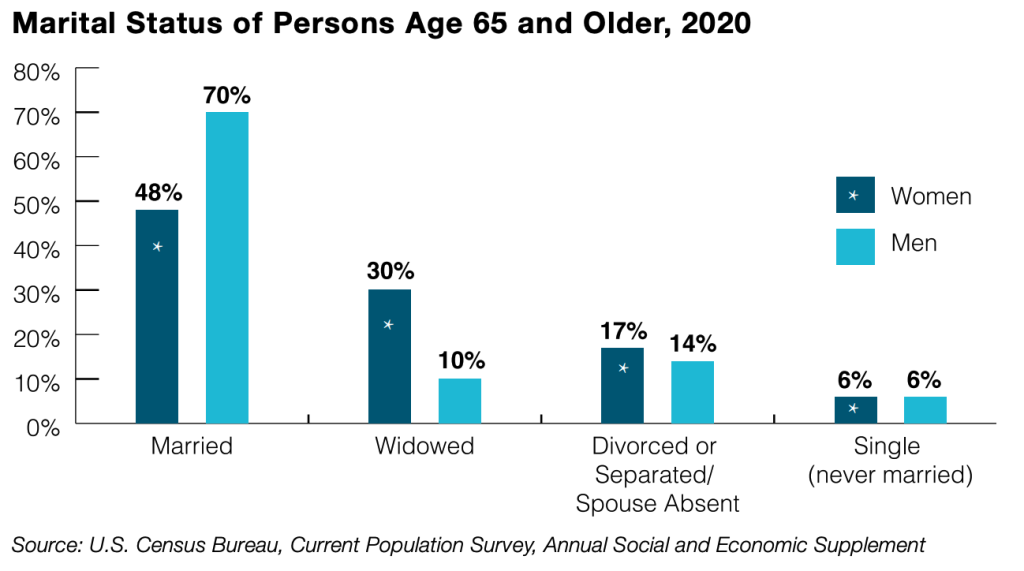

The concept of retiring together with a partner or spouse may sound appealing. However, in reality, this is not always true. According to the U.S. Administration on Aging, nearly a third of men and more than half of women over age 65 are widowed, divorced, or never married.

While dual-income households do have some advantages, plenty of single people are able to retire comfortably — and even prosper. In particular, this applies if you set a lofty goal like retiring early.

In this article, we’ll explore the pros and cons of early retirement for single Americans, as well as what they can do to prepare.

Table of Contents

ToggleThe Pros

Financially, you might be better off.

Although single people are said to suffer the most from the cost of living, being single may have financial benefits.

According to debt.org, “21% of single people had credit card debt, [compared to] 27% of married couples without children and 36% of married couples with children.”

You decide what is important to you when it comes to money.

You are fully in control of your financial and personal goals when you are single. Unlike married individuals, you do not need to compromise or sacrifice. There is only one thing that matters: what you want.

As such, that makes setting goals a whole lot easier. This isn’t just about short-term goals like traveling or buying a new car. Also included are long-term goals, such as saving for a house or retiring. Your priorities are totally up to you.

Planning is usually a good idea once you’ve set your financial goals. Without a plan of action, you can’t accomplish your goals. A few things to consider could be:

- In order to achieve your dreams, how much money will you need?

- What is the maximum amount you can save?

- What other options do you have?

You’ll need to ask yourself these questions if you want to manage your finances on your own while single.

You can retire whenever you.

A lot of couples dream of retiring together and enjoying their golden years. It is, however, advisable for couples to consider whether retiring together at the same time is the right decision. After all, when both spouses retire simultaneously, they have to contend with both financial and emotional ramifications.

“Unless couples are the same age, and in the same health, it usually makes more sense for one person to retire earlier. There can be both financial and relationship benefits,” says Morris Armstrong, registered investment advisor, Armstrong Financial Strategies, Cheshire, Conn. In terms of finances, there are three advantages.

Let’s say one spouse works longer than the other. They can delay the age they claim Social Security benefits to past full retirement age. In turn, the amount of those benefits will increase.

Plus, they’ll have a few more years to save for retirement with the working spouse’s income. Last but not least, if your spouse works an extra three to five years you’ll need your retirement assets sooner, so you can withdraw more money each year.

