There’s been a lot of buzz, good and bad, regarding non-fungible tokens (NFTs). Case in point, over $40 billion was reported as the market value of the NFT market in 2021. You’ve also probably come across the headlines “Meet the 12-year-old coder set to earn over $400,000 selling NFTs,” or the teen who built a $26 million NFT empire.

But, that’s not all. GameStop has launched a wallet for crypto and NFTs. Even the Harvard College Class of 2021 will receive a commemorative NFT.

Yeah. Even if you aren’t exactly sure what an NFT is, you’ve probably heard something about it in passing.

But, what exactly are NFTs? And, are they worth the investment? Well, even someone like me who’s into crypto investing doesn’t have all of these answers. That’s why I asked Robert Farrington for clarification on NFTs.

Farrington, who founded The College Investor, also has a separate website called Cult of Money which focuses on cryptocurrency and non-fiat currencies. So, I would definitely consider him an NFT expert. And, someone I trust to help clear the air.

Table of Contents

ToggleNFTs Defined

Some people think that NFTs are nothing more than a .jpeg photo, which is not the case, says Farrington.

According to Farrington, non-fungible tokens are essentially blockchain-based digital versions of smart contracts. NFTs, however, can range from a collectible to a piece of digital art. In fact, you could use an NFT as a ticket to gain access to a specific community. I even came across a Wall Street Journal article discussing how resorts are converting room nights for sale into NFTs. Guests of hotels can purchase or sell these tickets like those on the StubHub market for concerts and sporting events.

Additionally, NFTs are also used for play-to-earn games. The idea is that participants earn crypto to purchase collectibles, avatars, and in-game items. I can see why GameStop would want in on the fun.

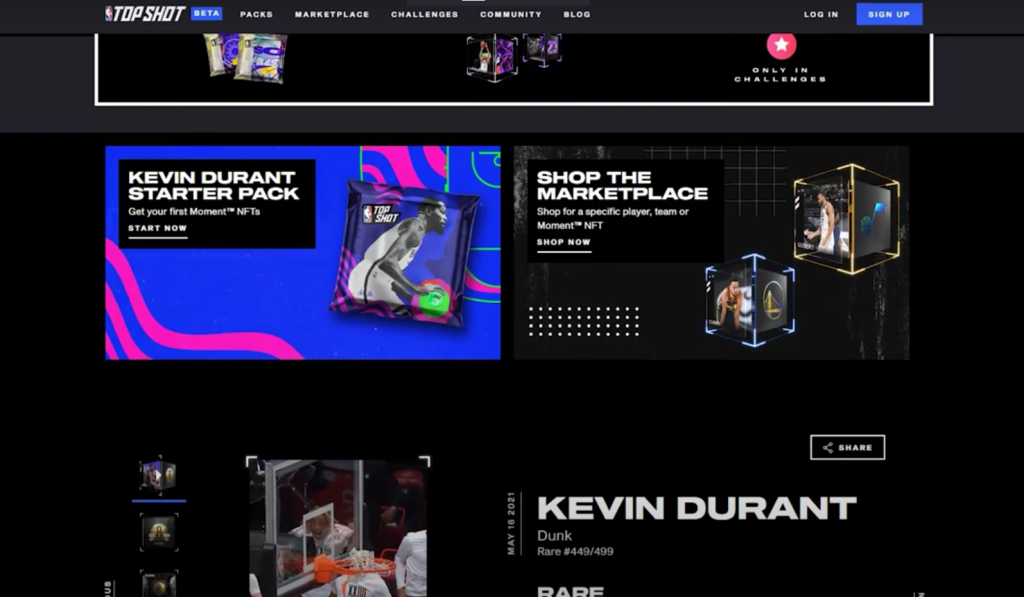

Among the NFTs I am personally familiar with are the Top Shots from the NBA. Among the NFTs available is one that has a digital video of LeBron James dunking the ball. Some NFTs are only released in quantities of 25 or 50. Because of this, it’s almost like purchasing a one-of-a-kind piece of artwork.

Interestingly, NFTs have been sold at Sotheby’s along with mainstream art, according to Farrington.

“There’s so much out there and people have always loved collecting things that are unique and rare,” he remarks. “This just happens to be the digital format of it.”

Along with thinking about NFTs as art, he also points out that they are great for demonstrating ownership and provenance. The concept of provenance is usually used in connection with traditional art. So, you may not be familiar with it. In that case, “provenance” is a term used to describe the history of ownership of a piece of art. In turn, this proves its authenticity.

What Are NFTs Used For?

