Launching a new business venture is a giant leap, even in the best of times. Variables, increased costs and a new responsibility as an owner are all big shifts, and the unpredictability of th economy makes them even more challenging. “Recession” strikes fear in the hearts of many, as a downturn can stifle the job market and money flowing through infrastructure. On the other hand, a recession may be your ticket to a flourishing new business.

Yes, there are distinct challenges to starting a business in a recession, but there are various benefits that could be in your future as well. Better yet, the creativity, flexibility and resourcefulness you employ during this process will strengthen your resolve and business model long after the recession has ended.

A recession can’t stop you from soaring to new heights. With all the proper information and planning at your side, your new business is ready to cement itself as a solid and valuable player in the industry.

Table of Contents

ToggleWhat Challenges May Arise?

Recessions and depressions are a little different. A recession is any significant decline in economic activity that lasts for a few months. People tend to view recessions as years-long struggles, probably because of the collective shock that was the 2008 financial crisis. Not to mention, the decade-long Great Depression left thousands homeless and destitute. However, depressions are much more severe and widespread, particularly in unemployment.

The U.S. recently traversed a recession in the spring of 2020, lasting just two months. The government shutdown and restrictions halted production, employment, spending and the general flow of the economy.

Today, the country’s economy is still facing ripples from the pandemic but is steadily growing. A recent poll of economists found a growing prediction of a 2023 recession, but that it will be mild and brief.

With a recession potentially on the way, what challenges might your business face if it does arrive? While there are many growth opportunities, knowing what challenges or roadblocks may arise for you and your team is still crucial. These include:

- Widespread job loss and layoffs

- Curbed credit access

- Slow economic output

- Decrease in consumer spending

- Lessened business investment

- Bankruptcies on the rise

- Reduction in marketing and research

What Are the Benefits?

Historic challenges are great to keep in your back pocket. Later on, they’ll help you formulate a contingency plan and meet obstacles. Things may seem scary right now, but the benefits of starting a business in a recession outweigh the challenges in many cases. How can your new business hop on these enticing benefits in the coming year?

1. Motivated Investors

While investing may decrease, it does not end entirely. Moving out of the stock market and into a well-articulated and organized business model would actually be a saving grace for many investors. It’s a win-win operation for both your startup and investor, as you both gain security for the future.

2. Cheaper Supplies

Because of the decreased demand from consumers and businesses alike, your suppliers are sitting with an abundance of materials on their hands. To get funds flowing and make sales, these suppliers are selling off their products at a significantly lower cost than before the recession.

As you launch your business, you’ll face a large overhead of new costs like inventory, shipping, staffing and rent. Starting a business in a recession means you can snag your first equipment, materials and infrastructure at a reduced price.

Because you’re buying at a critical time for those suppliers, you’re also forging a reliable relationship with them that could last decades. Negotiating long-term deals is a must to keep those costs reasonable after the economy rises.

3. Lessened Competition

Recessions can be scary and probably frightens away other start-ups during this time. However, that leaves more room and reduces competition for you and your team. A market once dominated by fortified players now has gaps for a small but mighty startup to make waves. Remember, a recession will affect both large and small businesses in some way, so it evens the playing field.

4. Opportunities to Answer Unique Consumer Needs

Recessions also offer you the chance to impact customers. At a time when people are struggling or — as in the 2020 recession — isolated and reeling from a pandemic, they’re looking for answers. That answer can come from your business.

Before, their needs may have already been met by the established players in the industry. However, your new addition can identify the problems people are facing and introduce a relevant and timely solution.

For example, COVID-19 trends centered on businesses that offered contactless delivery or even products to beat the quarantine blues.