Also, the transition to retirement can be tough emotionally.

Some find losing their sense of identity through work easy, while others struggle. Retirement suddenly puts a couple at home all the time, without the separation of work they’ve grown used to. An abrupt shift can strain a couple’s relationship. In such a case, couples might find it easier to go through this process at the same time. Especially if one spouse expects to have trouble adjusting.

If you’re single, then you don’t need to worry about the above.

There is more time for you.

Having free time allows you to focus more on your needs, reflect on what you really desire in life, and find out what you like, thereby helping you grow as a person. Additionally, you are free to progress at your own pace in life — especially when you retire early.

As most of us don’t have the privilege of spending quality time with ourselves very often, it should be regarded as a gift. Moreover, you have the freedom to pursue your own interests, such as hobbies, traveling, or socializing. In fact, people who have always been single are more attentive to their friends and family, according to a study published in Contexts.

There is more time to hustle.

There is a lot of work and time involved in relationships. When you spend time with someone, you can forget about quiet evenings. When you get home, you have to prepare dinner for yourself and your partner, wash twice the amount of dishes, and listen to them about their day, By then, you’re exhausted. And, it’s even more tiring if you have kids.

When you’re single, you have lots of free time at your disposal, and it’s up to you how you spend it. You could, for example, waste time binge-watching TV. You could also work on projects or hobbies that could bring you extra money.

By starting a side hustle, you could be able to boost your finances and as a result, save more money. With that money, you could pay down your debt and contribute more to your retirement savings. You may even turn this side hustle into a passive income to supplement your retirement income.

Another option would be to find a part-time job or join the gig economy via freelancing or driving for Uber.

A relocation agreement is not required.

As a single person, you don’t have anyone to hold you back from moving to Florida when you retire so you can live near the ocean. It must be a joint decision that makes both of you happy if you are planning to retire in another state with your partner.

If your spouse dislikes hot, humid summer days, then moving to Florida would probably not be a good idea. Perhaps they prefer a landscape that includes four seasons and a winter that is cold and snowy, which you cannot bear any longer

In addition, you could also live a high-quality life at an affordable price. Here are some lists of the most affordable cities for renters and the cheapest countries where you can stretch your retirement savings.

There are alternative housing options available to you.

Owning a home means you may be able to pay the entire mortgage with the help of a housemate or two. As an example, the rent from your roommate could cover nearly three-fourths of the mortgage. It also eliminates the feeling of being alone or isolated.

At the same time, you are not required to rent a room to a long-term roomy in order to earn rental income. Airbnb allows you to rent out spare rooms. Alternatively, if you are traveling for an extended period, you may be able to rent out your entire home.

Another cheap housing option for singles is communal living or cooperative housing. Initially, it might seem strange, but it’s just another way to share household costs and responsibilities.

There is no need to worry about the credit situation of a partner.

It is common for lenders to pull both of your credit scores when you are in a relationship and purchasing a house or car together. Often, they will use the lowest of your scores to determine your interest rate. As a result, if you have excellent credit and your partner does not, you could end up paying more for your home loan.

There is no need to worry or stress about another’s credit history when you are single. Just remember that your chances of getting affordable financing are good if you pay your bills on time and maintain a low, manageable debt load.

Buying controversial items doesn’t require permission.

Buying large items in a relationship requires negotiation. In this case, if both people agree that spending $120,000 on an RV will quickly depreciate, gobble up gas, require costly insurance, maintenance, and repairs is worth the investment, then go for it.

The two of you can pursue your nomad travel dreams together. However, you won’t get that big purchase if one person says “no way.”

Single people, on the other hand, can spend a chunk of their savings or take out a loan to make an expensive purchase. While others may not find that purchase-wise, it’s your life, and it’s your money you’re spending.

It’s 100% up to you how much you spend and save.

Money is one of the biggest causes of conflict between couples. According to one survey, nearly three out of four married or cohabiting Americans say that financial decisions are often a source of tension in their relationships. The habits of spending and saving habits are rarely identical between two people, much less long-term financial goals, like early retirement.