As I mentioned previously, NFTs can serve as event passes. An example would be Gary Vaynerchuk’s recent sale of 10,000 tickets for an upcoming conference. He will only sell these tickets to the conference, so their value will likely skyrocket.

Rather than selling tickets through traditional means, this NFT allows content creators to generate income. In other words, an NFT allows content creators to include royalties in their digital contracts. As a result, the original creator receives royalties from the sale of an NFT on the aftermarket.

In this case, Farrington says that Vaynerchuk earns 5% of all sales. He makes 5% of the 30% of tickets sold if he sells 10,000 tickets to the conference and 30% of them are resold. Because no more tickets will be sold for these events, and the purchase price has the potential to increase in value, Vaynerchuk is able to profit from the growing value of each NFT, as well as its seller.

In the future, season tickets to sports games could also be sold as NFTs. Nobody gets a cut if you sell your season tickets to a friend. If sold as NFTs, season tickets would include royalties paid back to the team’s owner.

But, hold on, It gets even wilder.

Brands like Taco Bell and Charmin have auctioned NFTs to raise money for charity. Wokenwine and BlockBar allow you to invest in collectible drinks. And, NFTs have also shaped the way that music sounds.

Basically, NFTs are diverse in their forms. Some, however, have greater utility than others. This is part of the reason they’re so popular. The ways in which NFTs can be used are set to increase as time goes on; they’re interesting and unique.

What Makes NFTs Popular?

Currently, the top NFT can be found on OpenSea in the CryptoPunks collection. The next port of call is the Bored Ape Yacht Club.

These NFTs just look like a bunch of strange digital pictures of people and apes. You read that correctly. Apes. You probably saw Paris Hilton and Jimmy Fallon showing off their apes on The Tonight Show.

Why would anyone pay thousands of dollars in crypto for a picture anyone could screengrab for free? Robert says that many of the most popular NFT collections are built around communities. Therefore you are joining a community of 10,000 like-minded individuals.

NFTs are just digital versions of that. These NFT groups also meet in person and add value in other ways.

“You’re buying a membership in the club,” he adds.

NFT collections can also be popularized through the traditional marketing channels. Bored Ape Yacht Club, for example, recently partnered with Adidas.

“The most valuable collections are driven by really strong communities that are very tech-focused,” he remarked.

You can think of some NFTs as valuable baseball cards if you want to truly understand their value. Some people collect baseball cards that feature their favorite athlete. Others, however, may view the same baseball card as nothing more than an old piece of cardboard.

Generally, Farrington is quite open about the NFTs he owns. These include assets from the Royal Society of Players (a poker-based NFT community), Axie Infinity (a crypto-pay-to-play platform), and Behavior Gap, a NYT contributor.

He seems to invest mostly in areas of his interest and in things he is passionate about based on his NFT assets. You can definitely do that with NFTs as well.

“If you support the artist and the art, you can invest in NFTs that way,” he says.

How to Buy an NFT

You are probably wondering where you can buy NFTs if you are interested in them.

When I first invested in cryptocurrencies, I wondered the same thing. Back then, none of my brokerage accounts offered cryptocurrency.

Before you invest in NFTs, it is advisable to research the fees involved. You will also need to transfer funds.

“It’s definitely a process, and it all starts on where you own your crypto,” says Robert.

Decentralization is key to the concept of crypto, and ownership is also key, he says. Nonetheless, Coinbase and BlockFi hold onto your crypto.

“You have ownership of it because it’s in your name, but you don’t have true ownership of it yet. They’re acting as your custodian and holding your private keys.”

Because of this, if you want to invest in NFTs, you must use a hardware wallet. Farrington uses a Ledger hardware wallet and a platform called Metamask to store his assets.

By using this mix of products, he can hold the keys to his crypto, which is what he needs to invest in NFTs. Furthermore, Farrington said that the process of securing crypto assets allows people to avoid getting hacked and losing them overnight — more on that in a minute.

NFTs are sold on many sites, and each has specific requirements regarding the cryptocurrency you should use to buy them. For instance, iIf a site requires Ethereum, then the NFT must be purchased with enough Ethereum.

An NFT can be purchased from one of the following sites:

What to Know Before Buying an NFT

As you enter this space and learn more about NFTs, keep in mind that cryptography poses a major threat to hackers. Crypto scams are commonplace, and new scams regarding NFTs appear every day. On top of that, OpenSea Marketplace reports that 80% of NFTs on its platform are fake, plagiarized, or spam.

It is possible to lose your crypto in two different ways, according to Farrington. First, platforms like Coinbase can lock your account. And, to make matters worse, there really isn’t anything you can do about this.