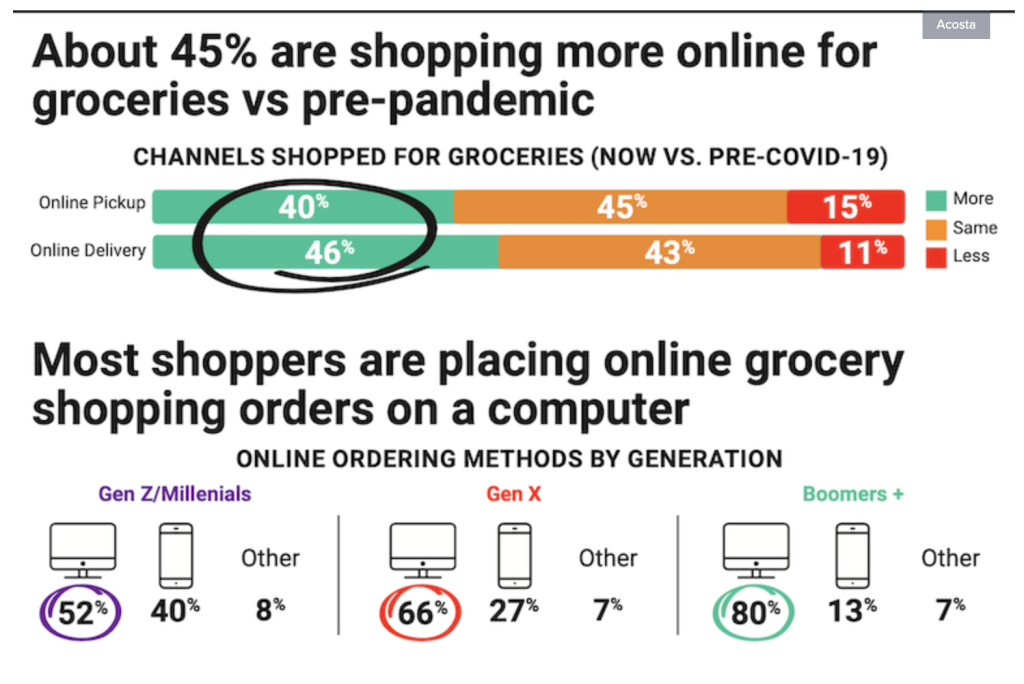

In 2021, 30% of people shopped less in-store and ordered their groceries online. Therefore, successful infrastructure during recessions can carry into the future. What problems does your product or service address, particularly in the recession?

Tips For Starting a Business In a Recession

Recessions offer your startup a shining wealth of opportunities. By positioning your business model correctly, you can traverse the shifting tides of the economy to find soaring profits, leads and opportunities. Explore the following tips to shape your next steps.

1. Find Your Niche

Before setting up shop, consider what your business adds to the market. Remember the benefit of open market opportunities to answer consumer needs? This is your chance to really dive deep into the uses of your products and services. Ask these questions about your model to uncover how best to market to a wide range of people:

- What is unique about your product?

- Is it handmade or crafted with unique ingredients?

- Does it offer solutions to social issues?

- Does it offer fun in a time of social distress? People may seek solace in these entertaining experiences or products.

- What do you stand for? Think about the businesses that took a people-first approach to health during 2020.

When evaluating your startup, consider the value to consumers, business partners, suppliers and investors. If there’s not a considerable area of entry or particular need for your startup, then it may be better to wait for the economy to return to normal.

2. Research Trends and Opportunities

On a similar note, your niche may be specific to trends in recessions themselves. Typically, recessions see a spike in household goods, such as health care and cosmetic needs, grocery staples and home supplies. People still need life’s necessities even when trying to save money.

However, even “frivolous” products can sell well in a recession. Again, in darker times, people want to find happiness and joy. Notably, leisure-related goods like sports, pet products and magazines rose during the COVID-19 pandemic as people searched for fun activities at home. What current trends or needs can your business provide to your audience?

3. Build Your Trusted Team

Because the state of the economy is uncertain, you want the most reliable team at your side. Building up staff is challenging at any time because people may be wary of the risk of startups. However, recessions often mean job loss and layoffs, so people are looking for work.

Share your plans for the future with your team to instill that confidence and security. Employees who believe in the company vision are more motivated to dig deeper into their tasks and accomplish goals.

4. Dial Into Customer Connections

Amid an economic downturn, people are cautious with their spending habits, so you must make an impression and demonstrate your value. You can pursue digital marketing tactics like email marketing to clue consumers into coupons and deals.

Social media marketing is also an excellent hub for small businesses. On apps like TikTok, you don’t need a huge following to reach a wide audience. Through their For You page, viral videos can appear on anyone’s page. Tap into humorous trends and communicate with users to make a significant impact and go viral.

Furthermore, always appreciate the power of face-to-face connections. At a time when digital marketing is everywhere, consumers find it refreshing to chat with brands in-person. Check out seminars and networking events around the area to make a name for your business.

Once those connections have been made, continually check in with leads and repeat customers to build that bond. You can invite them to local company events like barbecues or offer small tokens of appreciation like t-shirts and travel bags. Eight out of 10 people prefer physical promotional products over digital marketing techniques, so these personal touches during what can be a traumatizing time make all the difference to your consumer base.

5. Craft a Detailed Plan B

There are opportunities to advance in a recession, but there can be an equal amount of risk. By nature, they can be unpredictable in severity and longevity. Thus, you need a detailed and comprehensive contingency plan.

Write a list of “what-ifs” for your business model. What if the prices of your base material rise? Do you have a plan if your landlord decides to foreclose your office space? What if products sell out too quickly? How will you navigate financial aspects like quarterly estimated taxes or any unique tax relief programs?

Combine a list containing all possible good and bad options and formulate paths ahead. With a sharp eye and preparation, it will be easier to traverse those events if they do come to pass.

Remember the investors looking for more secure money-making ventures? At your pitch meeting, you have a chance to display your in-depth research and plans for the future. Once they see your predictive and thoughtful financial planning, they feel more confident in your ability to weather the recessional storm and into sunnier skies.

Find Growth in a Recession

Recessions are an economic downturn by definition, but your business can use this time to its advantage. Starting a business during a recession is not without risk and you should consider that from all angles. However, startups have opportunities to meet specific needs and traverse a more open playing field.

With meticulous planning and all the facts, you’re ready to turn your business dreams into reality, no matter the state of the economy.