Typically, one spouse is thrifty, while the other overspends. Even after agreeing to a solution, these habits prove difficult to break.

Furthermore, there’s the risk of financial infidelity – one or both spouses lying about their finances. CNBC reported that as many as 33% of couples in some demographics engage in financial infidelity.

All of that is not a concern for you. Your spending habits are under your control, and you can choose to save 50% or more if you want.

You do not have to take care of your spouse’s parents.

As a result of caring for aging parents for years, many people’s retirement plans are derailed for years. In the event of a health issue such as Alzheimer’s or other forms of dementia, mobility issues, or other serious health or safety hazards, most children and adults want to be there for their parents.

One day, you may no longer be caring for an aging parent, but your spouse’s aging parent may need part-time or full-time care. Even though that responsibility may be part of “for better or for worse,” it is also a major strain and can consume decades worth of savings. Also, couples can also suffer from the strain of caregiving, which can negatively affect their relationship.

It is possible to set extreme financial goals.

There’s a saying that’s as boring as it is true: “Marriage is all about compromise.” Compromise can help you keep your spouse from walking out on you, but it doesn’t lend itself to huge action.

When you’re single, you can do anything you want. Do you want to retire early and be financially independent? If your savings rate is high enough, you can do it. Have you ever thought about starting your own business? Don’t be afraid to invest all your extra cash in it.

Become a nomad with that single-axle Silver Bullet Airstream. Travel the world for a year or two, or move to another country. Any dream you have, you can fund it with all your money.

There’s a good chance you’ll never be able to pursue extreme financial goals again. Make the most of it and shoot for the stars.

The Cons

The cost of basic expenses will likely be higher.

If you don’t have a partner, you’ll have to pay 100% of the bills yourself. This includes everything from keeping the lights on, paying a mortgage, having a stocked fridge, and maintaining the appliances.

In fact, according to the U.S. Bureau of Labor Statistics 2021 Consumer Expenditure Survey, on average, a single person spends $48,000 per year, of which $17,899 is spent on housing. Comparatively, the average married couple spends $76,000 each year, of which $24,811 is spent on housing — $12,405.50 for each of them. In other words, married couples who live together spend nearly $5,500 less a year on housing expenses than single people.

You won’t see a boost to your Social Security benefits.

Social Security spousal and survivor benefits are one of the most important advantages of marriage. For example, if you’re married, you can both collect your own Social Security benefits or up to 50% of your spouse’s benefit.

As a result, if one of you earns more, this can be a major financial advantage. Additionally, widows and widowers may receive up to 100 percent of each other’s benefits. Furthermore, a minor child whose parent is deceased or disabled may be able to receive Social Security benefits.

You don’t have a financial safety net.

Imagine you’ve lost your job, had a medical emergency, or your retirement savings took a hit. When you’re single, you’ve lost 100% of your income or have to make a withdrawal from your retirement savings. But, living with a spouse or partner who works helps minimize these losses.

If you’re looking for another job or thinking of starting your own business, there is no one to support you. Financial disruptions such as medical issues that prevent you from working also apply to other life circumstances. For instance, instead of tapping into your nest egg, your partner can help cover that bill.

For this reason, financial planners often recommend sole breadwinners save six to 12 months’ worth of expenses in case of an emergency. You should also be sure that you have adequate disability insurance in case you are unable to work for a long time.

Income tax breaks may or may not be available to you.

Marriage has its advantages and disadvantages when it comes to income taxes. It is possible to file a joint or separate income tax return, but that does not mean your combined tax bill will be lower. If you both earn a substantial amount of money and file jointly, you may be pushed into a higher tax bracket. In contrast, one-earner families may pay less in taxes.

If you itemize your deductions, combining your income could affect some of your deductions, even though the standard deduction is higher for a couple. When you file separately, however, you may lose certain credits, such as the child tax credit and earned income credit, as well as deductions for contributions to an IRA.

In the end, it’s probably best to discuss this with your tax advisor to see which is best for you.

But, these are a few of the definite pluses:

- An unmarried person’s health insurance benefits are taxable when they include a partner. Tax deductions are available for premiums covering both spouses.

