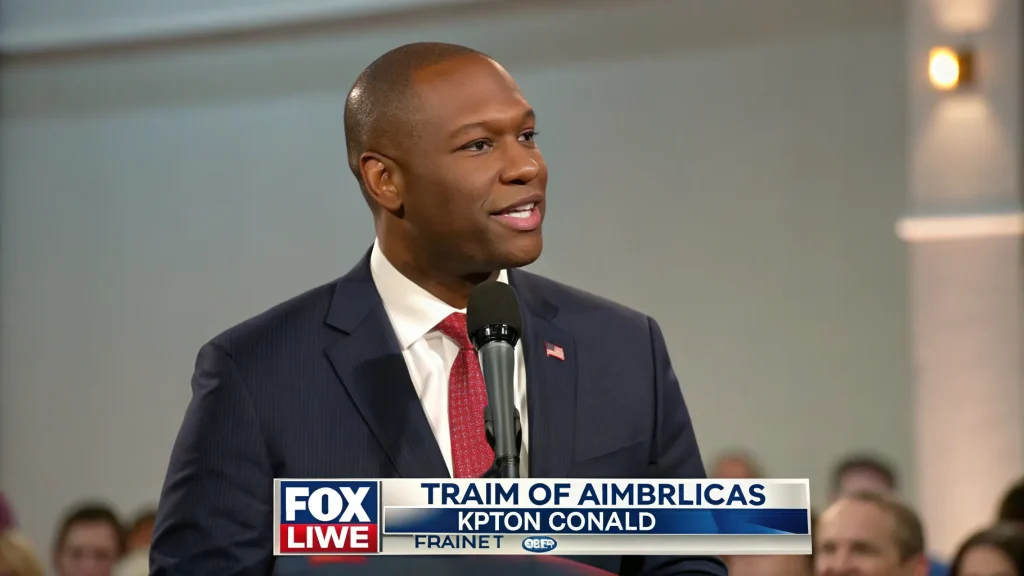

Florida Republican Representative Byron Donald offered his analysis of former President Donald Trump’s proposed tax legislation during a recent appearance on Fox Business Network’s “Varney & Co.” program.

The congressman, who represents Florida’s 19th congressional district, shared his perspective on Trump’s tax plan, which comes as economic policy continues to be a central focus in American politics.

Donald’s appearance on the business-focused program provided viewers with a Republican lawmaker’s assessment of the former president’s approach to taxation, potentially offering insights into how the GOP might position itself on fiscal matters.

Trump’s Tax Proposal Details

During the segment, Rep. Donald discussed the key components of Trump’s proposed tax legislation, which likely builds upon or modifies aspects of the 2017 Tax Cuts and Jobs Act passed during Trump’s administration.

The Florida congressman outlined how the proposed changes might affect American businesses and individual taxpayers, comparing the approach to current tax policies under the Biden administration.

Donald’s analysis touched on potential economic impacts of Trump’s proposal, including effects on job creation, economic growth, and federal revenue projections—core considerations for any major tax legislation.

Political and Economic Implications

The discussion on “Varney & Co.” also explored the political viability of Trump’s tax plan in the current congressional landscape, where Democrats hold a slim majority in the Senate while Republicans control the House of Representatives.

Rep. Donald addressed how the proposal might be received by various stakeholders, including:

- Small business owners concerned about tax burdens

- Middle-class families looking for tax relief

- Corporations making investment decisions

- Economic analysts evaluating long-term fiscal impacts

The congressman’s commentary provided a window into Republican messaging on tax policy as the party positions itself for upcoming electoral contests, where economic issues typically rank high among voter concerns.

Comparison to Current Tax Framework

A significant portion of Donald’s analysis involved contrasting Trump’s proposed tax legislation with existing tax structures and rates implemented under the current administration.

“The fundamental difference in approach centers on how we stimulate economic growth,” Donald likely explained during the segment, reflecting the ongoing debate between supply-side economics favored by many Republicans and the more progressive tax policies generally supported by Democrats.

The congressman may have referenced economic indicators and tax revenue data to support his assessment of which approach might better serve American economic interests in the coming years.

As a member of the House Financial Services Committee, Rep. Donald brings relevant expertise to discussions of fiscal policy and tax legislation, making his analysis particularly noteworthy for viewers of the business-focused program.

The appearance highlights the ongoing influence of Trump’s economic vision within Republican circles, even as the party continues to shape its platform for future elections. Whether Trump’s tax proposal gains traction in Congress remains to be seen, but Donald’s analysis provides a glimpse into how Republican lawmakers might approach tax policy discussions in the months ahead.