks a major market index and delivers exposure to leading U.S. companies. It has been noted for its low fees and solid market performance. The fund attracts investors looking for simplicity and steady returns. Its availability with no minimum investment requirement allows flexibility for new and seasoned investors alike. The fund has demonstrated reliable performance over multiple market cycles. Its diverse portfolio includes large-cap companies that help manage market fluctuations. Fidelity has a history of transparency and investor-friendly practices. The ease of investment makes it a popular option among retirement savers seeking both growth and stability.

Expense Ratio: 0.015%

Asset Growth: High

Performance: Steady

Accessibility: Excellent

Management: Investor-focused

| Summary of Online Reviews |

|---|

| Investors highlight the fund as accessible with consistent returns over time. |

Schwab S&P 500 Index Fund

Schwab S&P 500 Index Fund is a favored option among investors seeking exposure to large-cap U.S. companies. Its design offers balanced risk and steady returns. The fund is known for its low operating costs and minimal barriers to investment entry. Reviews describe it as a reliable choice for retirement planning. Its straightforward structure makes it accessible for both beginners and experienced investors. The fund benefits from the reputation of a trusted financial institution. It has maintained stable performance, even in volatile markets. By focusing on core market sectors, the fund supports capital growth and income generation.

Expense Ratio: 0.02%

Asset Growth: Reliable

Performance: Stable

Accessibility: High

Management: Efficient

| Summary of Online Reviews |

|---|

| Users call the fund dependable and appreciate its low costs structure. |

Vanguard Total International Stock Index Fund

Vanguard Total International Stock Index Fund offers exposure to global markets outside the United States. The fund provides investors with a well-diversified portfolio. It targets both developed and emerging markets to protect against regional downturns. This fund is appreciated for its modest fees and clear investment approach. Data shows it has successfully balanced risk while capturing international growth. The structured diversification gives investors a chance to benefit from varied economic trends. It has become a reliable tool for those building retirement portfolios. The fund highlights extensive global reach and efficient cost management. Its clarity in investment strategy benefits long-term asset growth.

Expense Ratio: 0.11%

Asset Growth: Solid

Performance: Steady

Accessibility: Good

Management: Global-focused

| Summary of Online Reviews |

|---|

| Investors remark on its broad reach and cost efficiency in global markets. |

iShares Core S&P Total U.S. Stock Market ETF

This ETF offers a broad exposure to the overall U.S. stock market. It is designed for investors seeking simplicity and liquidity. The fund has demonstrated steady performance with minimal fees. Many investors value its high liquidity and transparent structure. The tradeable nature of the ETF makes it flexible for retirement strategies. It has grown in assets while keeping operational costs low. The index tracking has shown consistency. Its wide market coverage supports long-term capital gains. Users appreciate the clarity in its cost structure and efficient management.

Expense Ratio: 0.03%

Asset Growth: High

Performance: Consistent

Accessibility: Very High

Management: Transparent

| Summary of Online Reviews |

|---|

| Clients praise its liquidity and note its transparent fee structure. |

Fidelity ZERO Total Market Index Fund

Fidelity ZERO Total Market Index Fund is designed with no expense fees. It offers exposure to the full U.S. stock market while eliminating typical investment costs. This makes the fund attractive for cost-sensitive retirement plans. Its structure is clear and favors a buy-and-hold strategy. The fund attracts both new and experienced investors who value a zero-fee approach. Its performance remains competitive with other low-cost funds. The investment style focuses on steady market returns and low entry barriers. Data indicates it has grown its asset base efficiently. Its simplicity and cost efficiency set it apart in a competitive market.

Expense Ratio: 0.00%

Asset Growth: Moderate

Performance: Competitive

Accessibility: Excellent

Management: Cost-focused

| Summary of Online Reviews |

|---|

| Investors call the fund extremely cost-effective with satisfactory market returns. |

Schwab U.S. Broad Market ETF

Schwab U.S. Broad Market ETF offers a straightforward path to investing in a wide range of U.S. companies. The ETF format makes it easy to trade. It has a low fee structure and appealing cost benefits. Investors praise the fund for its simple approach towards long-term growth. It displays steady performance and contains a broad market mix. The flexibility of purchasing single shares suits investors with varying capital sizes. Its performance in different market conditions has been steady. The fund is structured to support both growth and income generation over time.

Expense Ratio: 0.03%

Asset Growth: Steady

Performance: Reliable

Accessibility: High

Management: Simplified

| Summary of Online Reviews |

|---|

| The ETF is described as user-friendly and cost-effective by many investors. |

Vanguard REIT Index Fund

Vanguard REIT Index Fund provides exposure to real estate investment trusts. The fund offers diversification into property markets without directly owning property. It is known for its competitive fee structure and steady performance in the real estate segment. Many investors include this fund for income generation and a hedge against inflation. The fund has maintained attractive performance, backed by a wide mix of REITs. Its focus on long-term value has gained the attention of retirement savers. It is designed to capture income as well as asset appreciation. The fund remains a popular choice for those seeking balance in their retirement portfolios.

Expense Ratio: 0.12%

Asset Growth: Modest

Performance: Steady

Accessibility: Good

Management: Market-sensitive

| Summary of Online Reviews |

|---|

| Reviews mention the fund as stable with a focus on regular income. |

SPDR Portfolio S&P 500 ETF

SPDR Portfolio S&P 500 ETF offers an efficient way to track a well-known market index. The fund is structured to provide steady exposure to top U.S. companies. It benefits from low fee investment strategies and easy tradability. Investors value the fund for its simplicity and competitive fee structure. Its asset base has grown over time thanks to consistent market tracking. The ETF is set up to serve retirement investors seeking a balance between growth and stability. Its low minimum investment by share purchase increases its accessibility. The consistent performance and focus on core companies make it a reliable investment option.

Expense Ratio: 0.03%

Asset Growth: Strong

Performance: Steady

Accessibility: High

Management: Index-focused

| Summary of Online Reviews |

|---|

| Investors note the ETF is efficient and commonly appreciated for its straightforward access to the S&P 500. |

iShares Core MSCI EAFE ETF

iShares Core MSCI EAFE ETF provides exposure to developed markets outside the United States. The ETF is designed to offer steady international diversification. It strikes a balance between performance and cost control. The fund has been noted for its clear investment approach and efficient tracking. Investors find the ETF useful for smoothing out portfolio volatility that can arise from domestic market changes. Its allocation across major markets helps in mitigating risk while accessing growth overseas. The ease of trading and competitive expense ratio make it suitable for retirement planning. Its performance record supports its long-term viability.

Expense Ratio: 0.07%

Asset Growth: Moderate

Performance: Steady

Accessibility: Good

Management: International-focused

| Summary of Online Reviews |

|---|

| Users mention the ETF as balanced and value its international reach and clarity. |

Final Thoughts

The rankings reveal a variety of choices for retirement planning. Investors may choose based on expense ratios, asset sizes, and ease of access. Each fund offers stable performance with low costs and a clear investment approach. The evaluations highlight that a broad market exposure is vital. The selection appeals to those seeking straightforward options with steady growth. Readers should review the criteria and decide which fund meets their goals. The funds listed are well-regarded for balancing growth and risk in long-term portfolios.