- As long as the working spouse has enough earned income to cover the contribution, a non-working spouse can contribute to a Spousal IRA. It is possible to grow these contributions tax-deferred, and they may also be deducted.

- It is possible to postpone taking required minimum distributions until the year you turn 72 if you inherit an IRA from your spouse. As such, this gives you more time to grow your assets tax-free.

On group trips, you may be charged extra.

It is sometimes more expensive to take a solo trip if you go on a group retreat or travel experience. The reason for this is that you may be hit with a supplemental charge, which means you’re actually paying more per person than a couple signing up together.

You might feel that it is unfair. It is important to note, however, that the total cost per person takes into account negotiated room rates based on double occupancy. Consider a negotiated rate of $300 per night. For every member of a couple, the package assumes they will each pay $150 per night for accommodation. Therefore, solo travelers may be charged a supplement for using a room intended for two people.

The single supplement is not usually profitable for operators. As a cost-covering measure, they charge it.

You might be able to avoid this by bunking up with another solo traveler or asking about single-room occupancy.

Selling or buying a home is more challenging.

There are financial considerations whether you and your partner own a home together or not. But, you can get a mortgage regardless of your relationship status. In fact, a mortgage does not require a couple to be married.

Lenders, however, will consider both applicants’ financial status, such as their credit score, income, assets, and liabilities. In contrast, when selling, married couples with joint ownership get a capital gains exclusion of up to $500,000; single people only get $250,000.

Any property you own together that does not bear both your names is at risk. In the event of a split up, divorce, or death, the unnamed partner is vulnerable. As such, choosing how to own a home has long-term implications. Depending on your situation, you might also want to discuss setting up a trust with an attorney.

Gift and estate tax provisions aren’t as generous.

When it comes to gift and estate taxes, the IRS seems to favor marriage. A married couple may transfer an unlimited amount of property to one another without reporting or paying gift taxes. In addition, “gift splitting” allows them to effectively double the amount they can give jointly.

Furthermore, a married couple can generally leave their spouse any amount of money without paying estate taxes. Furthermore, the surviving spouse can take advantage of any unused portion of the deceased spouse’s lifetime estate tax exclusion. This means that married couples can pass on up to $ $25.84 million without paying estate taxes in 2023.

Insurance could cost more.

You may save money on your insurance premiums if you are married, or you may have more choices in coverage, depending on your existing policy.

The following are a few things to keep in mind:

- Health. A family policy may be a better deal if you already have separate policies, either through your employers or independently.

- Auto and Home. It is usually possible to bundle homeowners, car, and umbrella policies as a married couple, potentially reducing premiums. There are some automobile insurance companies that do not allow domestic partners to share a policy. Make sure you shop around and speak to your insurer.

- Long-Term Care. If only one party is approved for a couple discount, married couples or those with committed partners can save on premiums. In other words, it’s more cost-effective to purchase policies for both members.

It is possible to qualify for more benefits with a spouse.

Spouses may also qualify for employee, veteran, and federal government benefits. Military spouses, for instance, may be eligible for family separation pay and healthcare benefits. In addition to healthcare benefits, spouses of deceased veterans may also qualify for educational assistance, guarantees on home loans, and pensions.

Additionally, spouses of federal government employees receive healthcare, retirement, and survivor benefits. In most cases, civil unions and other forms of domestic partnerships other than marriage are ineligible for benefits.

Married couples tend to live longer.

The average life expectancy of married men and women is two years longer than that of their unmarried counterparts. This longevity benefit may be attributed to the influence of a spouse on healthy behaviors. For instance, Married people tend to eat healthier and drink less alcohol and smoke.

In contrast, men who are married to women tend to experience greater longevity benefits than women who are married to men, for a variety of reasons. It has been found, however, that women usually take the lead in promoting healthy behavior, benefiting their husbands as well.

Health behaviors can also be influenced by relationship quality. The likelihood of walking for exercise increased for both men and women who reported higher levels of marital support. Men, however, experienced stronger associations between marital support and walking as they aged, while married women did not.

You’re more likely to run short of money for retirement.

