John Rampton will be joining numerous bank industry leaders, fintech innovators, and investors from numerous VCs to share in a three-day discussion about subjects that range from debate about the potential end to banking as we know it, fintech trends, and mobile ecash banking to millennials as customers, customer engagement, fintech for small business and regulation technology.

Additionally, John Rampton will participate in a panel discussion on Wednesday, April 2oth about moving beyond bitcoin and focusing on the applications and opportunities within blockchain, which is also known as distributed ledger technology. Banks need to decide if cryptocurrency is a threat or something that they can turn into an opportunity and make significant improvements to the financial industry, including using it for mobile payments and other applications.

The Banking Disrupted Silicon Valley Leadership Summit will be held from Tuesday, April 19th to Thursday, April 21st at the Silicon Valley Crowne Plaza in Foster City. Organized by the Silicon Innovation Center. Also, besides three days of keynotes, panels, and discussions, the event will include a startup showcase, networking opportunities, and company visits.

Table of Contents

ToggleThe Startup Showcase

The startup showcase will feature some of the most talked-about startups from the top Silicon Valley venture funds in which they will present their disruptive technologies and compete in front a panel of distinguished judges that include banking executives, business angels, and VCs. The company visits on the last day of the event will include eight financial technology companies that will invite a select few from the Summit to come to their Silicon Valley headquarters for private briefing sessions and networking with founders and top executives. Sign-ups will occur one week prior to the event.

Among the financial services industry leaders and disrupters speaking at this event, there will be Chris Britt of Chime, William Hockey of Plaid, Stephen Dash of Credible, Brock Blake of Lendio, Aaron Vermut of Prosper, Louis Berylof of Earnest, Sasha Orloff of LendUp, Charise Flynn of Dwolla and more.

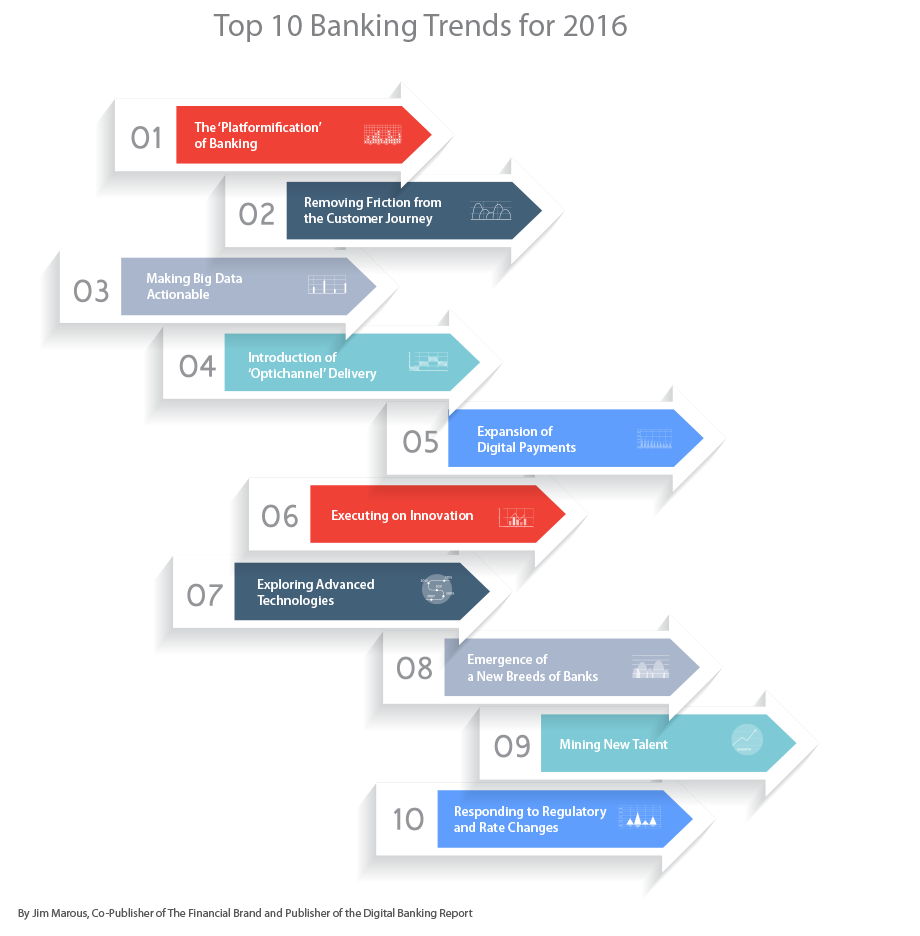

Here are a few of the important topics we’ll be talking about:

The event is now open for registration. You can register for the Banking Disrupted Silicon Valley Leadership Summit on Eventbrite.

SUMMIT AGENDA – DAY 1: APRIL 19TH

Opening Remarks

Andrey Kunov -President, Silicon Valley Innovation Center

9:15-9:45am

KEYNOTE ADDRESS

9:45-10:45am

Panel 1: The New Wave of Fintech: The End of Banking?