Secondly, hackers use a variety of complicated methods to hack cryptocurrency exchanges like Coinbase and BlockFi. Since crypto accounts aren’t protected the same way as regular bank accounts, when that happens there’s really no recourse.

In light of these and other reasons, Farrington recommends that anyone with more than $1,000 in crypto get a hardware wallet and Metamask to store your coins.

“As you do more and more in the digital space, that wallet with Metamask is going to enable you to buy your own NFTs and own the keys to your own crypto,” he explains.

You can purchase NFTs at the aforementoioned marketplaces after you have your crypto keys and your account is secure.

“These are basically like the eBay of NFTs,” says Farrington. And, as with eBay, some NFTs are sold by auction and others by buy-it-now.

There may also be tax consequences.

An NFT can trigger a taxable event if you have to sell cryptocurrency to purchase it. In other words, you may have to pay capital gains taxes when buying a NFT. How much tax you pay depends on whether you made a profit or not while holding the cryptocurrency. However, taking a loss on the cryptocurrency won’t affect your taxes.

You will also need to pay taxes on the profit you make if you sell your NFT. The IRS has not yet determined the exact rates. It is likely that the tax rate will be higher than when selling cryptocurrency.

How to Handle NFTs in Your Portfolio

Most financial experts advise people not to invest more than they can afford to lose. That’s true with any investment. But, since NFTs are still such a new type of investment, this is especially true.

An NFT is probably not a good idea if losing its purchase price would cause you to be stressed out or put in a precarious financial position. It is possible that you may miss out on the chance to purchase an NFT worth millions. Unfortunately, things like that rarely happen.

However, after talking to Farrington, I wondered if he had any last thoughts for people who are “crypto curious” and eager to invest in NFTs. His main point is that you need to start investing to learn more about it all.

“You just have to do it,” he advises. “There’s no easy way around it.”

NFT options are available on platforms such as OpenSea and Rarible. They let you compare success rates among projects.

You can also join Discord after purchasing your first NFT. In case you’re unfamiliar, this is a platform that only exists for NFT owners. For access to the platform, you must actually own an NFT. So, in order to participate, you need a small investment.

“Once you do, you’ll really start opening your eyes to what I’m talking about with the community,” Farrington says.

You’ll also discover that NFTs offer so much more than just a .jpeg. In fact, NFTs are the future of art, say some experts.

Frequently Asked Questions

1. What is an NFT?

An NFT represents a real-world object as a digital asset, like images. Most of them are purchased and sold online, frequently with cryptocurrency. Generally, the underlying software is often the same as that of many cryptos.

NFTs are gaining popularity as a way to buy and sell digital artwork. However, Andrew Steinwold says their origins can be traced back to a blockchain-based digital coin called Colored Coins from 2012.

2. Are NFTs and Crytpo the Same?

In general, non-fungible tokens are built using the same sort of programming as cryptocurrency, like Bitcoin or Ethereum. But that’s about all they share in common.

Physical money and cryptocurrency can both be exchanged. Or even traded for one another.

As a result, they are fungible. Bitcoins are always worth another bitcoin. Blockchain transactions are trusted thanks to cryptocurrency’s fungibility.

NFTs are different. NFTs are digitally signed, so they cannot be exchanged for each other or equated. Therefore, they’re non-fungible.

3. Are NFTs a safe investment?

Experts acknowledge that your portfolio can lose value at any time when discussing investing in the stock market. Markets fluctuate all the time. However, since the stock market has existed for over 200 years. So, experts can rest assured that the market will always recover.

NFTs don’t work that way. Sure, its relatively short history makes the NFT market exciting. But also more risky as it’s speculative in nature.

4. Why would I want to own an NFT? Can I make money on it?

The emotional value of an NFT is not that different from the value of physical items. Most people buy candles, outdoor gear, or new clothing because they want it. Not because they need it. It makes them feel good. So they buy it for that reason. The same can be said for GIFs, images, videos, or other digital assets.

Another reason is that you believe it is valuable. And, it will only increase in value over time. NFTs can also be resold for a profit.

5. How do you know that an NFT is legit?

“First off, the rule of thumb is: If the deal seems too good to be true, that’s because it probably is,” says artist Adrian Chesterman. “Prices of NFTs are based on supply and demand. If an NFT is priced significantly cheaper or more expensive than similar NFTs from the same collection or category, it may be a fake.”

“Check the authenticity of the NFT by doing a reverse Google image search. In addition, the platform can verify collections and their artists,” Chesterman adds. “Typically, a blue checkmark will appear by its title if it’s the real deal.”

“Ultimately, the best way to ensure your NFT is genuine is to choose the right platform, perhaps one with human moderators is best.”