According to the Employee Benefit Research Institute, single women, including divorced and widowed women, have a retirement savings shortfall that is three times greater than their married peers. Shortfalls reflect how much more money is needed to cover basic expenses such as housing, food, transportation, clothing, and medical care.

This shortfall can be attributed to a number of factors, including a lower overall career income. However, single, never-married people don’t have the same opportunities to save as married couples do. Single people can only save so much in tax-deferred accounts, while couples can save more and each can reach the maximum.

In a two-earner family, assuming they are eligible for employer-sponsored retirement plans, each spouse can contribute the maximum to their tax-deferred 401(k) plans. As of 2023, that limit is $22,500.

In addition, if a couple divorces, their retirement savings are usually split.

How to Singles Can Prepare for Retirement

The thing about being single? Whatever you want to do, you can. In retirement, you don’t have to deal with a spouse who has difficult relatives or opposing views.

However, trade-offs still exist. To safeguard your future as a single person, you must create a sound budget and financial plan. When you have one income, you’re the only one who has to deal with inflation, or with the possibility of a recession.

It’s also on you to learn about the laws, rules, and policies you can have a major impact on, which went through a major overhaul in Congress as part of the SECURE Act 2.0.

Having said that, here are five retirement planning decisions singles will want to consider differently than couples.

Invest in long-term care insurance.

It is common for couples to rely on each other for caregiving as they age. If you are a single person, you may want to have insurance coverage in place to cover caregiving expenses.

With a long-term care policy to help cover the cost, you are more likely to seek the care you need. Buying them doesn’t come cheap, but they offer the security of not worrying about covering later-life healthcare needs.

The process of claiming Social Security benefits is simpler.

Your Social Security claim choices are relatively simple if you are single with no previous marriages lasting more than 10 years. When you claim at 70, you will receive more benefits. It makes sense for most singles to file earlier if they have reason to believe they will die sooner than expected. But, if you decide to delay your payments and you’ve retired early, make sure that you have enough money to live off of until then.

Watch out for the Social Security earnings limit if you claim before you reach full retirement age and continue to work; you could end up owing back money. Upon reaching full retirement age, the earnings limit is no longer applicable.

The Social Security system is a bit more complicated for single people who have been married for at least ten years. According to your ex’s earnings record, you may qualify for spousal benefits and later switch over to your own benefits. In the event of the death of an ex-spouse, you may be eligible for a widow/widower benefit. Before you file a claim, consider all the options available to you.

What the new landscape of RMDs looks like.

A major change introduced by SECURE 2.0 is how you should strategize about other forms of retirement income, particularly required minimum distributions.

Beginning in 2023, you must begin taking mandatory withdrawals at the age of 73, up from 72. On January 1, 2033, it will rise to 75. As a result, you can postpone paying income taxes on these funds.

Investigate alternative lifestyles.

Singles can embark on new adventures at any time.

Have you ever considered living abroad? You may be surprised to discover that you can retire abroad very affordably. In retirement, how about traveling in an RV? If you want to travel with friends and have fun, you can find groups to join.

Alternatively, you could rent out a room in your home to make some extra money or stay in other people’s homes while traveling. Perhaps you just want to move from one state to another. Retirement income is taxed differently in different states.

As a single person, you can make all of these decisions more easily.

Consult an expert.