Instead of trying to improve an outdated legacy system, certain companies are focusing on reinventing the entire experience of banking from scratch. In our opening panel, true disrupters, entrepreneurs, hottest fintech companies will share their novel vision about the future of banking.

SPEAKERS:

Fintech

CEOs: payments, lending, remittance

10:45 – 11:15am

Coffee and Networking

11:15am – 12:15pm

Panel 2: Unbundling The Bank: The Latest Trends

We will discuss the biggest new trends in the financial services space with top fintech companies efficiently exploiting niches underserved by traditional institutions. Entrepreneurs will share their insights on how they are filling the gaps that traditional banking has not been able to fulfill.

SPEAKERS:

Executives from the top fintech startups: payment processors, credit and financial management

12:15-1:45pm

Lunch and Networking

1:45 – 2:45pm. Be sure to try to meet John Rampton!

Panel 3: Millennials as Customers: In Tech we Trust

Millennials will make up the majority of the workforce in less that 5 years. According to a recent study, 73% of them would rather handle their financial needs with a technology company rather than with their own bank. This panel aims to explore how generation Y brings a whole new set of demands Young tech leaders will share what type of client experience they expect from the industry.

SPEAKERS:

Millennial startup CEOs and leading Silicon Valley VCs.

2:45 – 3:45pm

Panel 4: Customer Engagement and Human Centered Design in Digital World

With customer branch visits growing increasingly rare, retail banks need to learn from fintech how to broaden revenue streams. Our panelists will discuss how to design innovative, customer-centric digital experiences to build new revenue channels and amplify growth.

SPEAKERS:

Executives and user experience professionals from leading technology companies. John Rampton will be there as well.

3:45 – 4:15pm

Coffee and Networking

4:15 – 5:15 pm

Panel 5: Fintech “Hysteria”: Is This a New Bubble?

It is expected that $40 billion of venture capital money will be poured in fintech startups this year in 2016. Skeptics suggest that there is a strong evidence of a new bubble growing. Our panelists, prominent Silicon Valley investors, will explore the reasons for excitement about this new hot topic and discuss fears of a new bubble.

SPEAKERS:

Top Silicon Valley venture capitalists, business angels

Panel 6: How FinTech is Changing Small Business

For traditional lenders, small businesses are unwanted customers: they are an expensive challenge expensive to monitor, with unstable cash flows and risky business models. Today’s financial technology companies are changing the rules of the game with a whole new caliber of sophisticated products. Will traditional players be able to keep up with the rapid new pace of progress?

SPEAKERS:

Leading fintech companies offering innovative products: peer-to-business lending, merchant finance, supply chain finance.

6:15 – 6:30 pmClosing remarks

DAY 2 – APRIL 20TH

KEYNOTE ADDRESS

9:45 – 10:45am

Panel 1: The “Uber Moment” for Banks: Adapt or Disrupt?

Our panelists, well-known innovators in the heart of the banking industry will provide insights on best innovative/creative paradigms and best practices and discuss whether or not banks will be able to reinvent themselves

SPEAKERS:

Top executives from leading banks

10:45 – 11:15am

Coffee and Networking

11:15am – 12:15pm

Panel 2: New Rules of the Game: Partnership Instead of Competition?

Banks are the largest informational companies in the world, yet systems and processes are still antiquated . Our panelists will show how banks may benefit from new technology solutions centered around connectivity, interactivity with customers, real-time decision making as well as automating and digitizing processes

SPEAKERS:

Leading technology companies partnered with banks

Banks technology accelerators

12:15-1:45pm

Lunch and Networking

1:45 – 2:45pm

Panel 3: Beyond Bitcoin: New Blockchain Technologies for Banking

While distancing themselves from bitcoin, major banks agree that blockchain technology is rapidly changing the way finance industry works. Our panelists will discuss how distributed ledger technology is evolving to become more suitable to serve the needs of banks.

SPEAKERS:

Blockchain industry advocates, leading blockchain companies and more. John Rampton will be there to listen.

2:45 – 3:45pm

Panel 4: Regulation Technology (RegTech): A New Hot Topic

Legacy core systems and regulatory pressure make banks reluctant to try new technologies. On the other hand, startups with disruptive solutions do not always know which regulations are applicable to their businesses. This discussion will explore the budding space of regulatory technology that is helping both incumbents and newcomers advance by navigating complexity smartly.

SPEAKERS:

RegTech companies providing innovative solutions for identity verification, regulatory disclosures, risk control and customer data management

3:45 – 4:15pm

Coffee and Networking

4:15 – 5:15pm

Startup showcase

Hottest startups from the portfolios of the top Silicon Valley venture funds will present their cutting edge financial technologies.

Judges:

Silicon Valley venture capitalists, business angels, banking executives

5:15 – 5:30pm