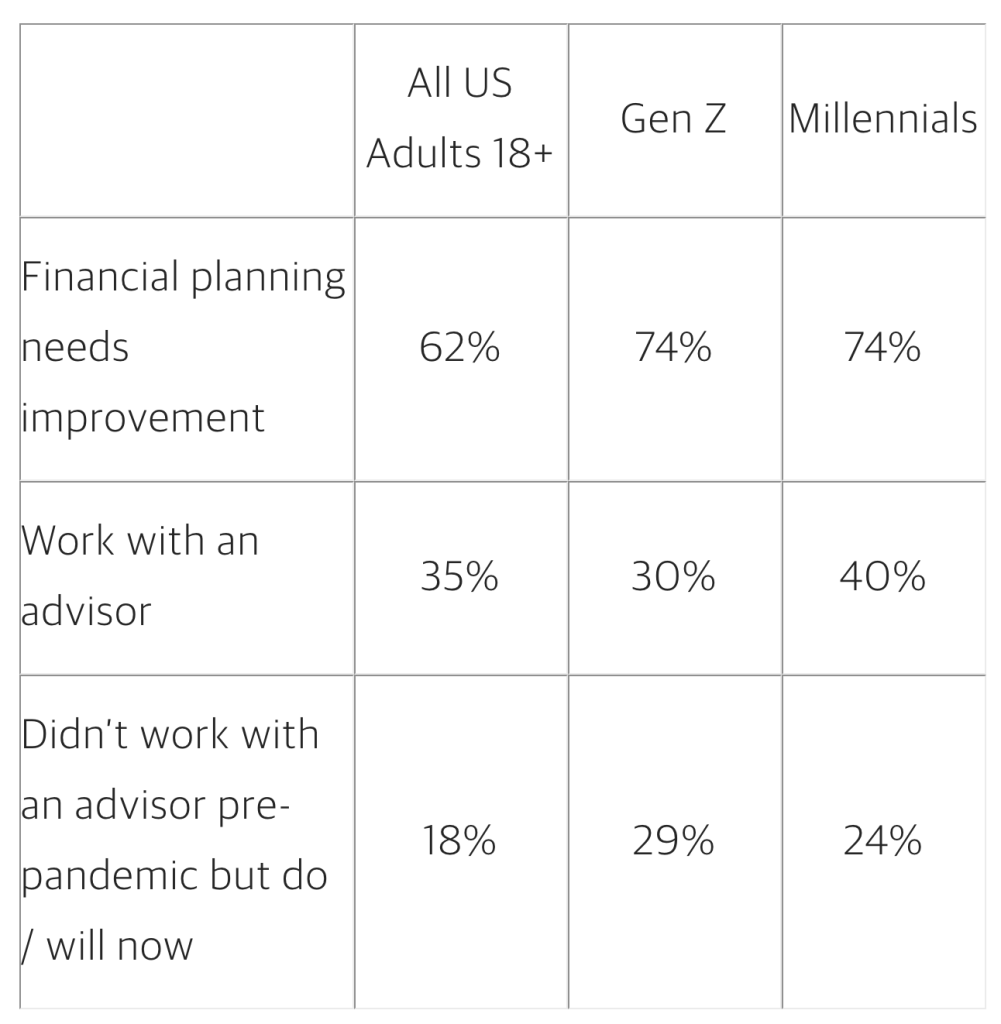

Develop a retirement plan with the help of a financial planner. Approximately a third of Americans consult with a financial adviser, according to a Northwestern Mutual study from 2022. According to previous research by the insurance company, single people are twice as likely as married people to have never discussed retirement with anyone.

FAQs

1. When can I retire?

Retirement is not based on a set age. Whenever you want, you can leave the workforce if you are capable of retiring.

The timing of your retirement may be limited, however, by certain factors. In general, pensions are available after 20 to 30 years of service. Apart from that, Social Security benefits are not available until you’re 62. Medicare won’t start until 65. As a result, employees covered by employer-sponsored health insurance may not be able to retire until age 65.

2. How much money do you need to retire?

It depends on your sources of retirement income and your planned retirement expenditures how much money you need to retire. A good rule of thumb is to save about 80% of your pre-retirement salary every year.

In addition to Social Security and pensions, you may need to set aside additional funds to cover your retirement expenses.

3. What is the rule of 55?

If you withdraw money from your 401(k) before you are 59 ½,, there is usually a 10% penalty. If you are 55 or older, there is, however, an exception. Your 401(k) can be distributed if you are separated from your employer within five years of turning 55.

4. Is marriage financially beneficial?

A married couple or a couple in a legal domestic partnership often enjoys financial benefits that single individuals do not. Being married offers many benefits, including tax breaks, Social Security benefits, and employer-sponsored health insurance.

Moreover, if you both work, your income is doubled. Or, you may able to live off one income and save the other for retirement.

5. What are the financial benefits of being single?

You are the only person who can control your own financial destiny when you are single – you won’t be affected by someone else’s poor credit score, debt on student loans, or car payments. As you don’t need to cover expenses for anyone else but yourself, you can often squirrel away more savings.